Kunakorn Rassadornyindee/iStock via Getty Images

I recently spent some time at two different birthday parties, and found myself observing the way gifts were given. At the first party, the majority of gifts were presented in gift bags, with no additional wrapping paper, while at the second party most gifts had colorful wrapping paper. I know it is just a small observation, but it genuinely has me wondering about the changing face of demand and use for paper. My own initial assumption was that the demand for gift-wrapping paper is in steady decline, as reusable bags or gift boxes take its place, but was surprised to find a slew of research reports calling for overall growth in the specialized gift wrapping category, such as this one claiming sales will grow from $4.3 billion to $6.3 billion over the next decade. None of the reports I saw claimed the market would shrink, although many of them were lumping wrapping paper in with all of the other ways of presenting gifts, including bags and boxes.

I have not the faintest idea if those reports will turn out to be on the mark, but one of my holdings, Sylvamo Corporation (NYSE:SLVM), could be impacted by any changing trends in the paper industry. As it happens, Sylvamo does not produce wrapping paper – the company specializes in uncoated freesheet such as office printer paper – but it also produces some specialty use papers for food packaging, construction tape, and paper bags. I have written previously about Sylvamo, and this little thought experiment has brought me back around to review the investment thesis.

First Half 2022 Review and Outlook

The company released its 2nd quarter results last month, reporting earnings results through the first six months generally flat compared to the prior year before accounting for discontinued operations. Total revenues for the period were $912 million, distinctly up compared to $695 million for the same quarter in 2021. Diluted EPS before the discontinued operations adjustment for H1 were $3.13, compared to $3.16 in 2021, but deep adjustments were necessary to account for cessation of operations in Russia. This adjustment came to cumulative loss per share of ($3.87), putting the diluted EPS year-to-date as of June 30 at ($0.74), compared to $4.03 in 2021. In spite of the accounting losses year-to-date, management increased guidance for the full year on two metrics: 1) raised adjusted EBITDA from a low of $725 million to a low of $740 million, and 2) raised free cash flow from range of $160 – $180 million by $10 million to a new range of $170 – $190 million.

As the change in guidance indicates, earnings alone do not tell the full story. Russian operations, which were a significant source of value for Sylvamo (accounting for “15% of our net sales and 10% of our long-lived assets” at 2021 year end, according to the Q2 10-Q), were divested over the first half of the year, and the company still churned out strong cash flow from operations, $130 million from continuing operations, and $175 including operating cash flows from now discontinued operations. This is $47 million less than 2021, however the mostly likely explanation seems to correspond directly to the timing. Since the discontinued Russian operations accounted for $45 million of operating cash flow and would have been transitioned to discontinued status sometime in late Q1 or early Q2 (given the Russian incursion in Ukraine starting in late February 2022), I think it is fair to figure that the difference in total H1 cash flow results from 2021 to 2022 is nearly all explained by a full quarter’s worth of inactivity. In other words, the $45 million contribution from discontinued operations happened pretty much entirely in Q1, and if Sylvamo had kept it on, at a steady run rate of contribution in Q2 the total for the first half of 2022 would have been in-line with the 2021 results, which is generally confirmed by the earnings figures as well.

As Q3 is wrapping up, there were some specific management targets to be looking for in the results over the remainder of the year, specifically around capital allocation between debt, dividends and share buybacks. First of all on debt, there is no major maturity facing the company until 2027, which then face three consecutive years of fairly evenly divided maturities but rather different profiles: $506 million floating rate term loan for 2027 (net interest rate of 2.52% so far in 2022, a rate kept lower due to some patronage distributions), $348 million term loan in 2028 (at LIBOR + 4.50%), and $443 senior notes at 7.00% due in 2029. In an environment in which rates are rising pretty rapidly, management’s goal is to get gross debt under $1.0 billion, and had been making aggressive progress. Including $20 million paid after the close of Q2, total debt stood at $1.3 billion. Debt reduction through H1 was $86 million; if this stays on pace the $1.0 billion figure will be within reach around the middle of 2024, assuming no new debt assumed.

On shareholder returns, Sylvamo has a fairly traditional two-pronged approach, consisting of a nominal dividend of $0.1125 per quarter (annual yield of ~1.30%), and a commitment to share repurchases in total of up to $150 million, which had not yet started in earnest as of Q2. Even if Sylvamo had to average $50 per share on its repurchases (a 43% premium to its current valuation), that would still retire some 3 million shares, or 6.8% of the shares outstanding. In other words, I believe that would represent an extremely conservative estimate, and somewhere between 7.5% and 8.0% of shares outstanding is likely closer to the mark if the full amount is used.

The other major development in terms of investment and capital allocation for Sylvamo in the medium-term is the recently announced acquisition of the paper mill located in Nymolla, Sweden from European operator Stora Enso (OTCPK:SEOAY), who is moving to focus exclusively on packaging. In terms of capacity, this particular facility has a maximum capacity to produce 500k short tons of uncoated freesheet per year, and generated some €350 million of revenues in the year ended 6/30/2022. Over that same period Sylvamo had revenue of $3,916 million, so looking backward this would be 9% more on the topline (at the current exchange rate). This addition, while costing Sylvamo €150 million using cash on hand (or about $150 million), is expected to be immediately accretive to free cash flow, with bonus efficiencies to come. At a 2.5x EBIDTA multiple on the transaction, not factoring in any potential synergies, Sylvamo has managed to get a solid value, giving it additional geographic balance in its markets and picking up a solid long-term asset. The deal is expected to close by mid-2023.

Valuation and Evaluating Opportunity

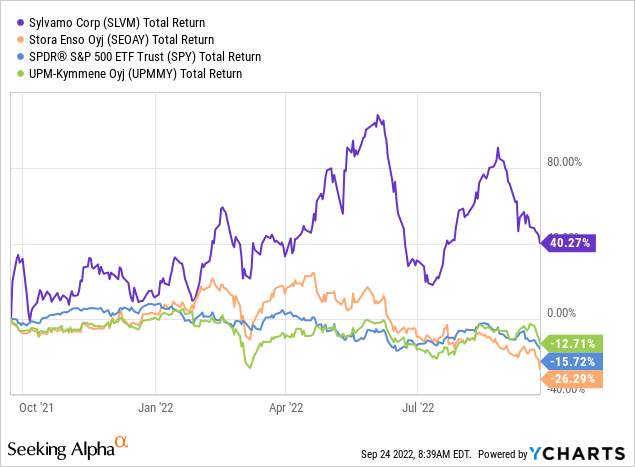

Sylvamo’s shares have outperformed both some sector peers and the S&P 500 (SPY) over the last year, but is getting caught in the market-wide down draft as expectations get reset.

In the current environment of rising interest rates making safer assets relatively more attractive, the opportunity to reap outsized gains from any particular investment is the fundamental question. Clearly Sylvamo’s relatively paltry dividend yield and buyback program are not sufficient on their own to drive a very attractive investment narrative relative to 2-year US Treasuries (US2Y), at least in the short-term. So the question comes down to whether or not shares are positioned to either beat the broader equity markets over the next year, or if those markets are likely to be heading down further, to do better than holding cash.

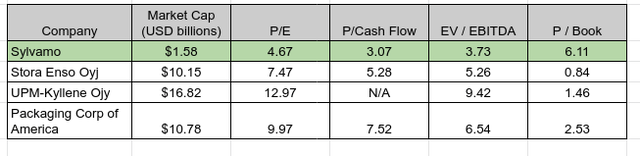

On the one hand, on a relative valuation basis compared to some industry peers, Sylvamo clearly looks potentially attractive in the sense that its multiples are measurably discounted, with the caveat that pure sector peers are hard to come by. The other companies here are all in the paper business, but not necessarily in the uncoated freesheet business alone, which is Sylvamo’s unique focus.

Sylvamo valuation relative to sector peers (author’s spreadsheet; data from Seeking Alpha)

With more capacity coming available with the mill being acquired from Stora Enso in 2023, price to cash flow and price to earnings metrics should both get even lower looking ahead, and they are starting from a pretty low base. Yet getting more cash flow does not necessarily count for much, if central bank actions are pushing up the discount rate for determining a fair present value. At the moment, it is more difficult for any company to grow its way to a higher valuation at a rate that will exceed investors’ willingness to see it pathway to future value when two-year US treasuries will get you around 4.30%. Nevertheless, Sylvamo has shared that the internal rate of return for the acquisition is greater than 25%, and leaves little doubt in my mind that Sylvamo is a more valuable company with those assets in combination with its management and skill.

That being said, I do not see it being a catalyst to valuation, with the market conditions generally keeping valuations in check, and I expect the market to be slow in recognizing the improved value. In the case of Sylvamo, I think the shares are valued inexpensively due to market factors, not because it is a value trap, and the company is quite solid on a fundamental basis.

Conclusion

In my view, Sylvamo is making some smart moves to consolidate its position as the go-to supplier of uncoated freesheet. It is well managed and generally share-holder friendly, but as the industry as a whole is a very mature one, so any investment in Sylvamo in the current environment is likely to require a good dose of patience (or a willingness to wait for yet further drops in coming months). Even though the present valuation is more than fair, there is simply little chance of much sustained upside happening over the next 12 months. Of course this isn’t just true for Sylvamo, but broad swaths of equities are probably stuck in a holding pattern until the rate tightening cycle is finished. For that reason, I consider it hold for the time being.

Be the first to comment