vale_t/iStock Editorial via Getty Images

Supply chain disruptions are heavily cited in the media and in firms’ conference rooms. The pandemic has laid bare the challenges. The semiconductor industry, owing to the COVID-19 pandemic, is often a standout of the challenge. The Inflation Reduction Act is loaded with funding for relevant industries as well. But I’m looking at supply chain investment cases. They are extensive. The macro environment is chock full of opportunities, but you have to know where to look and what to look for. While many focus on inflation’s impact, a different type of macro theme exists.

To precede some of this analysis, commentary about the new legislation follows:

About the Act, General Motors (GM) CEO Mary Bara (who I heard give the Duke University graduation keynote in May) says: “This bill will help drive further investments in American manufacturing and sustainable, scalable, and secure supply chains.”

Bill Gates credits the policy with developing “a new era of American innovation.” Maybe. We’re already there. Much more on that later.

Signals

Most importantly, the legislation is a signal. The market has to sort out the business and financial case for long-term winners. This leads back to supply chains…

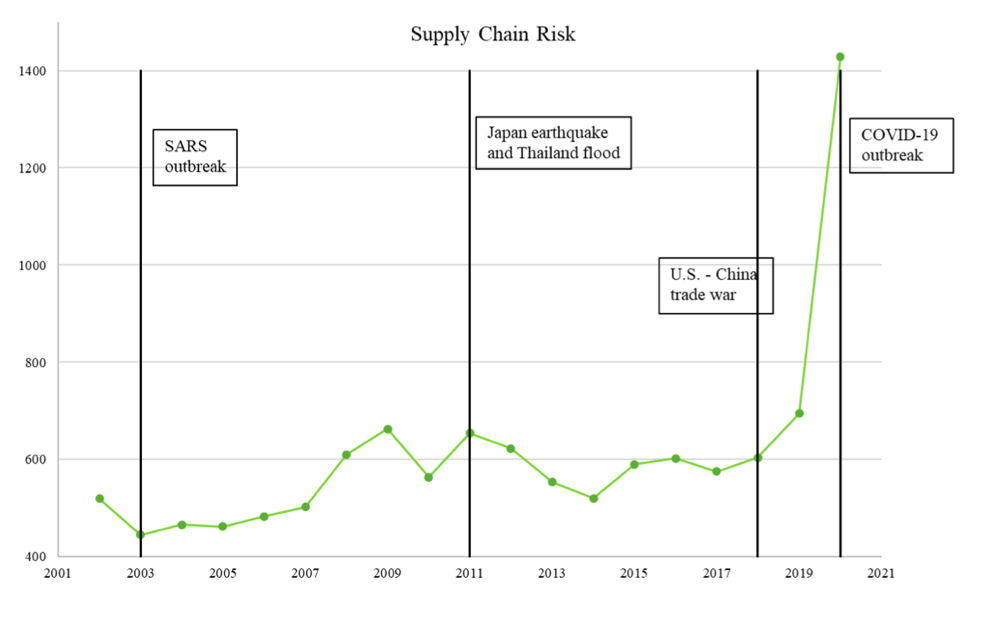

Supply chain research has often centered on shock transmission, and how events like the earthquake in Japan or Thai floods in 2011 affect firms’ supply chains. However, missing from the equation are insights into how firms are affected by supply chain risk—quantified at the firm level—and how they respond. The research by an SMU Cox Finance Professor Ruidi Huang and coauthors reveals novel insights into the nature of supply chain risk.

Huang and his co-authors analyze instances of supply chain mentions in earnings calls of publicly-traded firms’ transcripts, which speaks to “sentiment.” Secondly, they analyze risk and uncertainty associated with those supply chain mentions. A firm level measure reveals a lot of where the action is. For example, Apple (AAPL) has an extensive supply chain network globally.

Huang notes:

Apple has much more volatile supply chain issues compared to Microsoft (MSFT), with spikes in 2009 and 2018. Huang believes they correspond to issues in China in 2008 and issues with mineral mining in both years. When firms have lengthy discussions about supply chain, our measure tends to pick those up.

Further, he adds, “But Microsoft is not without supply chain issues. The graph looks flat (one he references I asked for). But that’s because Apple’s supply chain risk is much more volatile and changes the scale for the whole picture. Microsoft’s supply chain risk is almost three times as high in 2020 than in 2018.”

According to the analysis, supply chain risk appears to be heightened and sentiment becomes more negative in connection to events that are disruptive to global supply chains, such as the 2011 Great East Japan earthquake and the Thailand floods, the Sino-American trade war, and more recently with the COVID-19 outbreak.

Supply chain risk (Ruidi Huang and coauthors)

“Supply chain risk is not one sided,” the authors note. There are firms and periods with positive supply chain sentiment, with opportunities for outsourcing to reduce costs, and also of negative sentiment when concerns about bottlenecks and the reliability of the supply chain emerge.

According to the research, manufacturing industries are the most sensitive to supply chain risk. So are others. In particular, the pandemic revealed a “flight to quality.” When faced with supply chain risk, the research finds that firms seek out leaders in their industry. The trend toward reshoring is a byproduct of supply chain risk. Semiconductors follow that line of thinking and are represented by iShares Semiconductor (SOXX), VanEck Semiconductor (SMH), and Invesco PHLX Semiconductor (SOXQ). The larger story however is the drive toward supply chain resiliency. That is driving capital in macro and micro ways.

N.M. Arroyo (Jennifer Warren)

Thesis building

Now, how do you operationalize a supply chain thesis? There are many ways to skin this cat. Certain sectors are more relevant than others: High-tech, manufacturing, minerals, and machinery. We can drill into this by sector, for example, in “green” minerals, VanEck Green Metals (GMET) is a candidate. Or an individual firm such as MP Materials (MP) for rare earths fits a number of supply chain themes. SPDR S&P Metals and Mining ETF (XME) is relevant in a more macro thesis manner.

(See my YouTube interview with Huang for more detail.)

Jennifer Warren interviews Huang on supply chain risk (Jennifer Warren)

Huang and co-authors document how firms respond to supply chain risk. Their work helps explain why Tesla seeks to buy firms that contribute to their smoother operations strategically. News stories are numerous about Tesla (TSLA) and its battery plant opportunities with partners, which includes the lithium story.

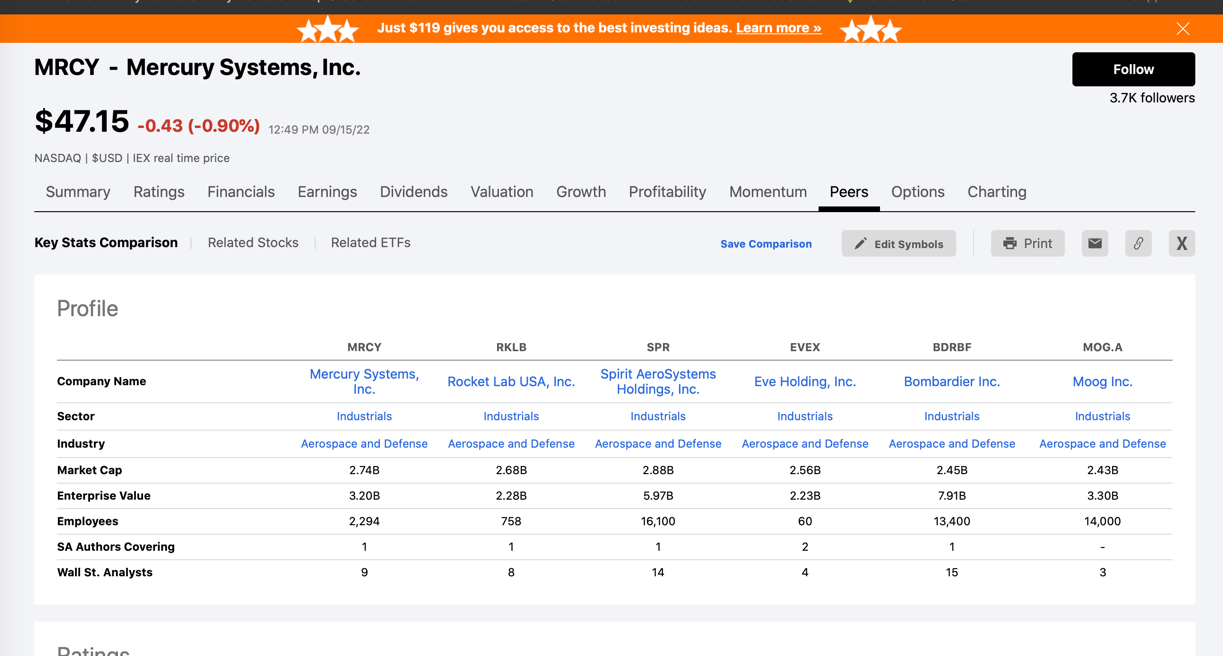

There are other stories to tell: The research mentions Mercury Systems (MRCY), focused on critical technology in the aerospace and defense industry, as an example of supply chain discussions their machine learning software picked up, specifically in April of 2020 with COVID’s ill effects.

Mercury Systems (Seeking Alpha)

Another firm mentioned in the research is Entegris, Inc. (ENTG) in critical minerals, also deeply enmeshed in supply chains. (I’m literally being a wayshower here, not analyzing specific stocks, or talking my book.)

To address supply chain risk, firms increase investment in the supply chain, which includes increased merger and acquisition (M&A) activities such as buying suppliers. They increase their number of suppliers, that is “multi-sourcing,” which also diversifies the chain. Heightened supply chain risk leads to the movement toward greater geographic proximity and aligning with industry leaders as well, a key point in the research.

The study considers M&A with firms in up and downstream industries. They find that an increase in supply chain risk leads to a higher probability of M&As; this probability of an M&A with a supplier or a customer increases by around 25% relative to the baseline merger probability of less than 1%, generally speaking. So, one could identify links in a supply chain for a larger firm that needs to vertically integrate. This is relevant obviously for small- and medium cap firms, with (VB), (VOE), (VOT) constituents in supply chain heavy-exposed industries as potential targets for industry leaders.

Additionally, supply chain risk and sentiment are driven by idiosyncratic risk—at the firm level. While Huang notes that macroeconomic shocks matter, the way firms discuss supply chain risk appears to be highly idiosyncratic. “Most of the variation in supply chain risk is explained by firm-specific shocks rather than time- or industry-specific shocks,” the researchers say in their paper.

The pandemic has created a whole tectonic shift in supply chain-related activity. This is going to take a long while to wash through.

Concept Elemental (Jennifer Warren)

Be the first to comment