GDArts/iStock via Getty Images

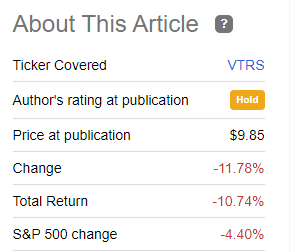

When we last covered Viatris Inc. (NASDAQ:VTRS) we doubled down on our previous call that headwinds would alter the earnings trajectory and investors should exercise caution.

Q2-2022 results and subsequent guidance will be critical to determine the direction. If we are correct, there should be a good drop across the board for revenues, margins and EBITDA. Remember, that our free cash flow estimate ($2.3 billion) is way below the company’s $2.7 billion midpoint. We think investors should prepare for a bad quarter and be prepared to buy weakness following that. We maintain our stoic “hold”.

Source: Guidance Likely To Be Cut With Q2 Results

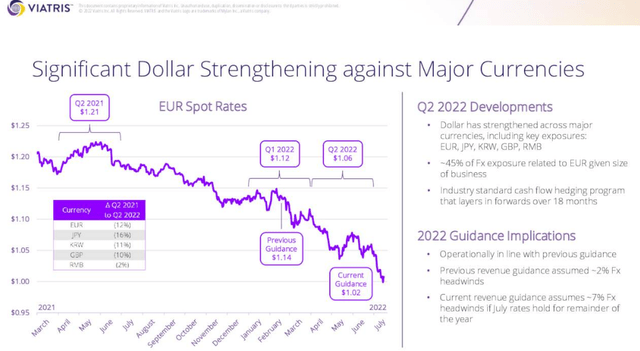

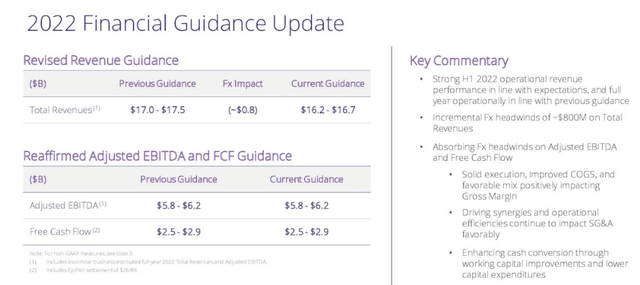

The company gave us our report card and it was not too great. VTRS led off the revised 2022 guidance showing just how strong the US Dollar compared to previous forecasts.

As we expected, they did chop revenues down. But shockingly, held the adjusted EBITDA and free cash flow right at the last level.

The stock is still lower than when we wrote that last piece.

Seeking Alpha

What do we make of this?

Q2-2022

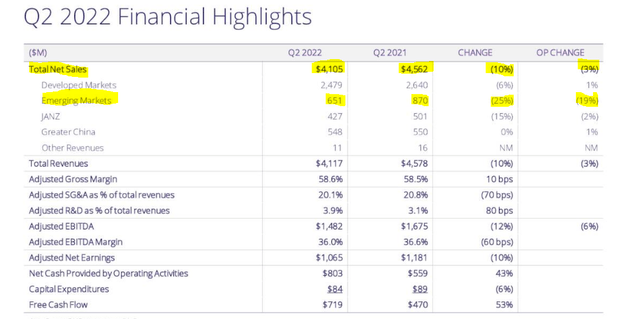

The quarter in question was not great by any stretch of the imagination. Sales were down 10% year over year and emerging market sales were in freefall.

Lot of this was the forex headwind, but even adjusted for that (shown as operating change), emerging markets were down 19%. The good news for investors was that all of this was part and parcel of the original guidance. The better news from our perspective was that VTRS held that gross margins line and held it really well. It is a rare feat to see gross margins rise when sales drop by 10%, but that is what we got. Free cash flow was strong once again and the company paid down $627 million of debt in the quarter. This has been a good run-rate of free cash flow and debt paydown has been steady and consistent.

Outlook

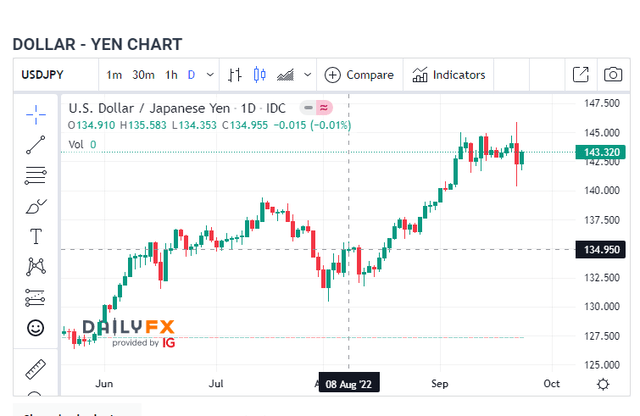

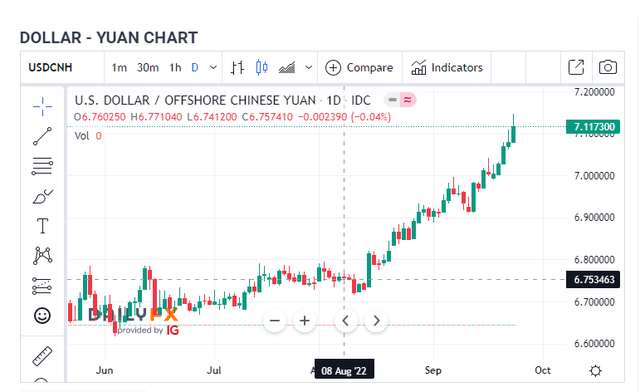

VTRS did not give the guidance cut we expected as it maintained higher gross margins, cut costs and also cut capex for the back half of the year. Unfortunately, the forex headwinds have become stronger since the last conference call. Their guidance the Euro for example at 1.02 to the US dollar and that is now 3.5% south of that. The Yen is substantially weaker since the August 8 guidance.

The same can be said about the Chinese Yuan.

Our thoughts here are that while they did do ok in the first round of this battle, they are going to face a tough Q3-2022 and a very rough Q4-2022 at these spot rates. We would still expect another guidance cut on the Q3-2022 conference call as there is only so much maneuvering you can do in the face of such drastic challenges.

Valuation

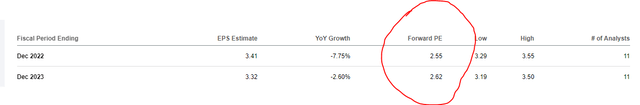

VTRS looks insanely cheap on a forward P/E basis.

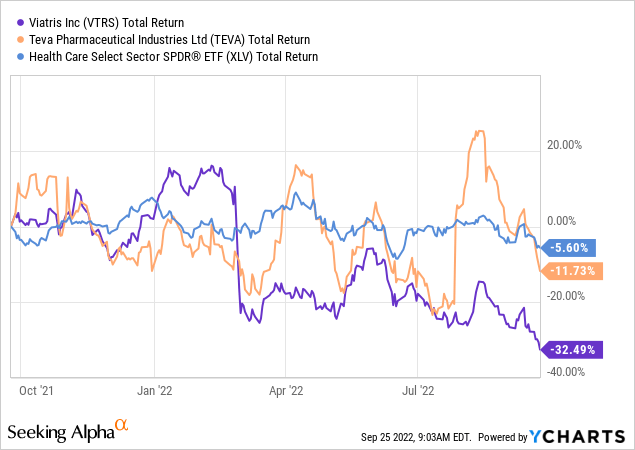

That unfortunately does not account for how the debt features into this equation. VTRS has underperformed the Health Care Select Sector SPDR ETF (XLV) substantially despite always appearing cheap.

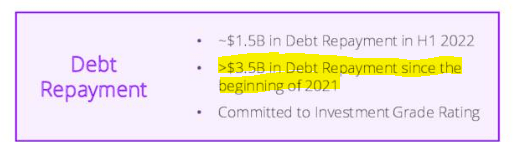

In such a case, we normally would like to see deleveraging, and if we got that, we would expect the stock to start performing well. Now, we have had that deleveraging.

VTRS Presentation

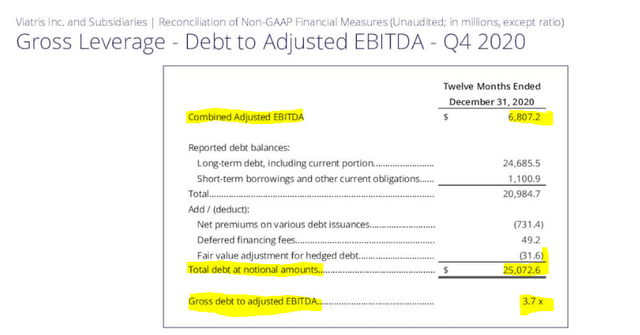

Where have the returns gone then? The answer is quite instructive. At December 31, 2020, VTRS’s leverage was at 3.7X.

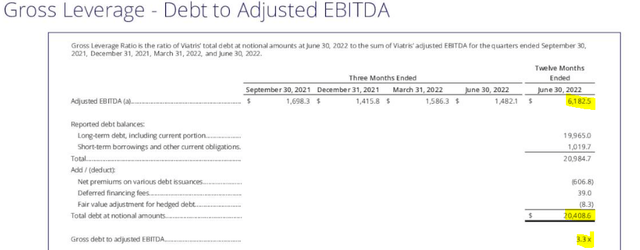

Yes, we are aware that the official company launched after that but these are the adjusted amounts based on its two predecessors. Total debt is down today by over $4.5 billion and debt to EBITDA is down 0.4X.

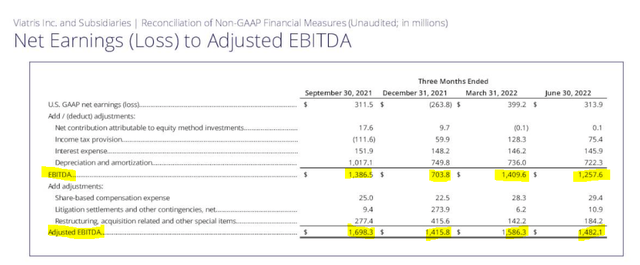

What the equity holders are concerned about is the drop from $6.80 billion to $6.18 billion. Yes, adjusted EBITDA has dropped slower than debt, but there are still challenges ahead. Most notable here is that even the Adjusted EBITDA shown above is for the trailing 12 months. The most recent quarter annualizes to $5.92 billion and the debt to adjusted EBITDA is realistically at 3.45X. VTRS has also benefitted from its foreign currency debt translating into fewer US Dollars. So overall improvement here has been quite modest.

How VTRS Can Fly Again

Realistically, VTRS needs a stable adjusted EBITDA for a few quarters and a debt to adjusted EBITDA below 3.0X to start getting equity holders to notice. Some might find the criteria stated above as harsh. We think they are quite modest, especially in light of the massive and consistent gap between EBITDA and adjusted EBITDA.

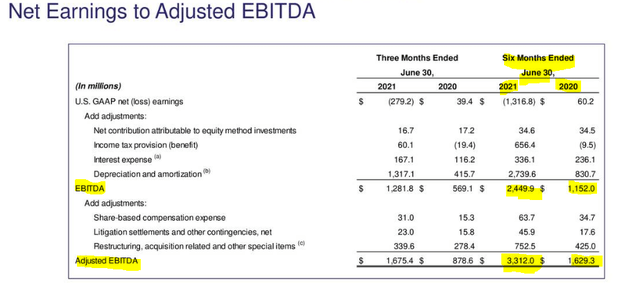

Over the last 4 quarters, actual EBITDA has been lower than adjusted EBITDA by $1.4 billion.

How about the two quarters before that?

EBITDA was lower than adjusted EBITDA by $862 million.

The previous year, before the merger, also shows EBITDA trailing adjusted EBITDA by about $480 million. Some of these are likely one-time charges but the history over here suggests that one take a cautious approach until we see Adjusted EBITDA and EBITDA land in the same postal code.

All said and done, we think VTRS can deliver good results from this equity valuation but still think some major headwinds lie dead ahead.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment