JacobH

Syrah Resources Limited (OTCPK:SYAAF) is an Australia-based graphite miner whose main asset is the Balama mine in Mozambique. Balama is the world’s largest flake graphite mine, and is anticipated to have an operating life lasting longer than 50 years. The mine is currently operational and Syrah has been generating revenue throughout most of this year, but it has experienced a few operational issues along the way.

Those problems, however, now appear to be behind the company, and its most recent quarterly numbers show Syrah to be achieving consistently higher realized graphite prices with each passing quarter. This is a trend that is highly likely to continue given rising demand coming from the EV sector; graphite is central to the production of battery anodes. But Syrah is not limiting itself to mineral extraction as the company anticipates beginning production at its newly constructed Active Anode Material (AAM) facility in 2023. This article will discuss what impact the initiation of anode material production may have on the Syrah’s stock.

Backgrounder

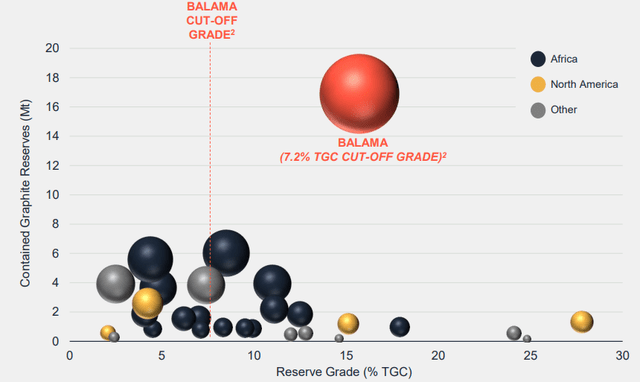

Syrah’s Balama property is located in Cabo Delgado Province, Mozambique and is the world’s largest flake graphite deposit. It has a reserve of 107Mt with a grade of 16% while the total resource size is an extremely impressive 1.4Bt graded at 10%. Unsurprisingly, the mine also has the world’s highest capacity, when it comes to the production of flake graphite, with a nameplate of 350ktpa.

But while the total potential capacity may be very impressive, actual production has fallen well short of that level. The disruption in the global container shipping market has limited Balama to a 15kt per month production rate, and a strike that began in September halted production until mid-October. The strike has since ended, but the work stoppage resulted in Q3 production numbers coming in light, falling to 35kt from Q2’s 44kt. The Q4 numbers should also fall short of targeted production, but the company looks set to produce at least 180kt in 2023.

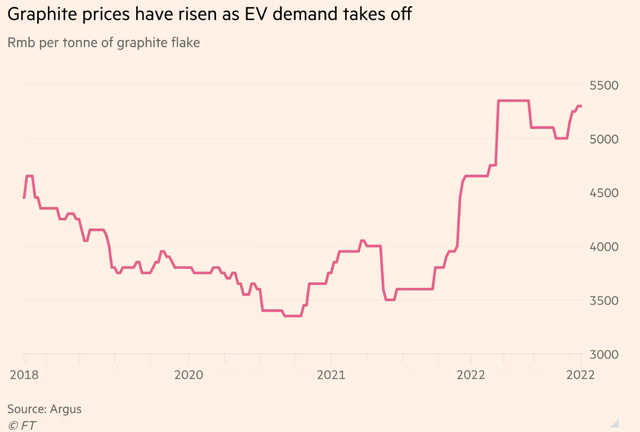

That’s good news because graphite prices have risen substantially since the middle of last year, and Syrah has been able to ride that wave. In the most recent quarter, the company realized an average selling price of $688 per tonne, which is 30% higher than the $530 per tonne it was getting in Q4 of last year. As can be seen in the exhibits below, Syrah has been able to get consistently higher prices even after the price of graphite on the open market leveled off somewhat earlier this year.

Potential Catalysts

The higher prices resulted in Balama achieving positive net operating margins last quarter when its average costs come in at $615 per tonne. It’s also worth noting that $40/t of that cost number was attributable to the September work stoppage, and will not recur in future quarters. Management has also said that better shipping availability, which will allow the company to increase production above 15kt per month, coupled with other productivity initiatives should allow Syrah to further reduce costs in future quarters.

Needless to say, a scenario of rising graphite prices coupled with falling costs should lead to a rising stock price. However, even if graphite spot prices level-off or even pullback somewhat, Syrah may be at least partially insulated from such volatility as very little graphite is traded on the spot market. Most graphite is bought through long-term supply agreements between producers and consumers, and it’s probably safe to assume that Syrah is locking in some long-term sales contracts at or around current prices.

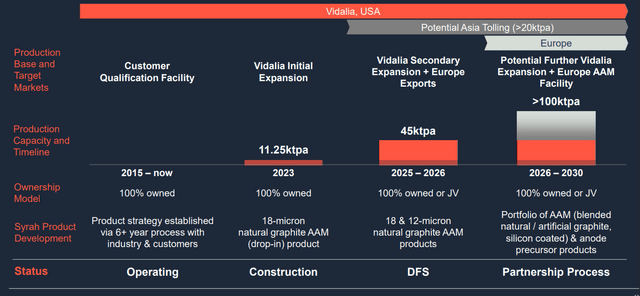

The other major upcoming catalyst is going to be the completion of Syrah’s Active Anode Material production facility which is slated to begin production in Q3 of next year. The project, which is on budget and on schedule, is being built in Vidalia, Louisiana, and it will have a capacity of 11.25ktpa of AAM once it ramps to full production.

The facility’s feedstock will come from the Balama mine and Syrah has already signed a binding offtake agreement with Tesla, Inc. (TSLA) for most of the production. It also has a number of non-binding MOUs with several other companies that cover possible future production expansions. And as can be seen from the exhibit below, these future plans are not merely vague intentions but rather an ambitious growth strategy based on an eventual expansion of its Vidalia capacity as well as the construction of a new European AAM facility.

Financing

The market is often very skeptical when small companies outline ambitious downstream growth plans. Questions arise as to management’s ability to follow through as well as to the company’s ability to finance a large expansion.

Those questions, however, may not be as well warranted in Syrah’s case. The company has clearly been able to bring the Balama mine into production and Vidalia’s construction has, so far, been smooth. Financing of the project may have been a point of concern, but earlier this year the company was granted a $102 million federal loan to help finance construction of the facility. This was part of the governmental program geared towards securing America’s clean energy supply chain.

Downside Risks

Nevertheless, such ambitious growth plans obviously bring with them certain risks. Any unforeseen construction problems and possible accidents could delay completion of the Vidalia facility by many months. The feasibility of the facility, as well as the mine, are both predicated on graphite prices remaining within a certain range. A sharp drop in prices could result in all of the company’s projects becoming uneconomical.

There’s also the risk of future strikes at the mine or that Syrah is unable to increase the amount of concentrate shipped out of Mozambique. This would severely hamper the company’s ability to grow future production and shareholders would undoubtably suffer for it.

Takeaway

But in spite of these risks, Syrah’s stock looks like it has a lot of potential. Rising graphite prices, powered by the EV transition, will continue to help Balama’s performance, and the start of production at Vidalia will transform Syrah from a miner to an integrated producer of AAM. This will probably lead to the market taking greater notice of the company and that may go a long way towards helping share price performance.

Be the first to comment