jetcityimage/iStock Editorial via Getty Images

Introduction

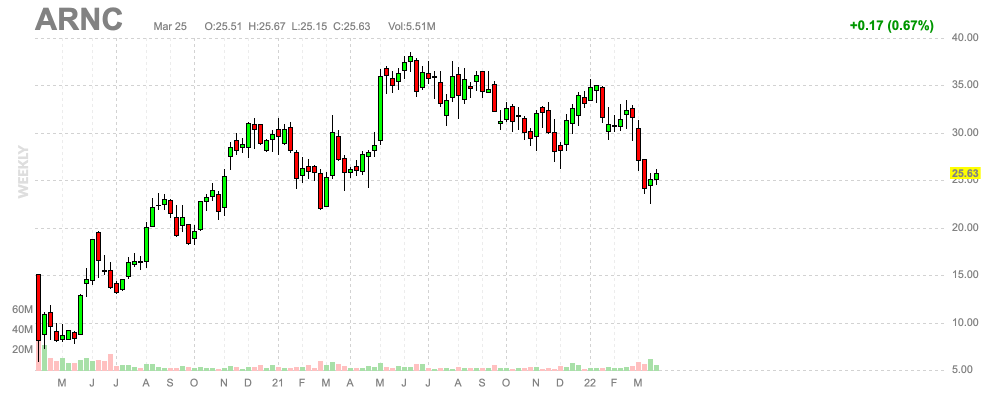

I’ve been looking forward to writing this article for two reasons. First of all, my last article was published in May of 2021, which means it’s time to update my thesis. Reason two is connected to reason one as my bullish call is underwater. Back then I underestimated the uptrend in aluminum prices, which was fueled by the ongoing war in Ukraine. I could not have predicted that unless I had Russian intel. In this article, I’m going to re-assess the situation and explain how to deal with the fascinating Arconic Corporation (NYSE:ARNC). It’s a high-quality supplier of various aluminum-intensive industries after being spun off from Howmet Aerospace (HWM) which has outperformed the automotive industry and only suffers from high input inflation because of the war and broken supply chains. The stock has approached favorable valuations as it entered a downtrend along with the automotive industry. In this article, I will give you the details!

What’s Arconic?

But first, a little history. Arconic used to be part of the mighty aluminum producer Alcoa (AA) until Alcoa was spun off in 2016 to create a business focused on aluminum metals and engineering and an industry focused on aluminum and alumina production. The goal was to create shareholder value as businesses like Arconic have higher valuation multiples compared to basic material companies – in general.

Then, on February 8, 2019, Arconic announced that it would split into two separate businesses (again). Arconic would be renamed Howmet Aerospace Inc. (HWM) and a new company, Arconic Corporation, would be set up and spun out tax-free from Arconic. The new Arconic Corporation is focused on rolled aluminum products and Howmet Aerospace on engineered products. The separation was completed effective April 1, 2020.

Basically, rolled products are used in the production of finished goods ranging from automotive body panels and airframes to industrial plates and brazing sheets. Sheet and plate are used extensively in the transportation industries as well as in building and construction and packaging. They are also used for industrial applications such as tooling plates for the production of plastic products.

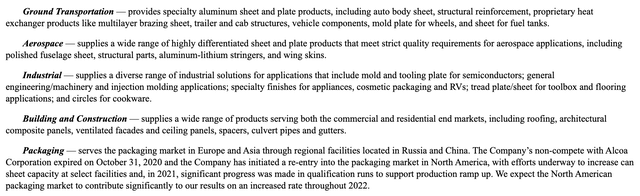

The company sells its products to 5 industries:

Now, let’s involve some financial numbers:

Outperforming Automotive Growth

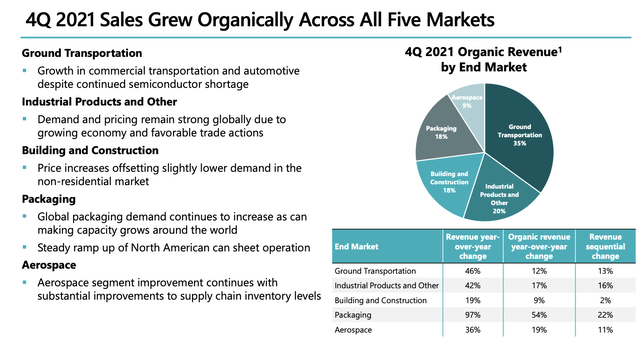

Based on what I wrote above, the overview below shows the company’s sales breakdown per segment, which shows very high ground transportation exposure. Followed by industrial products, building and construction, and packaging. Aerospace is small, but this will recover as long-haul demand comes back going into the second half of this year.

In this case, the company mentions “supply chain inventory levels” which were a key reason for weakness in the industry. When COVID hit, suppliers and manufacturers like Boeing (BA) worked on existing orders using their current inventory. Companies did not order new stuff as nobody knew how bad the economy would get. In 2021, we figured out that it wasn’t the end of the world. The demand came back, inventories were empty. Now, we’re slowly witnessing rising demand in that industry.

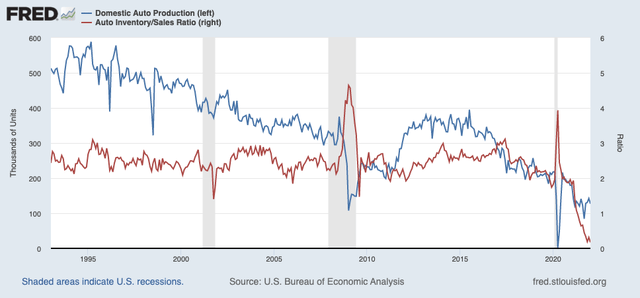

The company’s biggest segment, ground transportation, was pressured by ongoing semiconductor shortages. The graph below shows automotive production in the US. Going into this year, the number was close to 130 thousand units per month, which is one of the lowest numbers “ever”. In the meantime, the ratio between autos in dealer’s inventories and dealer’s sales fell to 0.2! That’s zero point two. I wish I made an error. It’s the reason why used cars are so expensive. Prior to the pandemic, that ratio used to be close to 2.5x.

This trend makes it hard for companies to do well in the industry, even if they have the best products and services. It’s simply impossible to do well when customers (the car companies) are unable to put all supplies together due to missing parts.

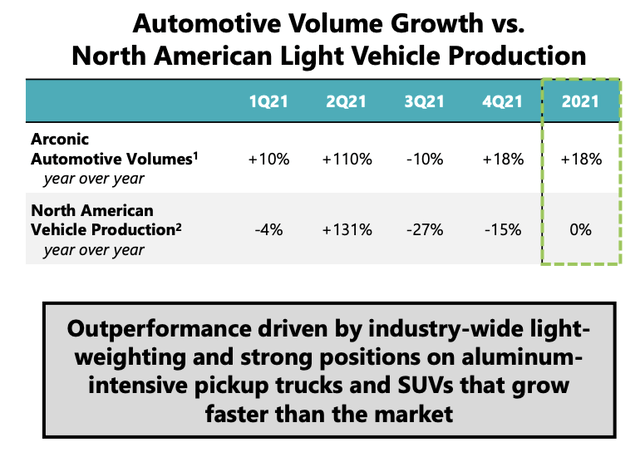

Yet, and this is the good news, although 2021 car production was flat versus the pandemic year of 2020, Arconic’s automotive volumes improved by 18%! This is due to the company’s exposure to aluminum-intensive pickup trucks and SUVs that outperform the market.

I also discussed this on Intelligence Quarterly last year when I covered the European automotive industry – which is a huge market due to German and French producers that dominate large segments. What companies like Mercedes & co are doing is moving semiconductor supplies to car models with higher margins. Volkswagen prioritized its Porsche and Lamborghini brands, Mercedes mainly focused on its AMG and SUV models, and in the US, the same is happening.

Arconic is a major supplier of trucks like the Toyota Tacoma, SUVs like the (expensive) Jeep Wagoneer, the highly successful Ford Bronco, as well as upcoming models like GMC’s Hummer EV Pickup.

I expect this segment to remain strong, which means ARNC will boost sales in this segment when the semiconductor shortage eases later this year (I expect this to happen in 3Q22/4Q22).

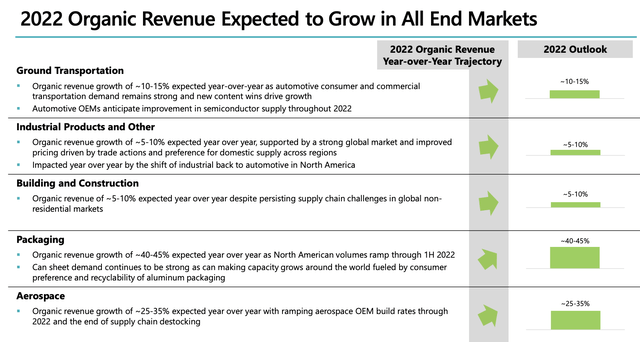

In 2022, expectations are that all segments will grow by at least 5% with up to 45% expected growth in packaging. This segment is benefiting from a sustainability trend that favors aluminum. All other segments are seeing easing supply chain problems and very high organic growth rates.

Aerospace is expected to benefit from higher OEM build rates, which means inventory replenishment.

Unfortunately, there are two problems.

2 Problems

Problem one is inflation.

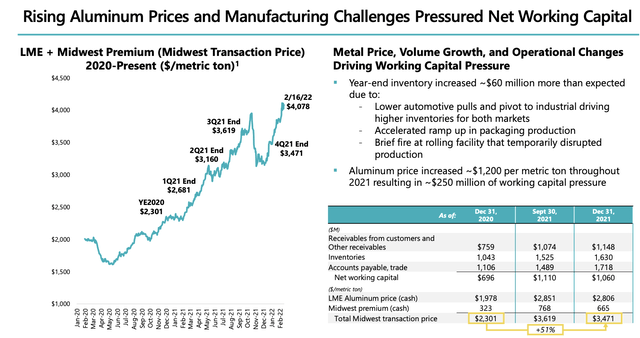

Because the company does not produce its own aluminum anymore, rising prices become a headwind. In 2020, aluminum bottomed in the low $1,600 range. It quickly accelerated as inventories were depleted and supply came back only slowly. As of February 16, aluminum was close to $4,100. In the case of ARNC, it resulted in 51% higher costs for aluminum between 4Q21 and 4Q20. It reduced working capital by $250 million.

This is what the company commented on rising inflation:

We are experiencing high inflation, which can no longer be offset by normal productivity initiatives. Savings net of inflation was a negative $35 million, as our $35 million in shop for productivity measures could not offset $71 million in inflation in the quarter, primarily from energy, transportation and alloying materials.

Our pricing initiatives are expected to offset this inflation but have a lagging effect. The unfavorable aluminum price impact of $15 million in the quarter is related to the impact of rising metal prices aluminum to the Building & Construction Systems segment, which was offset by pricing in the year.

Problem number two is related to problem number one: Russia.

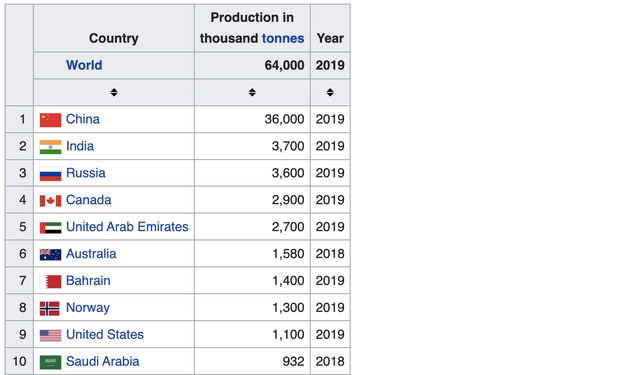

Shortly after the company presented its 4Q21 numbers, Russia invaded Ukraine. This was followed by significant sanctions and self-sanctions as companies pulled out of Russia, causing a significant recession. In 2019, the country produced 3.6 million tonnes of aluminum, which put it in the top 3. Close to India, but way below China’s volumes.

Wikipedia (British Geological Survey)

These volumes will have changed a bit since then and nobody knows exactly how long the war will take, or how severe sanctions will get. Yet, all of this is enough to push aluminum to new highs.

LME aluminum futures (London-based) are now trading at $3,400 as covered by Intelligence Quarterly. That’s more than 100% from its 2020 lows.

Intelligence Quarterly

In addition to that, the war hurt automotive supply chains. Ukraine is the main location of cable harness supplies and certain materials used in the semiconductor industry.

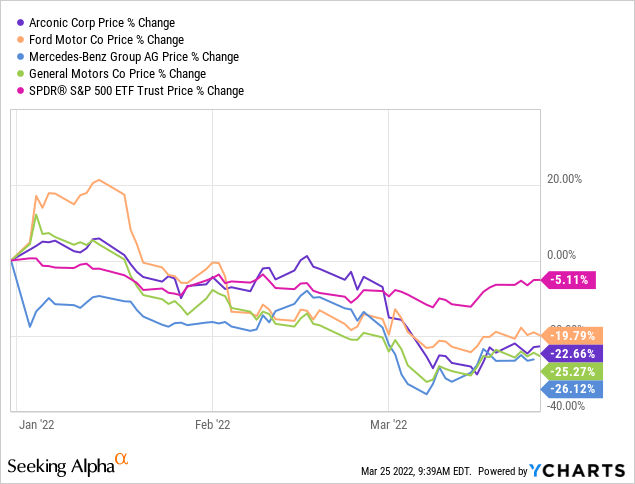

As a result, the entire automotive industry experienced a setback. In the graph below I’m comparing the year-to-date performance of ARNC to some of the “big guys” in the industry.

The good news is that the valuation has come down a lot, too.

Valuation

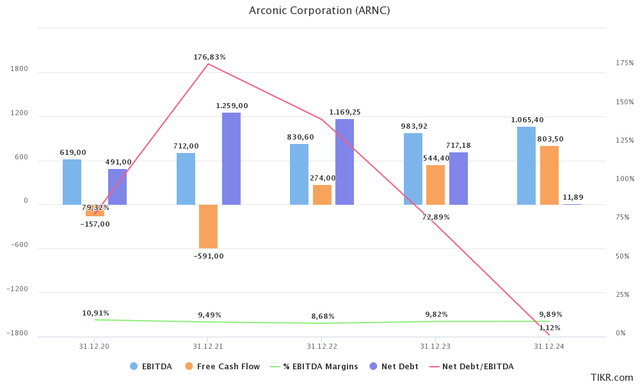

The chart below shows us why ARNC is such a strong company. First of all, despite inflation, EBITDA margins are expected to rebound gradually to the high 9% range in 2024. This is expected to boost EBITDA to $980 million in 2023 – up from $830 million in 2022E. Net debt ended 2021 at $1.3 billion, which is expected to come down to $720 million next year because of high free cash flow. Next year, free cash flow is expected to be $540 million, or 20% of the $2.7 billion market cap. The company does not pay a dividend, so money flows to debt reduction. In 2024, the company can push net debt to zero.

Using the aforementioned $2.7 billion market cap and $720 million in expected 2023 net debt, we get an enterprise value of $3.44 billion. The company also has $1.1 billion in pension-related liabilities, which I will add. This gives us a new enterprise value of $4.54 billion. Minority interest is neglectable, so I will keep it at $4.54 billion.

$4.54 billion is just 4.6x next year’s expected EBITDA. I’m pricing in quite a lot of growth here, but it’s justified, in my opinion.

The problem is that ARNC does not have a useful EV/EBITDA history and its peers have volatile and useful histories due to i.e., years with negative EBITDA.

Either way, 4.6x expected EBITDA is too cheap. This needs to be at least 7x, in my opinion.

In other words, I believe that ARNC can rise to $40-$45 over the next 12-24 months, which is roughly in line with JP Morgan’s price target of $40, which was released on December 10, 2021.

FINVIZ

Takeaway

Arconic is a fascinating company. I believe the spin-off was a smart decision as Arconic is now a well-diversified supplier of multiple industries. The company is a key supplier of automotive customers, aerospace producers, and related industrial players. It benefits from a fast-growing packaging industry as well as its exposure in large SUVs and pickups, which helped the company to avoid weakness in 2021.

Unfortunately, the war in Ukraine is adding a lot of uncertainty, which is hurting both Arconic and its customers.

Yet, the valuation has come down too much. While EBITDA expectations might come down due to the impact of supply chains and inflation on consumers, the move down has priced in a lot.

I believe that Arconic has the potential to add up to 80% over the next 12-24 months if the war does not escalate.

However, if you are buying this company, make sure to keep your position limited. I believe that long-term investments should have a lot of exposure. Shorter-term trades should be smaller. Especially when dealing with a lot of uncertainty.

(Dis)agree? Let me know in the comments!

Be the first to comment