Jorgefontestad

Instead of an investment thesis

Last year, I already wrote about Rio Tinto (NYSE:RIO) and how the stock seemed mispriced to me compared to the dynamics of the company’s key commodities. At the time, copper, iron ore, aluminum, and the diamond index all suggested that RIO was trading at too large a discount. At that time, hardly anyone was trying to assess the risks of a recession, which is now being talked about everywhere.

Even as the discount to the price of base metals/minerals persisted, RIO continued to feel good given the high dividend yield. This lasted until mid-April 2022 – since then the quotes have fallen by >30%, and the profitability of my call is now almost equal to that of the (SPX):

Now the stock has shown signs of recovery again – in the last 2 weeks RIO is up 12.4%, which is very good for a mining stock with a market capitalization of $93 billion.

It seems that it is time to be bullish because it started to rise rapidly from its local lows. This time, however, I decided to approach the analysis qualitatively rather than quantitatively, focusing on how the company was coping with the ESG challenges of the modern world. Unfortunately, RIO failed the test due to its repeated ESG policy violations, which may have a long-term impact on the production part.

Why is it important?

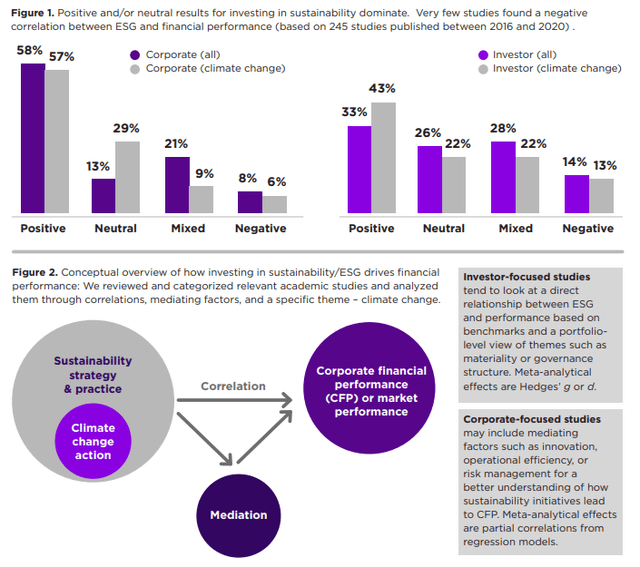

I know what you may think when you see the abbreviation “ESG” above. But in fact, this term is not just used to lead our world to underinvestment in the oil and gas sector – it is a broader concept. Each letter in this acronym is inextricably linked to the other two, and the risks faced by companies that fail to heed these letters are very, very great. That’s why companies that are conditionally ESG-friendly have lower volatility and higher profitability over the long term, according to a study by Madrid-based IE Business School:

Journal of Sustainable Finance & Investment, “ESG factors and risk-adjusted performance: a new quantitative model” [2016], with author’s notes![Journal of Sustainable Finance & Investment, "ESG factors and risk-adjusted performance: a new quantitative model" [2016], with author's notes](https://static.seekingalpha.com/uploads/2022/10/11/53838465-16654858759362092.png)

NYU Stern Business School and Rockefeller Asset Management come to similar conclusions in their study:

“Uncovering the Relationship by Aggregating Evidence from 1,000 Plus Studies Published between 2015 – 2020”

Therefore, in my opinion, the consideration of ESG aspects cannot be eliminated when investing in industrial companies. Moreover, it is necessary to focus not only on emissions – it is obvious that this is the first point to which management will pay our attention. One needs to look at the rest of the letters with the same meticulousness.

What’s wrong with RIO’s ESG factors?

In my opinion, given the history of the company’s relationships with its stakeholders, RIO has a whole host of problems that, taken together, make the company’s stock a pretty bad place to invest for the long term.

1. Evidence of bullying, sexual harassment, and discrimination

The 149-year-old mining firm has shockingly high levels of bullying, harassment, and abuse, according to a report by former Australian sex discrimination commissioner Elizabeth Broderick that was commissioned by the corporation on February 2022.

More than a quarter of women surveyed said they had been sexually harassed and almost 40 per cent of men who identified as Aboriginal and Torres Strait Islander said they had experienced racism.

Source: Financial Times

Then the new CEO tried to convince everyone that the company was taking action to address this violation of corporate and ethical standards – investors believed him.

2. Desecration and lack of respect for indigenous culture

On this subject, the company has a lot of stories to tell. For example, the destruction of a 46,000-year-old Aboriginal heritage site in Juukan Gorge, Australia, to expand the iron ore mine [The Guardian, May 2020]. However, I will focus on what happens after December 2020, because that is when the current CEO Jakob Stausholm was appointed. I am doing this intentionally to avoid being accused of taking on outdated events that will not happen in the future thanks to a “better new management team”.

The Sydney Morning Herald reported on March 9, 2021, that the U.K. pension fund alliance Local Authority Pension Fund Forum expressed concern to Rio Tinto about the lack of inclusion of indigenous voices in the mining company’s decisions about the Resolution copper-gold project in Arizona.

In August 2021, Senator Pat Dodson called for an extensive investigation of Indigenous land use agreements after traditional owners in the Pilbara discovered Rio Tinto may have underpaid them by as much as $400 million.

In June 2021, it was revealed that Rio Tinto allowed the dumping of priceless Aboriginal cultural materials and did not inform the traditional owners for 25 years.

3. A threat to the environment and human rights violations

In January 2022, the Serbian government revoked Anglo-Australian mining company Rio Tinto’s licenses to explore and mine lithium after several months of protests. The planned mine in Serbia’s Jadar Valley was perceived as a threat to the way of life of dozens of communities in the picturesque region.

In March 2022, the Australasian Center for Corporate Responsibility (ACCR) published an assessment of Rio Tinto Group’s 2021 Climate Change Action Plan. According to the publication, the lack of Paris-aligned government policies, such as carbon pricing, to support the company’s decarbonization goals is a major issue in Rio Tinto’s Climate Change Action Plan.

This threatens Rio Tinto’s ability to meet its Scope 1 and 2 targets, and also undermines its efforts and options for managing Scope 3 emissions. There is insufficient evidence that Rio Tinto is advocating for the policy settings required to rapidly decarbonise and in fact, it remains a member of some of the most obstructive industry associations to climate policy in Australia and the United States.

An assessment by the Australasian Centre for Corporate Responsibility of Rio Tinto’s climate statement found that despite progress elsewhere, the company was not doing enough these emissions.

It also found Rio Tinto maintained memberships in industry associations that lobbied against climate action.

Source: ACCR

A month after this was published, a Rio Tinto investor voted against the company’s financial reports at the mining giant’s annual general meeting in London because he was unaware of the risks the company faces because of climate change.

In July 2022, the company announced plans to study the impact of its former mine – 32 years after it left Bougainville as the island descended into civil war.

4. Possible corruption and tax avoidance

Apart from the corruption scandal in 2017, when former Rio Tinto CEO Tom Albanese and ex-CFO Guy Elliott were charged with fraud by the SEC, I would like to draw your attention to the relatively recent past.

In October 2021, it was revealed that Rio Tinto, BHP Billiton, and other Australian mining companies continued to do business with Chinese steel billionaire Du Shuanghua after he confessed to paying bribes to a Rio Tinto executive, according to ABC News.

In 2010, the company had to retroactively fire 4 of its Chinese executives after a Chinese court sentenced them to prison terms ranging from 7 to 14 years for bribery and secrets charges. With Du Shuanghua also believed to be involved in dirty deeds, RIO now runs the risk of being caught up in such corruption scandals again once they are uncovered.

In July 2022, it was announced that Rio Tinto has settled a decades-long tax dispute with the Australian Tax Office and is handing over nearly $1 billion in unpaid taxes following an investigation of its Singapore marketing hub. This is a direct violation of the letter “G” in the acronym we are now discussing.

As an interim conclusion, I will give my opinion based on all the above violations. As we can see, the new management has not led the company to a fundamentally new way of doing business. “Rules are made to be broken” is a motto that does not sound very good for a 21st-century high-quality value stock, but apparently not everyone thinks that way.

Some investors or managers themselves may think, “Who cares how we make money? We bring our shareholders a good dividend yield, and that’s the essence of commercial success.” But in my opinion, the more a company allows violations of mandated policies – both corporate and ethical – the more value it can expect to lose in the future, as its long-term risk profile deteriorates in proportion to the number of its violations.

On September 1, 2022, Verisk Maplecroft published a study showing that 101 countries have seen an increase in civil unrest in the last quarter. The researchers’ conclusions are not encouraging – the worst is yet to come as socioeconomic pressures mount. The deteriorating macroeconomic environment in the world, especially in developing countries – where RIO and other large conglomerates operate many mines and subsidiaries – is leading to an increase in mass protests and unrest.

The data, covering seven years, shows that the last quarter saw more countries witness an increase in risks from civil unrest than at any time since the Index was released. Out of 198 countries, 101 saw an increase in risk, compared with only 42 where the risk decreased.

As the conditions for civil unrest build in a growing number of countries, the severity and frequency of protests and labour activism is set to accelerate further over the coming months.

With more than 80% of countries around the world seeing inflation above 6%, socioeconomic risks are reaching critical levels. Almost half of all the countries on the CUI are now categorised as high- or extreme-risk, and a large number of states are expected to experience a further deterioration over the next six months.

This cannot help but increase the risks for companies like RIO, especially if they treat local populations the way I described above.

Valuation

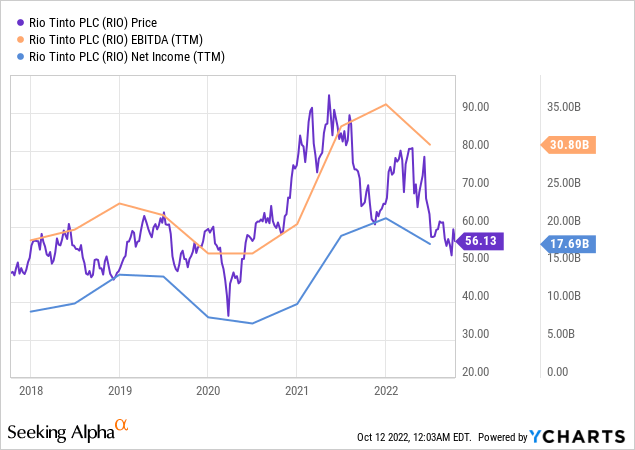

Since its peak in 2021, RIO stock has fallen more than 40%, correlating with the dynamics of EBITDA and net income (in absolute terms):

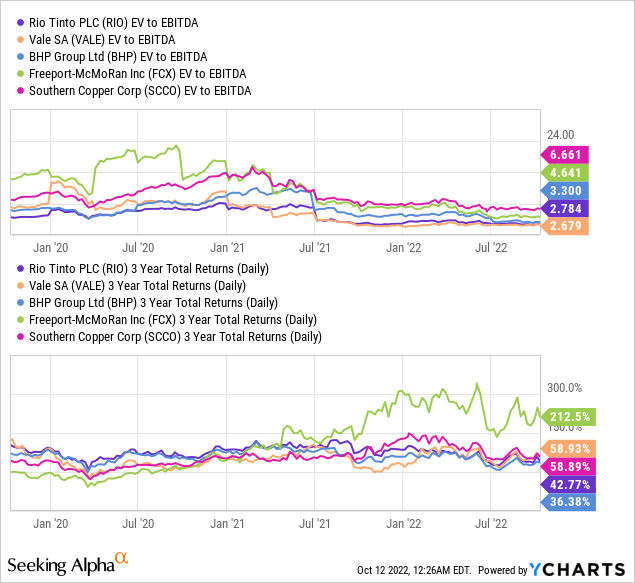

Due to declining financials, RIO trades at only 2.8 times the TTM EV/EBITDA multiple, making it one of the lowest in the industry. However, compared to the same peers, the company always trades at a similar discount – as we can see from the 3-year total return, this discount has not resulted in outstanding performance:

This is a cyclical company and we are now in a new bull cycle. RIO is one of the biggest producers of primary aluminum, a crucial raw element used in the green revolution for things like wind turbines and electric vehicles. Another important raw ingredient for the manufacture of batteries, lithium, is also being developed and produced by the company. RIO also has another “green” raw element in its toolbox – copper. As long as the risks I wrote about above do not materialize, the company will likely continue to pay good dividends and please its yield-seeking investors. The current weakening of financial indicators appears to be temporary and will likely change once the global economy emerges from recession sentiments. However, given the way management handles the principles of sustainability, I cannot repeat the call to buy RIO.

Bottom line

I think the era of aggressive capitalism is over, but apparently not for all companies. Based on the analysis of recent news about how the company relates to its sustainable development, I have the impression that RIO is many years behind modern business approaches and it’s what I’d call irresponsible management style is increasing risks for shareholders. As the new global economy develops and macro indicators in the developing world deteriorate, the operational risk for RIO and all companies that “sloppily” follow ESG principles is steadily increasing. No one knows when this risk will materialize – the commodity supercycle we have today could help Rio Tinto delay this. Therefore, I rate this stock as a HOLD. However, I would not recommend this company for a long-term value investment.

Be the first to comment