Stephen Chernin/Getty Images News

Investment thesis

A rapidly depreciating Japanese yen will act as a tailwind for Nintendo’s (OTCPK:NTDOY) reported financials, but the shares are not responding in their usual fashion which points to concerns over a softer than anticipated festive season. Valuations remain relatively palatable on PER FY3/2024 17.6x, but with concerns over consumer activity, we reiterate our neutral rating.

Quick primer

Nintendo is a leading franchise in electronic entertainment. We estimate its latest Switch game console has reached over 111.08 million hardware unit sales this festive season – the bestselling console for the company to date since the Wii which sold 103.51 million units.

Key objectives

Coming up to the busy festive season, we want to update our view on Nintendo since our neutral rating was issued in January 2022, which was based on what we felt was a fair valuation with a consensus free cash flow yield of 5.5%.

In this piece, we will focus on the impact of the weakening yen and the outlook for the second half of FY3/2023.

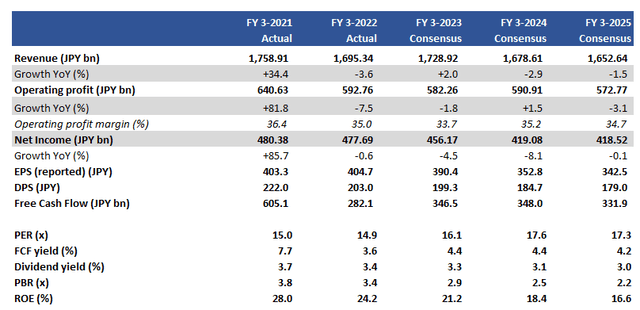

Key financials with consensus earnings forecasts

Key financials with consensus earnings forecasts (Company, Refinitiv)

Recent trading ahead of expectation, but macro concerns mount

Nintendo will report H1 FY3/2023 results on November 8th, 2022, and with the material movements in foreign currency markets, we expect to see positive high single-digit sales growth YoY for the September quarter, as opposed to the 4.6% YoY sales decline seen in Q1 FY3/2023. This should not come as a huge surprise, considering that Nintendo’s FX assumptions are JPY115 to the US dollar (currently JPY144, a 25% move) and JPY125 to the euro (currently JPY140, a 12% move). With overseas sales making up nearly 80% of sales, Nintendo’s earnings are very FX sensitive.

The fact that the shares have not responded as expected to the rapidly depreciating Japanese yen is a concern. With the Bank of Japan intervening to prop up the currency, the market may think a weak yen is a temporary trend. Another view may be deepening concerns over the all-important festive season, where consumer activity could be materially weaker YoY given the increasing uncertainties over the macro outlook.

We think it is realistic to assume that consumer activity will be less robust compared to Christmas 2021 on a global basis. Our biggest concern is for the European market, where for example UK retail sales volumes are expected to drop YoY although with inflationary pressure sales value is expected to increase. Limited access to cheap credit is another concern; the average annual percentage rate is 18.1%, the highest since January 1996 according to Bankrate.com data, and is expected to continue rising. In the US people are saving money much less than before with higher outgoings, with the Fed’s Personal Savings Rate tracker (calculating personal savings as a percentage of disposable personal income) falling from 10.5% in July 2021 to 5.0% in July 2022.

Videogaming by the more mature and mid to hard-core gaming community tends to be less impacted by economic turbulence. However, one of Nintendo’s core competitive strengths is its appeal to a wider audience and addressable market. Unfortunately, this could work against the company now as families begin to feel the pinch over discretionary spending, and difficult choices have to be made.

Nintendo does not tend to discount in order to shift volume, and hardware sees price cuts only with new version releases coming through. Whilst this should help maintain its high profitability, a negative surprise for the market would be a flattish earnings growth profile YoY at Q3 FY3/2023. Despite a relatively active slate of strong first-party titles in the next 12 to 18 months, macro headwinds may derail the company’s aim of sustaining its current historically high level of earnings.

Current consensus forecasts (see Key financials table above) point to a very stable earnings profile for the next two financial years. We believe this would be a highly commendable performance (with stable FX rates), but perhaps a little too bullish when considering the Switch is approaching its 6th anniversary in March 2023, and any new platform release will take at least 1.5 years to scale. Are there any major developments on the horizon? We know that Nintendo is moving into motion pictures, expanding its space at Nintendo World, and a next-gen Switch is in development. There may be more disclosure at the Nintendo Live 2022 event in Japan on October 8th-9th, but we do not see the company being in a position to re-accelerate growth.

Valuation

On current consensus forecasts, the shares are trading on PER FY3/2024 17.6x, a free cash flow yield of 4.4%, and a dividend yield of 3.1%. These valuations are not particularly demanding, again denoting fair value for a well-run IP business generating stable earnings.

The 10 for 1 stock split is a welcome development but we believe the benefits of this corporate action will be limited for two reasons. Firstly, what moves Japanese large-cap stocks are not retail money but overseas investors – and they already have in excess of 48% shareholding (53% if we ignore treasury shares) which is at a relatively elevated level already. Secondly, September 29th, 2022 was the first day of trading post-split, but trading volumes rose only 1.4% from the previous day indicating that investors are not reacting. To conclude, if you wanted to be a Nintendo shareholder, you would likely already have been invested.

Risks

Upside risk comes from a very strongly performing festive season in Q3 FY3/2023, as demand for the Switch outperforms ahead of expectations. Secondly, new disclosure of strong software releases into FY3/2024 and beyond will boost earnings visibility. Thirdly, share buyback activity would be a positive catalyst for the shares.

Downside risk comes from subdued consumer activity in European markets for the short to medium term – although a smaller market than the US, it is still material contributing around 25% of total earnings. If Nintendo’s management adopts a more conservative style of management with increasing macro uncertainties, new product releases may see unexpected delays until the environment is more stable.

Conclusion

Nintendo shares have held up relatively strongly during 2022, but the big test is coming for the festive season. FX will act as a tailwind for JPY-reported revenues, but we have concerns that weaker retail activity will place pressure on sell-through volumes and Nintendo will experience softer demand compared to the last three years. We believe some of these negative expectations are being priced in, and on current valuations (which are by no means stretched) we reiterate our neutral rating.

Be the first to comment