ablokhin

Investment Thesis

J.B. Hunt’s (NASDAQ:JBHT) intermodal segment is poised to see good growth as capacity constraints ease. The company is also working on joint initiatives with BNSF railroad to significantly increase intermodal volumes. Consolidated operating margin outlook is also positive with strong pricing and volume outlook of intermodal business and stable dedicated contract services outlook with annual price indexation more than offsetting any headwinds in the other smaller segments. Valuation is also at discount to historical levels.

JBHT Q2 2022 Earnings Highlights

The company reported consolidated revenue of $3.84 billion (vs. the consensus estimate of $3.6 billion), a growth of ~32% y/y. Diluted EPS was up by ~50% at $2.42 (vs. the consensus estimate of $2.31). The intermodal segment reported 42% y/y growth, driven by an ~8% y/y increase in volume and a ~ 32% y/y growth in revenue per load. The demand for intermodal capacity remained strong throughout the quarter. However, it was impacted by slower rail velocity, which affected the execution of greater volumes. Revenue per load for the segment benefited from changes in freight mix, customer rates, and fuel surcharge. Excluding fuel surcharge, revenue per load increased by ~20% y/y. Another major segment, the dedicated contract services segment, recorded ~39% y/y growth in revenues as the number of average revenue-producing trucks increased by ~21% and productivity increased by ~14% y/y.

The consolidated operating margin increased by ~90 bps y/y. The increase of ~60 bps y/y in intermodal operating margin was partially offset by a decline of ~240 bps y/y in the dedicated segment’s operating margin as labour costs continued to put pressure on margin as expected.

Growth Outlook

J.B. Hunt’s intermodal segment has good growth opportunities both in the near term as well as the long term. The company’s intermodal volumes are picking up. Last quarter, intermodal volumes were up 4% in April, 9% in May and 10% in June on a year-over-year basis and trends are expected to further improve in the second half of this year as capacity constraints ease.

The intermodal market is facing tight capacity issues and the weak industry-wide box turns due to slower rail velocity are adding to it. There has been some improvement in the velocity of late, but there is a lot of room for improvement. The company is also working with BNSF on joint initiatives to improve capacity. Discussing these initiatives in a press release BNSF mentioned,

As part of the initiative, BNSF will increase capability at multiple intermodal facilities. To further integrate its joint service product with J.B. Hunt, BNSF is providing several property locations around key intermodal hubs in Southern California, Chicago, and other key markets to increase efficiency at terminals. Additionally, BNSF will bolster its railcar equipment to accommodate the anticipated increase in container capacity, which will support efficient throughput and strong service performance.”

One of the reasons behind BNSF and J.B. Hunt’s close cooperation is the fact Schneider (SNDR) is moving its primary western railroad partnership to Union Pacific (UNP) from BNSF effective January 2023. This will free up a lot of capacity at BNSF and J.B. Hunt will have an opportunity to fill that capacity. JBHT has received positive feedback from its customer on the demand side and anticipates that it should be able to fill that capacity. Below is management commentary regarding it from JBHT’s last earnings call,

Starting early next year as new capacity becomes available to us on BNSF, we fully anticipate filling that available capacity, which is supported by feedback from our customers.”

By leveraging the resources of BNSF, JBHT can position itself well to meet growing demand. JBHT has announced plans to grow the container count to nearly 150,000 in the next 3 to 5 years which is up 40% from FY2021 year-end levels. Management plans to increase capacity along with improving rail velocity and increasing demand should help the company increase its revenues meaningfully.

There is a secular growth in demand for faster and more secure transportation of goods at lower prices and Intermodal transportation offers these benefits. There is also a large opportunity to convert highway freight and transloading cargo into domestic containers, especially on the eastern network side. Based on the analysis of its J.B. Hunt Shipper 360 platform transactions and annual bid activity, JBHT has estimated that there is an opportunity for 7 to 11 million shipments that can be converted to intermodal. As the company grabs these opportunities by increasing the capacity, the intermodal segment should see multi-year growth.

Other than the intermodal segment, the dedicated contract services segment is the second largest contributor to revenue and together these two segments contributed 70% of the company’s revenues. This segment is also expected to deliver good growth on the back of strong momentum with healthy backlogs and a pipeline for new businesses and start-ups continuing to build to record levels. The rest of the segments are expected to face some pressure due to concerns about the upcoming recession but strong growth in these two segments, especially intermodal business, should more than offset any headwinds and overall revenue should grow at a healthy pace.

Operating Margin Outlook

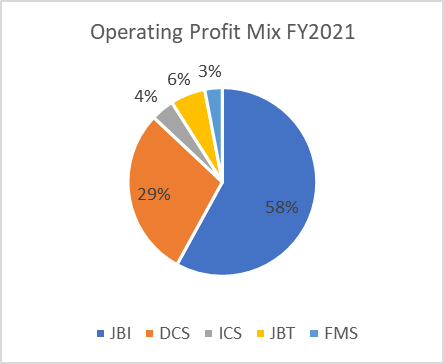

JBHT Operating Margin Mix by Segment (Company Data, GS Analytics Research)

The intermodal and dedicated segments contribute the majority of the company’s operating profit, accounting for ~87% of the consolidated operating margin in FY21. The intermodal segment is anticipated to expand its operating margin with strong pricing due to the tight capacity in the market. Demand for intermodal is also expected to remain elevated for a longer time period, as discussed above in the growth outlook, which should result in benefit from operating leverage. The equipment costs are expected to increase due to the inflationary environment. However, the company should be able to pass these costs to customers given the current tight market conditions.

On the dedicated contract services business side, some investors are worried about the potential softening of the trucking market. However, the company’s dedicated segment is generally less affected by cyclicality or softening of the spot market as it involves long-term contracts with the customers and annual index-based pricing. While the company is facing some headwinds in the near term due to labour shortage issues, these are transitory in nature and the conditions are improving as we return back to normal. So, I am optimistic about its margin prospects.

Highway space consisting of integrated and truckload segments could be prone to downward pressure on prices over the remaining year due to anticipated softer demand. However, the contribution of these segments to the consolidated operating profit is low. So, the total consolidated margin outlook for JBHT is positive.

Valuation and Conclusion

JBHT offers an attractive short and long-term growth opportunity thanks to growth in the intermodal segment, and improving operating margin. The company’s intermodal business has several structural tailwinds which can help its growth even if the economy enters a recession. I am optimistic about management’s growth target for this segment and believe its margins can improve, looking forward. Other than intermodal, dedicated contract services is also a good stable business somewhat shielded from the slowdown due to the long-term nature of its contracts. I believe J.B. Hunt can continue its secular growth, even if there are cyclical headwinds, driven by good performance in these two segments. J.B. Hunt is currently trading at 20.18x FY22 EPS and 19.67x FY23 EPS vs. its 5-Year average forward P/E of 23.09x. I believe long-term investors can consider buying the stock at the current levels.

Be the first to comment