Michael Vi

LendingClub Corporation (NYSE:LC) released its Q3 earnings report soon after the market closed on Wednesday the 26th of October. The after-hours reaction (LC shares down ~9%) suggest that the market was somewhat disappointed with the earnings release. It seems that the main culprit was the light guidance for Q4’2022, which is projected to be down compared with Q4’2021. Mr. Market was also disappointed with the Net Interest Margin (“NIM”) compression reflecting the higher cost of funds and the lower gross yield on assets, as the firm pivoted to retaining higher quality loans.

For me, though, the earnings report and commentary are exactly what I expected in light of the prevailing macro environment. In my recent article on LC, I noted the followings:

My expectation for Q3 earnings is that the marketplace revenue is going to be challenging (I expect a material reduction in revenue quarter on quarter for the marketplace). The rise in interest rates and recession fears effectively mean that some investors (especially ones that use warehouse lines and are interest-sensitive) will move to the sidelines for now.

I expect LC to leverage its balance sheet and retain selective loan assets on its book, especially ones that are of higher quality. I would also not be surprised if they reduced marketing spending and focused on servicing existing LC members.

Clearly, there is very little stress now in terms of loan loss provisions for existing assets but more recent originations are likely to normalize very quickly. I expect LC’s management to exercise caution in the current macro environment.

This is indeed what played out in the Q3’2022 earnings:

Key points from the Q3 earnings

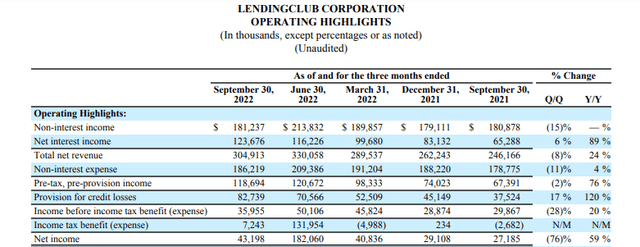

An extract from the Q3 financials (including comparables from prior quarters) is shown below:

As I expected, marketplace revenues (non-interest income) were down 15% quarter-on-quarter. This predominantly reflects the impact of rapidly rising rates where the cost of funds for certain investors is calculated based on the expected yield curve (i.e., factoring future Fed hikes) whereas the gross asset yield is only repriced with a significant lag. As such, certain marketplace investors are on the sidelines until the Fed pauses and credit card interest yields are reset. This will likely play out over several quarters.

Net Interest Income (“NII”) has grown 6% quarter-on-quarter predominantly due to growth in unsecured personal lending. During the quarter, LC has retained a record $1.15 billion of unsecured lending assets on the balance sheet and has grown the net balances by a whopping ~700 million (retention of loan assets minus loan repayments/losses over the quarter). The end-of-period (“EOP”) balance now stands at an impressive $3.64 billion (up from $2.93 billion in Q2). I expect LC to exit the 2022 year with an unsecured personal lending balance well above $4 billion (as projected in my previous article).

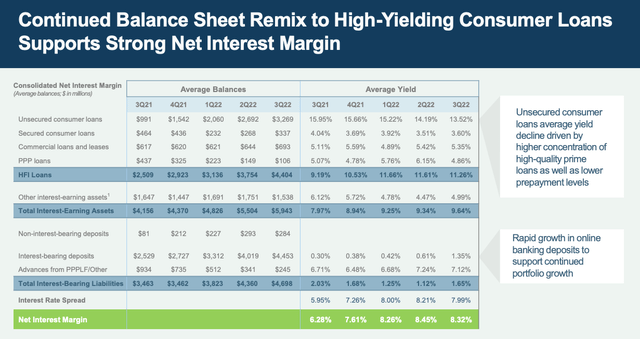

However, the revenue growth was impacted by two key factors. Firstly, as LC employed a more cautious approach toward credit risk and thus originated higher-quality assets, the gross yield of the personal loans decreased commensurately. Secondly, the cost of funds from interest-bearing deposits has also increased materially. As discussed earlier, the deposits reprice instantly as the Fed raises rates whereas the loan assets’ yield reprices with a lag.

These pricing dynamics are illustrated in the below slide:

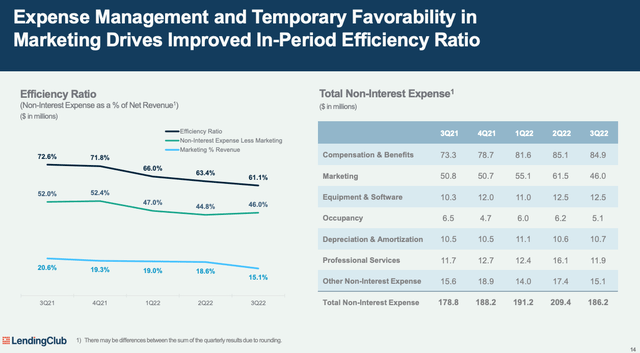

Finally, as I expected, LC also reduced its marketing spend as well as delayed some of its investments given the uncertain macro environment.

The read across to Upstart and SoFi Technologies

The LC’s Q3 earnings report is certainly a preview of the conditions peers Upstart Holdings (UPST) and SoFi Technologies (SOFI) have likely faced in Q3.

In my view, the current environment is much more dire when it comes to UPST’s business model. UPST is likely to feel the impact of rapidly rising rates on its investors/partners base, just as LC did, if not more so. UPST cannot rely on its balance sheet, either, and given its originations typically focus on the sub-prime and near-prime segment, I expect its business model to be extremely challenged in the current macro conditions. UPST does not have the balance sheet and low-cost deposits to lean on to fund loans’ originations. In short, the flaws in the business model are conspicuous and coming to the fore in the current macroeconomic settings.

For SoFi, it is more of a mixed story. I expect it, similarly to LC, to lean on its balance sheet (and newly acquired banking license) to originate and retain super prime high-quality personal lending assets. Similar to LC, I expect its NIM to compress materially given the higher cost of funds. However, I also expect its student lending refinancing products to stall in the current high-interest environment as there is much less of an incentive for consumers to refinance fixed-interest student loans.

Final thoughts

The major headwind currently for LC is the rapid rise in interest rates. NIM is compressed temporarily as deposits reprice quicker than the yield on loan assets. It also forces certain investors to move to the sidelines until the Fed pauses. This puts (temporary) pressure on revenue generated from its marketplace. These headwinds, however, are temporary and will turn into tailwinds when/if the Fed pivots. The demand for the LC product is and should remain exceptionally strong and the business model is sound and sustainable.

LC is doing absolutely the right thing by turning cautious on credit risk. The quality of the portfolio is exceptionally high with a 730 average FICO score.

This recession is LC’s coming-of-age moment. I believe it is well-positioned to sail through this recession and come out the other side stronger than ever.

I remain very bullish.

Be the first to comment