Klaus Vedfelt

Earlier this week, I surmised that investors would shift their concerns from inflation, as price increases abate, to growth, as recession fears intensify. The beginnings of that shift were noticeable yesterday, as better-than-expected inflation data was neutralized by a weaker-than-expected manufacturing report from the Institute for Supply Management. As a result, the S&P 500 finished virtually unchanged on the day, which I call a win considering the monster rally we had the day before. Suddenly, poor economic news may no longer be good news for the market.

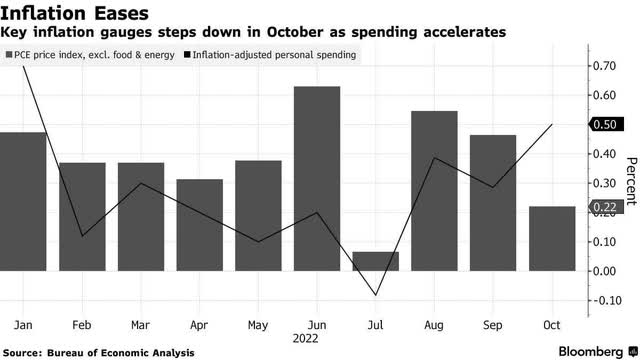

The Fed’s preferred measurement of inflation, which is the core personal consumption expenditures price index (PCE), rose 0.2% in October. That number excludes food and energy and was below the 0.5% from the previous month and 0.3% expected. On a year-over-year basis, the rate fell from 5.2% to 5%. I see the rate of price increases declining more rapidly as we begin the new year once the service sector starts to slow, commensurate with what we have seen in goods.

The personal income and spending numbers for October remained strong, despite a waning rate of inflation, with spending increasing 0.8%, which was in line with expectations and above the 0.6% in the prior month. On an inflation-adjusted basis, spending rose 0.5% and is up 3.1% on a three-month annualized basis. This is a strong start for the rate of economic growth in the fourth quarter. I think real spending growth is sustainable next year, primarily because the rate of inflation will fall to prop up the inflation-adjusted number. Therefore, we can see spending growth fade but remain positive on a real basis to prolong the expansion.

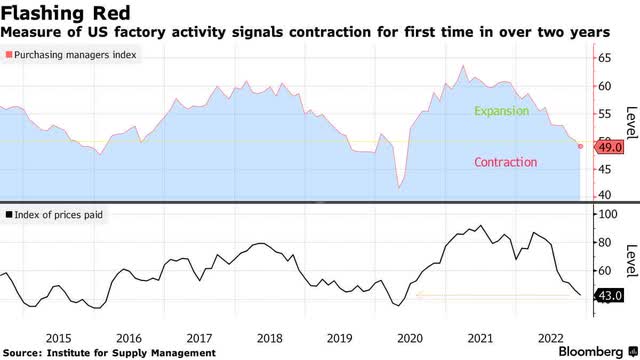

While this good news gave the market a lift at the open, the ISM purchasing managers survey for the manufacturing sector was not welcomed later in the morning, as it showed a contraction in activity for the first time since May 2020. The gauge fell from 50.2 to 49 in November, with 50 being the line of demarcation between expansion and contraction.

It should come as no surprise that the manufacturing sector is cooling. Consumers gorged on durable goods after the pandemic, retailers loaded up on inventories, and factories were humming to catch up. Now consumers have shifted their spending to services, leaving retailers with bloated inventories that they must work off. As a result, new orders and business activity for manufacturing companies are in retreat. This is another example of the unevenness of the post-pandemic recovery, but it does not mean the economy is in recession, as was the case during prior contractionary periods for the index.

The silver lining in the index is that the price paid by manufacturers for materials fell for the eighth month in a row, and the input price sub-index shrank at its fastest pace since May 2020. This is already showing up in goods prices, which is what the Fed wants to see. We cannot see price increases abate without much weaker rates of growth, and that is what is happening in the manufacturing sector.

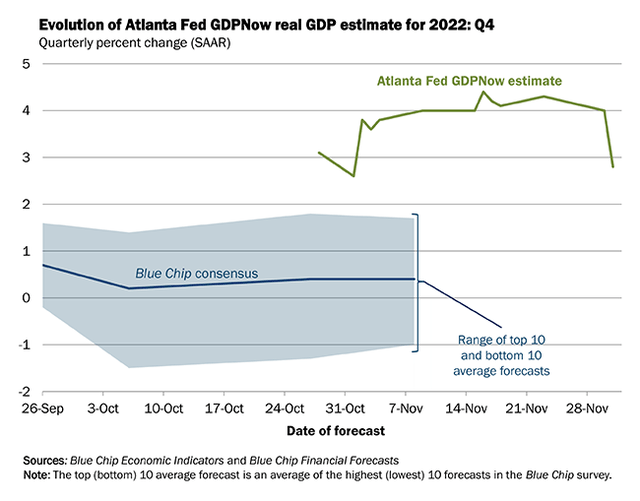

As a result of this report, the Atlanta Fed’s GDP Now model lowered its estimate for the rate of economic growth in the fourth quarter from 4.3% to 2.8%, which also takes pressure off the Fed to tighten more aggressively. Today’s employment report will hopefully reflect a softening in demand for labor, led by the manufacturing sector.

Be the first to comment