Iryna Mylinska/iStock via Getty Images

International Paper Company (NYSE:IP) is one of the leading producers of renewable fiber-based packaging and pulp products. It has manufacturing facilities in parts of the U.S., Europe and North Africa.

Following a series of spinoffs in the previous fiscal year, the management reaffirmed its CAPEX initiatives this Q2 ’22, with a focus on its packaging business, implying potential bolt-on acquisitions.

IP enjoys improving liquidity and has had a reassuring free cash flow (“FCF”) update from the management this FY22. IP trades near support and has an attractive dividend yield compared to its peers, making this stock a good buy.

Company Overview

IP generated total sales of $5,389 million in Q2 ’22, increasing 12.98% year on year from $4,770.00 million in the same quarter the prior year. Analysts expect its revenue to be about $21.50 billion this fiscal year, marking an 11.06% increase year-over-year. Looking at its trailing YoY growth of 3.09%, compared to 10.24% from its previous year, revealed certain growth concerns to be monitored.

Aside from the weakening economy, one of the reasons for this concern is the various spinoff activities last fiscal year. To mention a few, in October 2021, they spun out its printing papers business, which is now Sylvamo Corporation (SLVM), and in August 2021, they spun off Kwidzyn Mill.

The previously stated spinoffs intend to enhance its cost structure and accelerate long-term shareholder return. They are aligned with the company’s Building a Better IP goal.

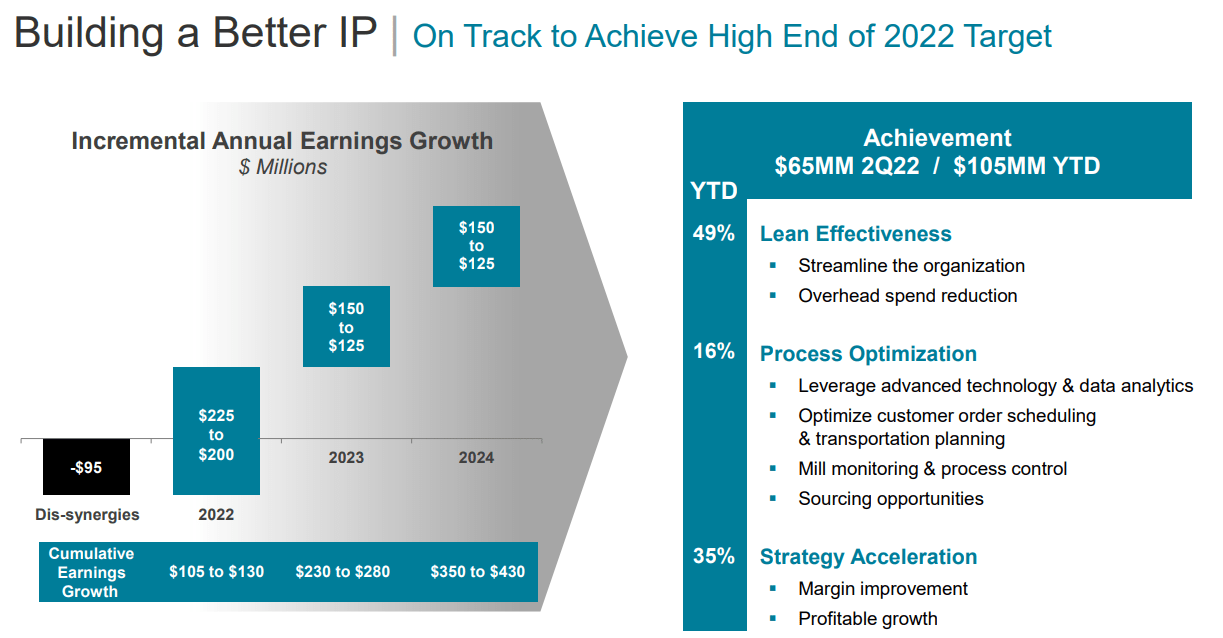

Building a Better IP (Q2 2022 Earnings Presentation)

As part of its Building a Better IP program, the company plans to simplify its product portfolio by focusing more on its packaging business and achieving cost synergies. According to the management, they are already seeing great earnings benefits and are on course to meet their FY24 objective.

We’re making solid progress and delivered $65 million in earnings in the second quarter for a total of $105 million for the first half of the year. Source: Q2 2022 Earnings Call Transcript

These cost-cutting initiatives resulted in outstanding operational performance this quarter, with operating income increasing to $585.00 million, up from $373.00 million in Q2 ’21 and $420.00 million in Q2 ’20. IP’s operating margin increased to 10.86%, up from 7.82% in the same quarter the previous year and higher than its 5-year average of 8.99%.

Additional Spinoff

However, due to the uncertainties in Russia’s operation, the management revealed its intention to sell its 50% equity interest in Ilim Group. In fact, this quarter, IP recorded a declining equity earnings net of tax amounting to $95 million, compared to its $101 million recorded in Q2 ’21. Its Ilim joint venture provided IP with a generous cash dividend of $154 million in FY21.

Management’s FCF outlook and enhanced CAPEX initiatives for FY22 remain unchanged. Despite the probable loss of its cash dividend and equity interest from its Ilim JV, I believe IP remains fundamentally stable.

Additional Caveat

In today’s highly inflationary environment, we can argue that IP’s margin will remain pressured despite its cost reduction initiatives mentioned before. However, with management’s guidance about potential input cost stabilization, as quoted below, this provides positive catalysts in today’s market volatility.

…We see some more input cost pressure at a slower rate of increase in the third quarter than we saw in the second. And then I think as we go through late third quarter through the fourth quarter, we see more stabilization at these elevated levels. Source: Q2 2022 Earnings Call Transcript

Additionally, this quarter, both of IP’s operating segments, Industrial Packaging and Cellulose Fibers, had year-over-year sales volume declines of -4.37% and -3.10%, respectively.

Today’s current pattern of firms preparing for a recession is causing a decline in sales volume in its packaging business, as seen below.

Our volume was flat sequentially and below last year’s strong comp. As Mark mentioned earlier, we saw a shift in consumer spending from goods and services and the retail channel managed through elevated inventories which then impacted box demand across segments like e-commerce and shipping and distribution, durables, and other non-durables. Source: Q2 2022 Earnings Call Transcript

However, I believe IP trades at an Attractive Price Today

The firm reported an increasing diluted EPS of $1.38 in Q2 ’22, up from $1.09 in Q2 ’21. In addition to the company’s improving diluted EPS, the management issued a comforting comment regarding attaining their FCF high range target in FY22. FCF is expected to be approximately $1,500 million in FY22, up from $1,481 million in the previous fiscal year. This growing figure takes into account a higher CAPEX expenditure of $1.1 billion in FY22, up from $549 million in FY21.

Relative Valuation

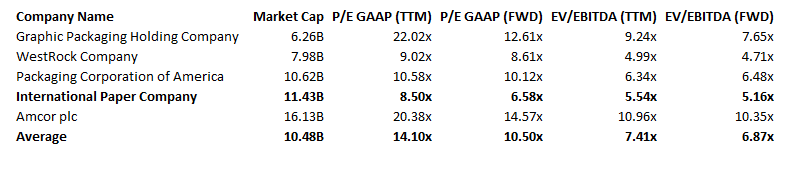

IP: Relative Valuation (Data from Seeking Alpha. Prepared by InvestOhTrader)

Comparisons in the table above to: Graphic Packaging Holding (GPK), WestRock Company (WRK), Packaging Corporation of America (PKG), and Amcor plc (AMCR).

Looking at IP’s trailing P/E multiple of 8.50x, it reveals some discount compared to its average peer group’s 14.10x, while its trailing EV/EBITDA multiple of 5.54x reveals some discount compared to its average peer group average of 7.41x.

IP is now trading at a forward P/E ratio of 6.58x, which indicates a more favorable valuation for the next 12 months compared to its peer group’s average forward P/E multiple of 10.50x. Furthermore, the firm trades at a forward EV/EBITDA multiple of 5.16x, which is cheaper than its 6.87x peer average.

IP’s EV/EBITDA multiple of 5.54x is considered cheap compared to the average of its peers. However, looking at WRK’s 4.99x, it appears that it is more attractive than IP’s 5.44x. Despite having a smaller market capitalization than IP, WRK has a higher enterprise value of $16.44 billion. This increase in total enterprise value is evident in its trailing total revenue of $20,944.5 million, better than IP’s $20,626 million, which implies some competition concern for IP to watch out for.

Trading at a Logical Support

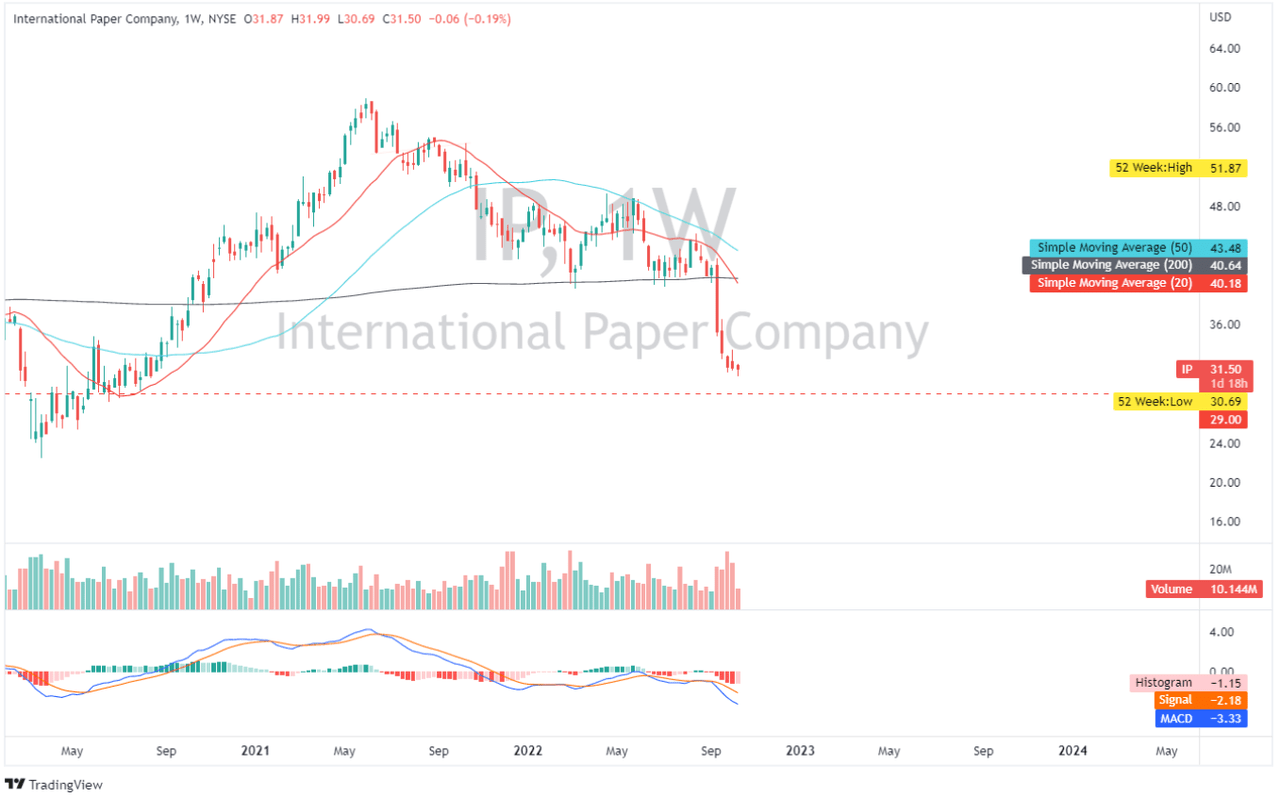

IP: Weekly Chart (TradingView.com)

Looking at IP’s daily chart, we can notice a massive drop caused by a fear-driven trading day on September 16 of this year. On a weekly chart, the price of IP is now trading below its simple moving averages, indicating significant bearish momentum. If negative pressure continues, I think $29 will be its significant major support. IP’s MACD remains below zero, suggesting to investors and traders that it is still in a bearish phase.

Concluding Thoughts

While the margin risk and growth concerns remain in place, any additional dip, in my view, will unleash good returns compared to the long-term potential.

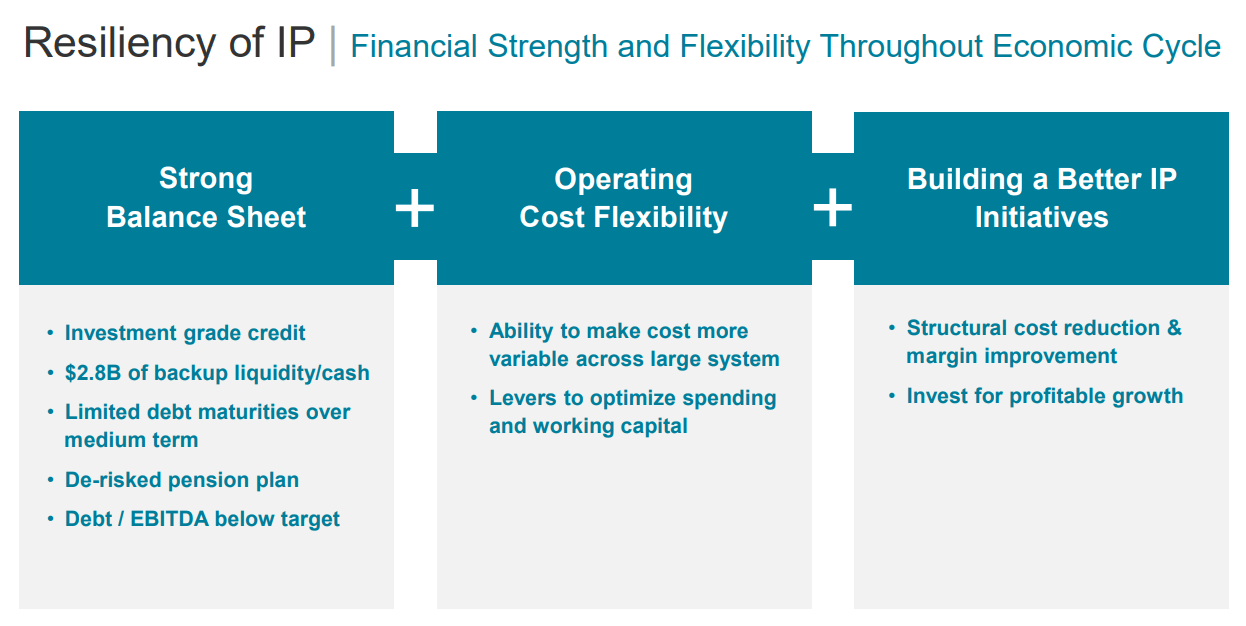

IP remains liquid and has shown an improving current ratio and debt-to-equity ratio. Its current ratio of 1.62x this quarter improved, compared to its 5-year average of 1.39x. Additionally, the company’s debt-to-equity ratio improved to 0.66x, which is lower than its 5-year average of 1.24x.

Resilient IP (Q2 2022 Earnings Presentation)

IP maintains investment-grade credit, remains liquid, and has a declining total debt figure, making it well-positioned in today’s economic downturn.

Finally, IP is fundamentally appealing, particularly given its dividend payout ratio of just 46%. It shows an attractive dividend yield of 5.87%, and the management’s positive outlook for FY22 makes this stock a good buy at today’s low.

Thank you for reading and good luck everyone!

Be the first to comment