Anastasiia Shavshyna

What a difference a month makes! Entering July, it appeared that we were entering a period where dividend growth bargains would be relatively easy to find. But, by the end of July, it was starting to feel like 2021; Markets were determined to go higher regardless of the news.

Of course, short-term sentiment drives the market much more than anything else. And the saying goes that the market is forward-looking. The question becomes, “just how far forward looking?”

I wish I knew what the next few months hold. I am letting dividends accumulate in this portfolio as I expect this fall to bring better values. But it certainly looks like the market will continue to rip higher through August and into the first part of September. Eventually, sustained high inflation and continually rising interest rates will catch up with the consumer. Fortunately, as a dividend growth investor, the market’s gyrations don’t have much impact on my investing.

I became a dividend growth investor at the end of the Great Recession. Having watched my portfolio devastated multiple times over the years as I struggled with finding the correct strategy, dividend growth investing just made sense. You see, the part that challenged me most was understanding my end goal – should I try to accumulate $1 million, $10 million, as much as possible?

Investing without a clearly defined goal in mind wasn’t working for me. I needed something I could measure and see progress to keep me motivated. Thinking of my goals from a wealth standpoint didn’t cut it. Once I shifted to a cash flow mindset, everything began to fall into place.

The concept of creating enough passive income to cover my expenses is simple enough for even me to understand. I know exactly what my expenses are and how much passive income I am earning at any given time. The difference is how much I need to make through a job.

Today I have multiple streams of passive income, and dividend growth investing is a large part. The portfolio I write about here was my first adventure into passive income. This portfolio has been closed to new capital since 2016 to allow me to fully evaluate how well I am doing without being skewed by moving new money into the portfolio.

Portfolio Goal

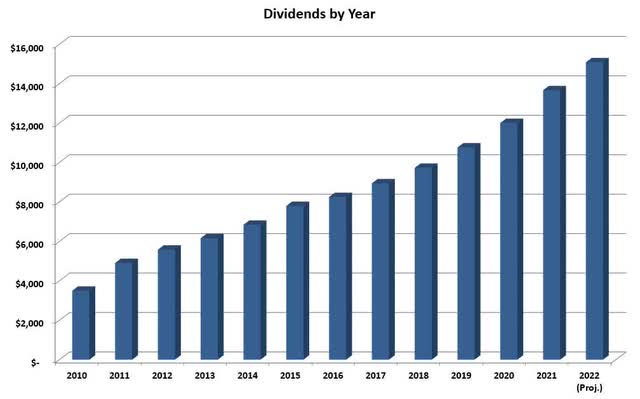

The portfolio goals are simple: Grow the income by 10% annually with dividends reinvested and 7% annually without reinvesting. This goal allows my income to double approximately every seven years while I am reinvesting and every ten years once I begin withdrawing the dividends. The table below shows the steady progress of income growth.

Portfolio Guidelines

I use guidelines to achieve my goals rather than rules. Rules imply something hard and fast, whereas guidelines are flexible but give a general direction to follow. I keep these simple, as I have found that complexity adds time without any real benefit. These have evolved over the years, the most recent being the addition of selling covered calls in certain circumstances.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. This is integral as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. I was burned by this in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I have a few other items I follow, but I don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don’t enjoy accounting for the taxes and FX rates causing fluctuating dividends.

Portfolio Holdings

Every few months, I publish the total holdings of the portfolio. The table below shows the holdings, ranked by position size. The table displays the percent of the portfolio each makes up and the percent of the income it contributes.

| Company | % of Portfolio | % of Income |

| Apple (AAPL) | 10.8% | 1.9% |

| Ameriprise (AMP) | 6.4% | 3.5% |

| Blackstone (BX) | 6.2% | 9.7% |

| Microsoft (MSFT) | 5.8% | 1.6% |

| Philip Morris (PM) | 5.0% | 8.1% |

| Altria (MO) | 4.5% | 11.7% |

| AbbVie (ABBV) | 4.4% | 5.7% |

| Lockheed Martin (LMT) | 4.2% | 3.6% |

| Visa (V) | 4.1% | 1.0% |

| Texas Instruments (TXN) | 4.1% | 3.3% |

| Cincinnati Financial (CINF) | 3.4% | 2.8% |

| Medtronic (MDT) | 3.1% | 2.7% |

| Enterprise Products Partners (EPD) | 3.1% | 6.9% |

| Duke Energy (DUK) | 2.5% | 2.9% |

| PepsiCo (PEP) | 2.3% | 1.8% |

| Aflac (AFL) | 2.2% | 1.8% |

| Johnson & Johnson (JNJ) | 2.1% | 1.8% |

| Broadcom (AVGO) | 2.0% | 2.0% |

| MSA Safety (MSA) | 1.7% | 0.8% |

| Starbucks (SBUX) | 1.7% | 1.2% |

| Abbott Laboratories (ABT) | 1.6% | 0.9% |

| Phillips 66 (PSX) | 1.5% | 2.1% |

| Automatic Data Processing (ADP) | 1.5% | 0.8% |

| Intel (INTC) | 1.4% | 1.9% |

| Omega Healthcare Investors (OHI) | 1.3% | 3.3% |

| A. O. Smith Corp. (AOS) | 1.3% | 0.7% |

| J. M. Smucker (SJM) | 1.2% | 1.2% |

| CVS Health (CVS) | 1.1% | 0.7% |

| Prudential Financial (PRU) | 1.0% | 1.4% |

| Walgreens Boots Alliance (WBA) | 1.0% | 1.4% |

| Best Buy (BBY) | 0.9% | 0.9% |

| Unilever (UL) | 0.9% | 1.2% |

| Ladder Capital (LADR) | 0.9% | 2.1% |

| Home Depot (HD) | 0.8% | 0.4% |

| Simon Property Group (SPG) | 0.8% | 1.5% |

| Realty Income (O) | 0.6% | 0.7% |

| Honeywell (HON) | 0.5% | 0.3% |

| National Retail Properties (NNN) | 0.5% | 0.5% |

| Healthcare Services Group (HCSG) | 0.4% | 0.8% |

| Cardinal Health (CAH) | 0.4% | 0.4% |

| STORE Capital Corp. (STOR) | 0.4% | 0.5% |

| Snap-on (SNA) | 0.4% | 0.3% |

| Diamond Hill Investment Group (DHIL) | 0.3% | 0.4% |

How is 2022 Shaping Up?

The current income projection for 2022 stands at $15,343, an increase of 12.3% over last year. This increase handily beats my goal of 10% growth, and we still have several months of dividend reinvestment! Of course, like last year, Blackstone has massively raised its dividend, which has led to outsized income growth. The graph below shows how income has grown over the years.

While the portfolio goals are entirely income-based, many readers are interested in total returns. To be clear, I don’t care about total returns; all that matters is that the income grows by 10% annually. However, for information purposes, the portfolio is down 6.2% through the end of July, still handily beating the S&P 500.

July’s Dividend Increases

The summer months are slow in terms of significant increases for this portfolio. While there were five increases last month, except for Blackstone, they have a relatively minor impact on the portfolio. The companies raising in July were either small positions or slow growers.

Blackstone

I’ll get the big one out of the way first. Blackstone followed up its first two quarters’ raises of nearly 55% with a third-quarter raise of over 80% (vs. 3rd quarter 2021.) Additionally, in 2021, the company raised the dividend by a whopping 87%! The company is more than making up for the declining dividend in 2019 and 2020.

Blackstone was purchased as a high-yield company when it was a partnership. It has since become the second largest position in the portfolio, and the second largest income producer, behind Altria.

J. M. Smucker

Last month J. M. Smucker announced a disappointing 3% raise. This amount was even below the low end of my expectation of 4% and well below the 5-year average of 5.9%. However, this raise will mark 25 consecutive years of dividend growth for the company.

Walgreen Boots Alliance

As expected, WBA announced a minimum increase of 1 cent per share. While this wasn’t surprising, I would just assume they freeze the dividend ala CVS and begin the raises again after shoring up the balance sheet and the business. As this is a small position, it will be up for review.

Duke Energy

This is one of those companies it’s easy to forget is in the portfolio. I look at it once a year to check the dividend increase. As expected, the dividend was increased by 2%. While not a fast grower, Duke energy doesn’t require much work to hold either.

National Retail Properties

As a new high-yield position in the portfolio, any increase is welcome. High yield positions are generally kept small, and in recent years I have been reducing risk by transitioning them to companies that provide some dividend growth whenever possible. NNN raised the dividend by 3.8%, much better than I expected when the company was added to the portfolio earlier this year.

NNN, along with a few other companies, was added as a replacement for Blackstone’s purchase of Preferred Apartment (APTS) and my elimination of Annaly (NLY) from the portfolio earlier this year.

September’s Expected Increases

There is only one increase expected in September, but it’s significant. Altria will announce its 53rd consecutive increase towards the end of the month. With its numerous spin-offs, Altria is not the same company it was for all those years. However, it is still a consistent dividend growth company.

As the single largest income producer in the portfolio, its raise is significant to achieving my goal of 7/10% annual income growth. In 2011 the company accounted for 13% of the income, which has only fallen to 12% today. This reflects the strength of the dividend growth over the past decade, as very little has been added.

While Altria has provided steadily growing income over the years, I have become less comfortable with them providing such a high percentage of income. They became oversized in March 2009 when they offered historically high yields, and I was buying aggressively. I am looking to sell covered calls against part of the position should the price increase/yield fall to where a reasonable alternative exists. It isn’t easy to replace a company with such a long and consistent dividend growth history.

Altria has a 5-year dividend growth rate of 8.6%. Last year’s raise was close to 5%. Even though Altria received a lot of press on the JUUL fiasco, this is a non-issue on its cash flow. I think we will be looking at another sub-5 % dividend increase, probably in the 3-4% range.

Sales in July

I rarely make any sales. Companies are purchased with the intent to hold them forever. However, lower quality high-yield companies and significantly overvalued companies are always up for review. Last month there were no sales to report.

Regular Purchases

Not a lot of purchases were made in July. I made the mistake of not thinking better deals were ahead when some great deals were available at the time. Below is a summary of the purchases I did make, all of which were completed before mid-July. Note the prices shown are average prices.

- 1 share of Texas Instruments @ $148.36

- 1 share of Best Buy @ $67.93

- 2 shares of Prudential @ $91.55

- 1 Share of Medtronic @ $87.16

What Else am I Looking At?

Since this is a closed portfolio, I can’t buy everything that looks interesting. I use this section to cover what I purchase and consider in my other portfolios. The other portfolios have different goals and rules but are also dividend growth portfolios.

By mid-July, there were many good deals available. So many so, that I purchased quite a lot of Schwab U.S. Dividend Equity ETF (SCHD). I have taken to this strategy when dividend growth stocks as a whole are looking attractive but the particular companies I am targeting haven’t hit my price.

I added more T. Rowe Price (TROW) below $110 and still believe the company offers an attractive price today. Retailers continued to offer good prices, but I cooled my buying as I still believe we may enter a recession and these will be hit hard by the market. Industrials remained stubbornly high priced throughout the month, as I would like to add to my Snap-on and Honeywell positions, but I will continue to be patient.

As a final note, I didn’t do as much purchasing as I might have last month. To the contrary, in one of my taxable accounts I used the price increases at the end of the month to raise funds as I am considering purchasing a new home in the coming months. Additionally, a work situation may force me into selling some huge winners so I am taking what little tax losses I have as I raise funds. I may have more about this in coming months as the forced selling would greatly impact the portfolio I write about here.

Final Thoughts

The market turned around fast the second half of July. I’m not convinced we have bottomed yet, as summer months are difficult to judge. For that reason I will consider to accumulate dividends in anticipation of better deals in the fall.

I don’t know where we are headed. On one hand, every restaurant is packed, flights are overbooked, and lines to get into anything are long. On the other hand inflation is hitting everyone’s pocketbook and on everyone’s mind. It feels like the mentality is spend until you can’t. But we could just be seeing just how divided we are with the haves and have-nots.

As I wait to see if deals appear, I will continue to collect dividends and rest easy knowing that regardless of what happens, my income will continue to grow.

Be the first to comment