airdone/iStock via Getty Images

Thesis

Alibaba Group Holding Limited (NYSE:BABA, BABAF), together with other Chinese tech giants, suffered double-digit price declines when the Monday trading session started after news confirmed Xi Jinping’s third term. BABA now faces an even more uncertain future, and investors now have an even higher stake decision to make. On the risk side, the market is concerned about heightened restrictions on China’s private tech companies like BABA. On the other hand, the stock is still highly profitable and also now trades at a dirt-cheap valuation.

So, the way I see it, the decision now boils down to this: have the risks been properly priced in, or not?

Such high uncertainty reminds me of an investment tenet I learned from Mohnish Pabrai, an investor that I’ve closely studied and followed. A key principle that he promotes involves looking for stocks with 1x P/E, which is one of his 10 “investment commandments.” In his own words,

It is best to look for stocks based on future earnings or hidden earnings that are trading at a 1x multiple. When you can buy at this valuation, good things tend to happen. Looking for the hidden PE is a really good exercise.

In such high-uncertainty situations, I view a hidden P/E near 1x as a good criterion to judge if the risks are properly priced. A similar investment decision that Pabrai himself faced was Fiat Chrysler when it was in a highly uncertain situation back in 2014. More specifically,

Pabrai says when he bought Fiat Chrysler, it was trading at less than $5 a share and the company had forecast by 2018 it would be making about $5 a share. In 2016 it spun off Ferrari, but including that it exceeded the forecast number. The PE of 1x materialized and the investment increased by 7 to 8 times in that time.

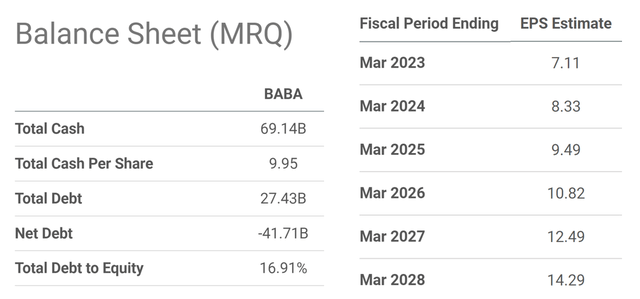

Now back to BABA, with the recent corrections, it is getting close to the 1x hidden P/E bet that Pabrai promotes based on its financials shown below. As seen, first, BABA has a net cash position of $69.1B on its ledger, translating into about $9.95 per share. At its current share price of $63, its cash-adjusted price is about $53 (=$63-$9.95). And consensus estimates project its FY1 EPS to be $7.11, thus translating into an FY1 P/E of 7.45x (=$53/$7.11) when adjusted for cash. In 5 years, the EPS is projected to grow to $14.29 per share, leading to a P/E of 3.7x and getting closer to 1x.

And next, we will see that its true P/Es are even lower when its CAPEX expenditures are correctly interpreted, pushing its hidden P/E further closer to 1x.

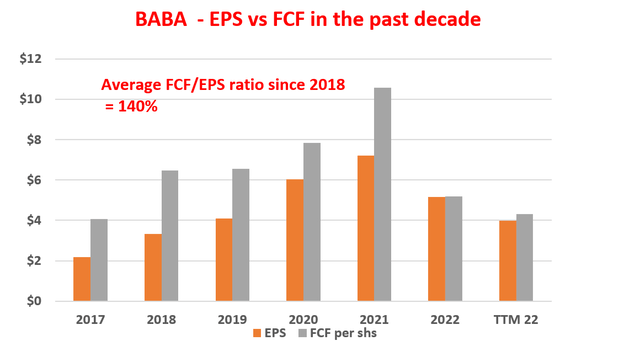

BABA’s EPS vs. FCF

You can already see the discrepancy between accounting earnings and economic earnings simply by comparing BABA’s EPS against its free cash flow (“FCF”) as shown in the next chart. The chart shows the accounting EPS and FCF per share for BABA since 2017. As seen, its FCF has consistently exceeded its EPS. To wit, its so-called FCF-EPS conversion ratio has been averaging 140% in the past 5 years since 2018.

And note that FCF itself also underestimates the true owners’ earnings because FCF was determined by subtracting ALL CAPEx expenses from the cash flow. While from a business owner’s perspective, only the maintenance CAPEx part is mandatory, and there only the maintenance part should be subtracted.

Source: author based on Seeking Alpha data

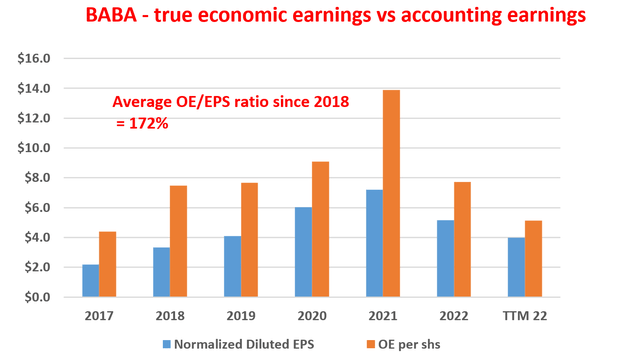

BABA’s Accounting earnings vs. owners’ earnings

For businesses that incur sizable CAEPX expenses, the accounting earnings may underestimate the true economic earnings as detailed in my earlier article:

- The key of interpreting owners earnings is to decompose the CAEPX expenses into two parts: the maintenance CAPEX and growth CAPEX. Maintenance CAPEX is the mandatory part to keep the business running. And the growth CAPEX is the optional part. The growth part should actually be considered part of the owners’ earnings because it can be returned to the owners if the owners decide not to grow the business anymore – a key insight that investors like Buffett have recognized.

- Under this background, the following chart shows my analyses to delineate the maintenance CAPEX and growth CAPEX of F. This analysis is performed by Bruce Greenwald’s method. Readers interested in more details could take a look at my earlier article on AAPL and/or Greenwald’s book entitled Value Investing.

The next chart below shows BABA’s OE (i.e., owners’ earnings) computed following the above method. As seen, when compared to its accounting EPS, its OE systematically exceeded its accounting EPS by a large margin. To wit, the average OE/EPS ratio has been 172% since 2018. That is, when its growth CAPEx has been added back to the OE, its economic earnings have been on average 1.72x times higher than its accounting earnings.

The ratio has decreased somewhere in recent years due to competition and also regulatory changes. As of TTM 2022, its EPS was reported at $3.99 per share and its OE stands at $5.13 per share, about 129% above its EPS.

In either case, its true valuation would be lower than on the surface. Again, as aforementioned, its P/E based on accounting earnings is about 7.45x for FY1 and about 3.7x for FY5 adjusted for cash. When the discrepancies between owners’ earnings and accounting earnings are considered, its FY1 P/E would be in the range of 4.33x to 5.77x depending on if you assume its future OE/EPS ratio to be 172% (the longer-term historical average) or 129% (its TTM value). And its hidden P/E after 5 years would be somewhere between 2.1x (assuming an OE/EPS ratio of 172%) and 2.8x (assuming an OE/EPS ratio of 129%), very close to the 1x PE that Pabrai looks for.

Source: author based on Seeking Alpha data

Summary of risks and final thoughts

BABA has always been a high-risk and high-reward opportunity since the miscarriage of its Ant IPO back in November 2020. The stock has been caught in the crossfire of a multitude of mega-forces. It was under regulatory pressure from the Chinese government. Its overseas exposure was sensitive to global geopolitics such as the Russian/ Ukraine situation. At the same time, the overall macroeconomic conditions in China are facing strong headwinds from a range of factors including the challenge of balancing COVID control and economic growth and its housing market. Now with President Xi entering the third 5-year term, much of the regulatory pressure and COVID control policies would be extended in the foreseeable future.

My overall impression is that the magnitude and complexity of these forces are largely beyond individual investors’ ability to compute accurately. In highly uncertain situations, I only hope to be directionally right. And a good rule that has helped me in the past is Pabrai’s 1x P/E commandment. When a stock begins to fit into this commandment, I have good odds. And in BABA’s case here, I see its hidden P/E getting closer to 1x.

Be the first to comment