Rob Atherton/iStock Editorial via Getty Images

Introduction

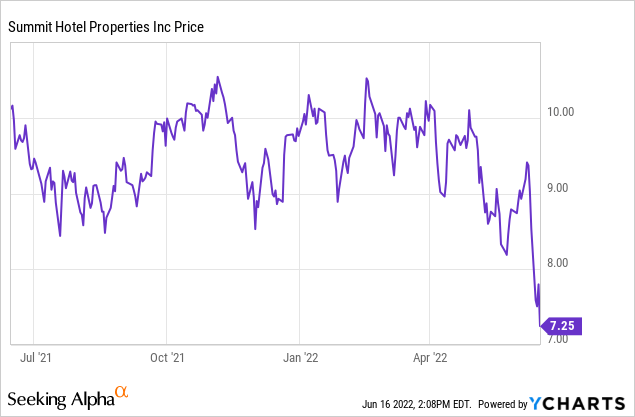

The increasing interest rates create opportunities in fixed income securities. Bonds are (finally) getting attractive again, but my recent focus has been on the preferred shares. The preferred shares with a fixed preferred dividend yield have been feeling the pain of the sudden reversal of the ZIRP and are trading substantially below the issue prices and call prices. This means that most of my preferred share investments are showing a capital loss at this point, but I don’t really mind. I’m planning to live for a few more decades, and fortunately, I’m in a position I can continue to move cash into my investment portfolio so as preferred share prices fall, I can add more (of course, on the condition the investment thesis and case has not deteriorated).

I have recently been buying more preferred shares of Summit Hotel Properties (NYSE:INN) as I like the risk/reward ratio offered by these securities.

The Positive Trend Continues In Q1

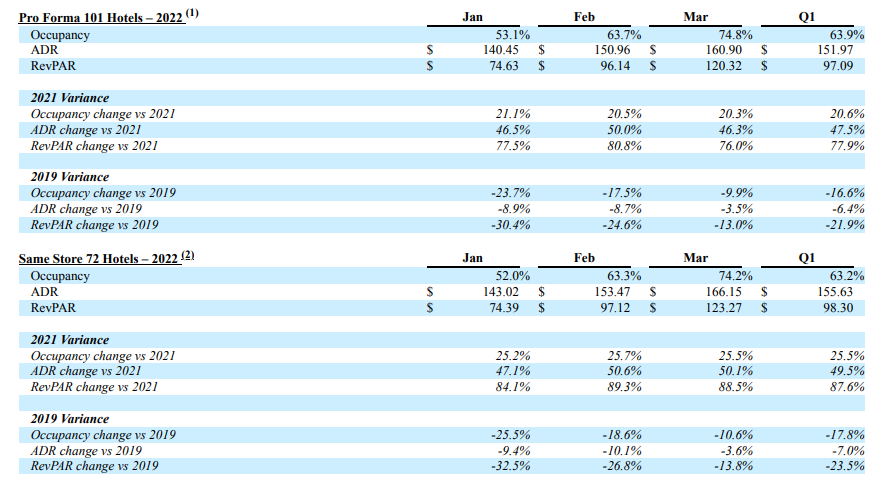

Summit Hotel Properties is a REIT, which means we shouldn’t care too much about the net income, but about the FFO and AFFO. But before getting into that, it’s important to understand where the REIT currently stands at. As you can see on the image below, the occupancy ratio was increasing throughout the quarter and Summit reached an occupancy of almost 75% while it was also able to increase prices. Whereas the occupancy ratio was just 53.1% and the ADR was just over $140/night in January, Summit’s ADR increased to almost $161/night in March, resulting in a Revenue Per Available Room of just over $120/night in March.

INN Investor Relations

While we aren’t back at the 2019 (pre-COVID) levels yet, it’s clear Summit’s performance is definitely improving, and that’s great news for its shareholders. The REIT also closed the acquisition of a 27 hotel portfolio for a total of just under $777M and Q2 2022 will be the first full quarter these acquisitions will contribute to the financial results.

Additionally, Summit exercised its option to acquire a 90% interest in a new hotel in Miami for $89M. The $38M equity component will be funded by a mezzanine loan and cash on hand.

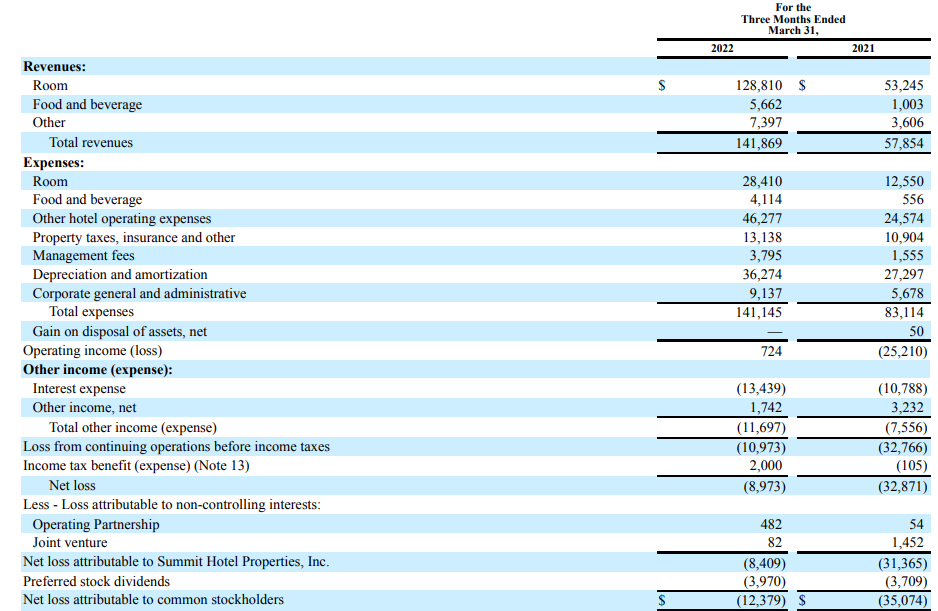

Although the net income is irrelevant for a REIT, I think it makes sense to just have a quick look as the reported net income actually provides the starting point for the FFO calculation.

We see the total revenue increased to almost $142M under the impulse of a very strong room revenue. And the gross margins on the rooms-only is excellent, as the difference between room revenue and room-related expenses was approximately $100M.

INN Investor Relations

The operating income was barely positive, and the pre-tax income was negative after taking the interest expenses into account. However, seeing a pre-tax loss of $11M isn’t bad at all considering the (non-cash) depreciation and amortization expenses exceeded $36M. Summit’s net income was slightly boosted thanks to a non-recurring tax benefit and after taking the almost $4M in preferred dividend payments into account, the net loss attributable to the common shareholders was $12.4M for a negative EPS of $0.12.

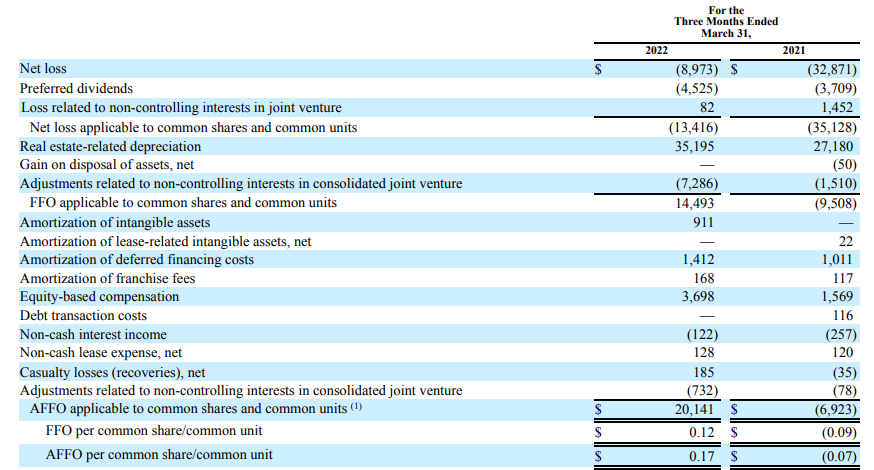

There’s no need to be alarmed. The image below shows the adjustments applied to the net loss, and the depreciation expenses obviously play a major role here. This means that although the REIT was clearly loss-making, its FFO was a positive $14.5M.

INN Investor Relations

And thanks to some other non-cash elements, the Adjusted FFO was even higher at $20.1M for an AFFO/share of $0.17. And keep in mind this includes the preferred dividend payments.

I Have A Long Position In Both Preferred Shares

This means that Summit Hotel Properties is currently very handsomely covering the preferred dividend requirements. If I’d use the $4.5M in preferred dividends mentioned in the FFO calculation, the pre-dividend AFFO came in at $24.5M, of which around $4.5M was needed for the preferred dividends. This means the preferred dividend payments have a coverage ratio north of 500% based on the Q1 results, and keep in mind the performance of the hotel portfolio was improving throughout the quarter.

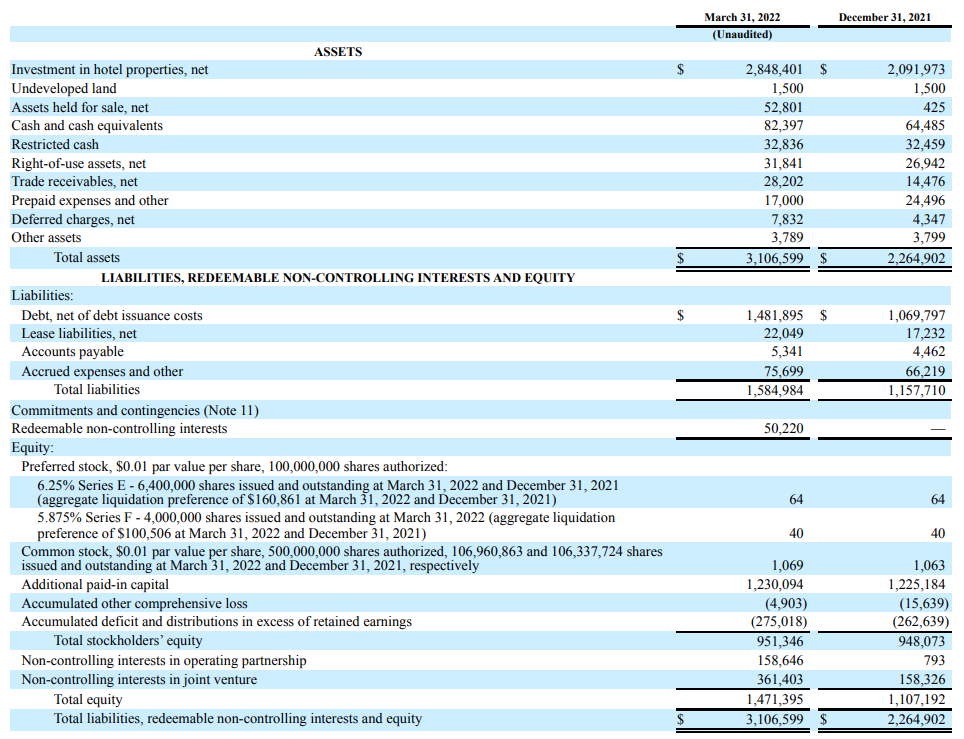

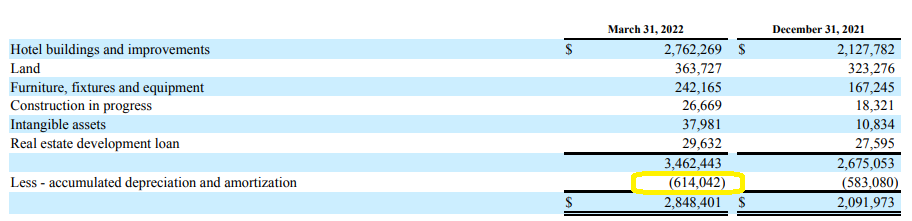

A second element I focus on when determining whether or not I should invest in a preferred share is the asset coverage level.

INN Investor Relations

Looking at the balance sheet of Summit Hotel Properties, we see the total equity attributable to the shareholders of Summit was $951M. There are currently 6.4M preferred shares E and 4M preferred shares F in circulation for a total of $260M. This means the asset coverage level is pretty good as well. And keep in mind the $951M in equity value is based on the $2.85B book value of the assets, which already includes in excess of $600M in accumulated depreciation, so the market value of the investments may be higher than the book value.

INN Investor Relations

As mentioned, there are two series of preferred shares outstanding. Both are cumulative in nature and the E Series are paying a 6.25% preferred dividend while the F Series are paying just 5.875%. Both series are trading at a substantial discount to the $25 call value and this boosts the yield to 7.8% and 7.75% respectively (so both series are offering similar yields).

Investment Thesis

I currently have a long position in both series of the preferred shares issued by Summit Hotel Properties. I started buying closer to par, so I’m sitting on an unrealized capital loss, but as I have a long investment horizon, I’m not too worried. Summit’s Q1 results clearly indicate the hotel REIT is moving in the right direction, and hopefully the recent acquisitions will help to further strengthen the balance sheet. Summit isn’t paying a dividend right now, so the FFO and AFFO is entirely retained on the balance sheet.

From the perspective of an investor in preferred shares, I think the Summit Hotel Properties preferred shares offer an interesting risk/reward ratio.

Be the first to comment