morning04/iStock via Getty Images

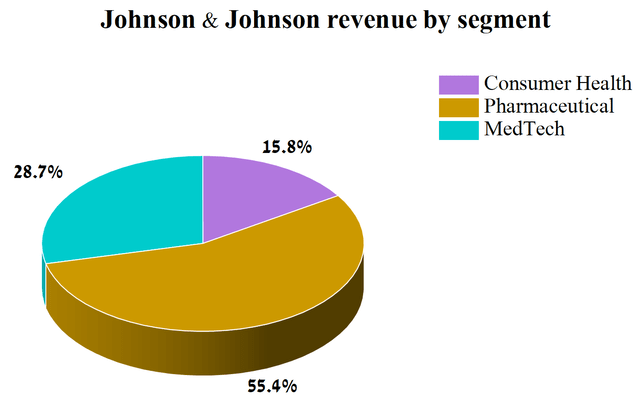

On November 12, 2021, Johnson & Johnson (NYSE:JNJ) announced its intention to spin off its Consumer Health business into a new public company while retaining its two fastest growing and highest margin segments, pharmaceuticals and medical devices. One of the main reasons for the global restructuring of the business is the desire of Johnson & Johnson management to mitigate damages from thousands of lawsuits in which the plaintiffs allege that the company’s talc-based products caused cancer because they were contaminated with asbestos. Sales of Consumer Health products contributed 15.8% of the company’s total revenue in Q2 2022, while sales of medicines and vaccines from the Pharmaceutical Segment were the largest contributors to Johnson & Johnson’s business.

Source: Author’s elaboration, based on quarterly securities reports

This article will provide an analysis of the most attractive segment of Johnson & Johnson, which, together with the Medical Devices segment, will become a new chapter in the company’s history from 2023.

The outlook for J&J’s product portfolio and its impact on the company’s financial position

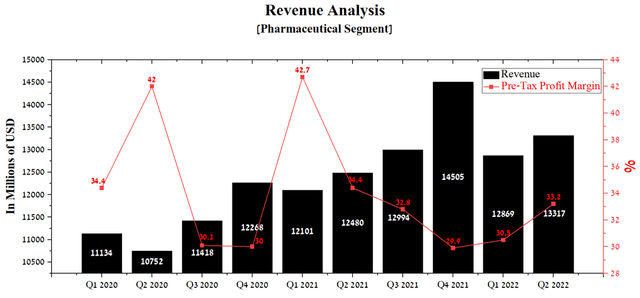

Johnson & Johnson’s pharmaceutical segment revenue was $13.3 billion in 2Q 2022, up 6.7% year-on-year. At the same time, the positive dynamics of sales of medicines and vaccines were also demonstrated on a quarterly basis, which shows the flexibility of the company’s management in making decisions and adjusting the strategy depending on the conditions in the pharmaceutical market.

Source: Author’s elaboration, based on Seeking Alpha

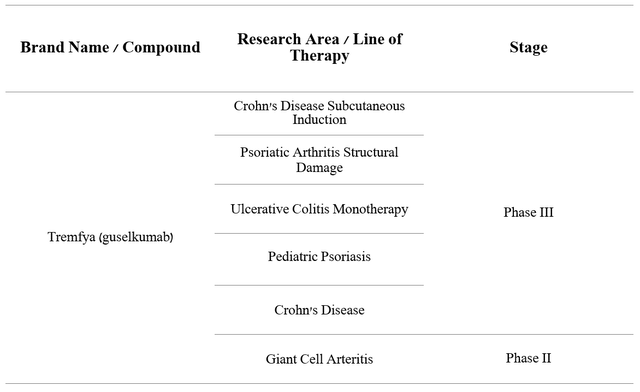

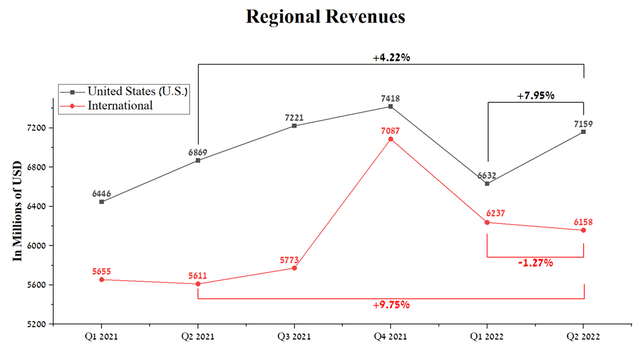

Johnson & Johnson’s single-digit increase in revenue was due to the negative dynamics of sales of certain vaccines and medicines in the US and abroad, increased competition in the pharmaceutical industry, and Remicade biosimilars, which, before losing exclusivity, brought the company $6-$7 billion a year. Johnson & Johnson’s U.S. revenue was $7,159 million in the second quarter of 2022, up 7.95% quarter-on-quarter, driven by strong demand for Stelara (ustekinumab), which is used to treat a variety of autoimmune diseases. Stelara’s sales amounted to $1,731 million, or 24.2% of the company’s total pharmaceutical segment revenue in the United States. The latest US patent for this blockbuster will expire in September 2023, bringing Stelara biosimilars to market starting in the fourth quarter of 2023. Whereas, the last European patent expires in 2024. I estimate that the average annual decline in Stelara sales will be 19.5% or a decrease in the total revenue of Johnson & Johnson by about $375-$400 million each year. In its portfolio, the company has medicines that can offset the negative consequences of the appearance on the market of generics and biosimilars of Johnson & Johnson’s blockbusters. One of the company’s hopes is Tremfya (guselkumab), which has been approved by regulators for the treatment of plaque psoriasis and psoriatic arthritis. The mechanism of action of Tremfya is based on the selective inhibition of IL-23 and as a result it can be an effective therapy for the treatment of other chronic autoimmune diseases. The company is currently conducting several phase III clinical trials to determine the efficacy and safety of guselkumab in the fight against such widespread diseases as Crohn’s disease, ulcerative colitis, etc.

Source: Author’s elaboration, based on Johnson & Johnson’s pipeline

While international revenue was $6,158 million in Q2 2022, up 9.75% year-on-year, but showing a slight QoQ decline due to the strength of the US dollar against the euro and the Japanese yen. I estimate that demand for the world’s dominant reserve currency will remain strong in the coming quarters, which will continue to put pressure on Johnson & Johnson’s medicine sales growth rate outside the US. At the same time, the war between Russia and Ukraine only indirectly affects the financial position of the pharmaceutical segment of the company, since sales of products in these territories account for less than 1% of Johnson & Johnson’s total revenue. On the other hand, the CIS region is one of the main sites for conducting clinical trials and the continuation of geopolitical tensions in this region may harm the patients participating in them, with a subsequent slowdown in the expansion of the company’s pipeline.

Source: Author’s elaboration, based on quarterly securities reports

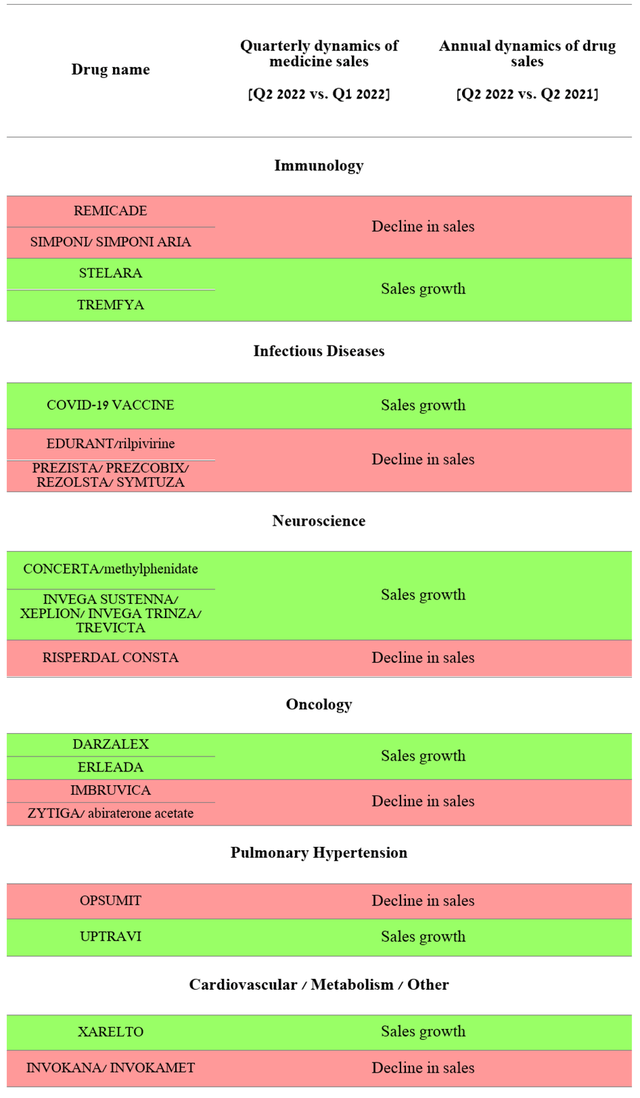

Johnson & Johnson’s pharmaceutical segment is focused on the commercialization of medicines and vaccines in six therapeutic areas. At the same time, half of the company’s portfolio shows a decrease in sales both on an annual and quarterly basis, thereby making me doubt the effectiveness of Johnson & Johnson’s business model and development strategies. I believe that the company’s management will have to pursue a more aggressive R&D and M&A policy, using some of the multi-billion dollar cash reserves to restore the former speed of business development.

Source: Author’s elaboration, based on quarterly securities reports

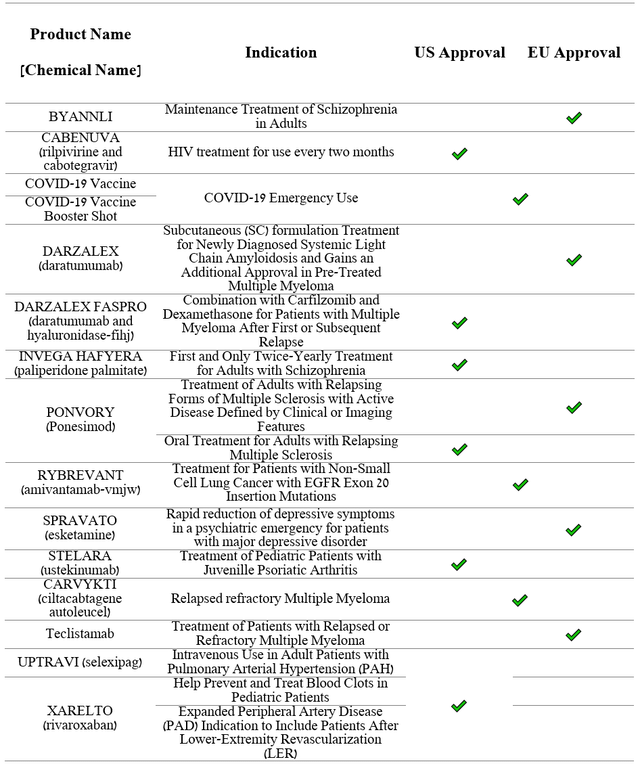

Since the beginning of 2021, the company’s medicines have received dozens of regulatory approvals in the US and Europe, opening up new investment opportunities for Johnson & Johnson in therapeutic areas where it has had little presence.

Source: Author’s elaboration, based on quarterly securities reports

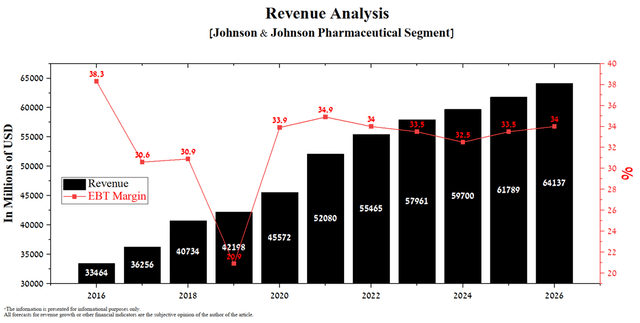

Based on Johnson & Johnson’s current portfolio of approved medicines, I expect the company’s revenue to increase by 8% in 2022 versus 2021. However, from 2023 to 2024, revenue growth and EBT margins will decrease slightly due to the negative impact of Stelara biosimilars and reduced demand for the COVID-19 vaccine. However, in the coming years, the company’s financial position will improve as new product candidates are approved and indications for the use of Johnson & Johnson’s medicines expand.

Source: Created by author

Conclusion

Johnson & Johnson is one of the largest medical companies in the world, which consists of three business segments, namely pharmaceuticals, medical instruments, and consumer health, which is scheduled to spin off by 2023 due to the massive talc powder scandal. The company is trying to use a bankruptcy maneuver to block more than 38,000 lawsuits related to allegations that some of Johnson & Johnson’s talc-containing products were contaminated with cancer-causing asbestos. However, the ongoing legal debate only increases criticism towards Johnson & Johnson and may lead to a significant increase in compensation relative to the amount that the company’s management planned to allocate for these purposes. As a result, these lawsuits will continue to put pressure on Johnson & Johnson’s share price in the coming quarters. On the other hand, the resolution of the talc scandal and the separation of the consumer health segment in the second half of 2023 will lead to an increase in investment interest in the rest of the business. In my estimation, Johnson & Johnson’s pharmaceutical segment has numerous fast-growing assets and an extensive portfolio of product candidates that can dramatically improve the quality of people’s lives. Taking into account macroeconomic risks, I expect the correction to continue down to $144 per share, where I plan to start investing in a dividend aristocrat.

Be the first to comment