bjdlzx

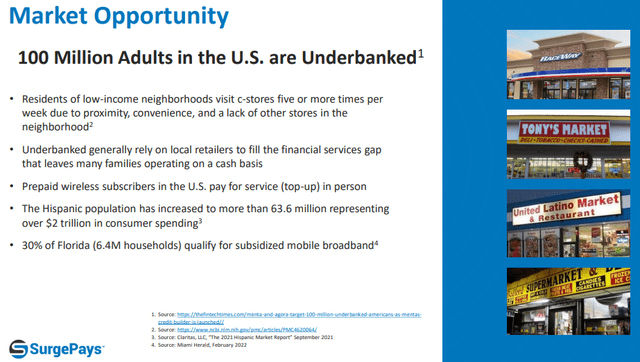

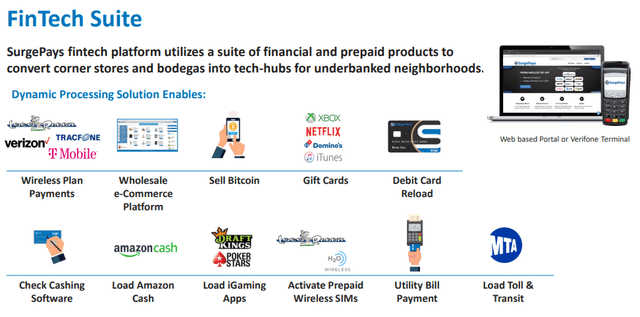

SurgePays (NASDAQ:SURG) offers fintech products through its network of third-party convenience shops that mostly serve the underbanked. These shops have installed SurgePays’ software with which they can process stuff like pre-paid cards and top-ups for pre-paid wireless phone services.

SURG IR presentation

It has to be recognized that the company has a unique market position here, but it hasn’t been able to monetize this as the products it sells through the network are low-margin third-party products.

SURG IR presentation

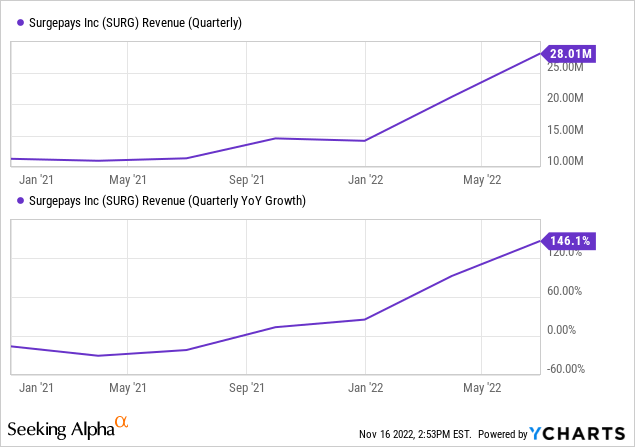

However, the company’s fortunes changed when the company started selling mobile broadband subscriptions subsidized (read, paid for) by the ACP, the Affordable Connectivity Plan, a bipartisan government initiative to provide internet access for poor communities.

These communities suffered on multiple fronts during the pandemic through a lack of access to online education, health, and jobs. Some 50M households qualify for ACP, but only 14M (or 28%) have applied, there is still a huge market out there.

Things accelerated with the acquisition of Torch Wireless, which enabled it to expand these services to all states. The company serves as an MVNO (mobile virtual network operator) using AT&T (T) and T-Mobile’s (TMUS) wireless backbones.

This costs them roughly $15 per subscriber, depending on data usage but efforts are underway to squeeze this towards $10 (for instance, through throttling heavy users).

Progress has been swift. Starting the year at 30K subscribers they recently overshot their yearend 200K target and have already 220K subscribers. This adds up, as the margins here are at least 50%, rather than the 4-6% of their Fintech business.

They are pre-financing tablets, which they give away (but get up to a $100 ACP subsidy per tablet per signed and vetted subscriber). Then they organize subscription drives in tents with banners stating “Free internet” to sign up ACP subscribers.

Pre-financing these tablets is the main bottleneck for accelerating growth as the ACP subsidies take up to 3 months to arrive and the costs (tablets, sales commissions, etc.) are up-front.

While in time, the existing base of subscribers will be large enough to produce the cash that enables them to finance these up-front costs, so far they were a little hamstrung.

Management refused to dilute shareholders (insiders own up to half the company and have bought fairly heavily recently). However, the company is finalizing a receivables financing with which they can accelerate growth.

But as winter approaches, these outdoor drives will decrease, but luckily they have another ace up their sleeve to continue the sales drive, their network of community stores.

ACP enrollments in stores

The company has added ACP enrollments to its SurgePays platform for convenience stores, which brings multiple benefits:

- 75% of store visitors use SNAP, by virtue of which they qualify automatically for the ACP, data can be quickly entered into the software running in their community shops, which makes it attractive for stores to join their network as this is an easy earner for them as well.

- It speeds up the growth of their ACP subscribers, especially as their outdoor pop-up tent subscription drives (used by most of their competitors as well) will decrease during winter.

- They hired Jeremy Gies as President of SurgePays Fintech to grow their network of stores (and sales and margins per store and adding ACP subscription to the stores is a pretty good way to start this).

- They also concluded a master service agreement with GPO Plus Inc. setting up stores to transact on their network. GPO has a 40+ sales team (they also sell products that can be added to the stores).

- There is no competitor out there that has something similar, they can really leverage their stores to boost their ACP subscribers and they can use their ACP service to boost their store network.

In short, the company can use its network of stores to boost ACP subscriptions and use that facility to grow its network of stores, and no competitor can match this.

So the stores are handy after all as they now have their own, high-margin product to sell, and they use that (as well as a separate manager Jeremy Gies and the partnership with GPO Plus) to increase their store network.

We think that the store network is an underappreciated asset as it offers access to a huge market of underserved and underbanked households that is difficult to match.

It just hasn’t been monetized very well, until now as the company has a very high-margin product to sell on its software platform running in these stores. The idea is to introduce more products and leverage their network, for instance through partnering with a telehealth provider (with payments made easy through the company’s Fintech services).

The company also has Shockwave, its own CRM software platform which it bought earlier in the year (as with the rising ACP subscriber number it turned out to be cheaper to buy it than continue to use it).

ShockWave is integrated into the National Verifier and the National Accountability Database of the FCC and the AT&T and T-Mobile backbones, which should reduce fraud (they also employ a third-party compliance bureau for this purpose).

One might also appreciate that several of their competitors are using Shockwave as well, which provides the company with a nice recurring revenue stream as well as data for analytics.

Possible macro headwinds and inflation are actually benefiting the company as more people qualify for ACP.

Finances

Q3 results (a further 149% growth to $36.2M) aren’t yet in the graph above.

- Management executed an audit and believes they can expand gross margins in both services and hardware and have protocols to enhance retention.

- Receivables increased from $3M in Q1 to $9M in Q3, these are government (ACP) receivables.

- SG&A increased less than 1% y/y with only insurance costs going up, there is great operating leverage in the model.

- Net loss came in at $1.5M versus $1.7M a year ago.

- The company had $7.9M in cash at the end of Q3

- $8.3M receivables (from govt ACP)

- The financing deal, which is about to be finalized could leverage them to be profitable and debt-free by mid-next-year.

The bottom line is that the company is still not profitable as the upfront costs are entirely expensed in month one, and accelerating sales keeps that bottom line down as these upfront costs get bigger and bigger (hence the need for the financing deal).

However, we think that in a few quarters the cash flow from their existing base becomes so large to be able to absorb these upfront costs.

Valuation

Even discarding their Fintech business, their margin expansion efforts and additional subscriber wins in the last 10 weeks of the year, their mid-October 220K subscribers provide a $79.2M revenue run-rate with nearly $40M in gross profits and in the order of $25M in operating profit.

The target is 500K subscribers by the end of next year which would produce a $180M run rate and $90M+ in gross profits and $4+ in EPS (run rate, not FY23 figures).

The increasing subscriber numbers producing recurring revenues are likely to bring the company in the black and cash flow positive next year.

Insiders own a big chunk of the company (29%) and have been buyers all year.

Risks

- The ACP has bipartisan support but whether that remains the case nobody can take that for granted 100%.

- We think SurgePays is well positioned versus the competition, most of which just sell simcards and don’t have their own MVNO service, let alone their own CRM software or a network of convenience stores strategically located in relevant areas to win subscribers.

- Fraud and attrition are problems, but we think the company has build multiple guardrails and vetting procedures (one might read above and see what Shockwave is plugged into) for this not to spoil the party.

Conclusion

- The new financing will maintain if not accelerate growth.

- Selling their ACP mobile broadband through their SurgePays Fintech network in their convenience shops is a win-win, it’s more attractive for shops to join the network and it maintains the growth of ACP subscribers during the winter when the outdoor tents are less viable. It also gives them a leg up against the competition.

- The target for next year is 500K ACP subscribers and they now have more tools at their disposal and financing. If they come anywhere close the shares are really cheap at these levels. 500K subscribers produces $180M run rate from their ACP business only at 50%+ gross margin and OpEx, which isn’t actually rising and well below $20M, that’s $70M in operating profit, $4 per share (run rate at yearend 2023), then add their FinTech business (although that’s low margin).

- Despite having bipartisan approval, one can have some concerns about the viability of the ACP long-term, or the attrition but the company is better placed than most to deal with the latter.

- We see continued subscriber and revenue growth, expanding gross margins and great operational leverage and think the shares are significantly undervalued.

- The upfront cost, which rise hand in hand with accelerating new subscriber numbers, are clouding a view of rapidly improving fundamentals, but that won’t last forever.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment