flyingrussian

Investment thesis

Talos Energy (NYSE:TALO) is one of the most undervalued U.S. oil producers, both on a net asset value and cash flow basis. I have argued these points before, so this article could be seen as update of my prior coverage:

Talos Energy: Still Trading At Significant Discount To NAV

Talos Energy: The Inflation Reduction Act Could Bring 2 Positives

The valuation thesis is supportable even just in reference to TALO’s core developed assets. This excludes Puma West, operated by BP p.l.c. (BP) and where Chevron (CVX) is also a partner, the Zama asset offshore Mexico and the startup carbon capture business. Any of these latter plays only add further optionality.

The question since Talos announced in September the acquisition of EnVen Energy has been how such a large acquisition (EnVen’s equity holders are projected to own 34% of the combined company) changes the valuation thesis. EnVen, a privately held company, also operates in the Gulf of Mexico, so the operating synergies look obvious. However, big moves such as this one always raise the concern if the acquirer’s management overpaid.

Fortunately for Talos investors, and based on the information released so far, it appears that the deal preserves and perhaps even improves slightly the valuation. One could also hope for improved multiples due to the larger scale and greater liquidity. Some shorter term negative consequences may be anticipated too, if EnVen’s owners are seeking a complete exit, but on balance I think TALO remains a “buy.”

The acquisition

The price tag Talos will pay was initially estimated at $1.1 billion, consisting of $212.5 million in cash, the assumption of $50 million of net debt and 43.8 million shares. TALO is roughly twice EnVen’s size so the projected post-close 66-34 ownership makes sense.

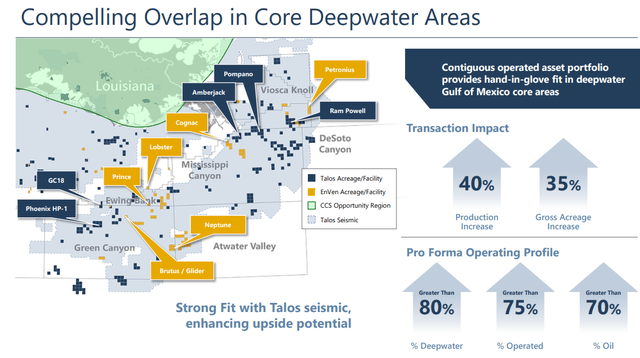

A look at Talos and EnVen’s neighboring acreage probably answers a lot of questions as to the business motivation for the deal:

Talos Energy Acquisition Presentation

In addition to scale and diversification, management also projects annual synergies of $30 million starting in 2023. EnVen’s production is quite oil heavy (>80% of its 24,000 boe/d production is oil) and is >90% operated, which could also make the case for more project control.

Valuation

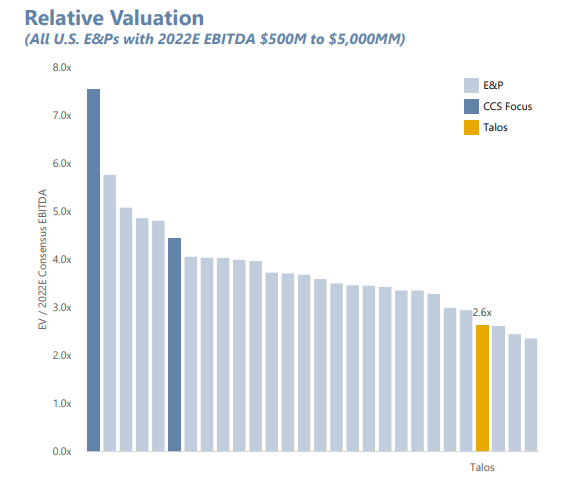

Management has already put forward a number of valuation metrics that show the deal is accretive to TALO’s shareholders. Prior to the announcement, Talos was trading at 2.6x enterprise value (or EV) to EBITDA:

Talos Energy Investor Presentation

Management estimates the implied multiples for the acquisition are 2.4x EBITDA and 1.7x unhedged EBITDA, so this would be a slight discount from Talos.

EnVen is 65% unhedged for 2023, which looks better than Talos itself for Q1 of the next year.

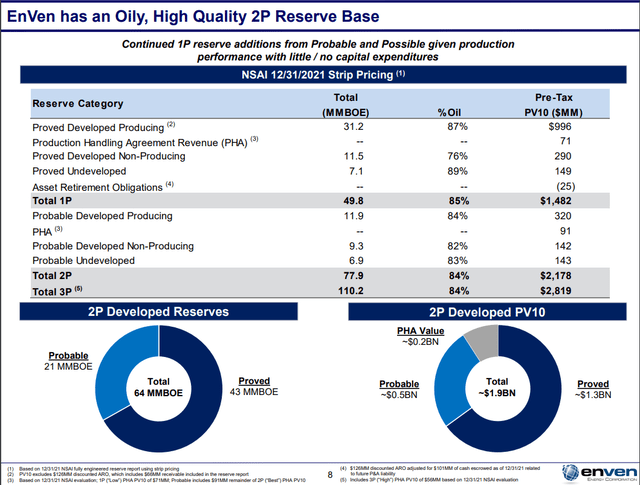

An older presentation from EnVen cites a PV-10 (standardized valuation measure for oil and gas assets) of $996 million for proved developed producing (or PDP) reserves, as of 12/31/2021 based on strip pricing back then. Total proved reserves were close to $1.5 billion:

Pricing is stronger now than back in December 2021, so the acquisition consideration may even be a slight discount to PDP.

In a nutshell, I am not seeing so far any indication that Talos has overpaid for EnVen. It is probably also good to mention here that management estimates the pro forma leverage at less than 0.8x EBITDA, so the combined company will have a very manageable debt level too. It will also represent a deleveraging from where Talos is on standalone basis now.

Short-term considerations

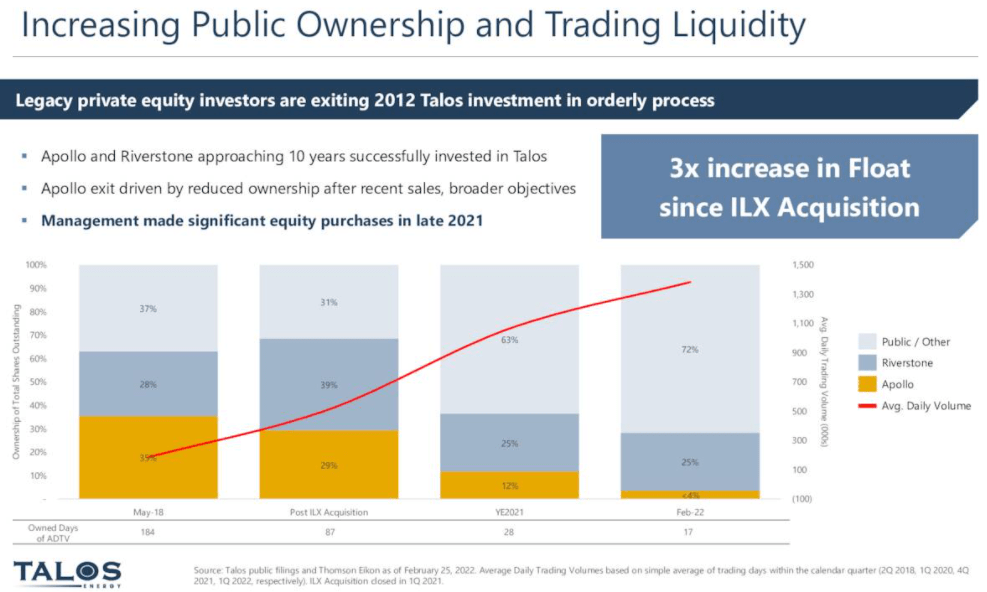

Anyone who follows Talos likely knows that the stock price has been pressured by the gradual exit of Apollo and Riverstone, the private equity funds which took Talos public:

Talos Energy Investor Presentation

Due to the constant selling, it has been hard for the stock to maintain its uptrend at times.

Now, only Riverstone still has significant ownership, but one can foresee that a similar situation may arise in the near future with EnVen’s current owners seeking to exit.

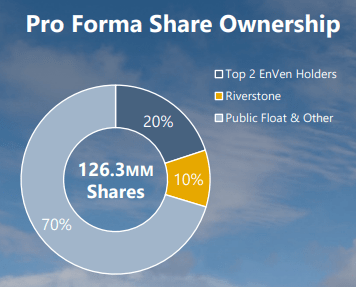

Per TALO’s management, Riverstone and the two largest EnVen owners will own 30% of the combined company:

Talos Energy Acquisition Presentation

Management has also disclosed that the three parties, i.e., Riverstone and the two big EnVen holders, will enter into a lock-up agreement upon closing. The lock-up agreement should restrict them from selling for some pre-determined time period, which should help reduce the potential pressure on the stock.

However, there are two caveats. First, we don’t know the details of this agreement and the lock-up period. Second, it looks that only the two largest EnVen owners will be subject to it. The 20% pro forma ownership implies these two unnamed parties currently own close to 60% of EnVen. The intentions of the parties who own the remaining 40% of EnVen (which will be about 13% of the combined company) aren’t clear.

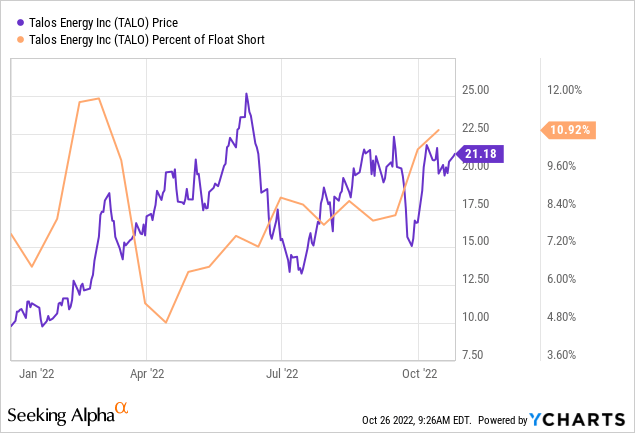

Separate from the acquisition, Talos has lately also seen a rise in the short interest:

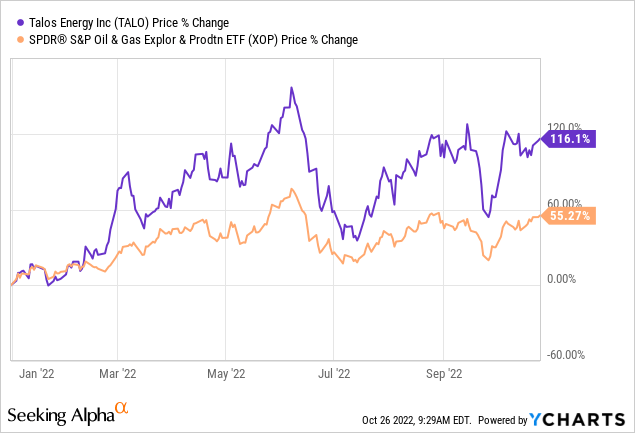

As much as oil has been volatile this year, TALO has been twice as volatile as a broader benchmark such as the SPDR S&P Oil & Gas Exploration & Production ETF (XOP):

While long-term TALO is a definitely a “buy” in my view, with the short-term technical factors and significant volatility, I would be careful with the entry points.

Conclusion

Ultimately, TALO discounts $60 WTI oil (CL1:COM) as I argued earlier. The EnVen acquisition is a major move by Talos, and there is always the risk that the acquiring management overpays.

Based on the preliminary information put forward in the public space, I don’t find any indication that may be the case here though. The EnVen price appears consistent with Talos’ standalone valuation metrics.

With a long-term holding horizon in mind, I think the stock remains a buy. However, TALO is also very volatile and we don’t yet know if or how some of EnVen’s owners may seek an exit post-close. It may therefore take longer for the stock price to reflect the intrinsic valuation.

Be the first to comment