BING-JHEN HONG

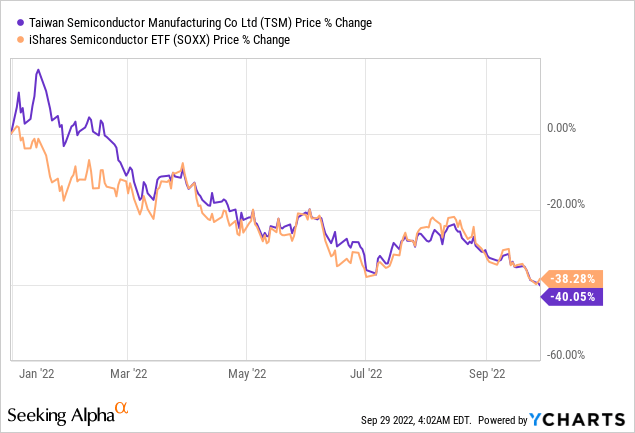

The semiconductor sector remains one of the worst performers in the 2022 market rout and shares of foundry leader TSMC (NYSE:TSM) are no exception. Year-to-date, TSMC’s stock has fallen more than the iShares Semiconductor ETF (SOXX) as markets remain extremely cautious on the demand outlook. Worse yet, the geopolitical landscape is not helping as increasing tensions between China and Taiwan have prompted a promise from the US to intervene should both sides start a military conflict. Without getting too much into the politics, let’s review what happened to TSMC since I last wrote about the company’s 2Q22 results and discuss how the business fundamentals look going forward.

Worsening macro outlook

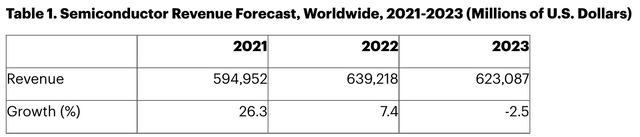

Semiconductors are as common as air, given how much humans rely on technology in the modern world. The pandemic greatly boosted the demand for consumer electronics as well as enterprise tech, and there’s no question that the semi party is taking a breather in 2022. Gartner projects the global semi revenue to grow by 7.4% in 2022 to $639 billion vs. a record 26% in 2021, while this number is expected to contract by 2.5% in 2023.

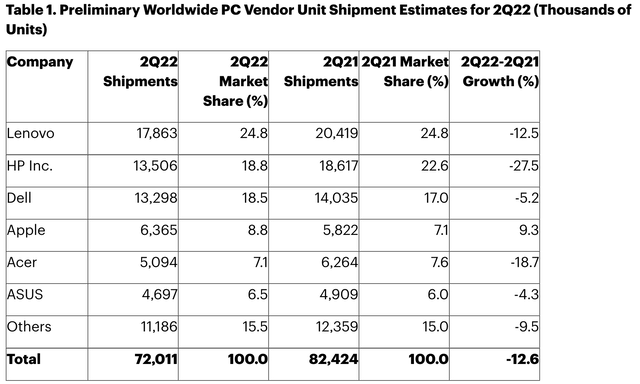

Despite the fact that a growing share of today’s semi demand comes from higher-growth sectors such as 5G, server, AI and auto, everyday items like PCs, smartphones, tablets and other household electronics (TVs, refrigerators, washing machines, etc.) still account for roughly 50% of global semi production. Smartphones, for instance, make up 30% of global semi revenue. Now that the pandemic is behind us, consumers are not in a rush to buy a new smartphone or laptop while paying significantly more for food and gas. Per Gartner, smartphone semi sales will only grow 3.1% in 2022 vs. 24.5% in 2021, and PC shipments are expected to decline 13%, translating into a 5.4% decline in PC semi sales.

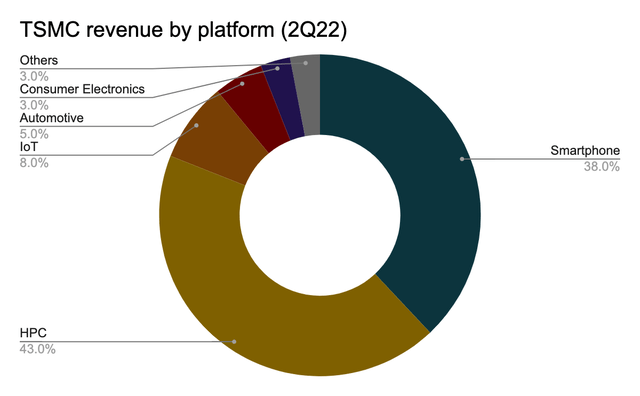

Evidently, inventory corrections are here and TSMC has already faced a series of order cuts from key customers including MediaTek (OTCPK:MDTKF), Qualcomm (QCOM), AMD (AMD) and Nvidia (NVDA), which account for roughly 30% of TSMC’s revenue. Earlier this month, the US government also banned Nvidia and AMD from selling AI chips to China. While, in 2Q22, TSMC’s revenue from the HPC platform exceeded Smartphone for the first time, some investors may begin to question the resiliency of HPC demand.

Apple, the biggest customer representing ~25% of TSMC’s sales, has recently abandoned its plan to increase production of the iPhone 14 which translates into 6 million fewer units in 2H22, leaving total forecasted unit sales at the same level as 2021 at 90 million (Bloomberg). Additionally, it was reported by the Economic Daily News yesterday that Apple rejected TSMC’s planned price hikes ranging from 3%-6%.

The key takeaway here is that things don’t look so good for TSMC as revenue growth is likely to experience a slowdown going forward and margins could easily come under pressure. It’s unclear how long the current de-stocking cycle will last (until 1H23?) and based on the plethora of bad news, it’s conceivable that TSMC’s 53%+ long-term gross margin target could be at risk should capacity utilizations come down. While a stronger dollar may provide some cushion (TSMC gets paid in USD, so a stronger dollar is a good thing), the trend in gross margin is still negative should top-line growth experience a material deceleration.

The long view

The consumer electronics sector experienced a period of overconsumption in the last 2 years and the demand outlook will likely remain choppy over the next 6-12 months. TSMC’s Smartphone business will no doubt experience pressure while the HPC segment is challenged by potentially slowing datacenter investments, US export restrictions on advanced chips and weak GPU demand due to crippling crypto prices.

However, I’m of the view that the semi industry is going through a cyclical down cycle vs. a structural downturn. As much as TSMC shares are having trouble in the current cycle, the company’s structural advantages in advanced node production remain relatively robust. TSMC is the undisputed leader in N3 with Apple being a major customer looking to adopt this process node for the A17 processor for iPhone 15 Pro and M3 for Macs and iPads. N3E is expected to ramp up in 2024 with Nvidia, AMD, Nvidia and Qualcomm likely joining the client list. While Samsung (OTCPK:SSNLF) became the first to mass produce N3 chips in July 2022, issues surrounding yield are something to monitor. Additionally, it’s difficult to imagine a competitor like Apple would want to have Samsung produce its most advanced smartphone SoCs.

In 2001, TSMC’s revenue declined by 24% YoY and EPS fell 87% on an 11.5% net margin. In 2009, revenue contracted by 11% and EPS fell 15% on a 30% net margin. No one has the crystal ball as to how much EPS will drop next year, but applying a 15% decline in earnings gives us an EPS of $5.25 in 2023 for a forward P/E of 13.3x. This, in my view, is a compelling valuation for those willing to ride through the current cycle. As much as markets may continue to remain nervous in the next 3-6 months, I’d encourage investors to take the long view on TSMC.

Be the first to comment