bloodua/iStock via Getty Images

Investment Thesis

It is apparent that Walt Disney Company’s (NYSE:DIS) theme parks have saved the company from Netflix’s (NFLX) streaming valuation, given the recent rally in its stock prices post F3’22’s strong performance. Assuming limited recession headwinds, improved bookings in its international theme park segment, and increased profitability in its D2C segment from FY2023 onwards, we expect to see a long-term stock rally ahead. Its political headwinds also seemed overstated in our previous analysis, given the potential reinstatement of its special district status in Florida, as reported by Bloomberg recently.

Therefore, DIS seemed well poised for growth in profitability, triggering a long-term stock rally ahead. However, it is also apparent that the stock is trading at a premium now. Therefore, we would prefer to rate the stock at a Hold now and wait for a meaningful retracement before recommending anyone to add more.

Rising Inflation Has Not Been A Problem for Disney

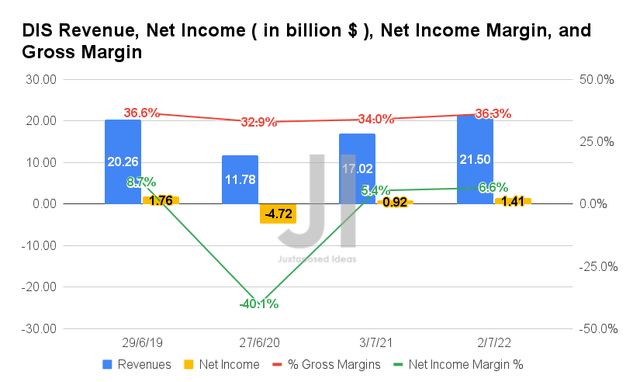

In FQ3’22, DIS posted impressive revenues of $21.5B and gross margins of 36.3%, representing YoY growth of 26.3% and 2.3 percentage points, respectively. Otherwise, a notable increase of 6.1% and relatively in line with FQ3’19 levels, respectively. These have directly translated to a remarkable gross profit of $7.82B and operating income of $2.43B in FQ3’22, indicating an increase of 5.3% from FQ3’19 levels of $7.42B and a minimal decrease of -11.6% from $2.75B, respectively.

In addition, DIS also recorded excellent net incomes of $1.41B and net income margins of 6.6% in FQ3’22, representing an increase of 53.2% and 1.2 percentage points YoY, respectively. Otherwise, a minimal decline of -19.8% and 2.1 percentage points from FQ3’19 levels, respectively.

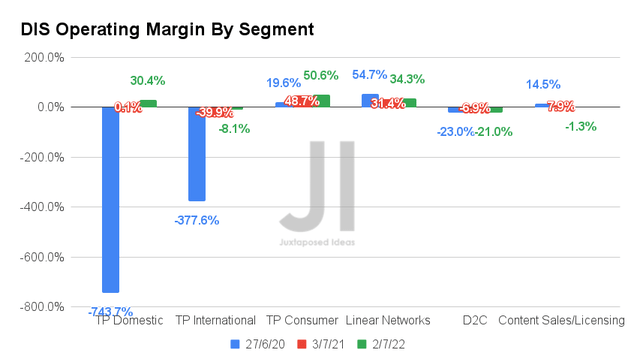

From the chart above, it is evident which segment had contributed to the stock’s tremendous recovery of 14.9% since the release of its FQ3’22 earnings in the past week. DIS reported excellent recovery in its domestic theme parks revenue at $5.42B and consumer sales at $1.18B then, representing an excellent increase of 22.6% and 14.9% from FQ3’19 levels, respectively, despite the limited park capacities.

In terms of operating margins, DIS recorded a notable improvement in its domestic theme parks at 30.4% and consumer sales at 50.6% in the latest quarter, compared to FQ3’19 levels of 26.1% and 36.2%, respectively. Thereby, pointing to its improved profitability in its domestic theme park operations, despite the rising inflation and perceived tightness in discretionary spending. This has directly balanced out the underperforming International theme park and D2C segments, which continue to struggle with profitability thus far.

For FQ3’22, DIS reported a 14.4M addition to its Disney+ subscription, 0.5M to ESPN+, and 0.6M to Hulu, bringing its total subscribers to 221.1M then, representing an increase of 7.5% QoQ and 27.2% YoY. However, the operating margins for its D2C continue to fall, from -6.8% in FQ3’21, to -18.1% in FQ2’22, and finally to -20.9% in FQ3’22, pointing to its unsustainably high programming and production costs thus far. Nonetheless, given the introduction of an ad-supported Disney+ tier at $7.99 and the increase in the ad-free tier to $10.99 by December 2022, we expect a notable improvement moving forward, due to the contribution from advertising dollars & the additional revenue from the premium upgrade.

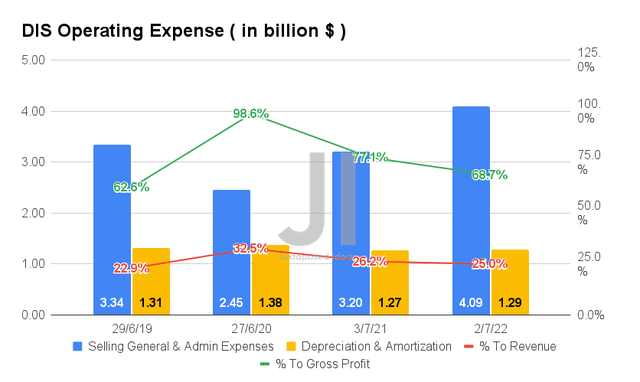

DIS has also proved relatively inflation-proof, given its ability to command higher prices to meet rising costs. By FQ3’22, the company reported elevated operating costs of $5.38B, representing a notable increase of 20.3% YoY and 15.6% from FQ3’19 levels. However, it is essential to note that the ratio to its growing sales has moderated thus far to account for only 25% of its revenue and 68.7% of its gross profits in FQ3’22, compared to 26.2% and 77.1% in FQ3’21.

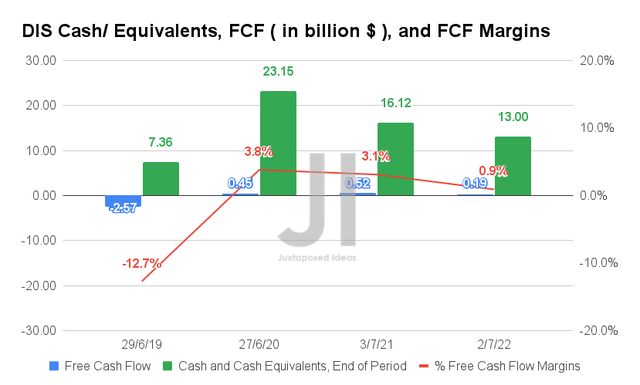

Therefore, given its improved performance, DIS has reported sustained positive Free Cash Flow (FCF) generation thus far, at $0.19B and an FCF margin of 0.9% in FQ3’22. It represents a decline of 72.7% QoQ, mostly attributed to the aggressive ramp-up in its capital expenditure of $1.73B then, compared to FQ2’22 levels of $1.07B. However, it is apparent that DIS continues to report improvement in its operations thus far, given the increase in its cash from operations at 8.8% QoQ and 31.6% YoY. Assuming similar outperformance ahead, we may expect to see DIS report pre-pandemic levels of FCF generation moving forward.

DIS’ Growth Continue To Face Temporary Headwinds

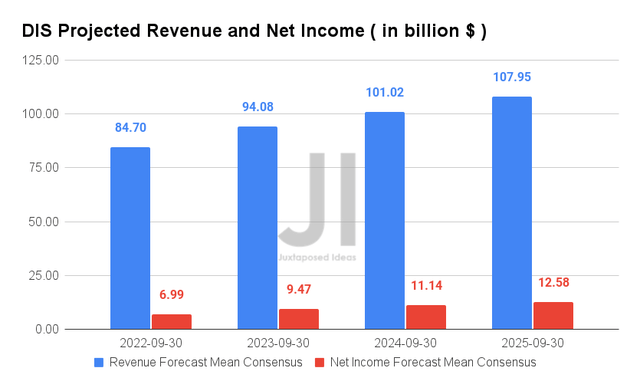

Over the next four years, DIS is expected to report revenue and net income growth at a CAGR of 12.49% and 58.56%, respectively. These numbers represent an apparent downgrade of up to -14.6% from previous consensus estimates in April 2022, though its projected net income margins remain broadly similar at 11.6% for FY2025. However, it is important to note that these margins still represent a notable decline from pre-pandemic levels of 15.9% in FY2019, though a massive improvement from pandemic levels of 3.9% in the LTM.

For FY2022, consensus estimates that DIS will report revenues of $84.70B and net incomes of $6.99B, representing YoY growth of 25.6% and 351.2%, respectively. Otherwise, an increase of 21.6% though a decline of -36.7% from FY2019 levels, respectively. It is apparent that DIS’ profitability will continue to be dragged down by its streaming segment moving forward, which may be potentially saved by the launch of its ad-supported tier by FY2023, given the projected jump in its net income margins from 8.2% in FY2022 to 10% in FY2023. In the meantime, we may expect to see a much-needed improvement in its International Theme Park segment in FQ4’22, given the global reopening cadence. We shall see.

We encourage you to read our previous article on DIS, which would help you better understand its position and market opportunities.

So, Is DIS Stock A Buy, Sell, or Hold?

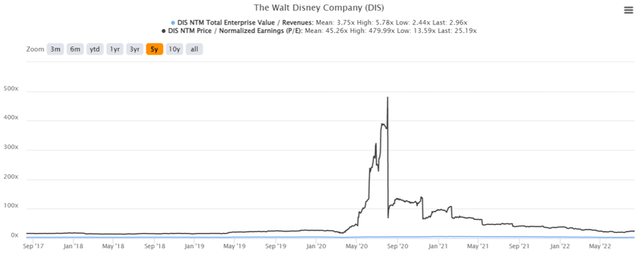

DIS 5Y EV/Revenue and P/E Valuations

DIS is currently trading at an EV/NTM Revenue of 2.96x and NTM P/E of 25.19x, lower than its 5Y mean of 3.75x and 45.26x, respectively. It is evident that the stock has bounced from its historical support level of $100, since it is trading at $124.26 at the time of writing. However, it is still down 33.7% from its 52-week high of $187.58, though at a premium of 37.7% from its 52-week low of $90.23.

DIS 5Y Stock Price

For now, consensus estimates still rate DIS stock as an attractive buy, with a price target of $139.21. However, given the minimal 14.51% upside from current prices, we believe that there are better entry points out there, once the current rally is digested. That is if traders or long-term investors missed the low $90s in June and July 2022.

DIS’ upcoming performance in FQ4’22 will be critical in proving its resilience in the potential economic downturn as well. Historically, the company has not performed well in the previous recession, with a -4.5% YoY decline in revenue growth and -25.2% in net income in FY2009. Its stock has also plunged by -46.3% between September 2008 to March 2009.

One must not overlook the ongoing political spat in DIS’ Florida park too, which is expected to culminate in an interesting but potentially destructive legal battle before 01 June 2023. On the other hand, there have been reports of the reinstatement of a slightly reduced special district status next year, in which there would be minimal changes to DIS’ current operations in Florida. Only time will tell.

Therefore, investors with a higher tolerance for risk and volatility may want to nibble once DIS retraces to $100s, given the potential success of the ad-supported Disney+ tier and increase in premium by FQ1’23. Thereby, triggering a short-term stock recovery then.

Otherwise, we prefer to rate DIS as Hold for now, given the obvious premium.

Be the first to comment