ablokhin

It’s been a little over two months since I put out my bullish call on Landstar System, Inc. (NASDAQ:LSTR), and in that time the shares have returned about 18%, against a gain of about 3% for the S&P 500. There are a few reasons for revisiting this trade today. The first, and most important by a very wide margin, is the fact that this trade gives me a chance to brag. The second reason is that I want to work out whether or not it makes sense to continue to own these shares. After all, a stock that’s trading at $166 is a far more risky investment than the same stock when it’s trading hands at $141. I’ll make this determination by looking at the updated financials, and the new valuation. Finally, I actually bought the shares when some short puts expired worthless. This is yet another example of the risk reducing, yield enhancing potential of short put options. I’ll write about these yet again to demonstrate, yet again, how powerful these tools can be. If you’re not yet familiar with them, I recommend becoming so.

I know my writing can be “a bit much”, especially when I have an opportunity to brag. For that reason, I offer up a “thesis statement” paragraph in each of my articles. This gives the reader the opportunity to get the “gist” of my thinking in the first few paragraphs, which gives them the option to leave the article before they are subjected to eye rolling levels of self-congratulation. This is yet one more example of how I try to make your reading experience a pleasant one. You’re welcome. I consider the financial performance here to be quite good. Although the capital structure has deteriorated a bit, the cash hoard still dwarfs long term debt, so I’d suggest that the balance sheet is quite solid. The problem for me is that the shares are no longer objectively cheap, and for that reason, I’ll be taking my gains off the table this morning. I may miss out on some further upside, but I’d rather miss out on that party than suffer the risk of capital loss. Finally, in the following paragraphs, I take pains to point out that I did very well on short put options also. While I normally like to repeat success, I can’t in this case as the premia on offer are too thin in my estimation. There you have my thinking in a nutshell. If you read on from here, that’s on you. I don’t want to read any complaints in the comments section about my incessant bragging or whether I spell properly.

Financial Snapshot

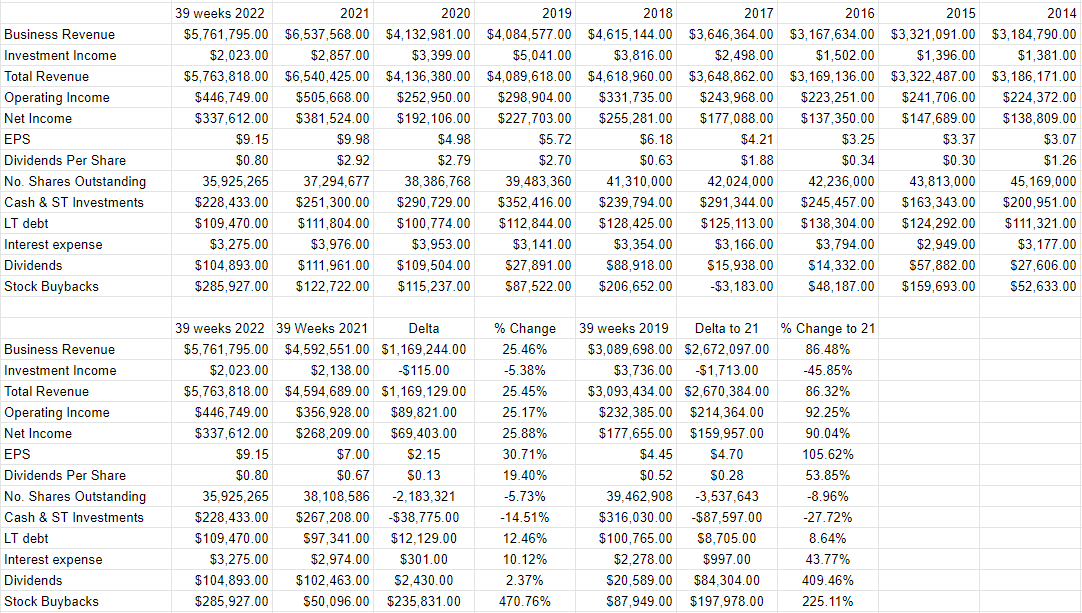

The first 39 weeks of 2022 have been quite good for Landstar in my estimation. Revenue was up fully 25.5% relative to the same period in 2021, and was fully 86.5% higher than it was during the same period in 2019. In spite of a 26% uptick in purchased transport, and a 30.5% increase in commissions to agents, net income climbed just under 26% relative to the same period in 2021.

The company rewarded shareholders with this performance by upping the dividend fully 19.4% from $.67 to $.80 for the first 39 weeks for the year. Additionally, the company spent fully $286 million of its enormous cash hoard buying back shares, which went some way in reducing the shares outstanding by ~5.7% relative to the same period in 2021.

The one aspect of the financial history that’s less good in my estimation is the fact that long term debt has climbed by about $12 million, or 12.5%. Predictably, interest expenses have increased right along with it, up fully 10% from the year ago period. My nervousness about indebtedness is ameliorated greatly by the fact that the cash hoard still represents about 208% of long-term debt outstanding. Although the capital structure has deteriorated somewhat, I think risk of a credit or solvency crisis is vanishingly small at the moment.

Given all of the above, I’d be happy to add to my Landstar position at the right price.

Landstar Financials (Landstar investor relations)

The Stock

If you subject yourself to my stuff regularly, you know that I think the stock is distinct from the business in many ways. A business pays for a number of inputs, like transportation services, and commissions to agents, for example, adds value to those inputs, and then sells the results for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for a given company, and the stock is buffeted by a number of forces some of which may have little to do with the underlying business. Inflation and the rising dollar may impact the business significantly. A fashionable analyst may decide that the shares are overpriced. The crowd may form a view about the relative attractiveness of stocks in general, and that drives shares up or down. Strangest of all in my mind, stock investors can be mesmerized by the pronouncements of Fed officials, as if the difference between a 50 and 75 basis point move in the overnight rate matters all that much.

Although it’s tedious to see your favorite investment get buffeted around for reasons having little to do with the health of the business, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. I absolutely hate to remind you about my great recent performance here, but the fact is that this is the approach I took when deciding to buy previously. The shares were “too cheap” given the performance here, so I bought aggressively. This is why I only ever want to buy a stock that is relatively cheap, and it’s why I’m reviewing Landstar again today. The shares may no longer be “cheap.”

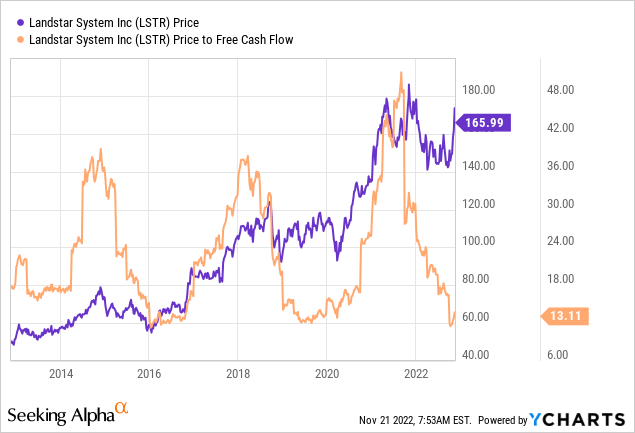

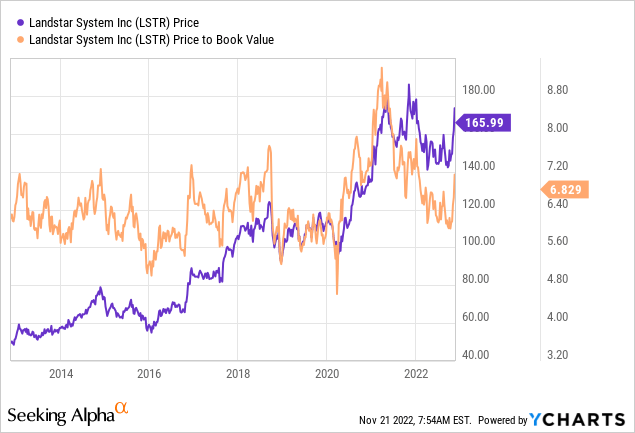

As my regular victims know, I use a host of measures to judge the relative cheapness (or not) of a given stock, some of which are quite simple, some of which are quite sophisticated. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I bought Landstar stock when it was trading at a price-to-free cash flow ratio of ~16.1. Fast forward a few months, and the shares are about 18.75% cheaper on this basis.

While shares are cheaper on a price to free cash basis, they’re about 17% more expensive on a price to book basis.

Given the above, there’s some ambiguity here. The shares are relatively cheap if we focus on the operating side of the company, but more dear if we focus on the rock-solid balance sheet.

My regulars know that I think ratios can be instructive, but I also want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future. Applying this approach to Landstar at the moment suggests the market is assuming that this company will grow earnings at a rate of ~5.9% in perpetuity. I consider that to be a pretty optimistic forecast for any company, even this one.

Given the above, I can’t recommend buying at current levels, and will be taking my own chips off the table this morning. The company is growing nicely, and that’s a necessary but not sufficient precondition to make a great investment. At the moment, I’d rather preserve capital than go for further gains, so I’m pulling the plug this morning. I’d rather forego a few more dollars of “upside” than risk losing capital. I may regret the decision if the shares spike from current levels. If that happens, that will be neither the first, nor the last time that I’m stung with regret.

Options Update

If my not-so-subtle brag about my return on this investment wasn’t enough for you, you’re in luck, because I’m about to deliver another helping of unhealthy self-congratulation. Way back in April I wrote 10 Landstar puts with a strike of $115 for $2.55 each. I considered these to be “win-win” trades, because the outcome would be great either way. At the time, my thinking went something like this: if the shares remained above $115 over the life of the option, I’d simply pocket the premium and move on. That would not be a terrible outcome. If the shares dropped below $115, I’d be “forced” to buy this stock at a net price of $112.45. That would also be a fairly good outcome. This is why I consider deep out of the money short puts on great companies to be excellent wealth builders. They reduce risk while they enhance returns.

I mention all of this at the moment for two reasons. First, it gives me yet another chance to brag, and I’m insecure enough that I’ll never pass up such an opportunity. Second, my experience in this case is hopefully instructive for those who haven’t yet made themselves aware of the yield enhancing potential of short put options. If you’re not yet using these instruments, I would recommend you start doing so.

While I like to try to repeat success when I can, there’s no opportunity to do so in this case I’m afraid. The premia on offer for reasonable strike prices is way too thin in my estimation. For example, the April puts with a strike of $140 are currently bid at $0. For that reason, there’s nothing for it but to sit on the sidelines and wait for what I consider to be an inevitable price drop from current levels.

Be the first to comment