raisbeckfoto

Investment Thesis

Cisco (NASDAQ:CSCO) has seen its share slide by 30% in the past 6-month period. Together with the rest of tech, investors are throwing the baby out with the bathwater.

There are many companies for which this selloff has been warranted. But I make the case that the highly profitable Cisco has seen its stock selloff more than justified.

The one blemish in the thesis is that its revenue growth rates are not that enticing.

That being said, where Cisco shines is in its ability to translate its revenues into profits at extremely high margins.

In fact, I make the case that Cisco makes so much cash, that its combined return capital return via dividends and repurchases reaches 2.9% for Q4 2022 alone, annualizing at 11.4%.

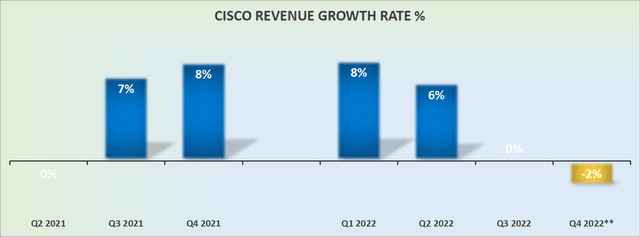

Revenue Growth Rates Are Not Enticing

Cisco revenue growth rates

Cisco’s guidance for Q4 leaves much to be desired. Right now, investors want stable companies, with solid profitability.

Although Cisco scores well in the latter, something we’ll soon discuss, Cisco isn’t offering much to shareholders in the way of stable revenue growth rates.

On the one hand, Cisco has been through these periods a few times in the past few years and bounced back. Consequently, we should not necessarily assume that this time it’s different.

On the other hand, this lack of a promising mid-single-digit revenue growth rate could not come at a worse time for investors. We are now in a period when investors are working hard to sieve through their portfolios to figure out what’s worth keeping?

Investors’ frame of mind is ”what have you done for me lately”?

Indeed, there’s an overabundance of really high-quality companies that have taken a material beating in valuation, meaning that investors now have more choice than perhaps at any point in the five-plus years. Besides the Covid crash, because once you blinked, you missed it.

And this in itself is causing problems for investors. Investors are desperate in trying to grapple with the normalization of Cisco’s revenue growth rates over the next twelve months. Investors are trying to look ahead, yet there’s just too much uncertainty.

As touched on already, this uncertainty has seen Cisco’s share price selling off nearly 30% in the past 6 months, in line with many pockets of the market.

Profitability Profile Shines Brightly

Back in Q4 2021, Cisco’s non-GAAP operating margin was 33.5%. This time around, at the midpoint, its non-GAAP operating margin points to 32%.

That being said, Cisco’s CFO Scott Herren is likely to be conservative with Cisco’s Q4 guidance, meaning that despite Cisco working with slightly fewer revenues, its profitability profile is likely to be unchanged y/y.

And if you think of it, this is where Cisco shines brightly. Right now, investors crave stability (as we’ve already discussed) and strong profitability.

In this uncertain environment plagued by macro headwinds, geopolitical tensions, and a rapidly rising interest rate environment, investors want to know that the companies that they are backing are well suited to come out the other end.

And with non-GAAP operating margins in the +30%, very few companies are able to be as profitable as Cisco.

This Is A Dividend Paying Stock, But

I recognize that the majority of Cisco shareholders are in the stock because of the dividend. I know this, you know this, and management knows this. That’s why Herren said at a recent conference call,

The dividend is incredibly important and it is not negotiable.

So we’ll continue, obviously, within our cap allocation policy to support the dividend.

Management is unambiguous that after investing in the business, the priority is in supporting its attractive dividend.

What may not be all that attractive to short-term shareholders may be Cisco’s share repurchase program. After all, this doesn’t have the same tangible feel. Even if it’s highly accretive to shareholders.

Along these lines, typically companies prefer to deploy excess free cash flows via share repurchases rather than dividends because you can always increase or decrease sums deployed towards share repurchases.

But if you signal to investors that you are decreasing your dividend, the stock would take a beating, and financial media headlines would add to this negativity. While increasing or decreasing the share repurchase program doesn’t carry the same attention.

All that being said, consider this recent comment from Herren on the same conference call:

Beyond that, [our priorities are] to offset the dilution of our equity plans, our annual equity grants with share buybacks and beyond that with excess cash to return to shareholders.

And so, year to date you see we have returned a significant amount, more than $15 billion to shareholders year-to-date through the combination of our dividend payments and our share buybacks.

Now, if you look back to Cisco’s Q3 2022 results, you’ll see that total capital returns come close to $10 billion, not $15 billion as noted above!

Over a nine period, there was $4.7 billion in the form of dividends and $5.3 in the form of share repurchases, totaling $10 billion in total returns.

Indeed, during Cisco’s Q3 2022 earnings call, Cisco’s management commentary reflects this sum by saying,

Year-to-date, we have returned a total of approximately $10 billion in value to our shareholders via cash dividends and stock repurchases

So, it could be said that during the first 9 months of fiscal 2022, Cisco returned $10 billion to shareholders, but over an 11-month period, Cisco’s total capital return is more than $15 billion.

Given that each quarter, very approximately Cisco deploys $1.6 billion towards its dividend, that means that there’s likely to be more than $3 billion worth of share repurchases made in fiscal Q4 2022.

That means that according to my estimates, Cisco’s shareholders holding the stock are getting a 2.9% total return this quarter alone, which annualizes at 11.4%!

The Bottom Line

Cisco has fallen out of favor with investors, once again. This is understandable given that despite all of Cisco’s efforts to move 50% of its business model beyond product sales toward a more sustainable recurring revenue model, its revenue growth rates remain volatile.

That being said, I make the case that investors don’t need to wait around several years to be rewarded. Right now, Cisco’s robust cash flow generation is allowing the business to return a 2.9% combined yield to shareholders in Q4 2022 alone.

I rate this stock a buy.

Be the first to comment