spooh

On Thursday, November 3, 2022, midstream giant Targa Resources Corp. (NYSE:TRGP) announced its third-quarter 2022 earnings results. The market certainly seemed reasonably pleased with these results despite the fact that the company missed analysts’ revenue estimates. The company did show the year-over-year growth trends that we have seen in the sector, though. This is most evident in the fact that the company reported higher revenues than it did in the year-ago quarter. The company posted year-over-year growth in several other areas of its business that are much more important, however. Despite the fact that things are going reasonably well for the company, it did not increase its dividend, although it did increase it earlier this year. The company only yields 2.09% at the current price though, which is one of the lowest yields in the entire midstream sector. That does not mean that it does not have potential and in fact, Targa Resources is well-positioned to continue on the growth trajectory that we see illustrated in this quarter’s earnings report.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Targa Resources’ third-quarter 2022 earnings results:

- Targa Resources reported total revenues of $5.3601 billion in the third quarter of 2022. This represents a 20.19% increase over the $4.4597 billion that the company reported in the prior-year quarter.

- The company reported an operating income of $430.0 million in the reporting period. This compares quite favorably to the $366.5 million that the company reported in the equivalent quarter of last year.

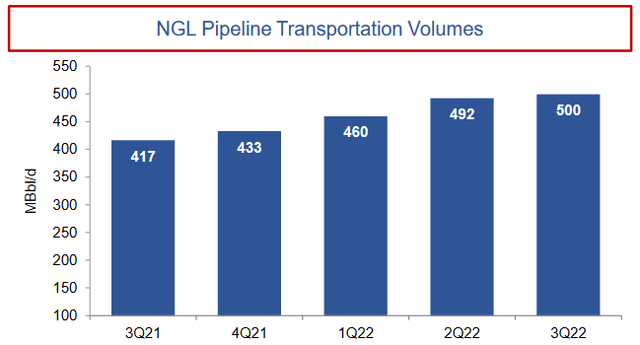

- Targa Resources transported an average of 499,500 barrels of natural gas liquids per day during the most recent quarter. This represents a 19.93% increase over the 416,500 barrels of natural gas liquids that it transported per day on average during the same quarter of last year.

- The company reported a distributable cash flow of $594.9 million in the current quarter. This represents a substantial 54.96% increase over the $383.9 million that the company reported in the equivalent period of last year.

- Targa Resources reported a net income attributable to the common shareholders of $193.1 million in the third quarter of 2022. This represents a 20.39% increase over the $160.4 million that the company reported in the third quarter of 2021.

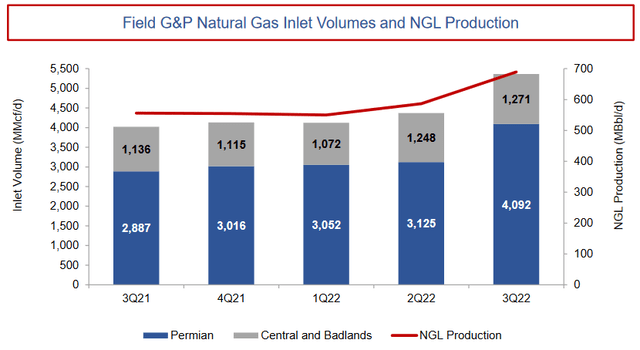

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that every measure of financial performance showed improvement compared to the prior-year quarter. The company attributes this to higher volumes of handled resources, which makes a great deal of sense. As we can see here, the company’s natural gas gathering and processing operation saw a large increase in volumes both in the Permian Basin and The Badlands compared to the third quarter of last year or indeed any quarter this year:

The reason why this would have a positive impact on the company’s financial performance is because of the business model that the company uses. In short, Targa Resources enters into long-term (usually five to ten years in length) contracts with its customers to move their resources through its pipeline infrastructure. In exchange, the customer compensates Targa Resources based on the volume of resources that it transports, not on their value. This has the effect of increasing Targa Resources’ revenues whenever volumes increase, as they did during the third quarter. The higher revenue means that more money is available to cover the company’s other costs so all else being equal Targa Resources will have more money available to make its way down to the company’s profits and cash flows.

It is important to note that the company’s natural gas gathering and processing operation is very different than what most people think of when they picture a midstream company. This business unit does not operate the large long-distance pipelines that take resources hundreds of miles. Rather, gathering pipelines are relatively short and low-capacity pipelines that grab resources at the wellhead that extracts them from the ground, and takes them to the first step on their journey to the end-user. In the case of natural gas, which is the product that Targa Resources handles with its gathering and processing operation, the first destination will usually be a natural gas processing plant.

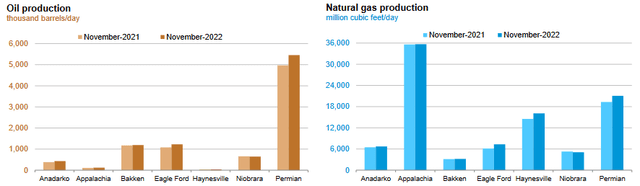

The bulk of the company’s gathering and processing operation is in the Permian Basin in West Texas. This is a name that will likely be familiar to anyone that has followed the oil and gas industry over the past decade or so since it has been at the center of America’s energy renaissance. There are reasons to expect that the company may see further volume growth in this area during the fourth quarter. This is because upstream companies have been increasing their output in order to take advantage of today’s high-price environment. We can see this here:

U.S. Energy Information Administration

As we can clearly see, the production of both crude oil and natural gas in the Permian Basin is significantly above the level that we saw at the same time last year. This means that it is likely that Targa Resources will likely see higher volumes in the fourth quarter of 2022 than it had in the fourth quarter of 2021. The reason for this is that somebody will need to transport these incremental resources to the market where they can be sold. After all, there is no point in producing resources that cannot be sold. This is exactly the business that Targa Resources is in and given the company’s significant presence in the Permian Basin, it is only logical that it will get at least some of this extra business. The company should thus see some revenue growth in the fourth quarter, which should translate into cash flow growth.

Targa Resources does have a more “traditional” midstream operation that transports hydrocarbon resources through large pipelines over long distances. In this case, the resources that the company transports are natural gas liquids. This business unit also saw volumes grow over the past year, although the increase from the second quarter was not particularly great:

The business model used by this operation is quite similar to the one that Targa Resources uses for its gathering pipelines. Basically, long-term volume-based contracts that Targa Resources has with its customers result in its revenue and cash flow increasing when volumes do. The company stated in its earnings press release that it expects to see fairly strong growth in these volumes going forward. In fact, the projected volume growth is great enough that the company announced the construction of a new pipeline to handle the higher volumes. This pipeline, dubbed the Daytona NGL pipeline, will transport natural gas liquids from the Permian Basin to Targa Resources’ Grand Prix NGL system in North Texas, which is the company’s flagship natural gas liquids transportation network.

One of the nice things about the Daytona NGL pipeline project is that Targa Resources has already obtained contracts from its customers for its use. This serves a few purposes but one of the most important is that the company can be certain that it is not spending $650 million to construct a pipeline that nobody wants to use. In addition, the company knows reasonably well how much money the pipeline will generate so it can ensure that it is getting an appropriate return on this money. Unfortunately, Targa Resources has not stated exactly how much it will generate but midstream projects usually pay for themselves after about four to six years of operation. This is therefore probably a reasonable estimate. The pipeline is scheduled to begin operating around the end of 2024 so we can expect to see its impact on the company’s financial performance around that time.

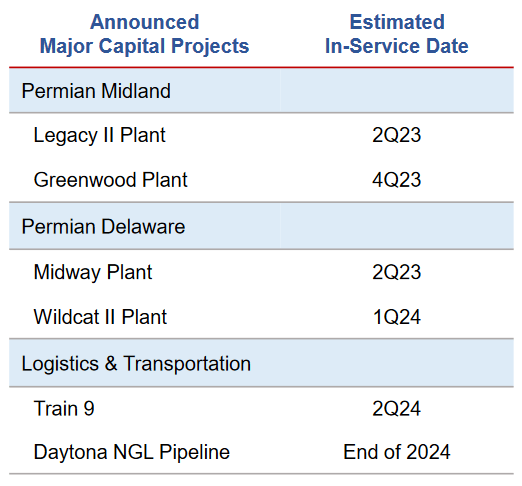

The Daytona NGL pipeline is not Targa Resources’ only growth project. In fact, the company has a number of growth projects that are scheduled to come online between now and the end of 2024:

Targa Resources

As is the case with the Daytona NGL pipeline, Targa Resources has already secured contracts for the use of this new capacity so we know that the projects will begin generating cash flow as soon as each is complete and comes online. Unfortunately, Targa Resources has not stated the return that it will earn on each of these so that makes it difficult for us to draw actual growth projections. All we can really say for certain is that the company has a nice pathway for growth starting in the second quarter of next year. The next two or three quarters will likely be fairly meager in terms of growth rates by comparison so we will really need to wait for about half a year to see our investment really begin to pay off. We will be paid for waiting but Targa Resources’ dividend yield is not particularly high so patience is going to be a real virtue here.

As I pointed out in a previous article, one of my longstanding concerns about Targa Resources has been the company’s incredibly high debt load. The reason that this is concerning is that debt is a riskier way to finance a business than equity because debt must be repaid. This is typically done by issuing new debt to raise the money needed to repay the maturing debt. This can cause a company’s interest expenses to increase following the rollover depending on the conditions in the market. In addition to this, a company needs to make regular payments on its debt if it wishes to remain solvent. Thus, any event that causes a company’s cash flow to decline can push it into financial distress if it has too much debt. Although midstream companies like Targa Resources typically have reasonably stable cash flows, bankruptcies have happened so we should certainly not ignore this risk.

The usual way that we measure the ability of a midstream company to handle its leverage is by looking at its leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all its pre-tax cash flow to that task. As of September 30, 2022, Targa Resources had a net debt of $11.0049 billion and a trailing twelve-month adjusted EBITDA of $2.6314 billion. This gives it a leverage ratio of 4.18x. This is reasonable as it is below the 5.0x that analysts usually consider acceptable. However, as I have pointed out in various previous articles, I like to see this ratio below 4.0x in order to add a margin of safety to the investment. Many midstream companies have been working to get their leverage ratios down below this level and many of them have succeeded. Thus, it appears that Targa Resources still has a way to go. However, the company’s ratio is definitely improving over the levels that it had immediately following the outbreak of the COVID-19 pandemic.

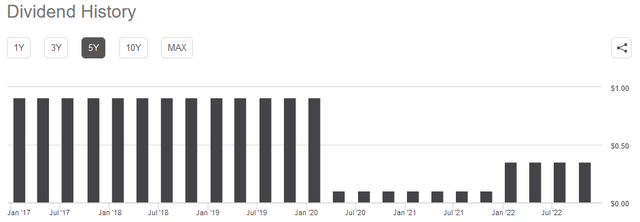

One of the biggest reasons that many people purchase shares of midstream companies is because of the very high dividend yields that many of these companies have. Targa Resources is admittedly a bit of a disappointment here as the stock only yields 2.09% at the time of writing, which is well below the 7.12% yield of the Alerian MLP Index (AMLP). However, Targa Resources does still yield more than the 1.65% yield of the S&P 500 index (SPY). Targa Resources’ low yield comes mostly from a massive dividend cut that the company imposed following the crash of oil prices that accompanied the pandemic and the fact that the dividend still remains much lower than its previous level despite an increase following the fourth quarter of 2021:

The company’s low yield might keep many traditional midstream sector investors away from the company despite its growth prospects. However, let us take a look and determine how easily the firm can sustain the dividend.

The usual way that we analyze the ability of a midstream firm to afford its dividend is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP figure that theoretically tells us the amount of cash that was generated by the company’s ordinary operations and is available to be distributed to the common stockholders. As stated in the highlights, Targa Resources had a distributable cash flow of $594.9 million in the third quarter of 2022. However, the company’s common stock dividend only costs about $79 million quarterly. This gives it a dividend coverage ratio of 7.53. Analysts consider anything over 1.20x to be reasonable and sustainable. As we can clearly see, Targa Resources can easily afford its dividend and could probably increase it by quite a bit without financially straining itself. Overall, this dividend is quite sustainable and the company has no real reason or likelihood to cut it again.

In conclusion, Targa Resources may not be the first company to pop up in a midstream investor’s mind when considering an investment. There are certainly a few things to like about it, though. The biggest of these is the company’s financial strength and growth potential. Admittedly, the debt is still a bit higher than I really like to see but it is not bad at all. The only real negative here is the company’s low yield. When we consider the firm’s cash flow though, it might increase the dividend in the near future once it gets the debt level down to the level that management desires. Overall, it may be worth considering a purchase in the company today.

Be the first to comment