Art Wager/E+ via Getty Images

Enterprise Products Partners L.P. (NYSE:EPD) is a rare gem for income investors. Rarely can one find the combination of world-class assets run by a management team that excels at operations and capital allocation.

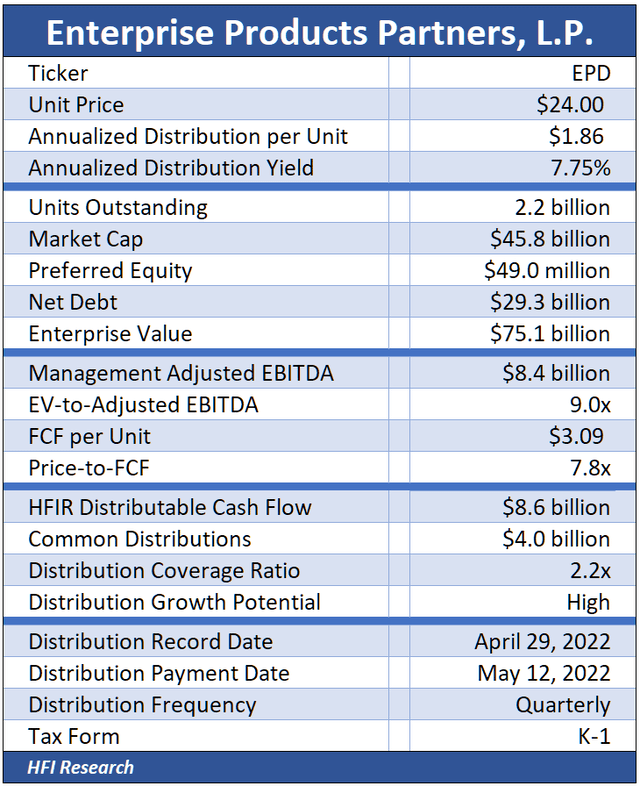

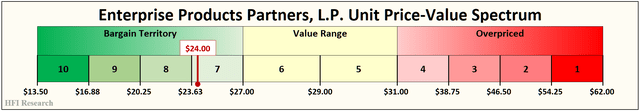

At the current unit price of $24.00, EPD units trade in bargain territory. With our price target more than 20% above the current unit price, EPD’s safe distribution yield, and the high likelihood that distributions will increase over the coming years, we rate the units a Buy.

EPD’s Assets

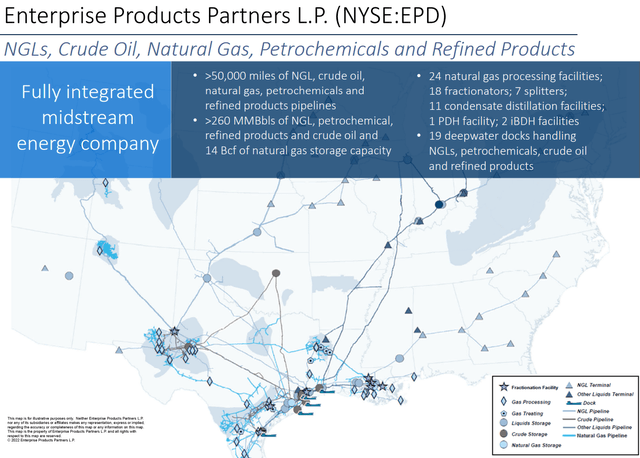

EPD’s assets are diversified yet integrated. First, geographically, as shown in the map below:

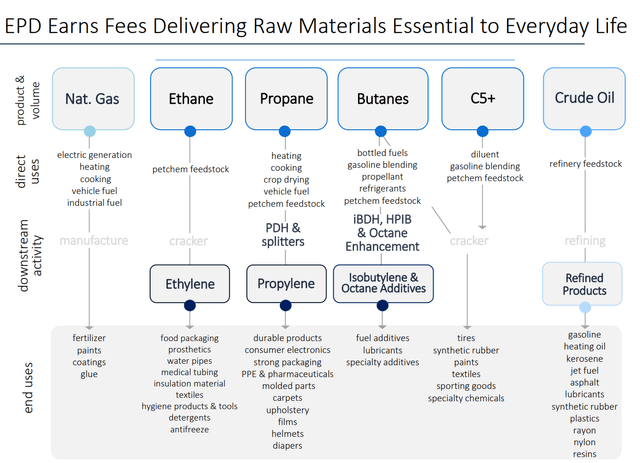

And second, throughout the midstream value chain:

While all EPD’s operations are subject to general economic cycles, timing differences between individual product cycles ultimately translate into more stable cash flows than its less-diversified peers.

Roughly half of EPD’s capital spending in recent years has focused on its upstream business. Its upstream investments, such as its recent $3.25 billion acquisition of Navistar Midstream Partners, are a low-cost means of increasing throughput volumes in its integrated midstream system.

The other half of EPD’s capital expenditures in recent years have gone toward building out its petrochemicals business. These are multi-decade investments such as EPD’s expansion of its ethylene and ethane export capacity and its planned $5 billion steam cracker project. Petrochemical cash flows tend to be less volatile than upstream oil and gas cash flows. They therefore garner a premium valuation relative to upstream-oriented midstream activities. Aside from cash flow stability, EPD’s increasing concentration in petrochemicals could benefit unitholders over time through a higher trading multiple.

EPD’s Operations

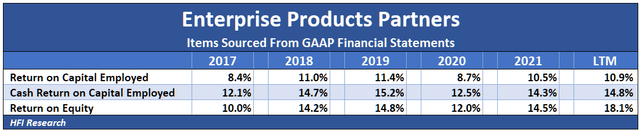

EPD has a proven track record for earning stable and attractive rates of return on capital. Since 2017, its return on capital employed has ranged from the mid-8% to the high-10% range. Its return on equity from 2017 through 2021 averaged 13.1%.

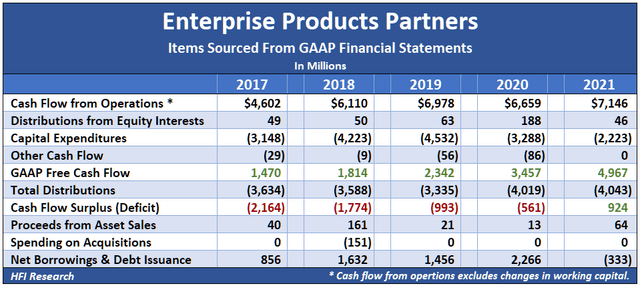

EPD’s large growth capex has consumed most of its cash flow. As a result, EPD has routinely operated at a cash flow deficit. The assets EPD has created through its capital spending have been counterbalanced by increases in debt.

An exception was in 2021, when relatively lower capex resulted in a cash flow surplus, part of which was used to pay down debt.

In many cases, the presence of a sustained cash flow deficit that is plugged by issuing debt would be a cause for concern. In EPD’s case, however, low-cost debt is used to fund low-risk and high-return projects, so we are not concerned by the company’s cash flow deficit.

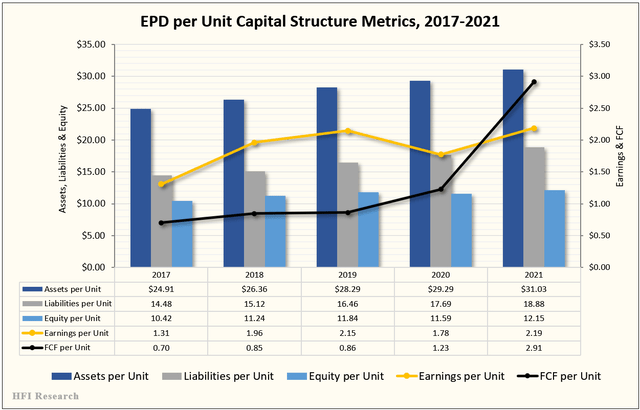

EPD’s results on a per-unit basis have shown a similar consistency as its companywide results over recent years.

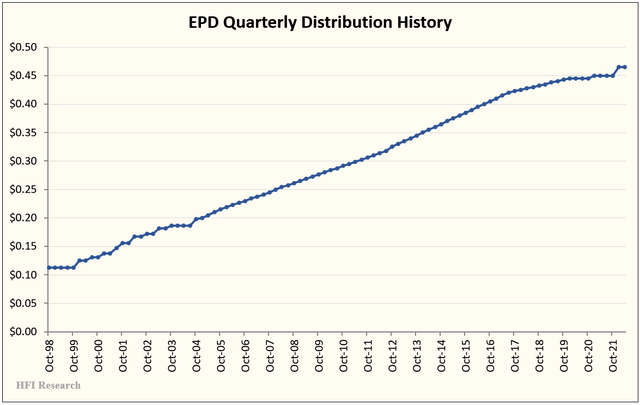

EPD’s high-quality assets and robust and growing cash flow have resulted in regular distribution increases since it came public in July 1998. The company paused the increases in 2020 but resumed them in the fourth quarter of 2021.

We expect distribution hikes to continue as the company reaps the benefits of recent years’ capital investments.

EPD’s Liabilities and Risks

EPD has been prudent in managing debt maturities, regularly refinancing near-term maturities at attractive rates. Most of its debt comes due in five years and beyond.

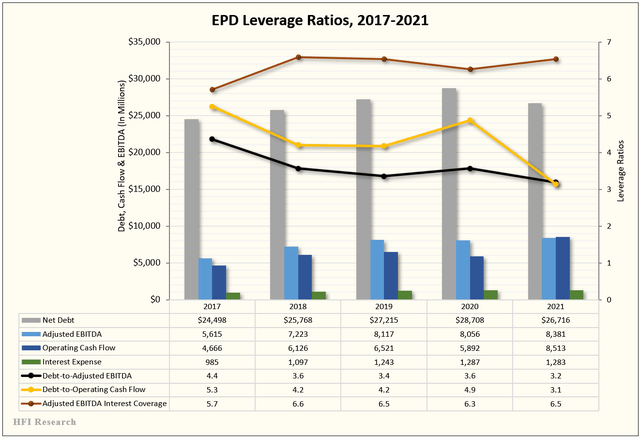

EPD’s leverage has remained reasonable over the past few years. Its leverage ratio stood at 3.4-times at the end of the first quarter. Leverage ratio trends are shown in the chart below. Note that EPD’s year-end 2021 net debt level was flattered by a large holding of cash that it used to fund its Navitas acquisition.

Liquidity at the end of the first quarter was more than ample at $3.9 billion.

While financial risk is minimal, EPD also has among the lowest operational risk in midstream, partly owing to its diversification and partly to the high quality of its management and operations. As of year-end 2021, management and members of the board of directors owned 32.6% of EPD units outstanding. The heavy alignment of interests between EPD’s management and board and its public unitholders gives us confidence that risks will remain low. The lack of a material conflict of interest between management and public unitholders helps ensure that management allocates capital for the benefit of all unitholders on an equal basis.

The flip side of EPD’s heavy insider ownership is that it is less influenced by its public unitholders and industry peers. In fact, the knock against EPD in the market is that its management has a tin ear to its public unitholders’ preferences. For instance, it has largely resisted the call for stepped-up unit repurchases. Since 2020, EPD has only repurchased $400 million of units, an insignificant sum relative to its $51.5 billion market cap. EPD also bucked the industrywide trend of reining in growth capex after the 2020 downturn. Insofar as these outcomes are disadvantageous for EPD unitholders, in our view they’re a small price to pay for management that boasts one of the best long-term track records in the industry.

Valuation

We value EPD at between $27.00 and $31.00. Our price target is the middle of the range, or $29.00.

Our valuations use average midstream multiples. EPD may deserve a higher multiple due to its high quality and its shift toward petrochemicals, so there is upside to our valuation.

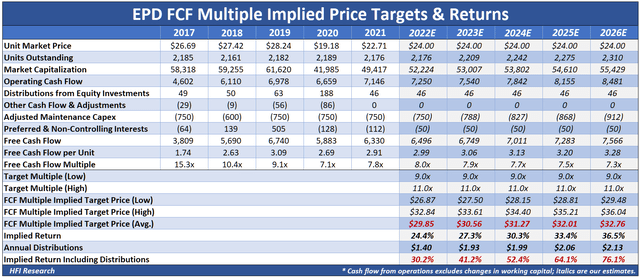

In our valuations, we assume EPD pays down $250 million of debt in 2022 and 2023 and that it does not repurchase any units. Free cash flow and Adjusted EBITDA increase by 4.0% each year, while distributions increase by 3.5% annually.

From a cash flow multiple perspective, we value EPD units at $29.85 in 2022. Including distributions, the units offer a total return of 30.2%. The total return increases to 76.1% by 2026, primarily due to distributions.

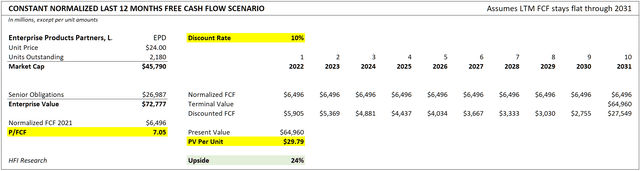

Our discounted cash flow valuation generates a similar result. It assumes our estimate of EPD’s 2022 free cash flow stays flat for the next ten years and values the units at $29.79, representing 24% upside from today’s price.

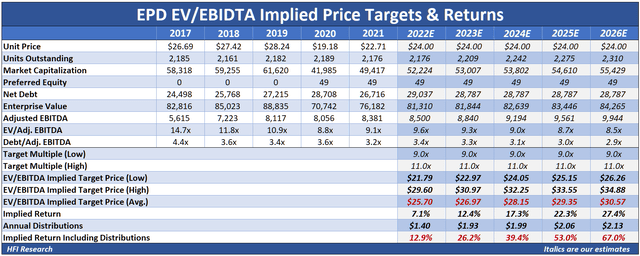

The lower end of our EPD intrinsic value range is informed by our EV/EBITDA valuation. By this method, the units are valued at $25.70 in 2022. Including distributions, the 2022 implied total return is 12.9%, increasing to 67.0% by year-end 2026.

Conclusion

EPD unitholders can rest assured that the company can weather any storm that comes its way, whether it arises from turbulent energy markets or an economic downturn. Companywide cash flow will hold up under even the most adverse conditions. For instance, its cash flow didn’t skip a beat during the violent 2020 downturn.

Unitholders buying EPD today can go a step further and secure a 20% margin of safety between EPD’s current trading price and our price target. Add in EPD’s 7.75% yield, and we’re hard-pressed to find a better total package for income investors. We rate EPD units a Buy and believe they should be an integral part of every income portfolio.

Be the first to comment