Sundry Photography

The tone of the markets is incredibly chilly. But while many investors are indiscriminately selling off their portfolios and rushing for safety, I still think there’s a case to be had for a potential year-end market rally – and even if not a full-blown rally, there’s still a strong reason to maintain a healthy exposure to equities. Stock-picking is of utmost importance here, however; and in particular the stocks that I think are “safest” to shelter in the growth space are those that are still trading at deep value.

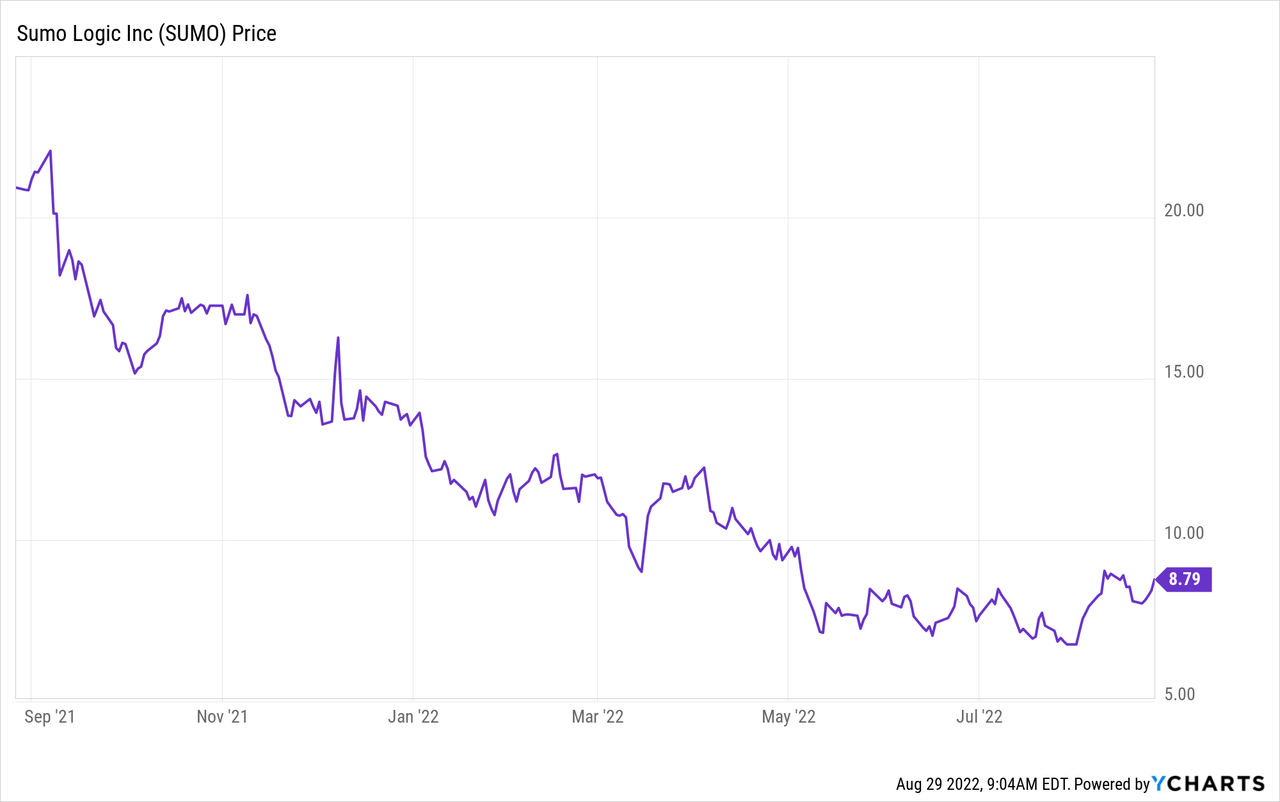

Sumo Logic (NASDAQ:SUMO), in my view, is an excellent pick here. The machine data company has seen a painful ~40% correction year to date, and is also trading at just a fraction of its post-IPO highs near $40. Recently, however, a strong Q2 earnings print and an upbeat outlook for the remainder of the year could forebode the beginnings of a rebound rally. We’re looking for stocks that are going to behave in an uncorrelated manner with the rest of the market – and Sumo Logic, with its market cap of barely over $1 billion and past year of highly volatile trading, fits the bill perfectly.

I remain very bullish on Sumo Logic. I continue to view this stock as a former growth champion that Wall Street discarded for a number of reasons (decelerating growth, relatively higher losses, and frankly, more exciting/flashier new IPO entrants), but whose valuation and business fundamentals are severely disconnected.

Sumo Logic, for investors who are unfamiliar with the name, is a machine data platform. Its software helps businesses harvest data that is being generated by their already existing internal systems, capturing this data to be used for both business analytics and security purposes. This type of technology is truly “horizontal” software that is applicable to clients in any industry, and has a myriad of use cases.

Here is my complete bull case for Sumo Logic:

- Big data has limitless use cases across industries and functions- Think about it in these terms: Sumo Logic is not a product but a platform. It’s a tool by which you can do many things. As more and more companies attempt to harness the value of big data, use cases will explode – and though Sumo Logic is in a competitive space with high-profile competitors, this is a large enough market for multiple key players. Sumo Logic estimates its TAM at a hefty $55 billion, indicating that it’s currently only about ~0.5% penetrated into this overall market.

- Recharged sales leadership- Sumo Logic knows that its growth in 2021 was disappointing to the markets and that it needed a go-to-market overhaul. The fact that the company just brought on a new President to lead its field teams may produce new ideas and new results in 2022 and beyond.

- Consistency is better than boom and bust- Sumo Logic is far from the most exciting software company these days. There are competitors like Datadog (DDOG) growing much faster (but also, priced much higher). But Sumo Logic has also gotten into a nice cadence of producing ~20% y/y revenue growth, which is on the cusp of what investors would consider to be a growth stock.

- Substantial cash war chest- For a company of Sumo Logic’s relatively small revenue size, the fact that the company has ~$350 million of cash, unencumbered of debt, on its balance sheet is a promising sign that the company can continue to invest in further growth.

- Cheap enough to invite M&A chatter- While I’m of the opinion that we should never bank an investment thesis on the hopes of M&A alone, I think Sumo Logic is exactly the type of declining software company that invites potential buyers’ attention as a small, tuck-in acquisition.

Last but not least, valuation is the main appeal to investing in Sumo Logic. At current share prices near $9, Sumo Logic trades at a market cap of just $1.02 billion. After netting off the $350.6 million of cash on the company’s most recent balance sheet, Sumo Logic’s resulting enterprise value is $667 million.

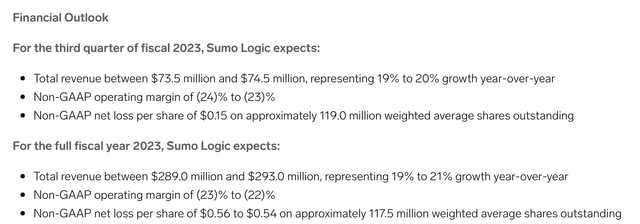

For the current fiscal year, meanwhile, Sumo Logic has guided to revenue of $289-$293 million, representing 19-21% y/y growth. Note that this is a slight boost over a prior outlook of $289-$292 million.

Sumo Logic outlook (Sumo Logic Q2 earnings release)

Now, you might think that a $1 million add to the high end of the guidance range isn’t meaningful – but in a quarter where many peer SaaS companies have instead slashed their outlooks, Sumo Logic’s confidence is actually a big distinguisher.

Against the new higher midpoint of Sumo Logic’s guidance range, the stock trades at just 2.3x EV/FY23 revenue – which sits below many peer software companies in the mid-20s growth bucket that are trading at mid-single digit multiples of revenue.

To me, Sumo Logic remains deeply undervalued due purely to under-recognition. Q2 was a good start to the recovery rally. Sit tight here, bide your time, and keep holding Sumo Logic through its eventual rebound.

Q2 download

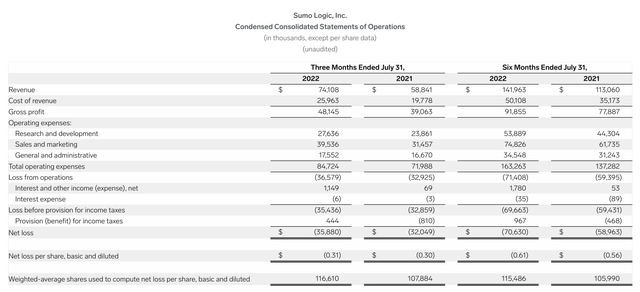

Let’s now go through Sumo Logic’s latest Q2 results in greater detail. The Q2 earnings summary is shown below:

Sumo Logic Q2 results (Sumo Logic Q2 earnings release)

Sumo Logic grew its revenue at a 26% y/y pace to $74.1 million, beating Wall Street’s expectations of $71.5 million (+22% y/y) by a respectable four-point margin. Again, this is a big distinguisher for Sumo Logic this quarter, in which many software companies have failed to meet consensus targets or even their own guidance numbers due to macro-related pressures and sales cycle elongation. We note as well that Sumo Logic achieved a slight one-point acceleration in growth over Q1’s 25% y/y growth rate.

Sumo Logic also grew its ARR at 25% y/y to $286.2 million. We note that Sumo Logic’s ARR covers almost the entirety of its annual revenue guidance, underscoring the fact that this business sits on a highly stable, high-margin revenue base. It also achieved a dollar-based net retention rate of 115% (indicating an average upsell of 15% for existing customers), in line with the prior quarter.

A big part of the company’s success has been a complete overhaul in the company’s sales department. Here’s some helpful commentary on this transition taken from CEO Ramin Sayar’s prepared remarks on the Q2 earnings call:

Now, I’d like to quickly give an update on where we are on our go-to-market team. Lynne Doherty, our President-Worldwide Field Operations has now been on-board for three quarters. Lynne has reshaped much of her leadership team recruiting leaders that understand the rigor and discipline requires a scale of global sales organization. She implemented the realignment of our sales teams into expansion and pursuit teams at the beginning of this fiscal year to drive more focus and continues to drive the changes needed to enable future scale and growth. Overall, we are pleased with the progress so far while recognizing that change management takes time and that not all theaters or segments will progress at the same pace.

In summary, while the broader challenges in the macroeconomic environment create a higher level of uncertainty we believe the need to deliver reliable and secure digital experiences for mission critical applications will continue to be a top priority for our customers and the broader market.”

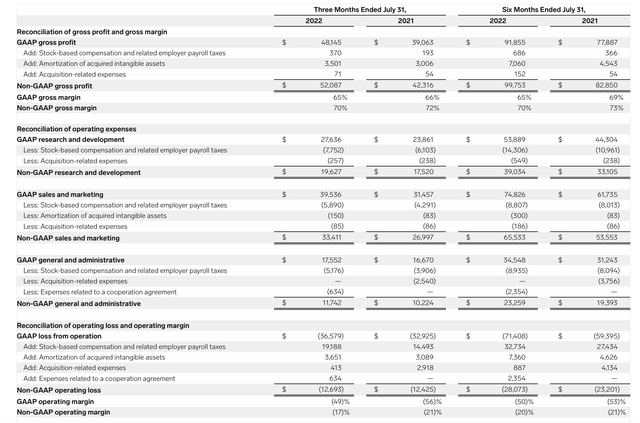

We note that Sumo Logic also continues to grow and scale profitably at the same time. As shown in the chart below, pro forma operating margins improved by four points in the quarter to -17%, up from -21% in the year-ago Q2:

Sumo Logic Q2 margins (Sumo Logic Q2 earnings release)

This boost was driven primarily by opex rationalization (in particular, G&A costs rose only 15% y/y to support a 26% y/y growth quarter), which helped to more than offset the two-point reduction in pro forma gross margins to 70%. Sumo Logic’s CFO noted that the company has trimmed its original hiring plans and continues to look for further cost reduction opportunities in the back half of FY23.

Key takeaways

Consistent growth and execution against a tough macro backdrop, operating margin progress, a market-leading product in a huge >$50 billion market, and a cheap valuation: there are plenty of reasons to remain long on Sumo Logic. Wait patiently on the rebound here.

Be the first to comment