ijeab/iStock via Getty Images

Investment Thesis

With inflation risk across the property sector increasing, Swiss Re AG (OTCPK:SSREY) could be well-poised to benefit in an inflationary environment as net premium demand is expected to increase. Additionally, the company is also seeing a recovery across its Life & Health segment – which further allows the company to diversify its inflation risk.

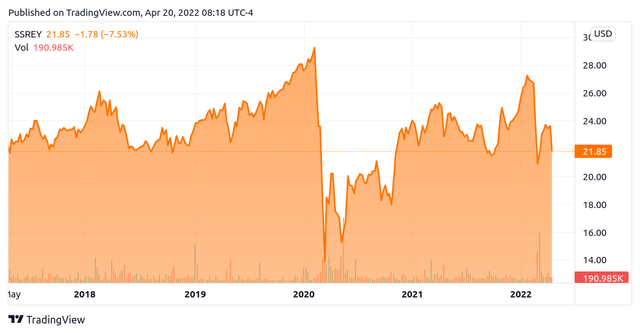

Swiss Re has seen a significant rebound in performance since the COVID-related drop in early 2020.

As one of the leading reinsurance companies worldwide, Swiss Re is a company that needs to manage its inflation risk across its insurance policies.

The purpose of this article is to elaborate on the reasons I believe Swiss Re is well poised to thrive in an inflationary environment going forward.

Performance and Outlook

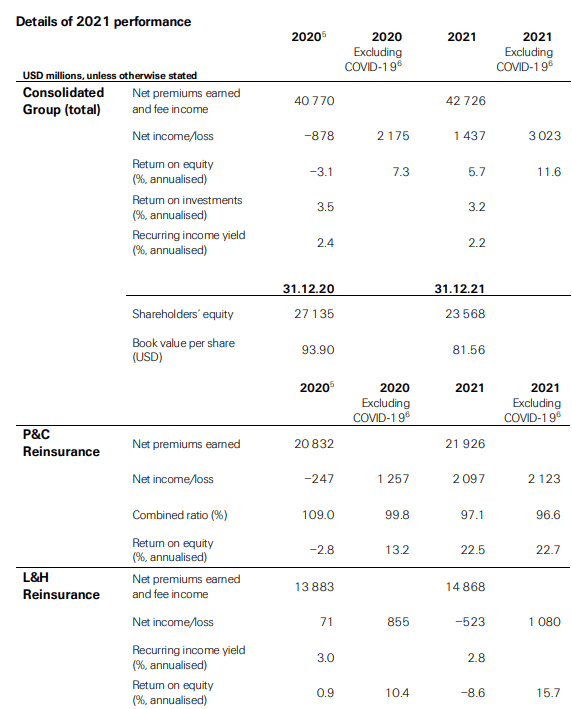

When looking at the most recent quarterly data, we can see that net premiums earned across both the Life & Health and Property & Casualty segments are up from 2020 – along with the combined ratio for P&C (both including and excluding COVID-19) having decreased significantly from the previous year.

Swiss Re News Release: 25th February 2022

Of Swiss Re’s business segments, P&C Reinsurance accounts for the largest portion of net premiums earned. The fact that we have seen a decrease in the combined ratio is encouraging, as it indicates that the company is paying proportionally less in claims and expenses than it is collecting in premiums.

In an inflationary environment, the Property & Casualty segment is invariably exposed to inflation – as rising property prices mean that the cost of insuring claims in the future is likely to be more expensive.

However, I take the view that the impact of inflation could actually work to Swiss Re’s favor in terms of higher premium demand.

As a reinsurance company, Swiss Re assumes risk from other insurers who are looking to limit losses across their own portfolio. In this regard, the prospect of more expensive claims as a result of higher property prices is likely to entice insurers to increase their reinsurance policies to mitigate such risk. This means that Swiss Re is in a significant position to bolster net premiums collected across this segment.

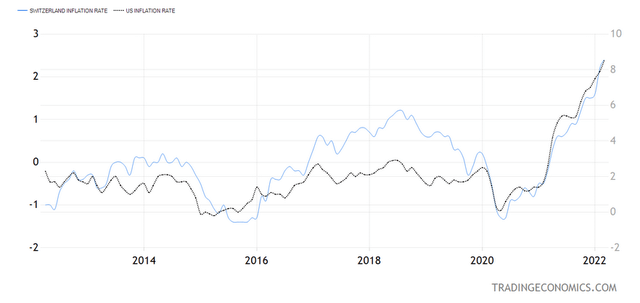

From a macroeconomic standpoint, inflation in Switzerland is currently significantly lower than in the United States – 2.4% for the former, compared to 8.5% for the latter at the time of writing.

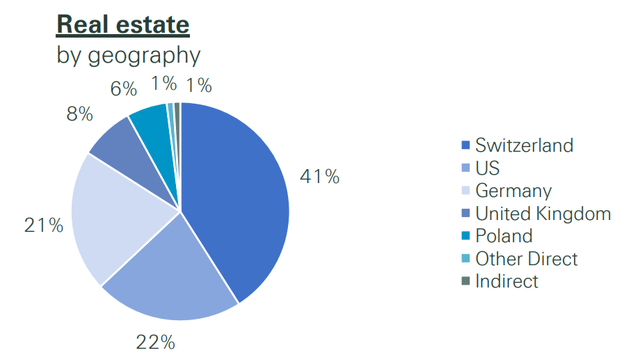

Notably, when analyzing the company’s real estate exposure, we see that Swiss Re’s exposure to U.S. real estate is 22% as compared to 41% for Switzerland.

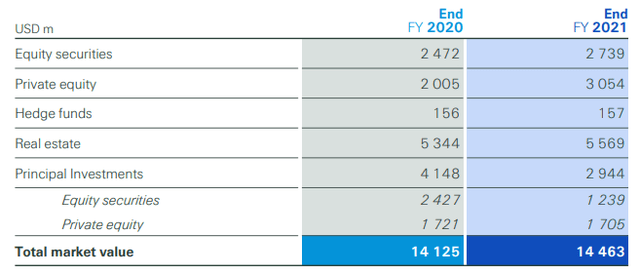

Additionally, when looking at the company’s equities and alternative investments as a whole, we see significant gains across real estate, private equity, and equity securities.

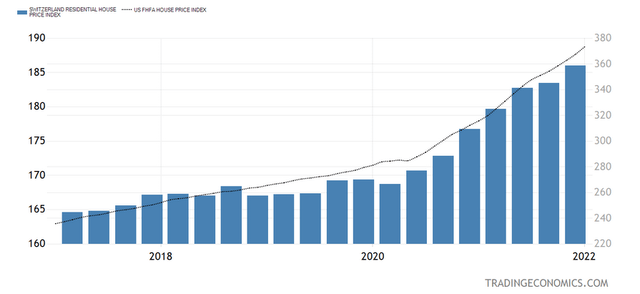

In terms of Swiss Re’s real estate exposure, the company’s geographic diversity appears to be favorable. For instance, while U.S. real estate prices have been rising quite significantly as compared to Switzerland, the limited exposure to the U.S. market helps to shield Swiss Re from risk in the event of a sudden downturn. With inflation threatening to push prices to unsustainable levels, the housing market in the United States could be prone to a correction over the longer term. Switzerland’s housing price index is up by just under 15% over the past five years, while the U.S. housing price index is up by approximately 50%.

High levels of inflation pose a threat to the viability of the real estate market, as prices will eventually reach a point where potential homeowners are no longer able to afford the higher cost. Inflation across the housing market in Switzerland and more generally has been more conservative. In this regard, I take the view that Swiss Re is taking effective steps to mitigate its risk by continuing to keep a large portion of its real estate exposure within Switzerland.

Moreover, while Swiss Re has seen significant losses across the company’s Life & Health sector due to excess deaths as a result of the COVID-19 pandemic, net income still improved by 26% to USD $1.1 billion in 2021 when excluding the impact of COVID.

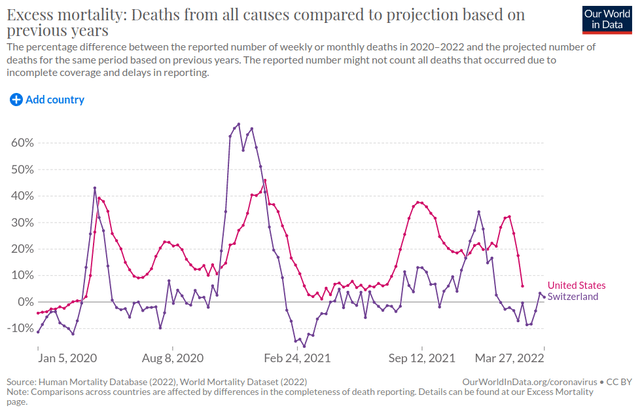

While the pandemic is still not over and we could still see significant seasonal outbreaks, excess deaths in the United States and Switzerland have seen a steady decrease overall and have not rebounded to levels seen at the end of 2020.

From this standpoint, a continued recovery in the L&H sector post-COVID is welcoming and would help Swiss Re to significantly mitigate the inflation risk seen across the P&C segment.

Valuation

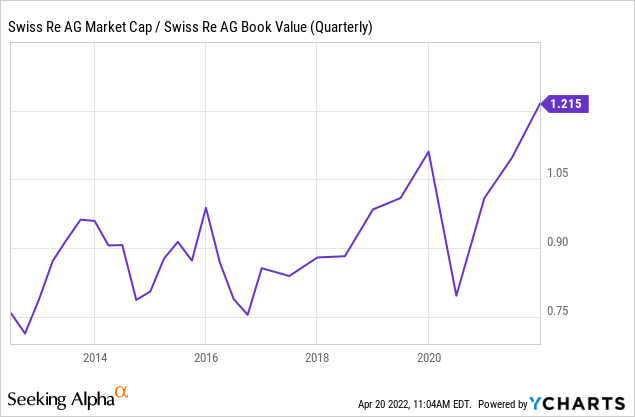

When looking at Swiss Re’s market capitalization to book value – a key metric used for valuing insurance companies with significant exposure to Life & Health – we can see that the ratio is trading at a 10-year high.

YCharts.com

With Swiss Re’s stock price having rebounded significantly since early 2020, continued losses across the Life & Health sector have contributed to the company trading at a significant premium on the basis of the above metric.

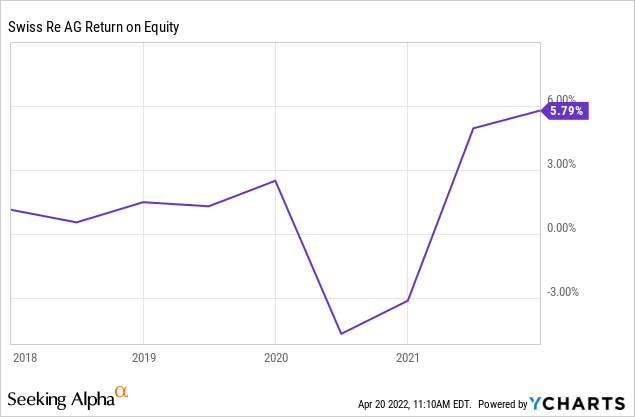

With that being said, Swiss Re’s return on equity is also at a 10-year high, which means that the company is generating a higher level of income relative to shareholder’s equity.

YCharts.com

In this regard, while Swiss Re might be more expensive than previously on the basis of market capitalization to book value, I take the view that the stock could still see further upside if the return on equity levels continue to grow.

Risks

Of course, no company is without risk in an inflationary environment and Swiss Re is no exception.

For one, growth in Swiss Re’s business is highly dependent on sustained net premium growth. While the company is in a good position to continue growing net premiums as insurance companies seek to diversify their risk exposure to higher property prices, sustained high inflation could have the opposite effect of reducing property demand and hence the demand for property insurance.

On the Life & Health side, while the threat of COVID-19 has been receding, further outbreaks or an uptick in excess deaths could further place strain on the company’s ability to return this segment to profitability – i.e., Swiss Re will continue to pay out more in claims than it will collect in new premiums written.

In this regard, while Swiss Re is in a good position to manage inflationary risks across its portfolio, it is still a reinsurance company that assumes risk in offering insurance policies across Property & Casualty along with Life & Health. Should these markets themselves see significant volatility, then Swiss Re could be adversely affected.

Conclusion

To conclude, virtually all companies are exposed to inflationary risks at the present time. Swiss Re is no exception. However, Swiss Re appears to have structured its investment portfolio to minimize risk to property inflation and, provided prices do not rise too dramatically, the company is still in a good position to increase net premiums written as demand for property insurance rises.

Additionally, the company’s Life & Health segment is also seeing a recovery, which further allows Swiss Re to diversify away from inflation risks.

Overall, I take the view that Swiss Re is well-positioned to thrive under the current inflationary environment.

Be the first to comment