FreshSplash

Investment Thesis: Oxford Industries could be set for further upside from here based on a strong cash position and potential for further earnings growth.

In a previous article back in September, I made the argument that Oxford Industries, Inc. (NYSE:OXM) could continue to see longer-term upside on the basis of continued strength in sales across the Tommy Bahama line, as well as significant earnings growth.

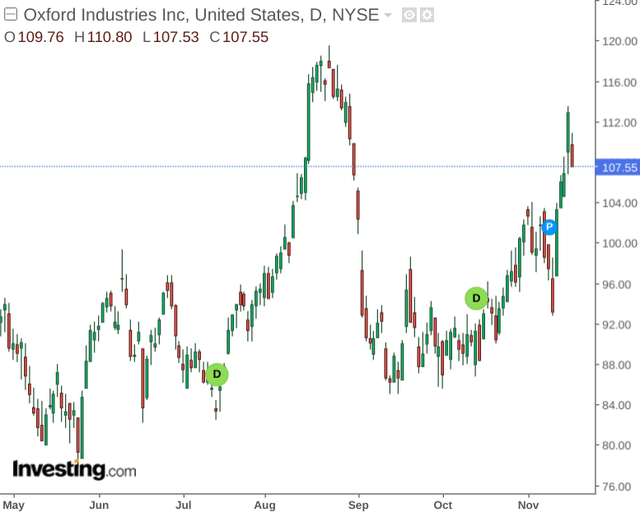

Since my last article, the stock is up by just over 16% at the time of writing:

The purpose of this article is to assess whether the significant growth that we have been seeing in the stock can continue from here.

Performance

Since my last article, the acquisition of the California-based luxury apparel brand Johnny Was for $270 million has been the most notable development for Oxford Industries.

The acquisition of this brand is expected to broaden the company’s customer base and Oxford Industries has raised earnings guidance due to the addition of the brand to its portfolio.

From this standpoint, while the earnings growth that Oxford Industries has been seeing is impressive – it is possible investors will look for further earnings growth resulting from the acquisition in order to justify further price upside.

From a balance sheet standpoint, the company’s quick ratio has remained above 1 and increased slightly from that of last year – indicating that the company has sufficient liquid assets to cover its current liabilities.

| Jul 2021 | Jul 2022 | |

| Total current assets | 349,046 | 421,248 |

| Inventories, net | 77,330 | 135,483 |

| Prepaid expenses and other current assets | 24,720 | 29,242 |

| Total current liabilities | 220,184 | 222,640 |

| Quick ratio | 1.12 | 1.15 |

Source: Figures (except quick ratio) sourced from Oxford Industries Second Quarter 2022 Earnings Results. Figures provided in USD thousands. Quick ratio calculated by author as total current assets less inventories less prepaid expenses and other current assets all over total current liabilities.

Given the cost of the recent acquisition of Johnny Was, investors are also likely to look for evidence that Oxford Industries can continue to maintain a strong cash position in the upcoming earnings quarter.

Specifically, I take the view that should Oxford Industries continue to see growth in earnings while also maintaining a quick ratio above 1 – then this could serve as a catalyst for further upside after the upcoming earnings season.

Looking Forward

Going forward, a risk for the apparel industry more generally remains inflation and supply chain issues. On the one hand, higher prices could reduce consumer demand for apparel, while supply chain pressures could mean that demand is not fulfilled.

However, performance to date has not suggested this to be the case for Oxford Industries. Indeed, since the company operates at the luxury end of the market, the company has so far shown resilience to a slowdown in demand.

Moreover, with luxury travel demand having continued to perform strongly post-COVID, Tommy Bahama’s new partnership with Lowe to expand into the hotel industry also provides Oxford Industries with an opportunity to extend their brand through the Tommy Bahama Miramonte Resort & Spa offering and expand the brand’s reputation for luxury outside of the apparel industry. Moreover, this could allow Oxford Industries as a whole to diversify away from the supply chain pressures that may continue to impact the apparel industry going forward, and allow the company to keep the Tommy Bahama brand profitable even if the apparel industry itself comes under pressure.

Conclusion

To conclude, Oxford Industries has shown strong growth to date. I take the view that if the company can continue to increase earnings and also maintain a healthy cash position in the upcoming earnings season, then this could serve as a catalyst for upside going forward.

Be the first to comment