Ethan Miller

An Unwarranted Plunge

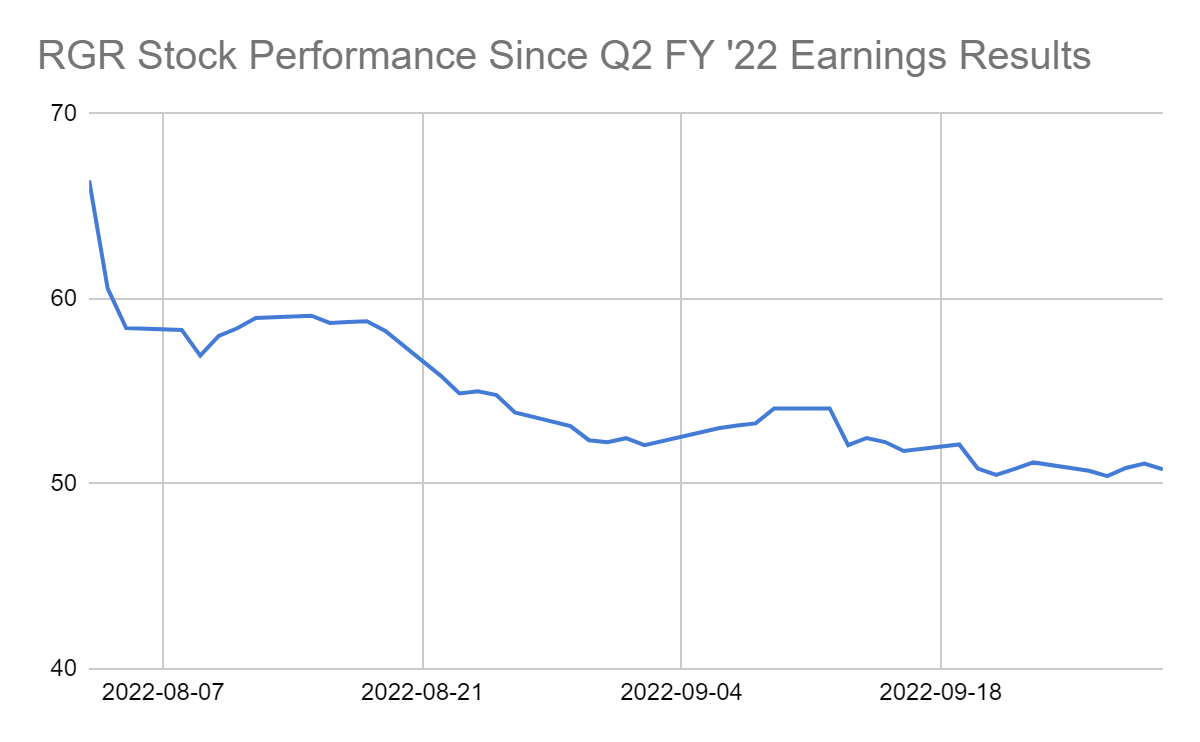

It might be a little early to start speculating about how Sturm, Ruger & Company (NYSE:RGR) might finish their year given that they won’t even be reporting Q3 FY ‘22 results until November. Yet, as I have taken a “wrong-way” ride on the firearms manufacturer this year, I can’t resist the exercise, especially with the stock plunging nearly (24%) since Q2 FY ‘22 earnings were announced in early August.

Figure 1: RGR Stock Performance Since Q2 FY ‘22 Earnings Results (Yves Sukhu)

Notes:

-

Data as of market close September 30, 2022.

-

Historical close price data from Yahoo Finance.

I suppose I state the obvious by suggesting that unwarranted fear and anxiety has likely driven a good bit of the selloff in RGR shares, as with the broader market. While understandable, RGR investors who have hung on might keep in mind:

1. The end-of-summer/fall/winter months typically act as a tailwind for firearms manufacturers with hunting season kicking in and more gun owners heading back to the range.

2. While interest in firearms this year is subdued as compared to the surge seen in 2020 and 2021, National Instant Criminal Background Check (“NICS”) data hints that consumer demand for guns in 2022 remains strong.

3. Fear drove the surge in firearms sales in 2020-2021. Fear over a breakdown in the social order of the United States due to the pandemic and highly-charged political climate, among other reasons. I would argue this sense of fear remains in 2022 and may continue driving growth in gun sales.

4. Key costs, including metal and logistics costs, have been trending down.

5. Ammunition shortages in the first half of the year, in part due to the lack of availability of key production metals, may be easing and encouraging increased gun sales.

While the company could still wind up laying a couple eggs, these points suggest that $0-debt RGR might yet reward investors with strong Q3 FY ‘22 and Q4 FY ‘22 results and, dare I say, a rally in shares.

5 Keys for a Strong 2H FY ’22 Performance

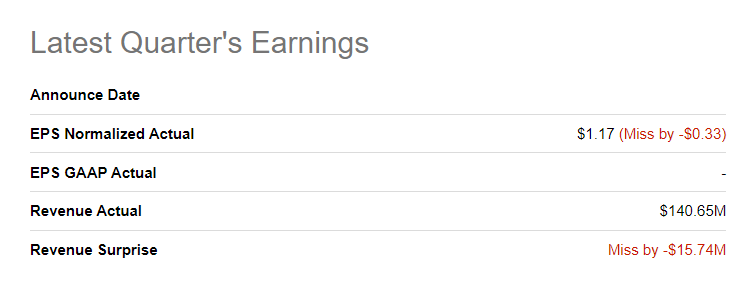

As a reminder, RGR missed both revenue and earnings estimates in Q2 FY ‘22.

Figure 2: RGR Q2 FY ‘22 Earnings Versus Estimate (Seeking Alpha)

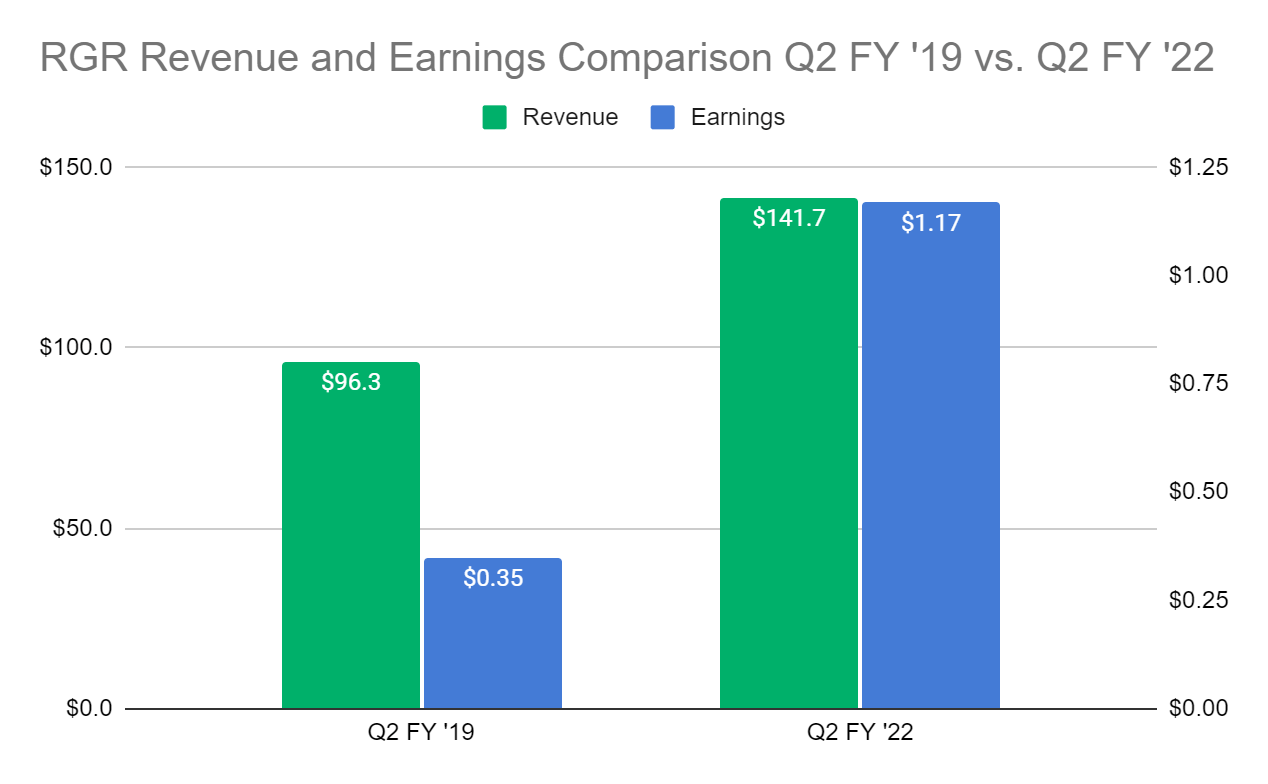

Bear in mind, however, Q2 sales and earnings were both well-above pre-pandemic Q2 FY ‘19 results, a result that should be considered in the context of 1H FY ‘22 high inflation and supply chain headwinds.

Figure 3: RGR Revenue and Earnings Comparison Q2 FY ‘19 vs. Q2 FY ‘22 (Yves Sukhu)

Perhaps Q2 FY ‘22 estimates were a tad too aggressive with firearms manufacturers bound to return to more normal levels of demand given “…the unprecedented levels of the [firearms] surge that began in early 2020 and [remained] for most of 2021.” Either way, the five points outlined in the Introduction serve as a basis on which to think Q3 FY ‘22 and Q4 FY ‘22 results might give RGR investors something to smile about again. I list each below with further elaboration.

1. The end of summer/fall/winter months typically act as a tailwind for firearms manufacturers.

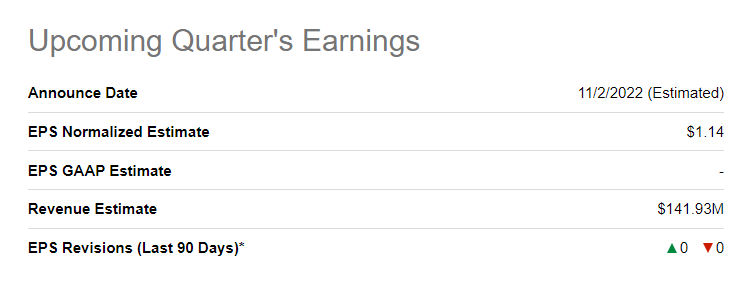

I suppose a good number of readers are already familiar with the seasonality of the firearms industry. But, for those who are not, a couple industry quotes are worth mentioning here. RGR CEO Christopher Killoy noted during the firm’s Q2 FY ‘22 earnings call that “typically, we do slow down as [we] enter into [the] May, June, July time period…[but] the good news is things associated with the fall hunting season seem to be coming on strong now.” Further, Smith & Wesson Brands, Inc. (SWBI) CEO Mark Smith mentioned on their recent Q1 FY ‘23 earnings call that “we expect[ed] Q1 to have been our lowest volume quarter and expect Q2 to pick up nicely as the summer ends and consumers begin to think about heading back to the range. We expect that Q2 will grow at a faster rate than historically seen over Q1 so that it will still represent approximately 20% to 25% of our total year units shipped.” So, seasonal effects should help bolster sales and, hence, earnings as RGR closes out its fiscal year. That being said, the average revenue estimate of $141.9M for Q3 FY ‘22 is almost 50% higher than the actual $95.0M in sales recorded in Q3 FY ‘19 pre-pandemic. The figure is roughly in line with “during-the-start-of-the-surge” revenues of $145.7M in Q3 FY ‘20 and about (20%) lower than Q3 FY ‘21 sales of $178.2M.

Figure 4: RGR Q3 FY ‘22 Earnings Estimate (Seeking Alpha)

In spite of having the favor of seasonality, is the Q3 FY ‘22 revenue estimate too aggressive? Perhaps not given the following 4 points.

2. Consumer demand for guns in 2022 remains reasonably strong.

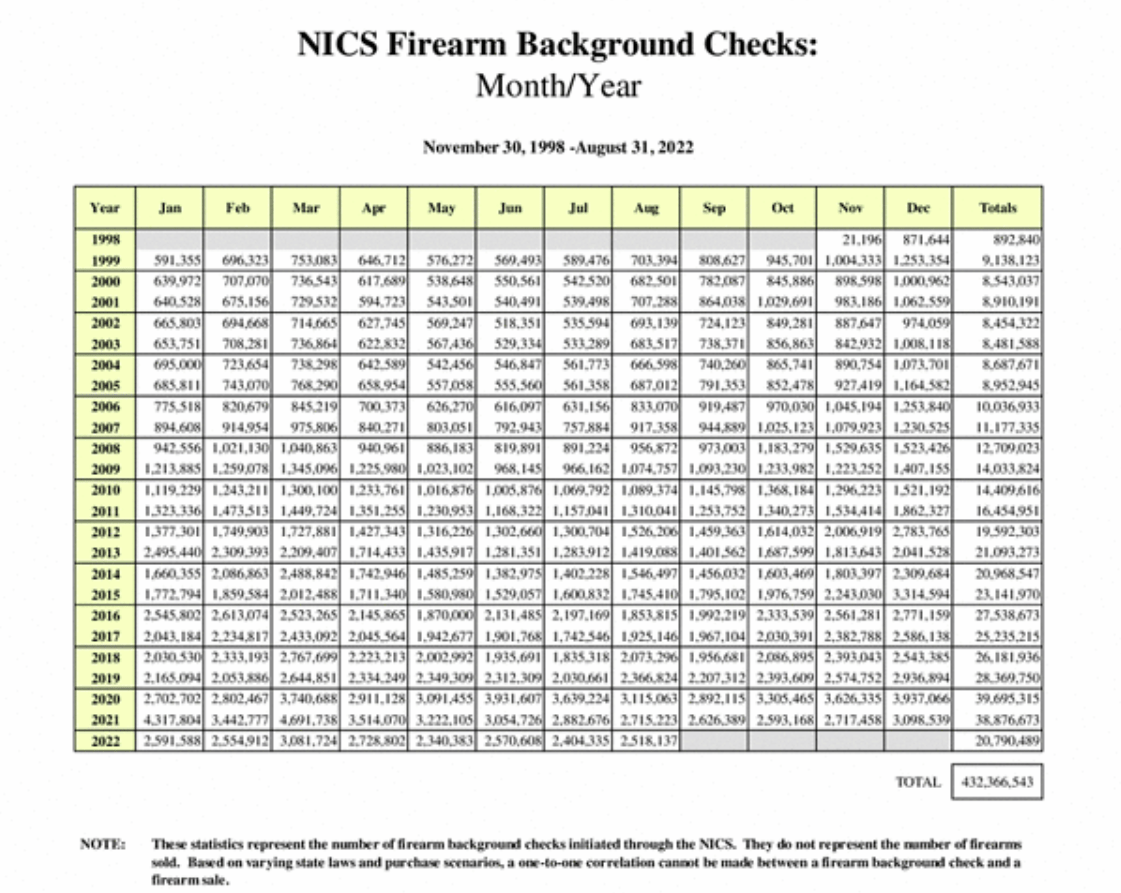

Figure 5 below details NICS background check statistics through August 31, 2022.

Figure 5: NICS Firearm Background Checks (Federal Bureau of Investigation)

While monthly figures for 2022 are below the analogous statistics for 2021 and 2020, the number of background checks this year, so far, is actually tracking above pre-pandemic levels. In fact, the total number of background checks this year through the end of August is about 2,000,000 more than through the same period in 2019. Now, NICS data does not correlate directly with firearm sales. Moreover, National Shooting Sports Foundation (“NSSF”) adjusted NICS data, which subtracts permit rechecks, actually decreased 17% in 1H 2022 versus 1H 2021, as noted by Mr. Killoy during RGR’s most recent earnings call. Accordingly, one must be cautious extrapolating from the raw NICS data above. Still, with the industry expected to benefit from typical seasonal effects and reasonably strong NICS data through the end of August, perhaps demand is shaping up nicely to support good Q3 FY ‘22 and Q4 FY ‘22 performances. It is also interesting to consider that new demographic groups may be driving NICS data and hence gun sales in the United States. CNN ran an article a few days ago with a title that says it all:

“Liberal, female and minority: America’s new gun owners aren’t who you’d think.”

While the article does not offer any particular statistics insofar as how big these “new” gun-owning demographic groups are, nor how fast they are growing. But it should nonetheless pique the interest of investors that the consumer base that the firearms industry can market to may be expanding.

3. Fear remains in 2022.

A couple quotes stuck with me as I read the CNN article mentioned in the previous point:

Our society and climate is changing… it’s just better to be prepared for your own safety and protection. That’s how we feel.

I’m a Mexican woman in a same-sex relationship; I need to feel safe. I need to feel protected, Mendez said. And right now the laws and the things that are going on don’t make me feel safe and don’t make me feel protected.

These are obviously two isolated examples, but they suggest a certain portion of the populace in the United States remains concerned about the state of the country for whatever reason. I certainly would prefer to live in a society without fear as opposed to one dominated by it. But, things being as they are, it seems that the current “climate” within the United States is driving more people toward gun ownership as opposed to the opposite.

4. Key costs, including aluminum, stainless steel, and carbon steel, have been trending down since the beginning of the year.

When asked about inflation, Mr. Killoy mentioned the following during RGR’s Q2 FY ‘22 earnings call:

The question about inflation, I mean, we’ve seen some significant increases over the past couple of years. Things like stainless steel up 7% from last year, carbon steel up 15% and aluminum up 20%.

The good news for RGR, and for investors, is that the prices for key commodities have been trending down. Current aluminum prices at $2,155 USD/T, for example, are ~(39%) below their March 31 price of $3,514 USD/T. With input costs decreasing, RGR is obviously in a more advantageous position in terms of passing those savings onto consumers in the form of lower prices, which in turn may help bolster Q3 FY ‘22 and Q4 FY ‘22 sales. And, with higher commodity prices helping to drag gross margin down by (800) bps from 39% to 31% in Q2 FY ‘22, current trends are obviously favorable from a profitability perspective as well. We should also consider the potential positive impact of lower freight and logistics costs which have benefited more recently from lower gas prices following the peak earlier in the year. Overall, with lower input and potentially lower logistics costs, the complexion of Q3 and Q4 FY ‘22 results may be far rosier than what investors saw in Q2. Of course, anything can change at any time with respect to RGR’s supply chain inputs and distribution costs. But, for the moment, things are looking a lot better than they did during 1H FY ‘22.

5. Ammunition shortages appear to be easing.

During the Q2 FY ‘22 earnings call, FactSet analyst Jim Misago probed: “From what I’m seeing in my universe here, ammunition seems to be more available. Is that helping reverting you guys at all?” Ammunition prices trended higher during the beginning of the year due to rising materials costs (see the previous point) and supply chain bottlenecks. These conditions, in turn, fed an ammunition shortage for several months in 2022. It seems, however, that the shortage is easing with Mr. Killoy commenting:

“We’ve seen ammunition settle back down, [and it is] still in strong demand. But we’ve seen that settle back down from an availability standpoint…[The] good thing for Ruger is it gets our customers out to the range, it gets them out enjoying their products…And so we’re seeing, I think, as those prices stabilize and consumers are comfortable that they can find ammo on the shelf, they’re getting back out to the range and enjoying our products. And that’s always good news for Ruger.”

This development obviously feeds well into the seasonal aspect of the firearms business mentioned in the first point, and serves as a tailwind for sales.

If I revisit the question posed earlier of whether the Q3 FY ‘22 estimate is too aggressive, we might – using the aggregate of the points above – bet that RGR is in a good position to hit the target (no pun intended) and perhaps even deliver a surprise on the top line. With “…[distributors] looking and asking for more inventory, particularly in some of the product lines” back in Q2 FY ‘22 and the release of new products post Q2 FY ‘22, the bull case for the company is arguably good.

Hold On…This One Could Still Be a Winner

As I write this, the market looks set to open down again and it would not surprise me if RGR dips under $50 – a price which, so far, has been acting as something of a floor for shares. Obviously, I can’t say the pain, in this quite painful year, is over for RGR shareholders.

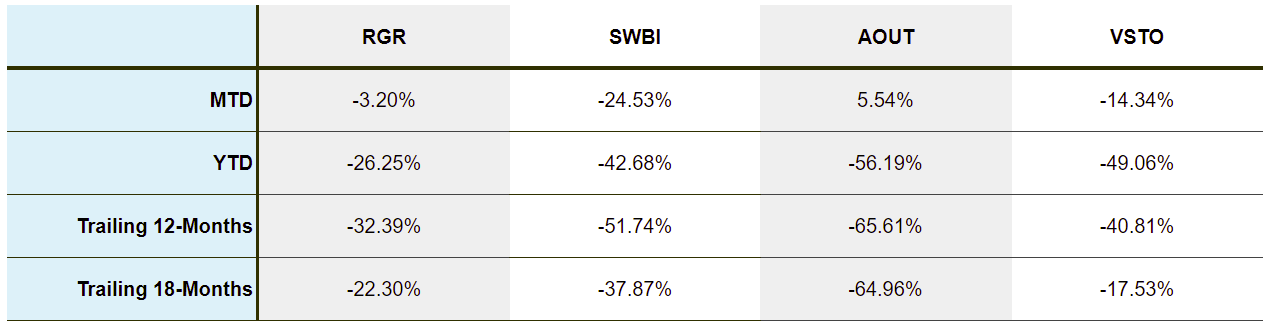

Figure 6: RGR and Selected Competitor Performance Comparison (Yves Sukhu)

That being said, I argue that investors who are holding on might hold on a little longer, on the bet that 2H FY ‘22 results could be stronger than the market is thinking right now. If readers recall, I mentioned earlier that RGR’s Q3 FY ‘22 sales forecast is close to its actual sales result from Q3 FY ‘20 when the firm was in the midst of a surge in firearms demand. It is worth pointing out that the corresponding Q3 FY ‘22 earnings estimate of $1.14/diluted share is (18%) below Q3 FY ‘20 earnings of $1.39/diluted share. My point is that the current earnings estimate is factoring in those headwinds unique to 2022 (e.g. weaker demand, inflation, etc.). But, based on my argumentation in the last section, those headwinds may be overestimated and/or weakening. So, RGR may find itself well-positioned to beat not only on the top line in Q3, but the bottom line as well. Bear in mind also that management had been “right-sizing” production following the pandemic surge. With manufacturing operations presumably better optimized post-Q2, it is yet another arrow pointing toward an improved profitability outlook for Q3 and Q4.

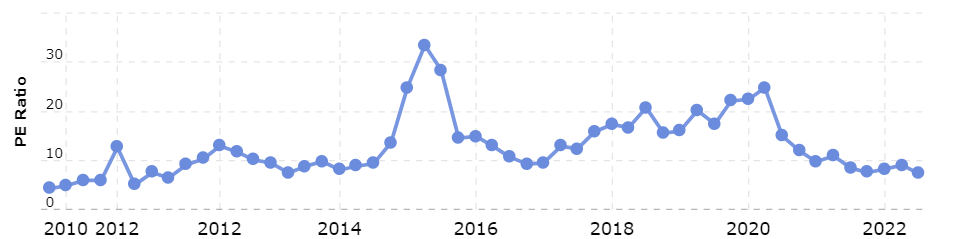

It may be worth noting that, using a trailing P/E of 7.27 from Macrotrends, we would have to go all the way back to 2013 to find shares trading at a similar valuation.

Figure 7: RGR Historical PE (Macrotrends)

It might be enticing then to nibble on shares as they’ve been beaten up “every way to Sunday”, if one agrees with the argumentation in the preceding section. Yet, keep in mind, while the stock currently appears to offer investors a good starting valuation based on the expectation of improving business conditions, it is not absurdly cheap either.

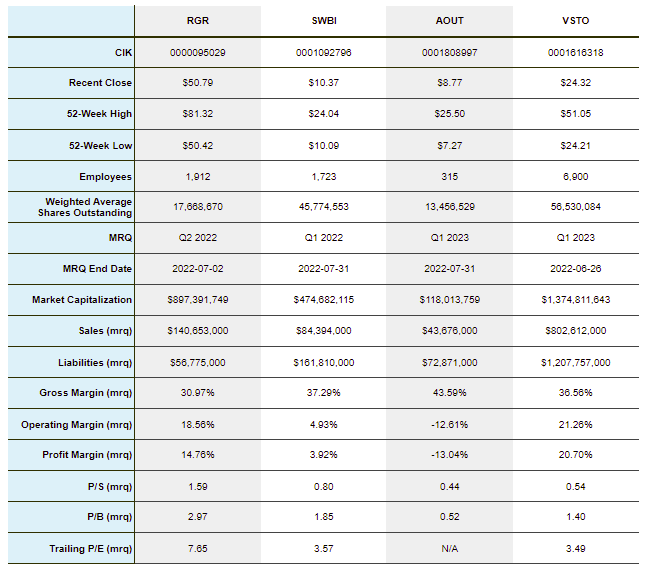

Figure 8: RGR and Selected Competitor Statistics (Yves Sukhu)

Notes:

-

Data as of market close September 30, 2022.

-

Data from Polygon.io except P/S, P/B, and P/E data from Yahoo Finance.

Some investors may be concerned by the recent move of some lawmakers to curb exports from firearms manufacturers. While not good news for RGR, or for the firearms industry in general, investors should keep in mind that only a small percentage of RGR’s current business is attributable to exports, with “[export] sales [representing] approximately 4% of firearms sales” in FY ‘21. Therefore, it would not seem that any such legislation – were it to pass – would have a significant effect on RGR in the near term.

RGR is a volatile stock. But RGR is also a company:

-

In business since 1949;

-

Characterized by excellent financial management and $0 debt;

- Sporting a nice 5.5% dividend yield at the moment (bear in mind the dividend is based on a fixed percentage of quarterly income); and

-

In an industry that is likely to continue growing in the United States despite the wishes of many that it wouldn’t.

So, for those investors who have hung on, the ride might get even bumpier but RGR could still be a winner in 2022.

Be the first to comment