hroe/iStock via Getty Images

If 2022 was about monetary policy tightening, then 2023 should be about the cumulative effects of tightening and slowing global growth. Inflation expectations are now heading lower, and while it may sound positive at first, stocks benefit from high inflation as it helps to boost sales and earnings growth. However, as inflation cools, sales and earnings growth will also fall, which will work to compress stock PE ratios more.

Additionally, rates are likely to remain elevated as long as the monetary policy stays restrictive, which is what the Fed and many other central banks want. Stocks have moved lower, and based on the Fed’s latest commentary, rates are likely to increase. For that matter, the Fed and the ECB have indicated they want financial conditions to tighten, which happens when rates rise, and stock prices fall.

Rates May Be On The Rise Again

The critical driver in stocks falling in 2022 was rising rates. Currently, rates are rising again, and they appear to be breaking out of their current trading ranges. It doesn’t apply only to rates in the US but globally and will weigh heavily on stocks as we head into year-end and the new year.

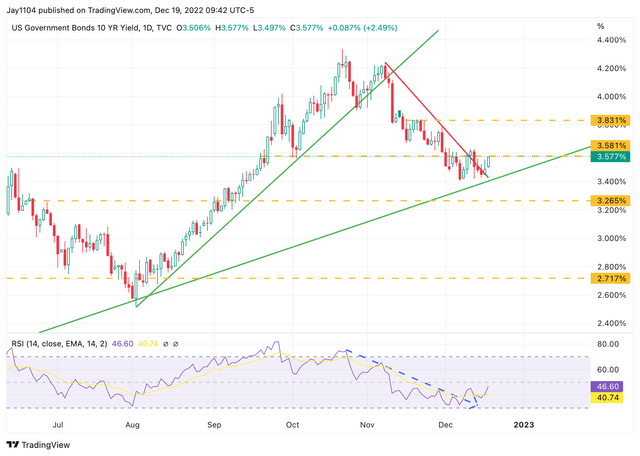

The most significant moves may occur on the longer end of the yield curve and are most notable on the 10 and 30 years Treasury rates. The ten and 30-year rates have shown a shift in momentum from lower to higher. The 10-year yield and the RSI have broken important downtrends, which could result in the 10-year rise back to roughly 3.8%.

TradingView

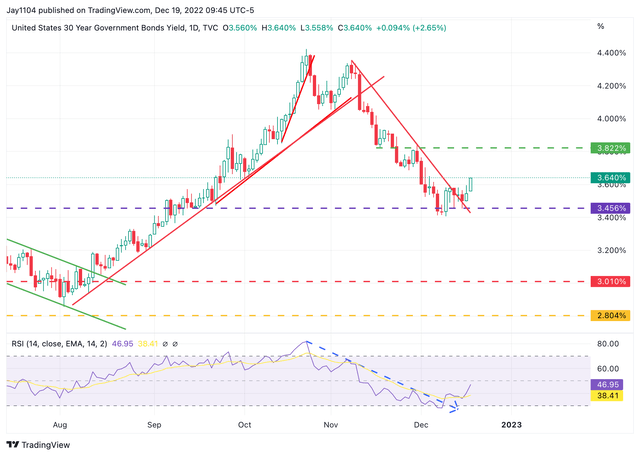

Additionally, we have seen the 30-year show shifting signs of momentum. The relative strength index for the 30-year also has a significant downtrend. It would signal that momentum is shifting from lower to higher rates and that the 30-year could rise to roughly 3.8%.

TradingView

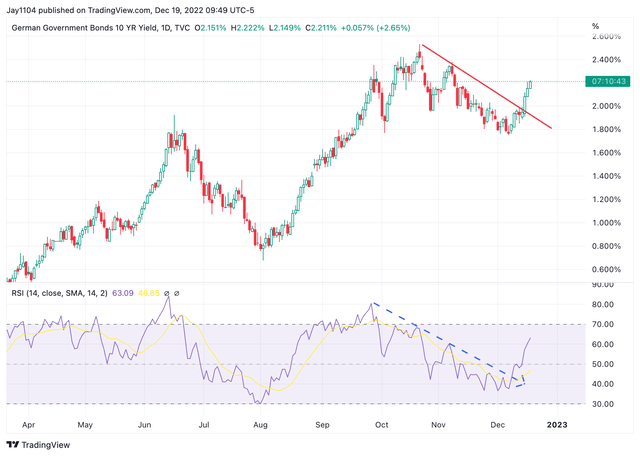

But the move higher in US rates is not an isolated event because the 10-year German rate has also started to move higher and shows many of the same characteristics as those in the US.

TradingView

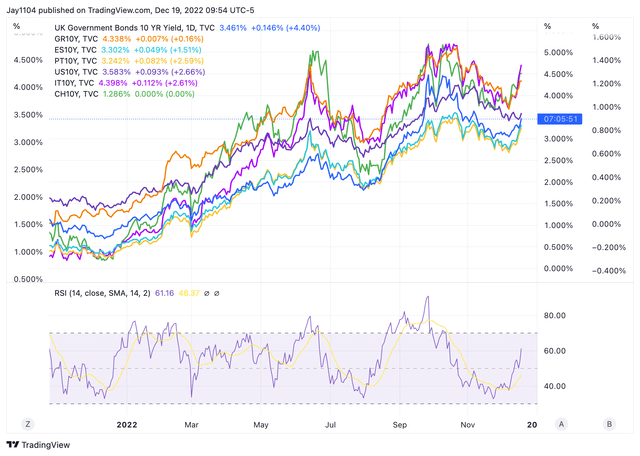

Similar moves are also occurring in Italy, Portugal, Spain, Greece, Britain, and Switzerland.

TradingView

More importantly, it indicates rates are moving together due to central bank policy worldwide, not just the Fed. In essence, central banks are working together to globally tighten financial conditions to help bring down the rate of inflation and slow global growth.

Slow Growth Rates

Whether or not rates return to their highs may not even matter. The cumulative effects of global monetary policy will have the most significant impact on equity valuations and, more importantly, global growth.

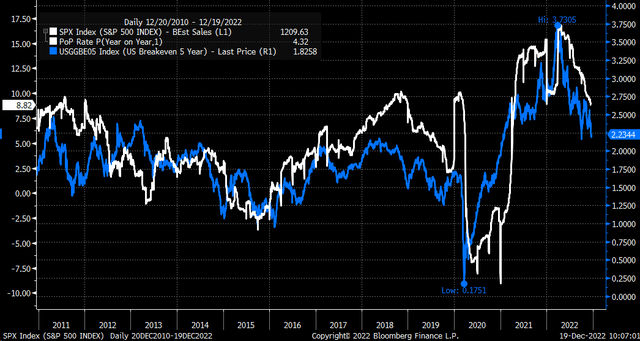

Those growth expectations are also falling because market-based breakeven inflation expectations are declining. These expectations are based on the difference between nominal and TIP rates. The 5-Yr inflation breakeven has fallen to 2.23%, which may sound good because expectations are falling for inflation. But the bad part is that S&P 500 sales growth also benefits from rising inflation. So when inflation expectations are falling, it also means that sales growth for stocks is also likely to fall.

Bloomberg

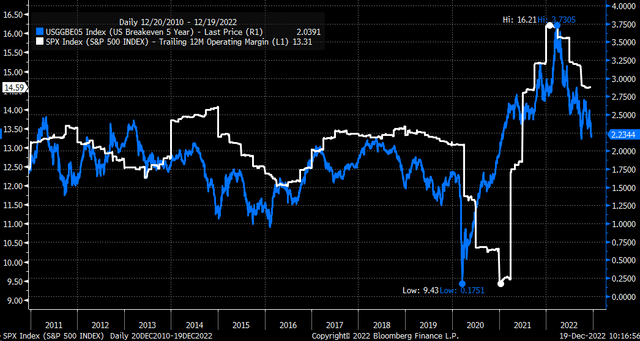

The S&P 500 and its companies benefited greatly from the inflation of the past two years because it resulted in tremendous sales growth and earnings growth as margins expanded. But as sales slow and costs remain elevated, operating margins should begin to shrink, negatively impacting earnings.

Bloomberg

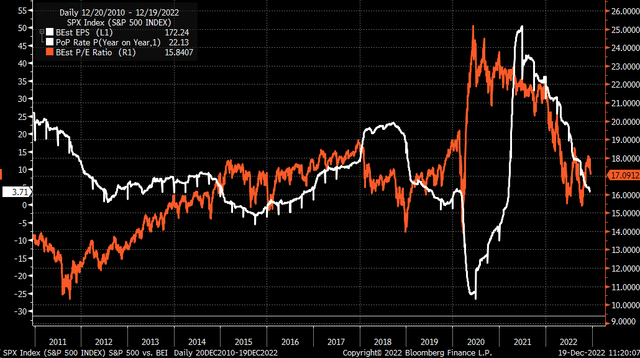

PE multiples will fall further, getting a double whammy of higher interest rates and lower growth rates. PE ratios of the S&P 500 tend to move in anticipation of earnings growth rates. At this point, the PE ratio of the S&P 500 has been moving in a range between 16 and 18 since May, perhaps waiting to see where the next leg of earnings growth goes. At this point, the trend in earnings growth is lower.

Bloomberg

Rates moving higher in 2022 will carry into 2023. But the big difference in 2023 is that rates continue to move higher as central banks tighten, global growth will slow, and as growth slows, it will drag revenue and earnings for stocks down, ultimately leading to lower valuations and lower prices for stocks.

Be the first to comment