Pogonici/iStock via Getty Images

The investment landscape is rapidly changing, and keeping up pace with what is happening in the global economy is imperative to find stocks that could help us deliver alpha returns in the long run. The S&P 500 index is down 7% in 2022 so far, so it would be fair to say that we are off to a tough start this new year. The energy sector has outperformed the broad market by a wide margin this year, returning 12.58%, whereas the financial services sector has lost 2.25% in value, which itself is a good performance in comparison to the market. In what I believe would be a challenging year for investors, the financial services sector has a lot to offer. While the focus of investors – especially income investors – might be fixed on large American banks, I believe there are good opportunities in Canadian financial services stocks although these stocks often remain under the radar. Just last month, we added a leading Canadian bank stock to our model dividend portfolio at Leads From Gurus on the back of the improving macroeconomic conditions for the global financial services sector. Today, I will discuss the prospects for Sun Life Financial Inc. (SLF), another Canadian financial sector company that I believe is poised to deliver handsome returns to income investors in 2022 and beyond.

A brief introduction to Sun Life

Sun Life Financial Inc. is a financial services company based in Canada that offers a variety of insurance, wealth, and asset management products. The company operates through five segments: Canada, the U.S., Asset Management, Asia, and Corporate. Individual insurance and asset management, as well as group benefits and retirement services, are provided through the Canada and U.S. segments. MFS (an asset management firm) and SLC Management (institutional investment management) are part of the Asset Management division, and these companies provide investment products. The Asia segment, which includes business in the Philippines, Hong Kong, Indonesia, Vietnam, Malaysia, India, and China, offers life, health, wealth, and asset management solutions through two business units: Local Markets and International Hubs. The Corporate division includes run-off reinsurance operations and business in the United Kingdom.

Interest rates do matter

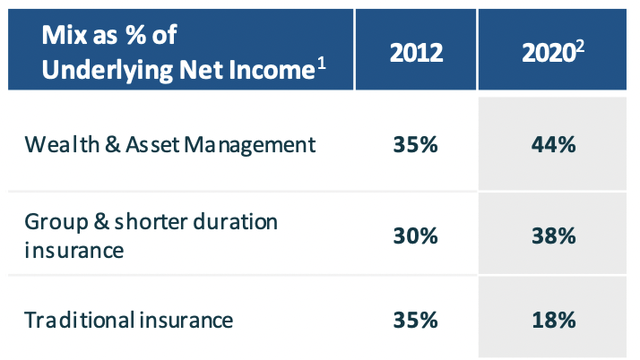

Sun Life has done a commendable job in diversifying its business in the last decade. The asset management business has grown to become the most important driver of earnings, and in the third quarter of 2021, this segment accounted for close to 30% of net income. In 2020, the wealth and asset management business accounted for 44% of underlying net income, a noteworthy increase from just 35% in 2012.

Exhibit: Net income by product type

The trend from a diversification perspective is positive, but Sun Life still cannot escape the implications of interest rate fluctuations. In general, insurers tend to do well during periods of interest rate hikes.

Many economic factors influence investment decisions, and one factor that is worrying many investors is the rise in interest rates. Interest rates are extremely important in the banking and insurance industries as most financial services companies and insurers invest their earnings in various income-generating securities to generate profits, as well as in stocks to generate capital gains for their policyholders. Interest rate fluctuations have a substantial impact on the profitability of these businesses as a result. The Federal Reserve slashed interest rates to offset the effects of slower economic growth at the onset of the pandemic, causing a decline in 10-year U.S. treasury yields. With the recovery of the economy, the Fed is planning to hike interest rates in 2022, and treasury yields are finally starting to rise. This makes it important for investors to assess the quality of their portfolios to weather any negative impact resulting from rate hikes, and the best course of action would be to gain some exposure to business sectors that are bound to do well in a rising rate environment.

Interest rate hikes and the performance of insurance companies

The interest rate risk is one of the key factors that should be monitored by investors who are keen on finding opportunities in the insurance sector. Now that the world is preparing for interest rate hikes, it makes sense to understand how insurance companies have fared in the past during rate hikes. Insurance companies generally benefit from interest rate hikes because they typically reinvest policyholder premiums in bonds, and higher rates allow them to invest the funds in higher-yielding securities. Insurance companies invest in fixed-income instruments that pay interest – mostly bonds – and a low-interest-rate environment becomes a major threat to profitability due to a contraction in margins.

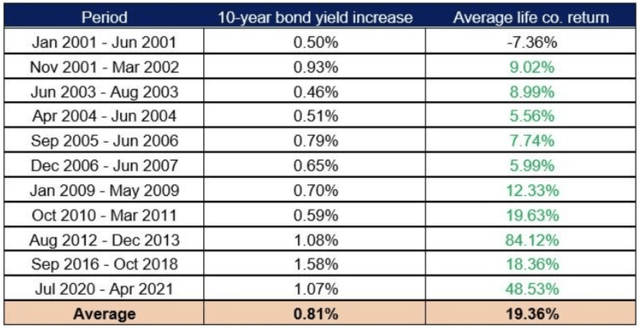

According to data compiled by CI Global Asset Management, in the last two decades, an increase in the 10-year bond yield has almost always boosted the Canadian insurance sector.

Exhibit 2: Performance of Canadian life insurance companies in rising yield environments

Going by empirical evidence, it would be fair to assume that Sun Life is entering a phase of the business cycle where insurance companies are bound to perform well.

Asia brings new opportunities and risks

Sun Life’s Asia business has become an important part of the company over the last few years, and Asia is likely to provide growth opportunities for the company’s insurance business in comparison to mature markets such as the United States and Canada. That being said, the Asian insurance market is highly competitive, which might force Sun Life to underprice policies, which in return will hurt the profitability of the company. The growing importance of the Asia business segment might lead to earnings volatility in the future as well because of the business dynamics in this region. The wealth management business in Asia is very likely to turn volatile numbers due to market fluctuations.

Sun Life has so far done a tremendous job in winning new business in Asia while keeping earnings volatility in check, but I am keeping a close eye on new developments that might impact the company’s dividend policy.

The dividend is what catches the eye

As often highlighted by the company management, Sun Life targets to allocate 40-50% of its underlying earnings for dividend distributions. Last November, The Office of the Superintendent of Financial Institutions lifted the ban on dividends imposed on financial sector companies, and this has created a platform for Sun Life to resume dividend increases once again. Sun Life stock yields a handsome 3% today, and the improving macroeconomic environment for the insurance sector suggests the company is on track to reward investors handsomely this year via dividend hikes.

Takeaway

Diversification is key when it comes to building a stock portfolio, and I believe many income investors will benefit from getting some exposure to the Canadian financial services sector this year. Sun Life Financial stands out as a good dividend pick with a strong track record of shareholder distributions, and the company is headed in the right direction to report slow and steady growth in earnings.

Be the first to comment