inhauscreative/E+ via Getty Images

Investment Thesis

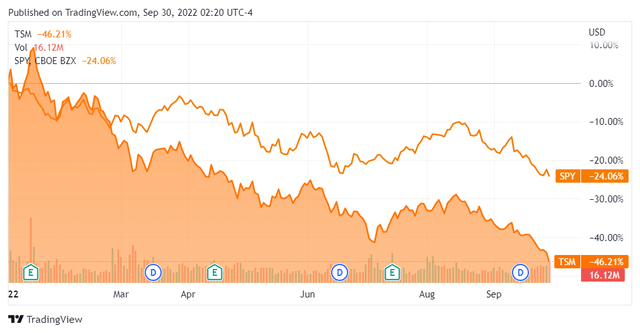

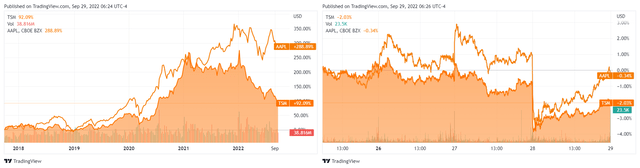

TSM & S&P 500 Performance YTD

After peaking in 2021, it is safe to say that Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has experienced a tragic correction post-reopening cadence. TSM has fallen by -46.21% YTD, with the S&P 500 Index also falling by -24.06% simultaneously, indicating peak market pessimism and fear levels. Both stocks also plummeted during the previous recession, with TSM reporting a -37.47% plunge and the S&P 500 a -43.37% plunge between August and December 2008.

The gaming and PC markets had already reported demand destruction by Q2’22, with the mid-tier smartphone segments impacted as well. As TSM’s major customers cut back orders from 2023 onwards, it seems that the stock may continue to underperform in the short term, significantly worsened by rising inflation, record high oil/gas prices, and geopolitical tension between the US and China.

As recessionary fears peaked, TSM also faced significant financial challenges, since it previously reported a -11.2% decline in revenues and -10.72% in net incomes YoY in FY2009. With Apple (AAPL) refusing to comply with TSM’s 3% price hike from 2023 onwards, we may see a further impact on the latter’s forward guidance, with rising costs affecting its margins. Otherwise, are we looking at the start of a painful split with its lead account? Ouch… Though very unlikely.

In the meantime, it does not mean that there is no more hope for the stock market. The September CPI report released in early October may provide the much-needed catalyst for the recovery. With the Fed’s projected terminal rate of 4.6% by 2023, we may see a 75 basis point hike in November, with January 2023 moderating with a 50 basis point hike. In other words, it might be safe to assume that most of the pessimism is already baked in, barring a lowered FY2023 guidance.

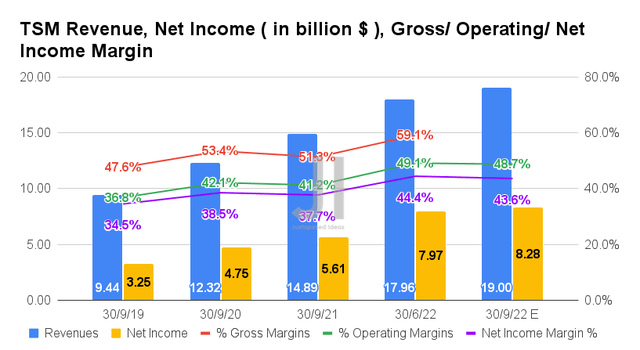

TSM Continues Investing In Growth Ahead

For its upcoming FQ3’22 earnings call, TSM is expected to report revenues of $19B and operating margins of 48.7%, indicating a notable increase of 5.79% though a decline of -0.4 percentage points QoQ, respectively, Otherwise, a remarkable YoY growth of 27.6% and 7.5 percentage points, respectively.

Naturally, TSM may report improved profitability, with net income of $8.28B and net income margins of 43.6% for its upcoming quarter, indicating an increase of 3.88% though a decline of -0.8 percentage points QoQ, respectively. Otherwise, impressive YoY growth of 47.5% and 5.9 percentage points, respectively, despite the rising inflation.

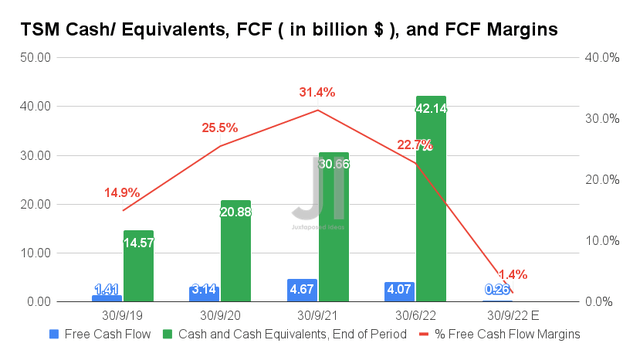

In FQ3’22, TSM is expected to report a Free Cash Flow (FCF) generation of $0.26B and an FCF margin of 1.4%, representing a massive decline of -94.43% and 30 percentage points YoY, respectively. However, these are mostly attributed to the company’s tremendous investment of $30.39B in capital expenditure reported in the last twelve months, with up to $44B planned for FY2022 and $40B for FY2023. Nonetheless, investors have nothing to worry about, since TSM is expected to generate FCF of $5.08B in FY2022, $11.98B in FY2023, and $18.57B in FY2024, respectively.

Furthermore, these aggressive investments would eventually be top and bottom lines accretive, as seen over the past three years. TSM had spent a total of $62B in capital expenditure to drive 48% of revenue growth at the same time, while planning a new $7B fab in Japan and another $12B fab in Arizona operational from 2024 onwards. Impressive indeed, given the insatiable demand for chips once the macroeconomics improves.

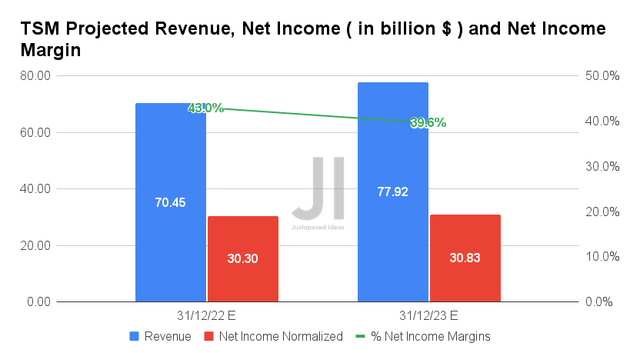

An Upwards Re-rating Will Happen Once Mr. Market Wakes Up

Over the next two years, TSM is expected to report revenue and net income growth at a CAGR of 16.68% and 19.75%, respectively. It is evident that Mr. Market expects a notable reduction in consumer demand, given the -5.89% downgrade in estimates since our previous analysis in August 2022. Nonetheless, the improvement in its net income margins remains stellar, from 32.3% in FY2019, to 37.6% in FY2021, and finally settling at 39.6% by FY2023.

Meanwhile, TSM is expected to report revenues of $70.45B, net incomes of $30.3B, and net income margins of 43% in FY2022, indicating impressive YoY growth of 23.09%, 40.93%, and 5.4 percentage points, respectively. Nonetheless, since the market is always forward-looking, it is apparent that analysts are not convinced about its delivery from FY2023 onwards, given the projected slowdown in YoY growth at 10.6% and 1.74% then, respectively. Thereby, explaining the massive stock correction thus far, since the rally was not sustainable then. It seems that hindsight is always 20/20.

However, we are a little more optimistic, since the destruction of demand in the personal devices segment would only give way to the available capacity for the automotive and industrial sectors, whose demand has remained unmet thus far, as reported by General Motors (GM) and Ford (F). The global EV market is also projected to grow tremendously from $246.7B in 2020 to $1.31T by 2028 at a CAGR of 24.3%, with the 5G market surpassing $1.87T in market value by 2030 at an accelerated CAGR of 44.63%.

While capital expenditure in the data center market may slow momentarily, we expect these to be temporary headwinds, given the sustained digital transformation post-pandemic. The global data center market size is expected to grow by $615.96B at a CAGR of 21.98%, significantly aided by North America’s insatiable demand accounting for 35% of the market’s growth through 2026. Therefore, we expect to see an upwards re-rating of TSM’s top and bottom line growth, once the macroeconomics improves and demand returns by H2’23.

In the meantime, we encourage you to read our previous article on TSM, which would help you better understand its position and market opportunities.

- Taiwan Semiconductor Has War-Deterrent Silicon Shield – Still A Buy

- Taiwan Semiconductor: On 37% Sale – Own One Of The World’s Most Important Companies

So, Is TSM Stock A Buy, Sell, or Hold?

TSM 5Y EV/Revenue and P/E Valuations

TSM is trading at an EV/NTM Revenue of 4.54x and NTM P/E of 11.52x, lower than its 5Y mean of 6.67x and 19.65x, respectively. The stock is currently at $69.28, down -52.22% from its 52 weeks high of $145.00, nearing its 52 weeks low of $68.48. Nonetheless, consensus estimates remain bullish about TSM’s prospects, given their price target of $103.00 and a 49.60% upside from current prices.

AAPL & TSM 1Y/ 5Y Stock Price

Since AAPL accounts for 25% of TSM’s annual revenue, they have also had an interesting co-existing relationship in their stock performance thus far. While APPL obviously had better returns thus far for the past 5Y at 289.6% and 10Y at 597.4%, TSM fared comparatively well with 105.9% and 450.7%, respectively, despite the latter’s geopolitical risk.

Due to the volatile China-US geopolitical tensions, we expect TSM to continue underperforming in the short term. The ongoing semiconductor war, escalating military tension over Taiwan, and the perceived ‘discriminatory’ EV tax breaks from the Inflation Reduction Act have all contributed to this strained relationship. We don’t expect things to improve in the coming weeks as China’s Zero COVID Policy continues to disrupt global supply chains. Despite the two world leaders’ first face-to-face meeting at the end of the year, things remain uncertain, given President Xi Jinping’s re-election and the US midterm elections in November 2022.

Therefore, it is safe to assume that there will be more downsides to current levels, with the stock already breaking its previous June lows. Investors with higher geopolitical risk tolerance and long-term trajectory may potentially nibble at current levels, though we prefer the margin of safety at the $50s. Stay safe during these turbulent times.

Be the first to comment