Justin Sullivan/Getty Images News

With people more wired to their mobile devices than ever, telecommunications seems like a safe bet in this environment. But the threat of massive lawsuits from disaffected Sprint dealers makes T-Mobile (NASDAQ:TMUS) a risky bet at this time.

Background: Sprinting To The Finish?

Wireless World Inc. CEO and Founder Kristian Allos is an American success story. His California-based communications company did well, but not amazing, until it became an authorized Sprint dealer in 2007. Then things took off.

For more than 10 years, Sprint recognized Wireless World as one of its highest-performing dealers in the country – growing eventually to roughly 100 shops nationwide in 2017. That year, Sprint asked Allos to seek the necessary investment capital to open stores in Las Vegas and Hawaii, but without telling him they were in talks for an acquisition by T-Mobile.

In April 2020, US telecom giants T-Mobile and Sprint in a $26 billion merger, whereby the country’s third- and fourth-largest wireless communications companies combined. At the time, this seemed like it could be a win-win for investors in both companies.

But many stakeholders were sounding alarms, citing the potential job loss, the impact of a less-competitive telecom marketplace, and even some fears about national security and critical infrastructure!

None of that trickled down to Kristian Allos and other small-business owners like him, who was assured that T-Mobile would end up closing no more than 12 of his stores. But after the deal went through, T-Mobile claimed it held no obligations to honor contracts with a company that no longer existed. It handed Allos and others a 700-page “Agreement Package” they had to sign in 10 days, de-optimized search engine results away from Sprint dealers and toward existing T-Mobile vendors, and laid off hundreds of employees from Sprint’s sales team.

And yadda yadda yadda by 2022, Wireless World’s store count has dropped from 100 to 18. At this point, Allos had been an American success story.

Sprint Lawsuit: Will T-Mobile Accept The Charges?

Affected former Sprint dealers have created the coalition Wireless Franchisees for Justice “to call attention to the troubling treatment of T-Mobile’s dealers following the merger that was approved under false pretenses.” That’s the nice way of putting things, but with total potential damages of $600 million to all the affected parties, perhaps the more legally accurate term is “sue the ever-living crap out of them.”

Allos’ legal documentation is available here, but there are 11 other claimants seeking damages for 2,600 lost jobs.

Everybody’s wondering when the current market volatility will bottom out, but prospects look even grimmer for a telecom company – even one as big as T-Mobile – that might need to write a $600 million check, is going to hurt its investors.

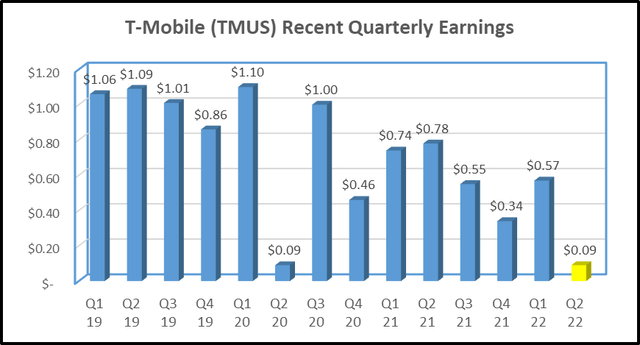

For Q1 2022, T-Mobile reported in April an EPS of $0.57, based on $713 million in net revenue. Despite the fact that this is lower than AT&T reported an EPS of $0.65, fellow Seeking Alphan Peter F. Way recently recommended T-Mobile as a better buy.

If T-Mobile, however, has to pay out $600 million in damages to former Sprint affiliates, those net earnings would drop to $113 million, resulting in an EPS of $0.09. Earning less than a dime on shares that cost about $125 each will not make investors happy.

TMUS Quarterly Earnings 2019 – projected Q2 if lawsuits succeed (Based on Macro Trends data)

The only quarter as bad as this in recent memory was Q2 2020, right when COVID hit and everyone was doing that badly (except of course people who made masks).

Longer-term profitability could be even worse – especially when people start looking at the fallout from the merger.

Before the merger, T-Mobile promised its customers the Sprint acquisition would increase capacity by 14 times, with improvements in speed and 5G coverage. But two months after the merger, T-Mobile delivered the worst carrier outage in recent times. The FCC called this “unacceptable.”

In 2021, it was revealed that T-Mobile lied to California government regulators about making its 3G and 4G LTE networks available to Dish Network users. Later that year, Consumer Reports wrote that after the merger, T-Mobile “dropped in almost every category, slipping from above average to just average for value, customer support, and data quality. Its rating for cell phone reception fell below average.”

And the new T-Mobile’s customer satisfaction index fell 5%, the worst in comparison to both AT&T and Verizon. Moreover, less than a year after the merger, T-Mobile raised its monthly price for Home Internet plan from $50 to $60 – right when everyone was stuck at home online and in economic dire straits because of COVID.

Conclusion

The job of the business world is to make money, not to play paddy-cake, of course. M&A happens, some people are winners and some are losers. But T-Mobile’s acquisition of Sprint has been bad for virtually everyone, especially T-Mobile shareholders if this kind of behavior scares away future investment dollars, plus the potential legal liability that T-Mobile has yet to disclose or acknowledge in any of their quarterly earnings.

This makes TMUS a sell, a risk even in risky times. But if the lawsuit is successful, maybe Kristian Allos will be able to “get more.”

Be the first to comment