marcoventuriniautieri/iStock via Getty Images

Thesis

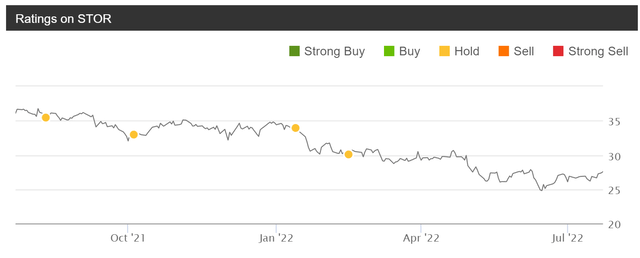

Due to past work experiences, I have been following and writing about a few REIT stocks periodically. And STORE Capital (NYSE:STOR) is one of them. As you can see from the chart below, I have been maintaining a lukewarm feeling about it in the past. I wrote several articles in the past year to explain why it is a good business, but I felt it was overvalued.

Recently, it caught my attention again as it showed up on my screening because its dividend yield surged to a record level since its IPO. Usually, when this happens, there must be signs that the business cannot sustain its dividends in the near future. However, after I take a closer look at its finances, it is not the case at all. As a matter of fact, its dividend safety and financial strength are almost near a peak level in a decade as you will see next.

Peak level yield

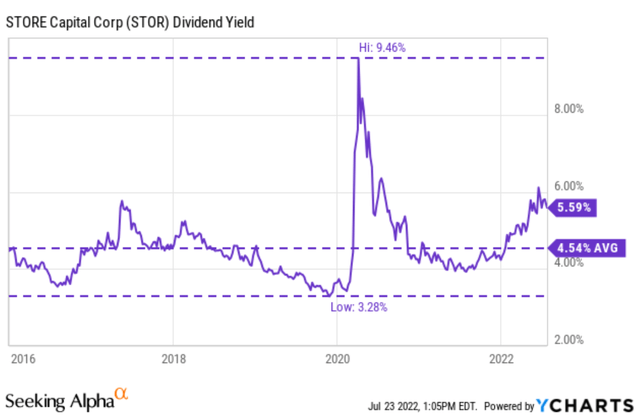

The dividend yield for STOR has been quite stable and fluctuated in a very narrow range if you exclude the outlier data points during the 2020 COVID crash. And this is of course a good sign for any stable and profitable business, especially for a REIT business because it pays out most of the earnings as dividends. As you can see, its yield has been stable in a range between about 3.28% to 5.9% with an average of 4.54%.

Therefore, its current yield of 5.59% is not only far above its long-term average (by a whopping 23%) but also near the peak level since its IPO.

As mentioned above, the next logical step is to check if there are reasons to worry about its dividend sustainability in the near future as we are going to do in the next section immediately.

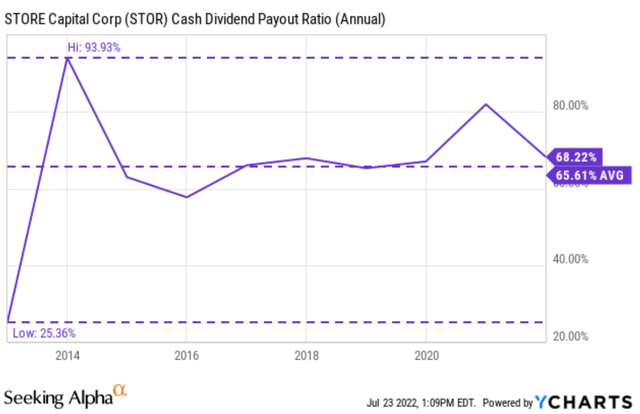

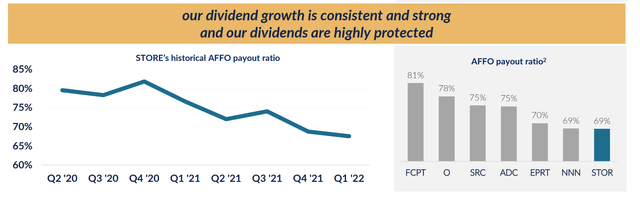

Peak level dividend safety

As you can see from the following chart, its dividend safety is actually totally normal relative to its historical record and quite conservative for REIT business (see chart 2 below). Here you need to again ignore the outlier data points in 2013, while its dividends have been stabilized yet. After that, its cash payout ratio has been in a stable range of 60% to 80% with a long-term average of 65.6%. And its current payout ratio of 68.2% is not only close to its historical average, but also towards the lower end of the historical spectrum.

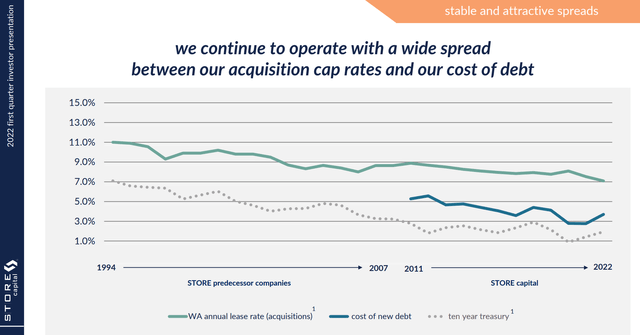

Looking forward, thanks to its pricing power, I expect it to continue a healthy yield spread (more on this in the next section) above treasury rates and borrowing rates and maintain profit sustainability as commented by CEO Mary Fedewa (abridged and emphases added by me):

With pricing power on the front end and our disciplined underwriting process, which includes a deep dive into both the credit of the customer as well as the value of the real estate, we are able to make accretive acquisitions with wide spreads, resulting in attractive risk-adjusted returns. We also have strong internal growth of 5% between our annual rent escalations, which average 1.8% on the portfolio, our retained cash flow from our low dividend payout ratio, which was 67.5% this quarter, and proceeds from dispositions.

The financing flexibility that we have built over the last decade positions us well to fund our growing pipeline of acquisitions with both debt and equity options, which allow us to optimize our cost of capital to generate attractive spreads.

Seeking Alpha STOR earnings report

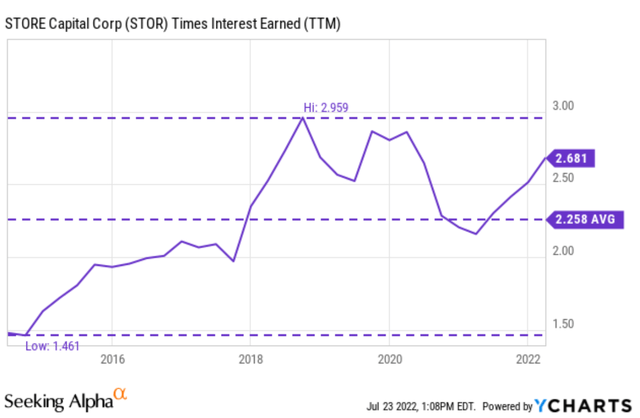

Peak level balance sheet

The next thing to check is any deterioration of the balance sheet. And the answer is no again. Its financial strength is currently near a peak level as you can see from the following interest coverage ratio. Its Times Interest Earned ratio has fluctuated from about a low of 1.46x to as high as 2.96x in the past. The current value is about 2.68x, close to its peak level. The root causes are the pricing power and disciplined acquisition to ensure a wide yield spread as aforementioned (and shown in chart 2 below). the leverage ratio in terms of debt-to-EBITDA is around 5.7x and is also toward the end of the target range.

Going forward, the business has ample liquidity. as commented by CFO Sherry Rexroad (abridged and emphases added by me). The long-term debt has an average maturity of 7 years at a modest rate of 3.9% and hence won’t cause any short-term issues.

We closed the quarter with a strong balance sheet and ample access to capital, including $39 million in cash, approximately $370 million available under our ATM program and the borrowing capacity available under our revolving credit facility. At March 31, we had $4.2 billion of long-term fixed-rate debt outstanding with a weighted average maturity of just under 7 years, and as noted earlier, a weighted average interest rate of 3.9%. Leverage is at the low end of our target range of 5.7x net debt-to-EBITDA on a run rate basis or under 40% on a net debt-to-portfolio cost basis.

Seeking Alpha STOR earnings report

Final thoughts and risks

It seems that the market is overthinking the 5.6% yield from STOR. It is indeed suspiciously high for a stable REIT like STOR, not only above its long-term average by a whopping 23% but also near its peak level since IPO. However, its dividend safety is actually totally normal relative to its historical record and quite conservative compared to other peers. And I see no issues with profitability sustainability or balance sheet.

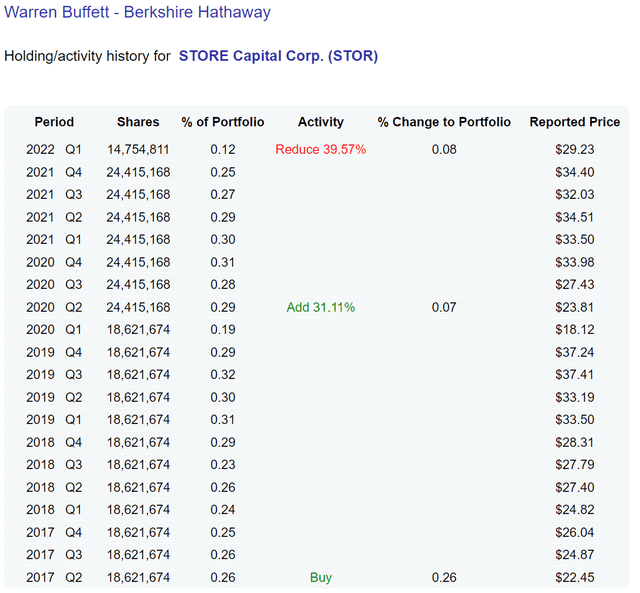

There are a few risks worth mentioning though. STOR has tenants who can be directly exposed to the pandemic, such as restaurants, theaters, and health clubs. Also, STOR’s founder and executive chairman, Chris Volk, has recently resigned as the chairman. Volk has been a successful series entrepreneur. Berkshire Hathaway’s 2022 Q1 disclosure (reported after Volk’s departure) showed a trimming of almost 40% in its STOR positions. I am not trying to hint at any causal relationship here simply because one thing happened before the other thing. But given Buffett’s investing style, I think Volk must be a consideration in Buffett’s decision to invest in STOR in the first place.

Be the first to comment