Key Talking Points:

- Bond yields continue to rise as investors move away from longer-dated bonds to adjust their portfolio duration

- Sellers continue to attempt to bring the DAX 30 lower, but strong support halts the culmination of the H&S pattern

Recommended by Daniela Sabin Hathorn

Get Your Free Equities Forecast

It’s been a busy week behind the scenes in global markets with the bond market being at the center of it. As a quick recap, here is what has happened so far.

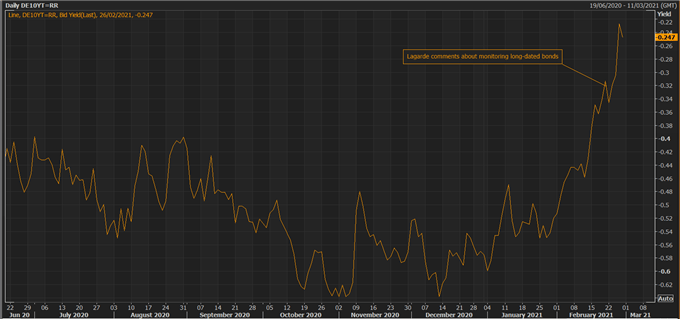

We started off the week with Christine Lagarde stating that the ECB was monitoring longer-dated bonds, which caused their yields to fall sharply. But this move has quickly been reversed, with the German Bund having risen significantly above the level where it started off the week, and the fact that yields are still negative in Europe shows to which effect Central Bankers are starting to fear a wild bond market.

German Bund Yield Chart (Jun 2020 – Feb 2021)

Their nerves are not so much related to the level of current yields but more to do with the volatility in the bond market, meaning that their power of control is rapidly diminishing. Throughout the summer and into the end of 2020, as equity markets were recovering rapidly, the bond market was relatively stable, something that Central Bankers look to achieve, but this has taken a quick turn into 2021 and the stock market is starting to feel the effect of more attractive fixed-income securities, which makes equities look expensive given their risk.

Trickle-down the week and the focus now is on mortgages and what effect they may have on economic recovery. When rates are low, people are more likely to prepay and refinance into a lower rate, which effectively shortens the duration of mortgage-backed securities (MBS). So when the opposite happens, and rates rise, we see mortgage payments come under stress, endangering the recovery in the housing market, and the wider economy, which is also likely to see consumer purchasing power reduce due to rising inflation. Coming back to the bond market, as the duration of MBS was reduced when rates fell, we effectively saw large investors pile up on longer-dated Treasuries to achieve a desired level of constant duration, increasing their demand. But we are now likely to see the opposite happen, with investors unwinding their longer-dated securities to balance out the duration of their portfolio as rates rise, causing their prices to fall and yields to rise.

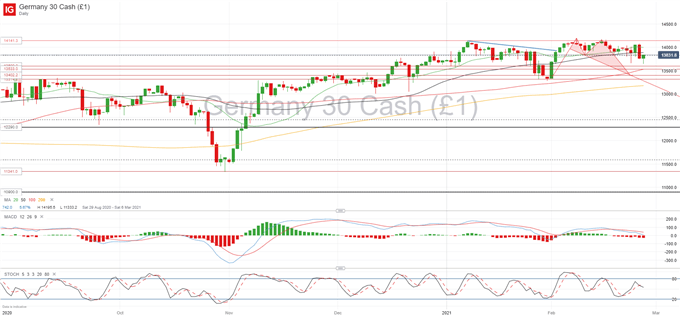

DAX 30 Levels

Focusing now on the stock market, the effect of a rapid rise in bond prices hasn’t taken its full effect, mostly because equities are partly shielded by the efforts of central banks to keep funds flowing into the stock market. The biggest effect so far has been seen in the tech sector, with the NASDAQ having staged two of its worst sessions since the pandemic broke out in the last month. This is likely because tech shares have been underpinned by low rates, pushing their valuations to all-time highs.

In Europe, stocks have been relatively more stable but we continue to see a short-term downward bias. I mentioned on Monday how the strong resistance to further bearish pressure was limiting the scope of the head and shoulders to culminate, and that is what we are seeing. Selling pressure has indeed faltered around the 13,600 mark and it is likely that we see sideways consolidation before any decisive move. That said, current rice is hovering around the H&S neckline (13,830) and if price closes above this level we may see further upside potential going into next week. To the downside, we would need to see price fall below 13,600 in order to assume bears are regaining control.

DAX 30 Daily chart

| Change in | Longs | Shorts | OI |

| Daily | -8% | 0% | -4% |

| Weekly | -6% | -11% | -9% |

Learn more about the stock market basics here or download our free trading guides.

— Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin

Be the first to comment