Galeanu Mihai/iStock via Getty Images

In late 2018, Sunoco LP (NYSE:SUN) was offering a 12.1% distribution yield. At that point, I recommended purchasing the stock and stated that its distribution was safe. Since then, Sunoco LP has kept its distribution intact. Even better, the stock has rallied 44% and thus it has offered excessive total shareholder returns. Despite its rally, the stock is still offering an attractive 8.4% distribution yield. In this article, I will analyze why the generous distribution of Sunoco LP remains safe.

Business overview

Sunoco LP is a master limited partnership [MLP] that distributes various fuel products through its wholesale business units. It purchases oil products from refiners and sells those products to both its own and independent dealers.

Sunoco LP is the largest independent distributor of fuel products in the U.S., with approximately 7,300 dealer, distributor and commission agent customers. It is also among the top distributors of Exxon Mobil (XOM), Chevron (CVX) and Valero (VLO) branded motor fuel. During the last 12 months, Sunoco LP has distributed approximately 7.5 billion gallons of fuel products. Thanks to the excessive volumes it transports through its immense network, Sunoco LP enjoys great economies of scale and has a strong negotiating position with its suppliers. This is paramount in this business, in which the weak players operate with razor-thin margins.

Moreover, Sunoco LP does not rest on its laurels. It greatly expanded its midstream asset portfolio in 2020-2021, with the acquisition of 10 terminals and storage capacity of 15 million barrels of products. These assets are strategically located within the distribution network of the MLP and thus generate significant synergies. In addition, management should be praised for the timing of these acquisitions, which materialized during one of the fiercest downturns in the history of the energy market.

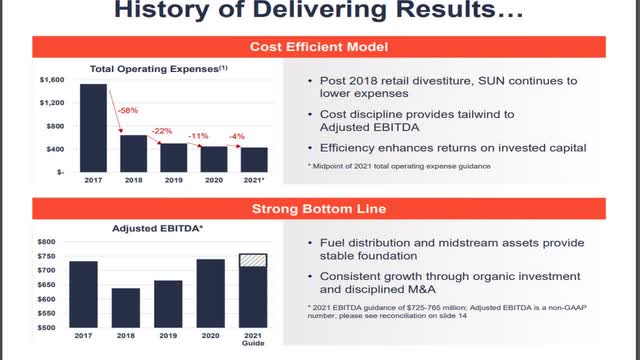

Furthermore, Sunoco LP has drastically reduced its operating expenses during the last five years.

Sunoco LP operating costs (Investor Presentation)

Thanks to its cost-cutting initiatives, the MLP has enhanced its efficiency and its resilience during downturns.

Distribution

Sunoco LP has never cut its distribution throughout its 10-year history. Moreover, the stock is currently offering an 8.4% distribution yield, one of the highest yields in the energy sector. Such a high yield usually signals that a distribution cut is just around the corner. It is also worth noting that the MLP has frozen its distribution for six consecutive years, thus signaling that it is somewhat struggling to maintain its generous payout. Nevertheless, the distribution has a wide margin of safety.

The first reason behind the high yield of Sunoco LP is its material debt load. The company has net debt (as per Buffett, net debt = total liabilities – cash – receivables) of $4.8 billion. This amount is 137% of the current market capitalization of the stock and hence it raises some concerns. However, this amount is only 9 times the annual distributable cash flow of the company while interest expense consumes only 20% of operating income. As a result, Sunoco LP can keep servicing its debt without any problem.

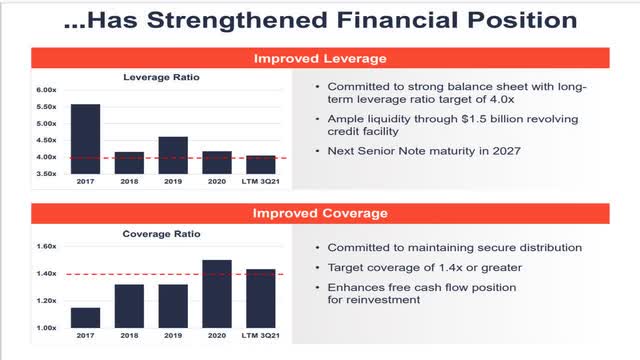

Moreover, the company has taken steps to strengthen its balance sheet in recent years. More precisely, it has reduced its leverage ratio (Net Debt to EBITDA) from 5.5 in 2017 to 4.0, which has become the new long-term target of management.

Sunoco LP debt (Investor Presentation)

Furthermore, Sunoco LP has set a goal of distribution coverage ratio of at least 1.4, which it has already achieved. Therefore, the distribution of Sunoco LP has a wide margin of safety.

It is also important to note that Sunoco LP has an exceptionally resilient business model and hence it can easily endure downturns in its business. To be sure, during the coronavirus crisis, in which the consumption of fuel products temporarily collapsed in 2020, Sunoco LP continued growing its distributable cash flow and maintained its distribution. When the prices of oil products collapse, Sunoco LP reduces its prices but it keeps its profit margins essentially intact, between 10.5 and 11.5 cents per gallon. It thus exhibits resilient performance even during the severe downturns of the energy sector that occur every few years.

Apart from the material debt load of Sunoco LP, the other major reason behind its extraordinary distribution yield is the rally of fuel prices to 13-year highs this year. This rally has resulted primarily from the sanctions of western countries on Russia for its invasion in Ukraine. As Russia produces about 10% of global oil output, the sanctions have greatly tightened the global oil market. Consequently, the prices of crude oil and refined products have rallied to 13-year highs this year. The extreme prices of fuel products are likely to take their toll on the consumption of these products at some point. Such a development will be negative for the business of Sunoco LP and hence the stock has incurred a 6% correction this year and thus its yield has somewhat increased.

However, it is critical to realize that the consumption of fuel products is highly inelastic. In other words, a great increase in prices causes just a minor decrease in the consumption of these products. Moreover, it is unreasonable to expect the prices of fuel products to remain around 13-year highs for years. Either the sanctions will loosen in the upcoming years or the world will adjust to the new norm by investing excessive amounts on renewable energy sources. To cut a long story short, the consumption of fuel products is likely to return to its long-term growth trajectory in the upcoming years.

Risk

A secular headwind for Sunoco LP is the shift of the world from fossil fuels to renewable energy sources. However, as the ongoing energy crisis has shown, this transition will take much longer than initially expected. Despite the excessive investments in renewable energy projects in recent years, global demand for oil products keeps growing and thus it has led the prices of oil and its products to skyrocket this year. Overall, the transition from fossil fuels to clean energy sources seems to be only a very long-term threat for Sunoco. Until this transition materializes, the consumption of fuel products in the U.S. is likely to remain in its long-term growth trajectory.

Final thoughts

When a stock offers an abnormally high yield, it usually signals an imminent distribution cut. However, this is not the case for Sunoco LP. The MLP has never cut its distribution and is currently offering an 8.4% yield. As Sunoco LP has a resilient business model in place, it has strengthened its balance sheet and has improved its distribution coverage ratio in recent years, its distribution has a wide margin of safety. Therefore, investors should lock in the exceptional yield of the stock before it is too late.

Be the first to comment