Evgenii Mitroshin

The DRLL ETF claims to be able to unlock value in the U.S. energy sector through superior corporate governance practices. However, nothing in the fund’s prospectus points to any differentiating ‘special sauce’. In fact, from what I can tell, the DRLL ETF is designed to passively track a float-adjusted capitalization weighted index of the largest energy companies.

I think may be better served by sticking with the ‘tried and true’ investment vehicles like the XLE ETF for energy exposure.

Fund Overview

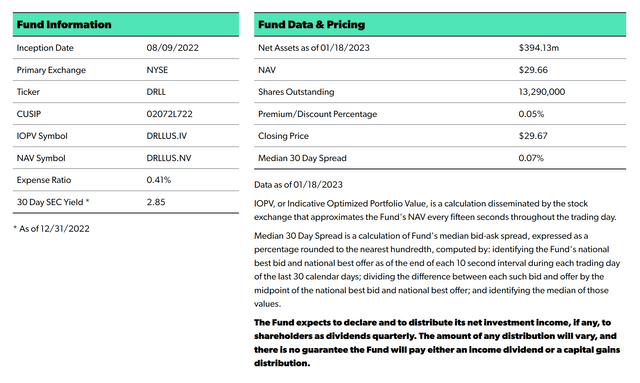

The Strive U.S. Energy ETF (NYSEARCA:DRLL) provides broad market exposure to the U.S. energy sector. According to the fund’s marketing materials, the DRLL ETF “aims to unlock value in the U.S. energy sector by mandating companies to focus on profits over politics” through corporate governance practices including voting proxy shares and engaging with management teams. The DRLL ETF has $394 million in assets and charges a 0.41% expense ratio (Figure 1).

Figure 1 – DRLL fund details (strivefunds.com)

Strategy

The DRLL ETF aims to passively track the investment results of the Solactive United States Energy Regulated Capped Index (“Index”). According to the fund’s prospectus, the index measures the performance of the U.S. energy sector as defined by Solactive AG and is a float-adjusted capitalization weighted index selected from the 1,000 largest companies in the U.S. The weight of any single issuer is capped at 22.5% and the aggregate weight of issuers that have greater than 4.5% weight is capped at 45%.

Investors should note that since DRLL ‘passively’ tracks its index and the index appears to be a simple ‘float-adjusted capitalization weighted index’, the marketing claim of ‘focusing on profits over politics’ seems to be misleading.

If the fund does not take active positions and the index it tracks does not measure anything to do with corporate governance, how is value going to be unlocked by DRLL’s ‘corporate governance mandate’?

Portfolio Holdings

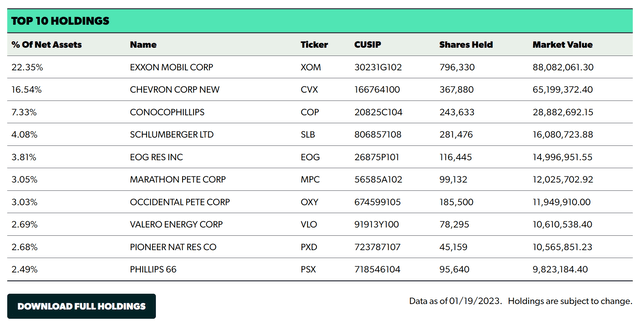

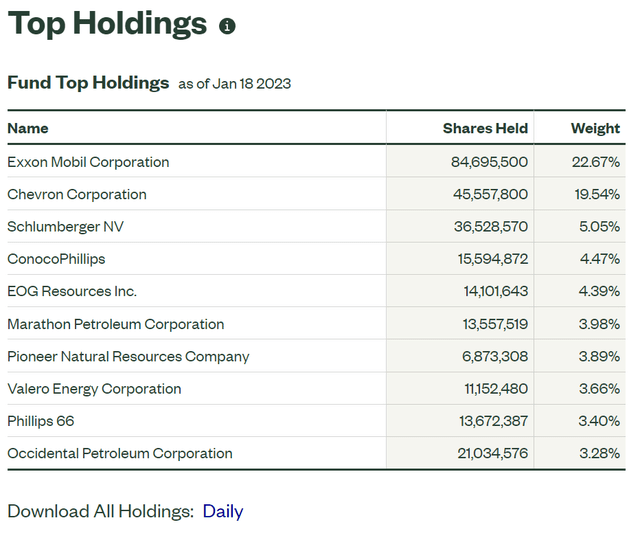

Figure 2 shows DRLL’s top 10 positions which account for 68% of the fund’s assets.

Figure 2 – DRLL top 10 positions (strivefunds.com)

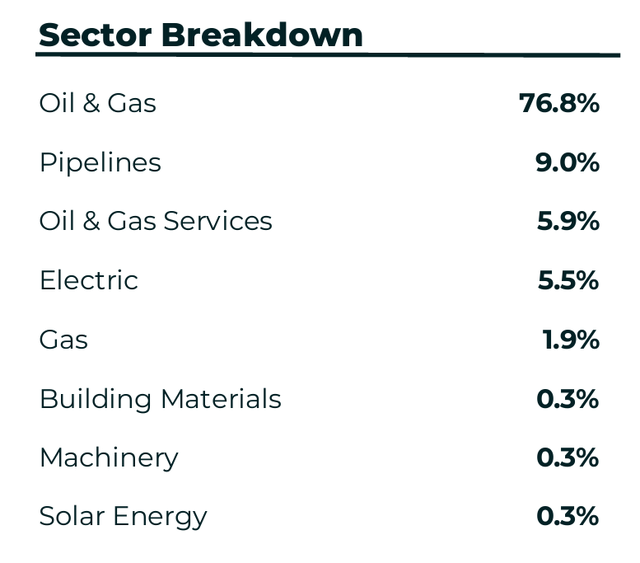

Figure 3 shows the DRLL ETF’s sub-sector allocation as of July 31, 2022 (note, this is from the most recent factsheet, which is months out of date).

Figure 3 – DRLL sector allocation (strivefunds.com)

Returns

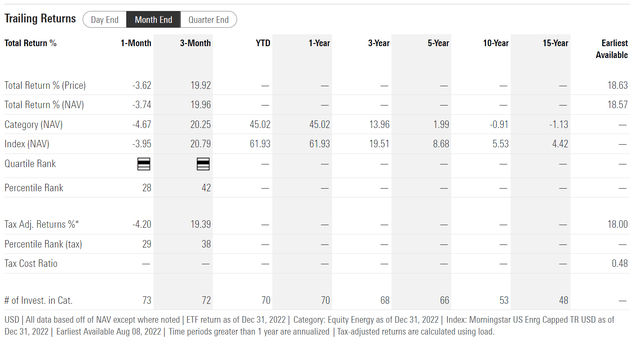

Since DRLL was only incepted on August 9, 2022, the fund has very limited returns history for analysis. The DRLL ETF returned 20.0% in the fourth quarter of 2022, a strong performance out of the gate (Figure 4).

Figure 4 – DRLL historical returns (morningstar.com)

Distribution & Yield

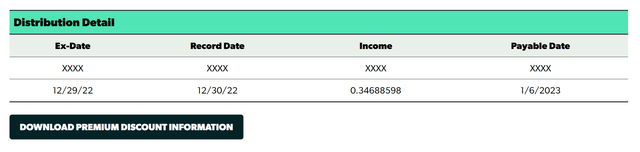

The DRLL ETF recently paid a $0.347 / share distribution (Figure 5). From the fund’s disclosures, it is unclear whether this distribution is a regular distribution of the fund’s income, or a special distribution of the fund’s 2022 capital gains.

Figure 5 – DRLL paid a distribution on January 6, 2023 (strivefunds.com)

Since energy companies tend to pay regular dividends and from figure 1 above, we can see the portfolio has a 30-Day SEC yield of 2.85%, investors should be on the lookout for some sort of regular distribution from DRLL.

DRLL vs. XLE

Whenever I see a new fund being launched, one of the things I want to focus on is how does the fund compare to existing products on the market? After reading DRLL’s prospectus, I do not see a compelling reason to own DRLL over existing energy ETFs in the market such as the Energy Select Sector SPDR ETF (XLE).

First, as mentioned above, although DRLL markets itself as differentiated with a mandate on ‘profits over politics’, nothing in the prospectus that I can see points to any differentiation. DRILL is designed passively tracks a float-adjusted capitalization weighted index.

Second, the XLE ETF has $41 billion in assets compared to DRLL’s $394 million, so XLE will have much better liquidity and tighter bid/ask spreads.

Third, the XLE ETF charges a 0.10% expense ratio vs. DRLL’s 0.41%.

Fourth, figure 6 shows the XLE’s top 10 holdings. It is virtually identical compared to DRLL’s top 10 holdings with the only difference being the position weights.

Figure 6 – XLE top 10 holdings (ssga.com)

Finally, perhaps most importantly, the DRLL ETF has underperformed the XLE ETF by 3.5% in the short time it has been in operation (Figure 7)

Figure 7 – DRLL has underperformed XLE by 3.5% since inception (Seeking Alpha)

Conclusion

The DRLL ETF claims to unlock value in the U.S. energy sector through superior corporate governance practices. However, nothing in the fund’s prospectus points to any differentiating ‘special sauce’. In fact, the DRLL ETF is designed to passively track a float-adjusted capitalization weighted index of the largest energy companies. I think investors should stick with a ‘tried and true’ investment vehicle like the XLE ETF for energy exposure.

Be the first to comment