golfcphoto

In this article, we look at the Split Share Corporations (aka split share funds), which is a distinctive investment product available in Canada. We examine the underlying features and the ‘split’ classes of share. How the prices and NAV change are important as the structure provides a form of ‘leverage’ to the different classes, offering both growth and income investors some attractive options. Given the readership is largely international, I have not addressed taxation issues as these may differ for many readers.

The split share corporation structure creates leverage for Class A shareholders interested in capital gains

To help us understand how the split structure works and what it offers each class of shares, we will use a basic example.

There are two classes of shares and we essentially have two types of investors, each putting up 50% of the funding to purchase a portfolio of common shares for the split share corporation. With a simplistic explanation, then, we can work out how the split share corporation structure provides leverage for investors (note that these explanations will be valid for the time of the issue of the shares and will change with time) at the time the shares are issued:

- The Preferred shareholder puts in 50% of the funding but receives most of the dividends from the underlying portfolio as their distribution. To keep it simple, they may receive an amount of 100% of the portfolio dividend income at the time of the creation of the shares as their distribution from the fund. This means that they receive quite a high distribution yield on their share of the split share corporation. Over time, if the underlying portfolio experiences a growth in dividend values received, the Preferred shareholders do not benefit from this increase in portfolio income, as their distributions are fixed.

- The Class A shareholder puts in 50% of the funding but receives 100% of the capital gains on the underlying portfolio. Distributions may come from capital gains, excess dividends from the portfolio, and possibly the sale of covered calls on the portfolio. If the portfolio does well, over time, and the underlying shares have a strong dividend growth, the portfolio may increase the net investment income, and this will benefit the Class A shareholders.

A split share corporation structure differs from preferred shares

The split share corporation structure has preferred shares, but the ‘fund’ element means it differs from investing in preferred shares for a company.

When we invest in preferred shares, we have an interest in an underlying business. We may take this option and give up the right to vote but benefit from a steady fixed dividend and a greater claim on assets and dividends than the common shares have.

A split share corporation means the investor has an interest in a bundle of other securities. Similarly, with regular preferred shares, there is a greater claim on the dividends; for instance, if the unit NAV (the sum of the NAV for the two classes of shares) falls below C$15 but then the Class A shares will not receive a distribution but the preferred shares will continue to receive the distribution.

The split share corporation structure allows investors to buy an interest in the underlying portfolio of shares, focusing on either their interest in capital gains in which case they will buy a Class A share or the stable and steady income, in which case they will buy the Preferred share. Each class of shares is listed, allowing investors to move in and out of their positions.

Preferred shares and fixed terms

As we look at the split share corporation Preferred shares, we see a discussion of fixed terms or maturity dates. This does not necessarily mean that they will wind the fund up, your money returned, and you looking for new investments beyond that date. Recall that the fund managers who earn income from the fund are, therefore, likely to continue to operate the fund to continue this source of income.

The redemption dates are important for the Preferred shares class of the fund. Recall that they have a ‘fixed’ distribution rate. This is fixed for a period (e.g., five years). Nearer to the end of the period, a new rate may be offered.

This ‘step-wise change’ enables the fund manager to assess appropriate levels of distributions. They may look, for example, at prevailing interest rates. As the current environment is one of increasing interest rates, a fund with a near termination date may opt to increase the distributions on the Preferred class of shares for the new ‘fixed period.’ Potentially, if the underlying portfolio of shares have successfully increased income from the dividends issued by the companies in the portfolio, the overall split share corporation may find itself with increasing amounts of income that can be used to increase the Preferred shares’ distribution rates in the next ‘fixed period.’ In this manner, having the fixed period allows stability but also enables the fund manager to judiciously adjust the distribution yield to accommodate both changes in the fund’s portfolio as well as the wider macroeconomic environment.

The $15 rule and missing dividends for Class A shares

The split share corporation format usually has an interesting rule in place that will prevent or reduce the impact of the erosion of NAV over time – this is the “$15 rule.”

Recall that this is a ‘split’ fund. The Unit NAV comprises 1 Class A share and 1 Preferred share. If the Unit NAV drops below C$15, then they will make no distribution to the Class A shares. The rule can protect the capital in the fund and prevent it from eroding too far. Over time, as the NAV builds up again, distributions can recommence.

This rule is not usually well-publicized but it can often be found if you hunt for it. For instance, it is the first note in the ‘Disclaimer’ on p. 5 of the Middlefield Group’s Split Share Primer for May 2022.

If you are reliant on investment income, this rule means that the Class A share is probably not what you want, and the Preferred share (RS.PRA:CA) would be the best choice.

Examples of other split share corporations and the $15 rule

There is a range of split share corporations that often offer sector exposure. For instance:

- Life & Banc Split Corp. (LBS:CA)

- Sustainable Power & Infrastructure Split Corp. (PWI:CA)

- Big Banc Split Corp. (BNK:CA)

- Global Dividend Growth Split Corp. (GDV:CA)

- E Split Corp (ENS:CA) also by Middlefield, holding only Enbridge (ENB:CA) shares.

The $15 rule appears to be in place for all the split share corporations I have looked at and is a general practice for this category of funds, rather than being specific to the fund manager.

It does not mean that when the unit NAV goes below the level the Class A shareholders will never receive distributions. Each month, the fund manager will check the unit NAV and will reinstate the distributions when the unit NAV recovers.

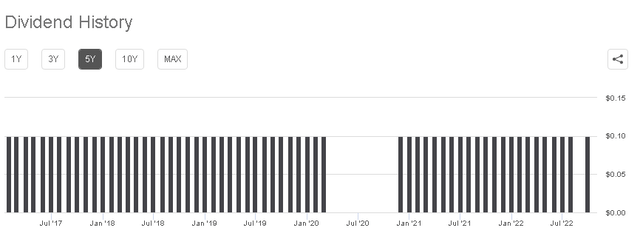

As an example of what may happen, the Life & Banc Split Corp. (LBS:CA) Class A shares paid distributions through 2017 and into early 2020 before suspending distributions so there was no distribution in March and they resumed the distributions in November after the unit NAV recovered (Figure 1).

So it is not a complete termination of distributions forever if the unit NAV drops this far, but it will affect the Class A shareholders and not the Preferred shareholders of the fund. However, it is notable that many ETFs may be providing lower distributions during tough periods rather than suspending distributions entirely.

Figure 1. LBS Split Share Corporation distribution history, showing suspended distributions in 2020. (Seeking Alpha Distribution History for LBS:CA)

Timing and opportunities with the $15 rule

Given that the $15 rule means that investors may miss dividends – is this an entirely bad thing?

There are two potential implications. First, the closed-end nature of the fund means that price and NAV can be disconnected and the $15 rule can exacerbate this, providing long-term investors with attractive entries. Second, funds trading close to the $15 level will mean that the Class A shares have relatively high distribution yields.

Benefiting from the price and NAV disconnect below $15

Much as regular CEFs often trade at a discount or premium, we see similar behavior with split share corporations. If we consider the Class A shares, this disconnect can be accelerated when the fund approaches the unit NAV of $15 and the Class A shares approach C$5. Given the relatively stable nature of the distribution amount, then, the distribution yield will be increasing. It is possible to see funds with yields of around 15% at this point.

What happens when the Class A share NAV decreases below C$5, pushing the unit NAV below C$15? As we know, the $15 rule is invoked, and distributions to Class A shares will be suspended. It prevents deterioration of the NAV for the Class A shareholders, but many of the shareholders will also be investing for yields and income. As a result, there may be a flurry of sales and trades as income-oriented investors dump their shares, pushing prices down so that the Class A share price drops below NAV, presenting the opportunity to purchase the shares at a discount to NAV.

A careful, long-term investor may look at this as an opportunity to buy the shares at a discount with the assumption that over months or several years the unit NAV will recovers to above $15, triggering the resumption of distributions to Class A shares. When this occurs, the prices will increase with the NAV, leading to rapid capital gains. Furthermore, shares that may have been purchased at a steep discount can now benefit from relatively high distributions relative to their purchase price, giving an attractive yield on cost.

So – how is this a risk?

The unit NAV may not recover or it may take a substantial time. The fund managers may allow the Class A shareholders to ‘wait it out’ or they may also do a reverse combination to bring the unit NAV above the $15 so that Class A shareholders will have fewer shares but can more rapidly benefit from the resumption of distributions.

High yields for income investors comfortable with risking their distributions

As suggested in the earlier section, if the Class A share is just above the $5 level, the shareholders may see a very high distribution. The risk is, of course, that the $15 rule is triggered and the shareholder experiences a suspension of the distribution for some, or maybe many, distribution payments.

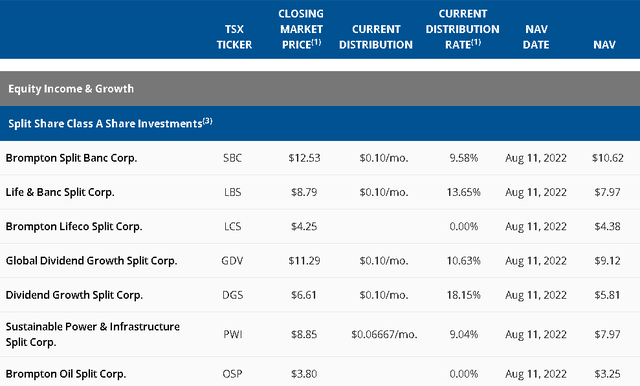

There are examples of some Class A shares in split share corporations hovering above and close to the C$5 level for extended periods of time, giving income-oriented investors the potential for high distributions. For example, if we look at Figure 2, we have the list of Split Share (Class A) offered by Brompton Funds with some useful details. First – we can see that two of the Split Corporations (LCS:CA and OSP:CA) have a NAV under C$5. We see that, as we expect, the current distribution is suspended or missing from the table. From the remaining shares, we see that those with prices closer to C$5 have a yield (Current distribution rate) that is higher; the further the price is from the C$5 point, the lower the yield is, but the less likely the fund is to hit the point where distributions will be suspended.

For instance, if we look at Global Dividend Growth Split Corp (DGS:CA), the closing market price shown is C$6.61 with a distribution yield of 18.15%. Attractive – but the NAV of C$5.81 is close to C$5, suggesting that the $15 rule may be invoked soon and the distribution would be suspended.

On the other hand, the Brompton Split Banc Corp. (SBC:CA) has a healthier NAV of C$10.62 and a price of $12.53. This represents an 18% premium but also a reasonable distribution rate of 9.58% with the NAV for the shares seemingly well above the C$5 level and, therefore, secure or safe. (Note that as this Split Corporation invests in banks, a shock to the global financial sector or the Canadian financial or banking sector could have an outsized impact on this highly concentrated holding.)

Figure 2. Brompton Funds list of Split Corporations Class A shares (Brompton Funds website)

Of course, the previous section noted what might happen if the unit NAV decreases below C$15: the prices may decrease faster than the NAV. For the Class A shareholder, this would represent a sudden loss of income, as the distributions are suspended, while also facing a capital loss as the prices disconnect and fall faster than the underlying NAV. We see it in Figure 2 with the Brompton Lifeco Split Corp. (LCS:CA) where the market price is lower than the NAV, while the Brompton Oil Split Corp. (OSP:CA) trades at a premium to the NAV, and all the Split Share Corporations with NAVs over C$5 trading at premiums.

Final challenges and notes

These types of shares and investments are certainly not for everyone. Some of the Split Share Corporations may have low trading volumes and the thin trading may add to the price volatility. You may not have access to Canadian listings or you may wish to avoid the complexity of investing outside of your home market.

As we have seen, however, if you can access these products and are comfortable, the Class A shares of split share corporations enable you to benefit from the structural leverage of the product’s structure to enhance your returns. You need to be aware of the $15 rule and monitor the unit NAV.

Split share corporations are often very focused on sectors/industries (see, for instance, Figure 2, with a banking-focused corp, banking and life insurance, life insurance, sustainable power and infrastructure, and oil). It is sensible to ensure the sector or geographic exposure does not double-up on existing portfolio holdings.

They may trade at a substantial premium to the NAV, and investors should examine this. If they trade below a unit NAV of $15, Class A shareholders will find their dividends suspended. Some options trade well above this level, such as RS:CA, which I will cover in a subsequent article. I like this Real Estate Split Corporation (RS:CA) as it provides specific Canadian REIT exposure and has a unit NAV that means I am unlikely to need to worry about the $15 rule for a while.

The investment should be a good fit with the overall portfolio. Income investors may find the Preferred share options attractive, with relatively high distribution yields and security of consistent payments. Those investors with greater risk tolerance may find the Class A shares more attractive; they may also have relatively high distribution yields but are at risk of having the distribution suspended. The volatility of the price may also add to a portfolio’s capital gains or losses while the Preferred class of shares does not.

Be the first to comment