Vertigo3d/E+ via Getty Images

A Strong REIT Hit Harder Than Its Peers

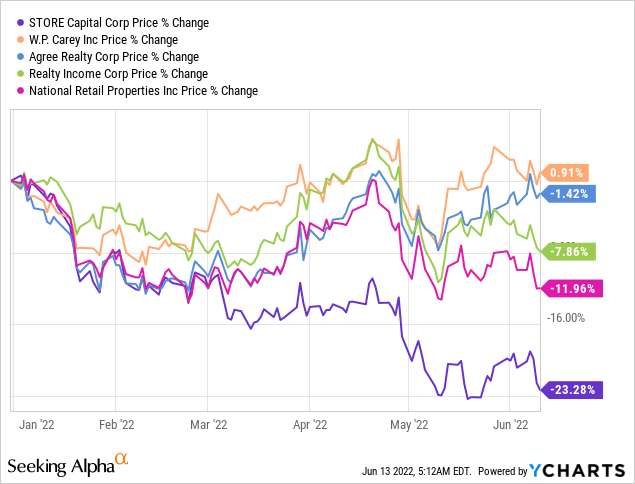

STORE Capital (NYSE:STOR) is a triple-net lease REIT with over 2,800 properties across 49 states in the US. Last year, I had endorsed STOR due to its strong business and portfolio fundamentals but cautioned investors on entering as it was trading close to fair value. YTD, STOR has seen its stock price fall by over 23%, underperforming all of its major triple-net lease peers. However, STOR’s fundamentals remain strong and their business continues to grow at a steady pace. In this article, I will be highlighting why I believe STOR is currently undervalued and why it is a good defensive stock to own in the uncertain microenvironment we live in today. For a deep dive into STOR’s fundamentals, you can read my previous article here: STORE Capital: A Great REIT To Keep On Your Watchlist

A Quick Summary Of STOR’s Strengths

Before moving on, I would provide a quick recap as to why I view STOR as a fundamentally strong triple-net lease REIT.

Well Diversified

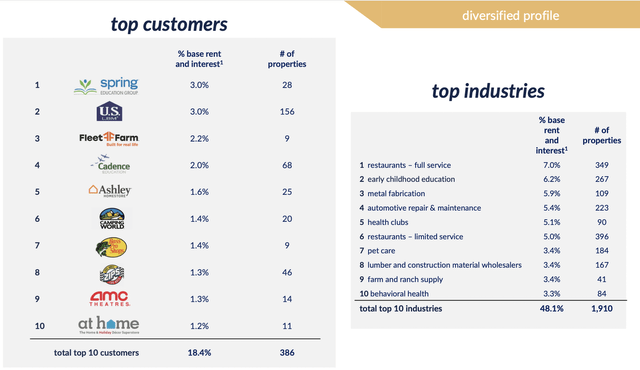

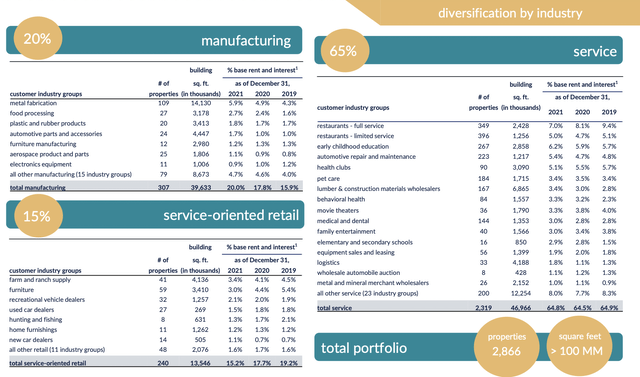

First, STOR is extremely well diversified. In terms of customers, the top 10 customers account for 18% of rent whereas the largest customer only contributes 3%. Industry wise, no particular industry accounts for more than 7% of rent and STOR’s tenants are well spread across the US with no state contributing more than 13% of rent.

Diversified Tenant Base Of STORE Capital (STORE Capital Investor Presentation)

Disciplined Underwriting

Next, STOR’s management adopts a very disciplined and conservative underwriting methodology, by assessing individual unit-level profitability. This allows STOR to gain a deeper understanding of each businesses’ operations and needs to better ascertain their financial position. In FY21, STOR’s average unit FCCR, which measures a business’s coverage over its fixed costs such as rent increased to 3.6x from 3.0x pre-COVID, meaning that its tenants can cover their rent expenses by over 3.6 times based on EBITDAR. This reinforces STOR’s strong underwriting standards which have continued to improve even in a pandemic.

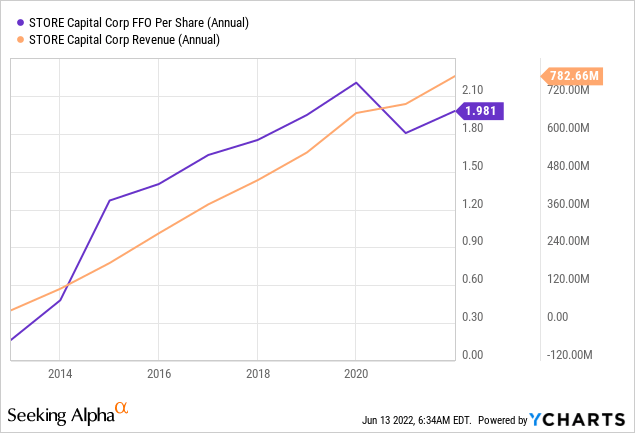

Steady Growth

STOR focuses on organic growth with over 80% of new leases derived from direct origination. Even through the pandemic, STOR has been able to continue growing its portfolio size which amounts to $13 billion today. This has resulted in steady revenue growth since inception, as well as FFO/share which has increased until the pandemic and is currently recovering well.

Dividend Growth

With strong revenue & FFO growth, STOR has also been growing its dividend at 6.2% per annum since inception. This reflects the highest growth rate amount developed among triple-net lease peers and STOR has a comfortable 74% AFFO payout ratio which provides downside protection and the potential for increases in future.

STOR Provides Downside Inflationary Protection

With inflationary concerns running rampant among investors, STOR could be a good defensive position as it provides downside protection for inflation. First, rental revenues can be considered recurring hence investors need not worry about decreasing demand and income which might be a bigger concern for consumer related stocks.

Next, STOR also has CPI-tied rent escalators for 85% of its contracts. Although recently signed rent escalations are capped in the 1.8% to 1.9% range which definitely does not beat high inflation levels currently seen, this still means that STOR will be able to grow revenue by at least 1.8% in the coming year without doing anything else. In fact, STOR itself has indicated that lease escalations are expected to lead to at least a 2.5% increase in AFFO in the upcoming year. With reinvestment returns of around 3%, this means that STOR will be able to generate >5% of internal returns, which serves as a good hedge against inflation.

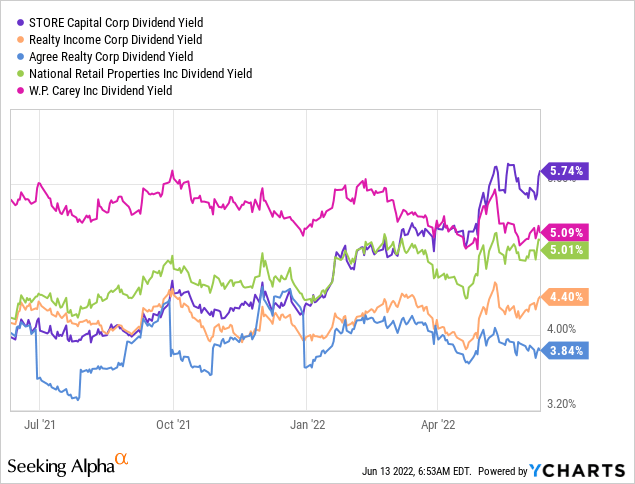

Coupled with an extremely attractive dividend yield of 5.8% currently, this gives investors a minimum, almost “guaranteed” return of 11%, which slightly beats inflation and will be much welcomed in today’s uncertain investing landscape. Additionally, STOR’s dividend yield is currently the highest among its peers, and a revaluation to its normal range of 4-5% will provide greater capital appreciation potential compared to its competitors.

STOR Is Well Positioned To Withstand A Recession

Another concern surrounding the market would be the possibility of an imminent recession. Similarly due to the reasons mentioned above, I believe STOR will be able to provide above average returns even in an economic downturn. However, let’s now assess STOR from a business perspective to show why they will be able to hold fort and even thrive in a recession.

- STOR’s conservative underwriting means that their tenants can lose up to 40-50% of revenue on average before having troubles to pay their rents

- The strength of STOR’s tenants have been shown during the COVID pandemic as occupancy from 2019 to 2021 remained flat and very high at 99.5%

- The weighted average lease length is >13 years, with only 0.5% of leases expiring over the next year. Hence we can expect recurring revenue to remain steady even in a recession

- STOR’s financial position is strong as reflected in their investment-grade rated debt offerings

Finally, when taking a closer look into STOR’s tenant breakdown by industry, I notice that many of them are defensive in nature and unlikely to experience revenue drops in the high tens of percent. More volatile categories would include restaurants, theatres, entertainment venues, furnishing and new car dealers – in all contributing only 30% of rent. Hence, I would aspect the bulk of STOR’s tenants to tide through a recession well and the management would consequently be able to work out arrangements with poorer performing tenants just like during the pandemic.

STORE Capital Tenant Breakdown By Industry (STORE Capital Investor Relations)

STOR’s Philosophy Remains The Same Despite Leadership Change

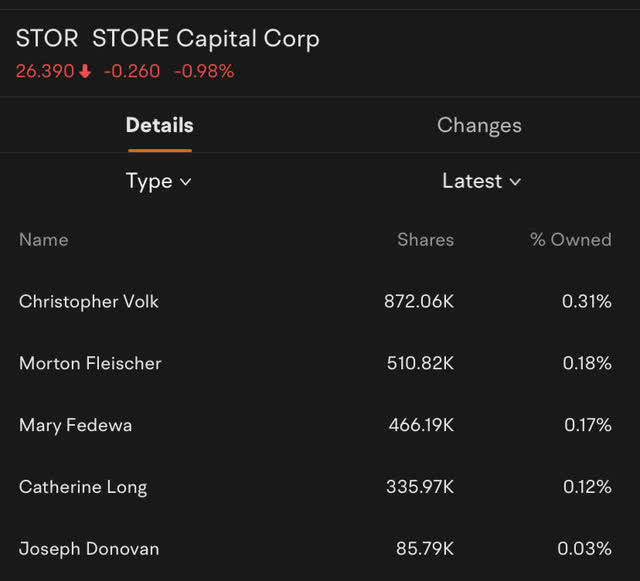

Another specific concern to STORE would be the sudden departure of co-founder Christopher Volk, and this caught many investors off-guard. However, since we are unlikely to find out the real reason why, we should take a forward looking approach.

New CEO Mary Fedewa is also a co-founder of STOR and has similar experiences and successes as Volk working on previous triple-net lease projects. Additionally, there have been no other departure of important leadership figures, signalling that there is unlikely any major feud or instability within the management. Next, Fedewa also has considerable ownership of STOR’s stock, around half that of Volk and other senior management has also been buying shares over the past few months, suggesting that they view the stock as undervalued.

STORE Capital Insider Ownership (MooMoo )

I believe that investor confidence will gradually return over the next quarters should STOR continue to report strong operational results while still aligning with their conservative underwriting philosophy. So far, there has been no sign that the company is deviating from this path.

Valuation

Net Asset Value

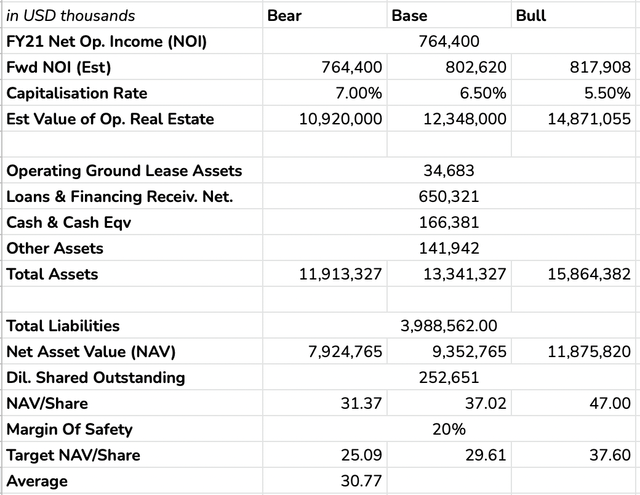

First, I conducted a NAV valuation of STOR using its FY21 NOI and a projected 0%, 5% and 7% growth rate where the base case is aligned to their internal growth rate. Capitalisation rates used remain the same as in my previous articles.

STORE Capital Net Asset Value Valuation (Author’s calculations)

With a margin of safety of 20%, I obtain an average entry price of $30.77 which is much higher than today’s share price. Excluding the MOS, an average target price would be $38.46.

Dividend Discount Model

To quickly sense check my NAV valuation, I have done a very simple DDM. I grew dividend yield at 7% from Y1 to Y5 which is reasonable as STOR still has room to lift its payout ratio. Subsequently from Y6 to Y10, growth will taper to 5% and eventually to 2% for the terminal growth rate.

On a 9% discount rate (15% return with 6% dividend), this gives a $32.27 target price, and a target entry at $25.81 with a 20% MOS.

Blended Average

Combining both methodologies, I reach a TP of $35.37, representing a 36% upside from a price of $26. With my 20% MOS, a good entry price would be $28.3, which STOR is currently trading below.

Conclusion

In all, STOR remains a fundamentally strong triple-net lease REIT that is undervalued by over 36%. Its well diversified and protected portfolio, strong business model and internal growth will help it weather inflationary and recessionary troubles that lie ahead, all while providing steady recurring rental revenue for investors along with an attractive 6% dividend yield. Hence, for investors looking for a defensive position, STOR stands out as a solid company.

Be the first to comment