Just_Super/iStock via Getty Images

Intro

A long time ago, in a galaxy far, far away, I was commenting to a friend that it seemed like all the value plays were gone. I was having to chase inflated assets for the most part.

Now the inverse is true. Everything that I track is on sale at a discount. The challenge now is where to deploy capital for long term appreciation. While I have many choices, the EV sector remains my favorite because lithium is in such demand and projected to be in high demand for the next decade+.

Narrowing down the lithium choices leaves me with many favorites to include Lithium Americas (LAC), Standard Lithium (SLI), Nano One (OTCPK:NNOMF) and some very speculative micro plays that I’ve written on in the past. In this article we are going to explore Cypress Development (OTCQX:CYDVF) and why they represent one of my larger positions.

Evolving Markets

Politically, the lithium market is evolving. American politicians are waking up to the fact China is not our friend. With that, various laws are now in place to encourage domestic production of lithium (along with rare earth elements, semi-conductor chips, and various gases including helium and hydrogen.) Canada has taken it a step further, demanding that China divest of some Canadian lithium companies.

However, just encouraging mining of lithium is not the solution if you have to process all that white metal in China. The U.S. needs lithium refining on domestic soil and this is coming. With domestic lithium refining in the works, North American-based lithium companies are poised to benefit as all the refiners will need a steady supply of lithium to feed the car makers.

However, in the short term the combination of inflation raging and interest rates rising has caused investors to huddle in collective fear mode. How long this might last or how bad things might get is anyone’s guess, but for the long-term investor betting on lithium, all should end well if one can practice patience and understanding. Political support is crucial; demand is equally important. Various companies such as Tesla (TSLA) are expanding and with that they will require more lithium. This bodes well for future lithium demand, and we will cover this in greater detail later.

Parallels to Lithium Americas

Realize that the average time (from concept to extracting pay dirt) in mining takes an average of 10 years, if not more. Cypress is no different concerning timelines, but we are getting closer to some sort of financing/joint venture in my opinion and that moves us closer to production. If we project Cypress forward a few years and compare how Lithium Americas stock performed as it hit milestones, we might make some valid rough assumptions of how Cypress might perform.

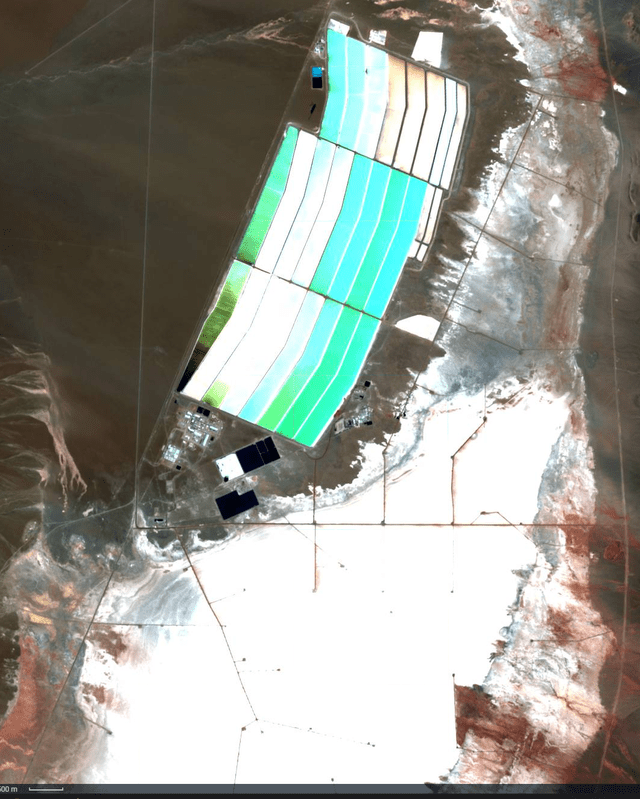

Looking way back to Feb 1, 2017, I wrote on LAC when they were a mere $3.62 a share. Back then, the entire LAC South American operation had a rather small footprint as seen below. Cozy, isn’t it?

LAC South American Project – 2017 (Lithium Americas)

And then a mere five years’ later we see large brine pools on the north side, wells on the south side in the salar and a building complex just south of the blue brine fields.

LAC Oct 2022 (Eos)

Funding for LAC came via Bangchak Petroleum, then SQM joined the fray only to pull out. Ganfeng then took over the SQM role and provided massive funding. After this, once the share price rose, we saw a few rounds of funding by LAC issuing stock.

Is this the route Cypress could mimic? Maybe. The point is LAC was at one point a small but promising potential miner. I think parallels are present with LAC and Cypress.

Cypress has to complete the feasibility study (FS). I’d venture this wraps up in Q1-Q2. Somewhere after the FS we should start seeing funding, deals, or a joint venture. Once the FS has completed, this opens doors to government funding of the project. Assuming we get all the funding over time, we are still years away from project start up, but much like LAC, as the project derisks and is physically built out, investor confidence will increase, and the share price might correspond.

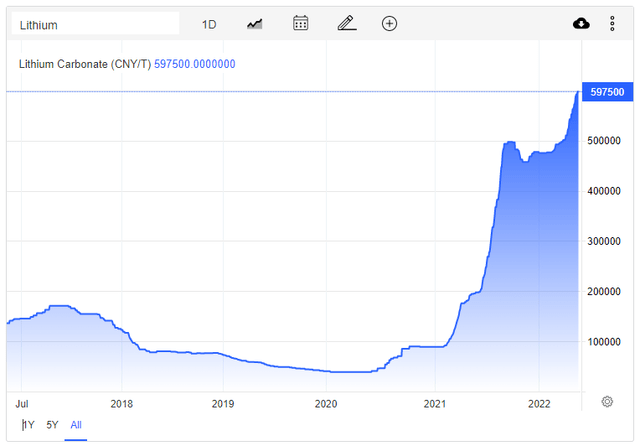

Of course, this is assuming Mr. Murphy works with us to some extent, but given lithium prices are at $82,416 as of 11/10/22 we should be able to endure various setbacks. Granted, this is spot price. Contract prices are much lower but generally in the $30,000 to $50,000 range from what I hear.

Chinese Lithium Prices 10/15/22 (Trading Economics)

Lithium Clay Is Here To Stay

One thing holding back Cypress and LAC Nevada to some extent is clay-based lithium is the new and not commercially proven kid on the block. I suspect some brine and rock guys would rather it not pan out, but clay is here to stay in my opinion. Let’s explore the various processes and thoughts behind them. Brine-based lithium extraction has been with us for decades. The basic story is easy to follow. Suck up lithium laced water (aka brine) and let Mr. Sun evaporate the water over years. Easy to present and understand.

Next up is rock-based lithium. Crushing rock to extract lithium is quite popular in Australia. How hard is it to explain to investors about crushing rocks? Even a caveman could figure it out.

Clay, however, while it is getting closer to production, is still unproven in a mass commercial setting to my knowledge. This might make attracting capital to clay a challenge in a risk averse market, meanwhile rock or brine-based lithium is proven. Plus, the clay story is a bit harder to sell to the masses via strange acid use as well as direct lithium extraction technology.

Australian investors are not used to this and prefer rock. The conservative brine guys and South American types prefer brine. Clay though? It just does not have a poster child of success … well, not yet that is, but with time I think Cypress and Thacker Pass will prove it scales to commercial status.

Poster Child for Clay

As we wait for Thacker Pass to hopefully be approved, this could signal a change. If Thacker Pass is approved, we could see deals for financing of this project for hundreds of millions along with government backing. This could wake up and excite the masses to the possibility of clay-based lithium.

If LAC were to rise in price, we might see the masses look for related clay projects in Nevada with water rights. Cypress would be one such project in Clayton Valley. One of a mere three companies that have meaningful amounts of water, the third being a gold company and the other being none other than powerhouse Albemarle (ALB). Albemarle, Albemarle, Albemarle… one has to wonder what they have been up to and how they factor into clay.

Albemarle and Lithium Clay

Concerning Albemarle, they have stated they are looking at lithium clay per page 17 of a SEC 10-K/A:

“There are no current exploration activities on the Silver Peak lithium operation. However, in January 2021, we announced that we will expand capacity in Silver Peak and begin a program to evaluate clays and other available Nevada resources for commercial production of lithium. Beginning in 2021, we plan to invest $30 million to $50 million to double the current production in Silver Peak by 2025, with the aim of making full use of the brine water rights.”

Notice the statement of no current exploration activities and with lithium brine values so low at Silver Peak (and non-battery grade too) it would make sense for ALB to look at neighboring clay assets that have much higher lithium values.

Cypress on Partnerships-Joint Ventures

In an October interview by CRUX, CEO of Cypress Development, Bill Willoughby, had some words concerning potential partnerships and or joint ventures:

CRUX: “Any conversations going on right now?”

Bill: “We’ve had conversations, but we haven’t gotten to the point of saying we want an off-take agreement. We don’t want to encumber the project with anything other keeping ourselves open to the options of financing and possible partners at this point. We obviously don’t want to do an off-take agreement that might limit say a major miner coming along and jumping in with us.”

CRUX: “Do you recognize at some point you’re gonna have to start putting yourselves out there to those small handfuls of those battery manufacturers and let them know that you’re gonna actually be able to deliver it to me?”

Bill: “I would say that that’s at least four or five months down the road for us. It’s going to depend on what sort of partnership and relationship that we develop from this point, as far as JV partners or potential investors coming in. You could have a party come in that has a metals marketing as part of their corporate and they want to do that and having an existing off take would possibly encumber that, that type of partner coming in or financing.”

Bill: What we have at our project site, I think, is about as good as you’re going to come across in the U.S.”Authors note: Five months from the October interview would place potential deals around the March time frame. This is potentially around the time the feasibility study is wrapping up or will be wrapping up in the Q1-Q2 time frame.

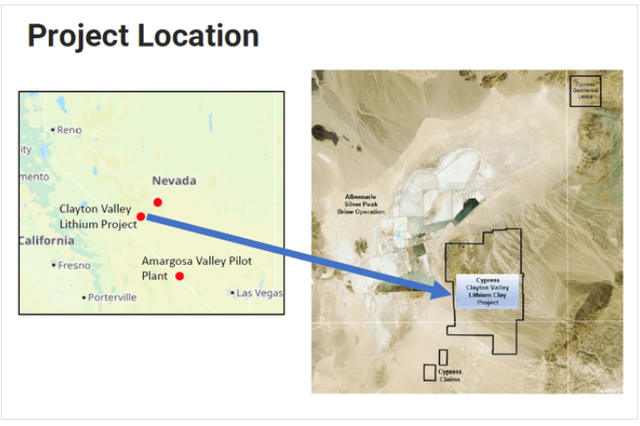

Clayton Valley Cypress Dev Property (Cypress Development)

Government Loans and Grants for Lithium Projects

Then the interview moves on to U.S. Gov grants and incentives:

Bill: “Oh, we’ve had some discussions with DoD (Department of Defense) and DoD” (Author’s Note: I would assume he meant DoE [Department of Energy] for the second instance above but that is how the interview was transcribed via CC)

Bill: “So that type of funding could come available to us. More likely the point we jump in on it is after we have the feasibility study completed and we are fairly well along in the permitting process. We intent to kick out of permitting, the NEPA process in another month or so since we have the documents together and put that in front of the BLM.”

Bill: “We are hoping we can go through the NEPA process and all the permitting in about a year, year in a half. The most significant permit is getting a record of decision and then going through the EIS. So the other permits we’ll need, we’ll need a water pollution control permit from the state, air quality permit.”

CATL Enters the Lithium Clay Market

In a show of confidence for clay-based lithium, powerhouse CATL bid and won on a China clay asset for $134.8 million USD in April of 2022. It appears that North America is not alone in realizing the strategic importance of lithium clay.

|

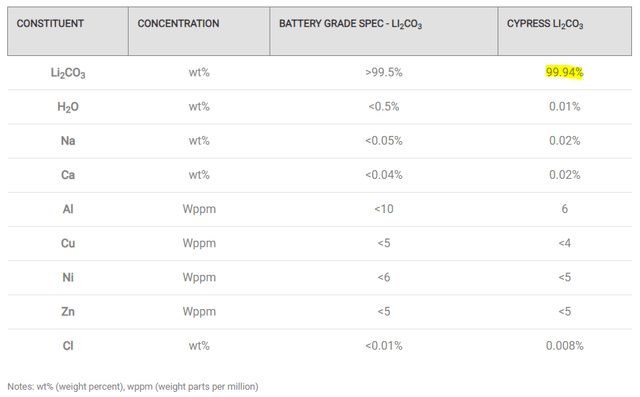

Cypress and Battery Grade Results

Moving away from the clay discussion we should glance at the favorable pilot plant results. After much patient waiting, Cypress Development has announced the results of the lithium it sent off to be tested and refined. The resulting product exceeded the standard for battery grade lithium at 99.94% (Battery grade is 99.5%). We must recognize this was the initial batch. Results will improve more over time as additional refinements and testing occur at the pilot plant. Additionally, Cypress has engaged Saltworks to help improve the process.

Enhanced Battery Grade (Cypress Development)

From Cypress per the PR:

Cypress has engaged Saltworks to integrate their designs into our pilot plant program and look forward to their continued work on the Project.”

and

The final product surpasses industry requirements for standard battery grade Li2CO3 and has achieved industry requirements for enhanced battery grade Li2CO3 for xEV use. It is common practice for lithium battery manufactures to have specific requirements for Li2CO3 used in their products dependent on application.”

As optimization occurs, the company will further refine the process and remove impurities to some minor extent. Thus, further minor gains might be realized in purity or maybe the company tones it back a hair to balance costs.

These positive initial results prove to investors that the company is capable of taking lithium-laced clay and producing better-than-battery-grade lithium from it; battery-grade lithium that the big boys such as Tesla and Ford (F) demand, no, crave for electric vehicles.

Hydrochloric Acid Optimizations

Moving on in the interview, Willoughby brings up an interesting point when discussing hydrochloric acid via:

“We are probably in the ballpark of 120 kilos a ton on consumption of hydrochloric acid. We would like to see that number way lower rather than build a bigger acid plant, we’d like to just cut the consumption of the acid down and then be able to keep or even exceed that target of production out of the plant.”

Producing acid requires a lot of power, if we decrease the acid use via efficiency increases, we decrease power use. Hence, Cypress could increase the company estimate output of 27,400 tonnes of lithium per year but at a reduced power-acid cost.

Takeaway: Less acid use per tonne of lithium = cost savings assuming water is not as constricting as one might think. In a recent interview Willoughby noted that power is the biggest constriction on the project which I thought was a very interesting statement.

Catalysts for Cypress Development

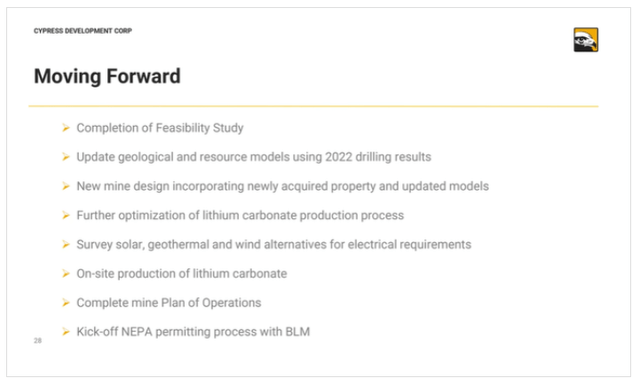

Spending some time glancing over the company’s numbers or bringing up a chart to see what people paid for the stock in the past is good, but what I like to focus in on is future catalysts. Catalysts move companies. What I want to see are events that will excite the masses. This could lead to stock price appreciation.

Listening to the virtual conference on 10/19/22 we are presented with the following slide of future events and potential catalysts:

Cypress Future Potential Catalysts (Cypress Development 10/19/22 Presentation)

Assumption

We might speculate that Cypress will start courting financiers shortly (if not already) as the feasibility study gets closer to competition. Per the CEO:

“Our main focus right now is our feasibility study, looking at permitting, getting ready to submit a plan of operations to the Federal government to kick off our NEPA process and then finally as we move forward, we’ll be looking at financing in the coming year. What are our options in terms of partnerships or funding sources.

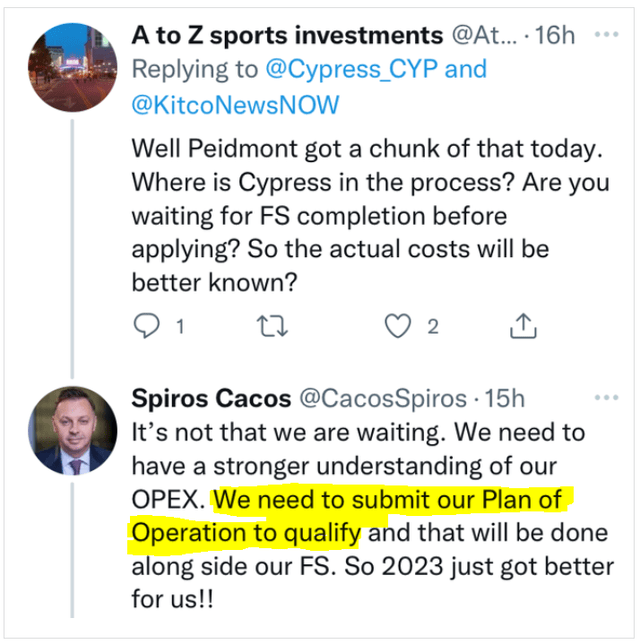

Government Funding of Lithium Projects

On 10/19/22 a PR came out that described several companies receiving government funding for various projects. Some people wondered why Cypress, Lithium Americas or Standard Lithium (SLI) did not receive funding. In the case of Cypress, we saw an explanation per Twitter (TWTR). Per Cypress IR Spiros Cacos:

Government Funding Timelines (Twitter)

Big Picture Lithium Demand

Let us view some big picture items that will quickly alter the lithium scene. Do note how much money will be flowing into Ontario alone.

$4.9 billion in EV upgrades for Ontario per Stellantis & LG Energy Solution

$1.6 billion per the Canadian gov.

$1.5 billion for Ottawa and Ontario per Umicore.

$1.4+ billion over 5 years for Ontario per Honda.

$50 million expansion for a Ford supplier in Ontario.

$45 million for EV chargers / Hydrogen refueling.

Tesla hires critical minerals strategist for Quebec, Canada.

Tesla in talks with the Canadian gov to explore manufacturing cars.

$2.36 billion via Goition to invest in a Michigan battery component plant.

Lastly, we see an estimation of $1.2 trillion in investments into EV by 2030. I would use it as a very rough estimation (subject to change), but it gives you an idea of intent.

Tesla Might Build a Lithium Refinery

In a move that has been a long time coming, Tesla has announced that it is evaluating a lithium refinery in Texas or Louisiana near the gulf coast. This is a positive move for aspiring domestic lithium producers like Cypress Development or lithium technology companies like Nano One. Meanwhile… in China.

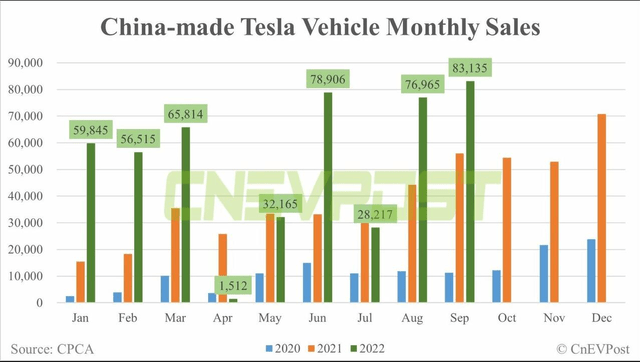

The Red Dragon

Note the yearly output increase. Nothing more needs to be said.

Tesla Breaks China Sales Records (Zerohedge via CPCA)

The Cypress-Zinc Wild Card

Cypress Development has a Nevada zinc project that is rarely talked about. Currently, Cypress has an agreement with Pasinex and Caliber Minerals where Pasinex can earn an 80% interest in the project. Per the terms, Pasinex must ultimately pay $1.5 million USD and incur $2.95 million in exploration expenditures.

Since the original agreement, several modifications have occurred which muddy up a clear view, but let’s try to break down the agreements. We can see here it has two parts to it. The first is to earn a 51% stake and the second is a 29% stake.

|

Pasinex must spend another $800,000 by December 31st, 2022. As of June 30th, 2022 they have spent $289,000. Thus, they need to spend another $511,000 quickly to secure the first 51% stake. It appears they will spend capital via a drill program that should be going on shortly and that should meet the costs needed exploration capital requirements.

It appears Pasinex is moving forward with the zinc project in Nevada per this March document:

|

To acquire the additional 29% we see the following due by December 31, 2024

|

Prior to December 5, 2021 (deferred to December 31, 2024) a payment of US$250,000 cash and issuance of 200,000 Pasinex Common Shares to Cypress. Spend an additional US$1.1 million in exploration expenditures as defined in the Option Agreement. |

Recap: Spend another $511,000 by this December and that buys you time to December 2024 if you want to earn more ownership of the project.

Meanwhile, we see zinc prices are elevated which bodes well for zinc plays such as Group Eleven Resouces (OTCPK:GRLVF), a zinc play that I am currently exploring.

10 Year Zinc Chart (dailymetalprice)

Risk

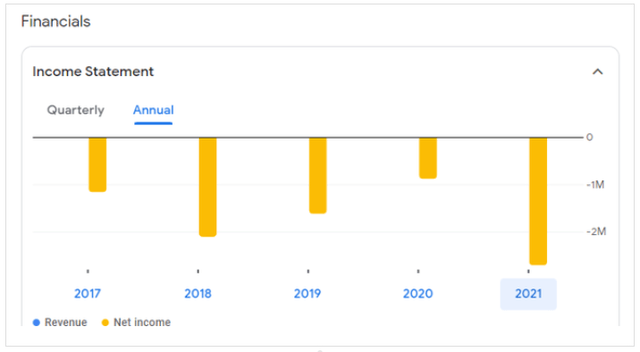

When we think about risk and Cypress, we need to consider company specific risk and industry wide risk. Concerning company specific risk, the biggest threat is decreasing capital. As of September 30, 2022, Cypress has $31.3 million in working capital. Compared to other lithium companies this is a healthy amount given the burn rate per year. Granted this burn rate should increase now that the pilot plant is testing lithium and the company has tasked out third parties for the feasibility study.

I see no need for the company to currently raise capital at the moment and given the low share price it is not an optimal time anyway. Granted I assume Cypress would want a reserve war chest so I could see additional raises down the road but that is anyone’s guess as to what threshold of decreasing capital would trigger that (or on the flip side what high share price might motivate the company to build up the company treasury).

The point is with the current cash position they can move forward for a few years at the very least with the low burn rate. Below we can see the burn rate in yellow (aka negative net income).

Cypress Development Annual Burn Rate (Google Finance)

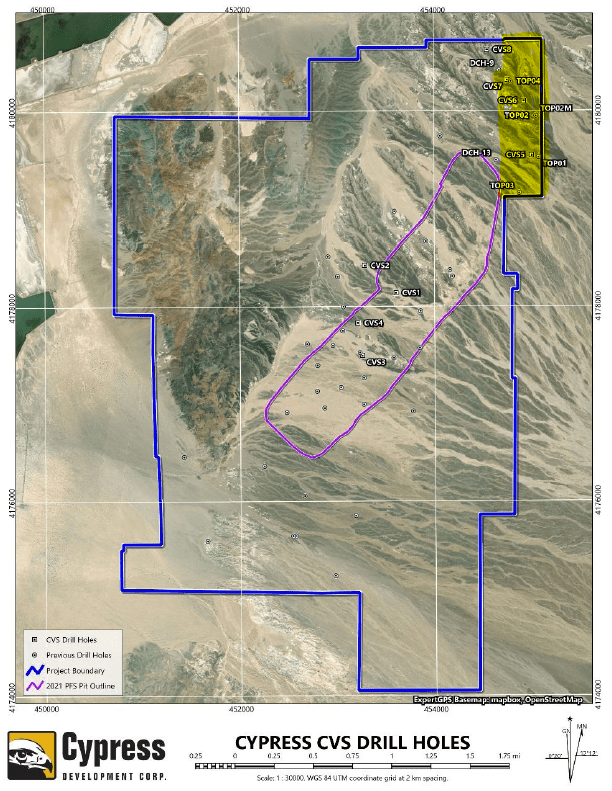

Concerning geographics Nevada is one of the friendliest states towards mining in the United States. Geographic risk is low. Another point of interest is infrastructure. Without access to power and roads, any project can be challenged. Cypress is next door to Albemarle at Silver Peak, Nevada which has ample roads. A future power line is planned as Cypress has rights to a geothermal asset that is north of the property. This can be seen on the map below at the top right. Concerning water Cypress is one of only three companies in Clayton Valley to have any meaningful water rights. Those without water are in a questionable state of being. Will they be acquired at a reasonable price or left to wither on the vine? Hence, having water puts Cypress in a strong stance as far as project viability.

Cypress Geothermal Asset (Cypress Development)

Cypress Development Finances

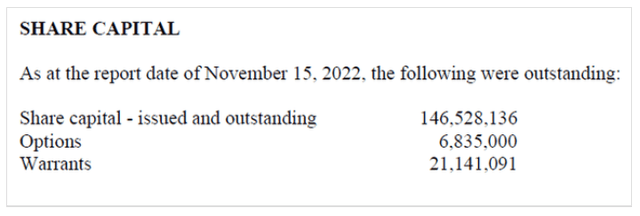

The Company’s working capital was $31,372,555 as of September 30, 2022. Obviously, Cypress will have to land a financing deal to move the project forward. Additionally, share structure is very normal.

Cypress Share Structure (Cypress Development)

Project Timeline Assumptions

Markets are favoring near time miners over longer-term miners. Looking back at 2017, prices for all lithium miners were very low. I think years from now we will look back at 2022 and realize that prices are very cheap for lithium companies. Pondering Cypress, I think a timeline might look like:

2023 – Focus on completing FS by Q2. Joint venture/funding.

2024 – The year of permits/Funding

2025 – Permits/Construction

2026-27 – Production/Revenue

These are just my guesses factoring in delays, supply chain woes, Mr. Murphy and such.

Takeaway

For a patient investor, Cypress (or lithium in general) could represent an extreme value play. I’ll leave the reader to ponder what Cypress producing 27,400+ tonnes of lithium at $30,000 to $50,000 (contract prices) looks like revenue wise for a company with a market cap of $149 million.

Extra Notes:

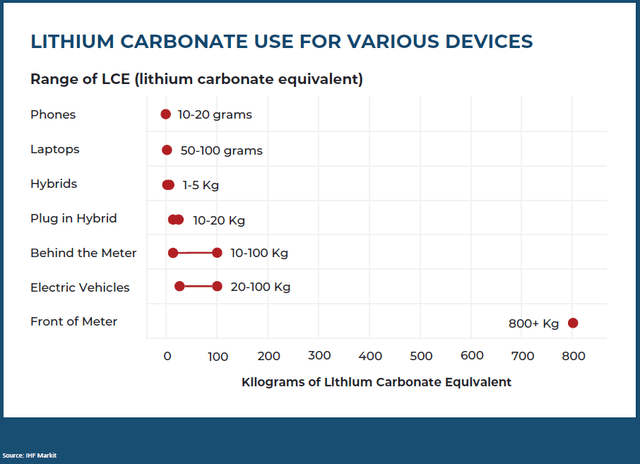

Observe the lithium use per car.

Lithium Use (ACME Lithium via IHF Markit)

Note the new property acquired in yellow by Cypress.

Cypress Development Acquired Lands (Cypress Development)

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment