Extreme Media

Investment Summary

After extensive review of Takeda Pharmaceutical Company Limited (NYSE:TAK), we have been impressed by the company’s latest financials and regulatory momentum. It’s been a busy year in FY22 for TAK, and given recent price action, we believe it may be a turning point for the stock after 2 years of disappointment. Here we discuss our key findings of the TAK investment debate. Rate buy, price objective $32.45.

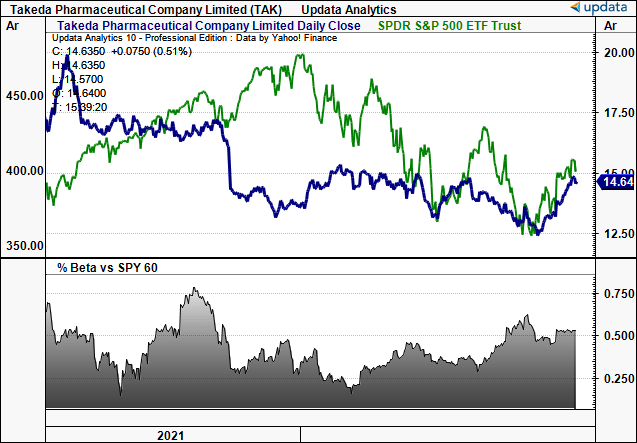

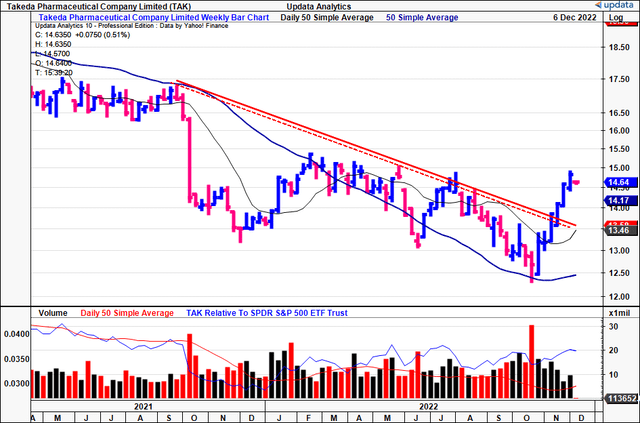

Exhibit 1. TAK 2-year price evolution vs. S&P 500

Data: Updata

TAK Q3 Financials – heavy spend, FY23′ looks to be the year

Turing to the numbers, we noted it was a strong period of reported growth for the company. We should also note, that TAK’s last earnings report was for the six months ending September 30, 2022. It reported this in late October, and is relevant to our thesis. Therefore, we’ll be talking in terms of TAK’s H1 FY22 from hereon in. Moreover, seeing as the company is domiciled in Japan and reports in Japanese Yen (“JPY”), we’ll also be talking in these terms for the purposes of consistency and to remove the effect of the USD/JPY cross rate.

In H1 FY22, the company’s core revenue grew 550bps YoY to JPY1,974.8Bn on core operating profit of JPY625.2Bn, growing at a rate of 14.5% in constant currency terms [all growth percentages are in constant currency unless otherwise specified]. As such, operating margins lifted 240bps to 31.7%, and it pulled this down to EPS of JPY288, growing at a rate of 15.8%.

It’s also worth noting that 98% of TAK’s on-balance sheet debt is secured at fixed rates with a weighted average interest rate of 2%. The company will pay off the final portion of its floating debt in November, putting it in a favorable fixed rate position and reduce rates sensitivity.

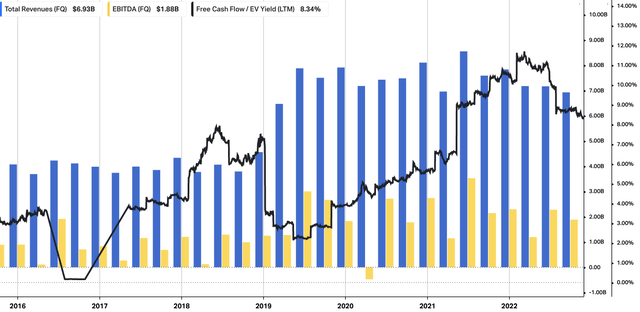

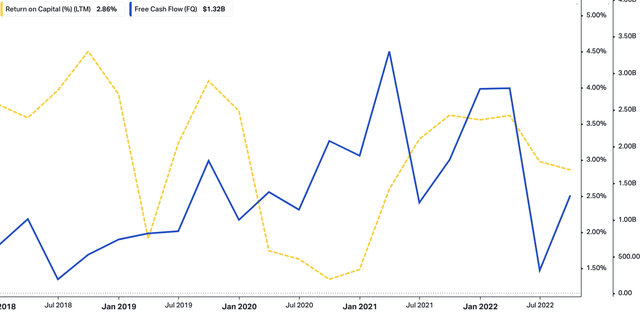

We also saw upsides in each of the ENTYVIO, TAKHZYRO, and Immunoglobulin segments. Specifically, each division recorded growth of 17%, 31%, and 17%, respectively. TAK itself sees potential for further market growth and share expansion for ENTYVIO and has raised forward sales estimates to a range of $7.5Bn–$9Bn. You can see a further breakdown of TAK’s operating performance from FY16–date in Exhibit 1. Note, the company is now printing revenue at pre-pandemic rates, whilst core EBITDA remains cyclical. However, investors can now buy TAK at a trailing FCF yield of 8.3%. You can also see a summary of TAK’s free cash flows and return on capital. It is pleasing to see that, as FCF flows out, the level of trailing return on capital employed has stretched up to ~2.9%.

Switching to the regulatory and clinical highlights, there were many for TAK across the period. To name a few:

- TAK achieved a key milestone this month with the Committee for Medicinal Products for Human Use (“CHMP”) recommended approval of its dengue vaccines candidate, TAK-003, for the prevention of dengue disease. This followed its first approval in Indonesia two months ago, and the European Commission is expected to decide on marketing authorization in the near future.

- The CHMP-recommended approval for TAK-003 is significant for Europe and dengue-endemic countries that participated in the EU medicine for all procedure. This is because severe dengue is a leading cause of illness and death among children and adults in Latin America and Asia, with over half the world’s population at risk, according to WHO data.

- The company also received a positive CHMP opinion for maribavir in relapse and refractory cytomegalovirus disease after transplant. Moreover, it recently signed a collaboration and licensing agreement with Zedira and Dr. Falk Pharma to develop TAK–227 for the treatment of celiac disease.

- The approval of TAK-003 without prior dengue exposure could eliminate a critical barrier to access in our opinion. It also serves as a bedrock to increase confidence about the efficacy and safety of the vaccines, and is expected to be launched in Indonesia in early 2023.

Exhibit 2. TAK FY16–FY22 operating summary, quarterly.

See revenue, core EBITDA remain cyclical, whilst FCF yield hovers ~8.3%.

Data: HBI, Refinitiv Eikon, Koyfin

Exhibit 3. Free cash outflows matched by corresponding uplift in return on capital employed

data: HBI, Refinitiv Eikon, Koyfin

As far as the divisional takeaways are concerned, we saw the following upside factors:

- The zenith of achievement was reached with ENTYVIO [vedolizumab], which grew by 17% YoY. This was largely attributed to an augmented prevalence of bio–naive patients.

- We should also note that TAKHZYRO turnover flourished with a 31% YoY growth, due to the augmenting demand and geospatial expansion.

- Additionally, management said the launch of LIVTENCITY was met with success, with 75% of the transplant centers in the US initiating treatment with at least 1 patient.

Combined, each of these factors create a robust springboard for TAK to thrust from in FY23 in our opinion. This adds weight to the risk/reward asymmetry.

Guidance

We noted that management updated its FY22 guidance on the earnings call. It lifted FY22 revenue estimates to JPY3.93 trillion on core operating profit of JPY1.18 trillion and core EPS reaching JPY525.

This is a growth of approximately 15%, revenue and 23% for core operating profit and core EPS. The company builds its updated outlook based on its assumption of the first half average FX rates, specifically JPY132 to the US dollar and JPY138 to the euro.

Furthermore, the company has also increased its outlook for free cash flow from JPY600Bn–JPY700Bn, now to JPY650Bn–JPY750Bn, primarily due to the FX tailwind.

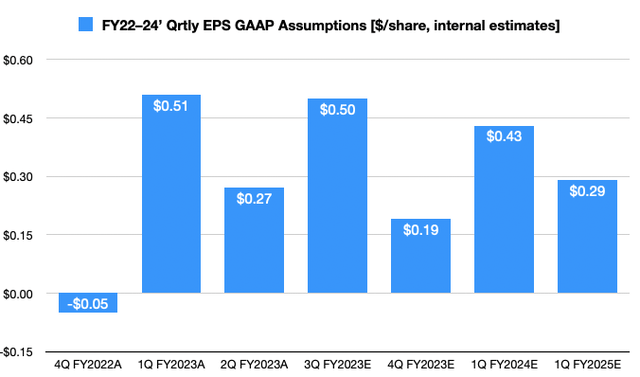

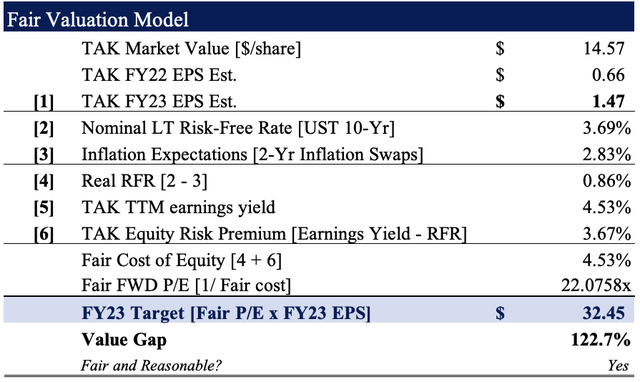

If we translate these numbers into the exchange rate above, and adjust the reporting schedule to US financial year, we believe the assumptions are fair and reasonable. We forecast a FY22 EPS estimate of USD$0.66, stretching up to USD$1.47 the year after. Meanwhile, as you’ll see below, we see strong quarterly EPS uplift into FY23. This also confirms our buy thesis.

Exhibit 4. TAK FY22–24′ quarterly EPS growth assumptions [internal estimates, $/share]

Data: HB Insights Estimates

Valuation and conclusion

You can see below that TAK has broken above its longer-term downtrend. It has closed up for 6 weeks in a row and trades above its 50DMA and 250DMA.

Hence, we expect further upside to come based on this presentation.

Exhibit 5. TAK 3-year weekly price action [weekly bars, log scale]

Data: Updata

Consensus values the stock at 28x forward earnings, ahead of our internal estimates.

Based on our FY22–23′ EPS growth assumptions, we see TAK fairly valued at ~22x forward P/E, or $34.45 when rolling our FY23 EPS estimates forward to that multiple.

This represents >122% upside potential and confirms our buy thesis.

Exhibit 6. Fair value estimate of $32.45

Note: Fair forward price-earnings multiple calculated as 1/fair cost of equity. This is known as the ‘steady state’ P/E. For more and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014]. (Data: HBI Estimates)

As such, considering the data presented above, combined with our price objective of $32.45, we rate TAK a buy.

Be the first to comment