supermimicry

Introduction

Retirement portfolios are a great place to invest in companies that are stable and provide growing dividends. This provides for a reliable form of income in retirement and a low risk of losing initial investment. Ball Corporation (NYSE:BALL) may be one the best companies to fit this mold. The business has had very consistent revenues and margins, along with dividend consistency, growth, and a low payout ratio. While 2022 has seen margins challenged a bit, Ball Corp. can pass on inflationary costs to their customers at a really good rate. Therefore, I think the next half year will yield more “normal” results. At just 15x P/E and with such a good dividend prospect, I am a buyer.

Ball Corporation Financial History

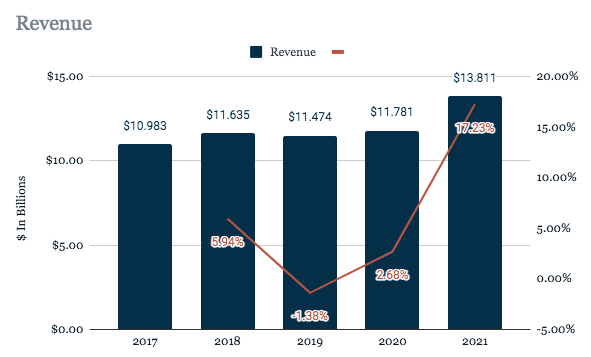

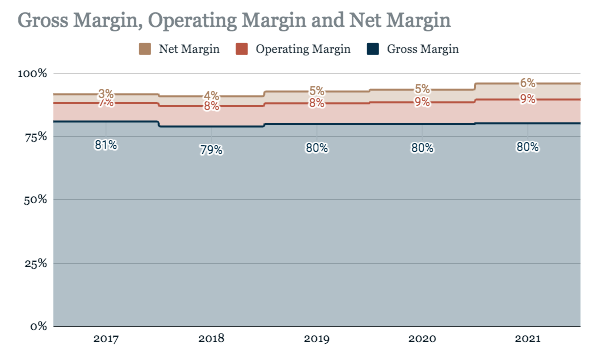

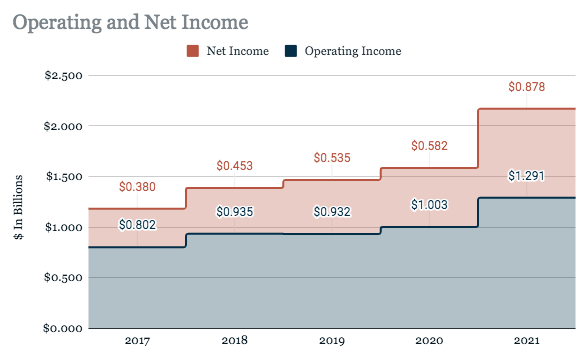

Ball Revenue (SEC.gov) Ball Margins (SEC.gov) Ball Operating & Net Income (SEC.gov)

Ball Corp. has seen very consistent revenue throughout the past five years. In 2021 the company saw revenue grow by 17.23% due to increased volumes, and a better product mix. Inflation has helped increase the revenue side due to higher pas through costs too. Therefore a better thing to look at for the stability of the business is margins. Ball Corp. has historically posted extremely steady margins, with the gross margin at 79-81% and operating and net margins slightly growing over time. What this shows is that costs not from sales have either stayed the same or decreased in the past five years. Overall this benefits the bottom line, which has grown at a clip of ..% since 2017. Stable business operations paired with growth in net income make for a reliable and potentially growing dividend.

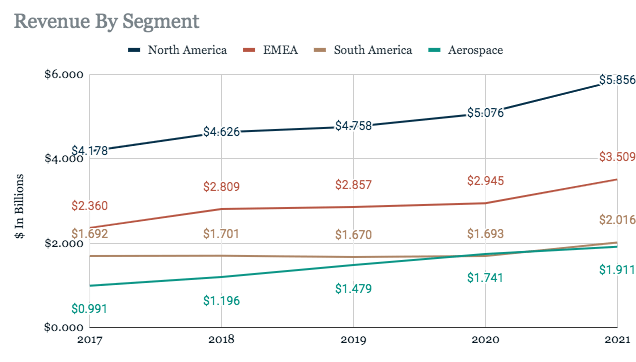

Ball Revenue By Segment (SEC.gov)

Taking a deeper dive into the segments shows each of them has the same consistency as the overall company. North America has grown at a clip of 7%, South America 3.5%, EMEA 8%, and Aerospace 14%. The only segment not to see revenue growth each year since 2017 has been South America. Margins have also been very consistent for each segment; North America ranges from 12-13%, South America 17%, EMEA 12-13%, and Aerospace 9%. As can be seen not much variability in margins. Again, really great and consistent business models.

This Year

So far in the midyear of 2022, revenue has again grown significantly, by 19.22%. This was mostly attributable to higher pass-through costs from increased raw goods and inflation. Therefore this growth isn’t much to be proud of. Looking at the margins, Ball Corp. has wavered a bit. The gross margin at the midyear has crept up a bit to 82%, thus reducing the operating margin and net margins to 6.4% and 3.4%. Overall, not the greatest but not out of control for the full year. Looking at each segment, North America saw revenue growth of 20% due to pass-through costs, but the operating margin declined by 2%. EMEA saw revenue growth of 22% on volume growth of 8.9% but saw margins fall 2% too. South America revenue increased by 9.5% due to pass-through costs offsetting a volume decline of 12.7%, and margins declined by 5%. Aerospace grew 12.6% from new contract wins and kept margins flat. Overall, each segment saw revenue growth, but this was mostly from pass-through cost increases. And with this, the company saw almost all segments decline in profitability. While the results this year are not the greatest, they are not out of this world. In the next half year, Ball Corp. will likely adjust pricing to reflect higher pass-through costs and regain margins. What will be key is if this affects volumes drastically.

Balance Sheet

At first glance, Ball Corp. doesn’t seem to have the greatest balance sheet. Current and quick ratios are lower at 1x and 0.38x, while debt-to-equity is high at 4.92x. But the company is very consistent and has a 4.59x times interest earned ratio, helping to negate the higher debt load. Liquidity is also not an issue as the company has a higher inventory turnover at 6-7x. Overall, with added color, Ball Corp. does have a healthy and manageable balance sheet.

BALL Stock Valuation

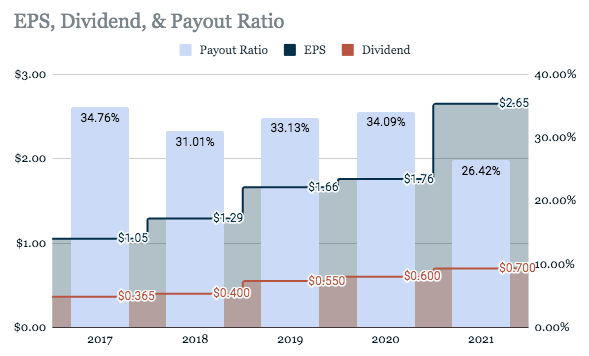

Ball EPS, Dividend, Payout Ratio (SEC.gov)

With established, stable, and consistent companies like Ball Corp., the real play for investment is long-term dividend growth and reliability. As of writing, the company trades around the price level of $50 per share. At this level, the business trades at a P/E of 15.58x using the 2022 EPS estimate of $3.21. Ball Corp. also trades at a 4.57x book value per share. This is probably a fair valuation for the company.

Looking at the dividend shows so much room for growth. Over the past 32 years, the company has consecutively paid a dividend. Over the last five years, it has increased that dividend. From 2017 to the most recent quarter, the dividend has increased 119%, from $0.365 to $0.80. And the payout ratio is low, never going above 40%. Taking all this together, Ball Corp. is a business that is growing the dividend payment, has paid very consistently, and has much more room to grow, at just 15x P/E.

Conclusion

While Ball Corp. has seen some margin pressure in the first half of 2022, I am confident the company will regain ground in the second half. The business has been historically consistent and stable and can change pricing to pass-through inflation and raw material costs. At 15x P/E and with a growing consistent dividend, this is a good company to buy for a long-term hold.

Be the first to comment