Talaj/iStock via Getty Images

Comments from Fed Governor Lael Brainard drove long-term interest rates sharply higher yesterday with the 10-year Treasury yield climbing to 2.55%, which is a new high not seen since May 2019. That sent stock prices lower, led by growth stocks, as the Nasdaq Composite fell more than 2%. What spooked investors is that Brainard emphasized that the Fed would be reducing the size of its $9 trillion balance sheet “at a rapid pace” as soon as its May meeting, which is a far more aggressive statement than what we heard from Chairman Powell following the Fed’s March meeting. It is too difficult to tell how much upward pressure balance sheet runoff will have on long-term rates, but it is clear that the anticipation has already had a huge impact. Still, I think this economy can weather higher borrowing costs without undermining the expansion.

finviz

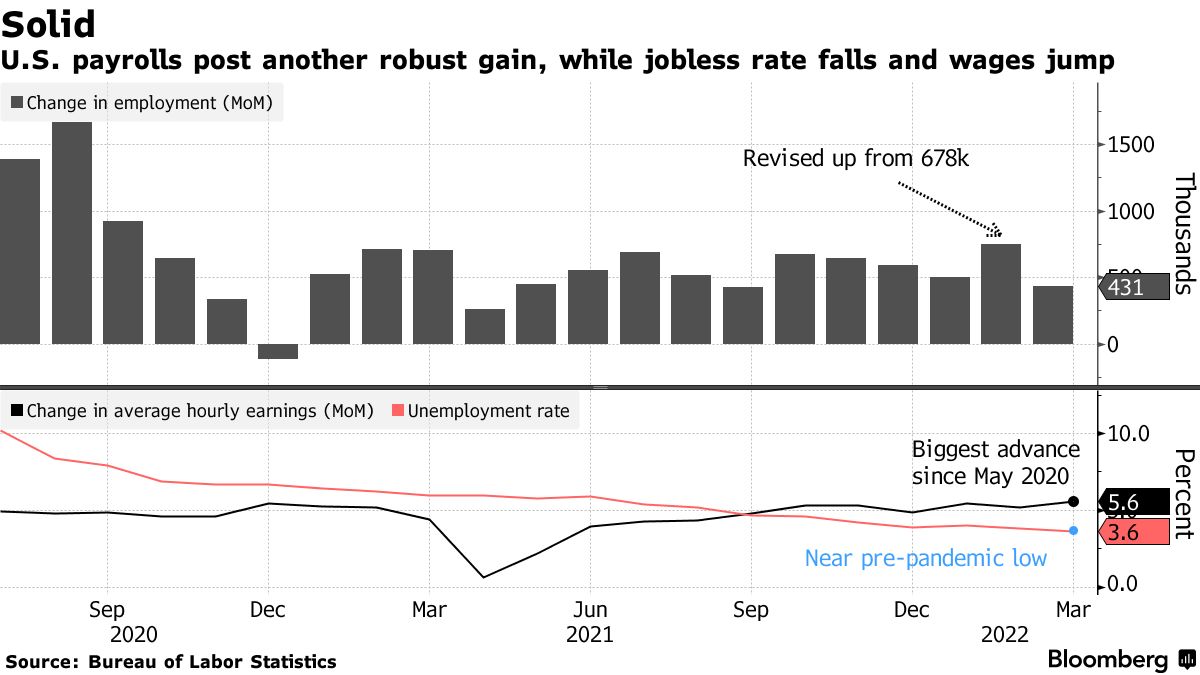

Last Friday’s jobs report reflects that fact. Not only did the economy add nearly 500k jobs with the unemployment rate falling to a near pre-pandemic low of 3.6%, but the participation rate is increasing, which should alleviate worker shortages that are helping to drive prices higher. Wages posted year-over-year growth of 5.6%, which is below the 6.4% increase in the Personal Consumption Expenditures price index (PCE), but that does not account for job gains. The total amount of wages has grown more than the PCE if we account for the 1.7 million workers that have been added to the labor force.

Bloomberg

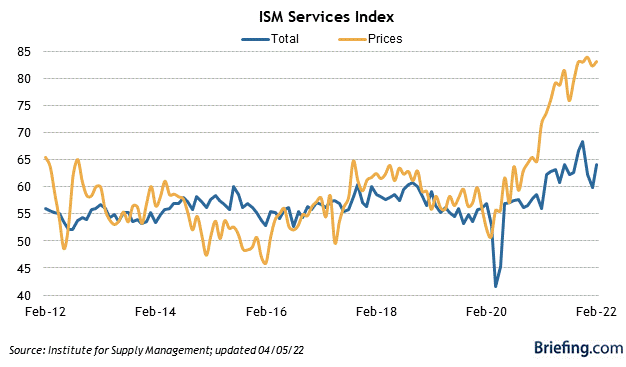

The strength of this economy can also be seen in yesterday’s Institute for Supply Management Services Index, which rose to 58.3 in March from 56.5 in February. Readings above 50 indicating expansion. The service sector is leading a solid advance in economic growth to close out the first quarter now that the economic restrictions from the pandemic are behind us. Granted, prices paid by businesses are at record highs, but I continue to believe that we are near peaks for many producer prices, which will result in an improving rate of change as the year wears on.

briefing.com

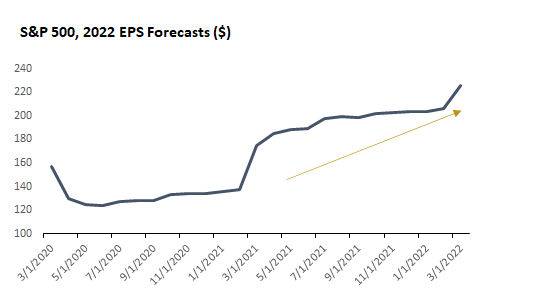

Corporate earnings growth still looks strong as we enter spring. According to data aggregator FactSet, the consensus forecast for S&P 500 earnings in the first quarter has seen a modest decline since the beginning of the year ($52.21 to $51.83), but there is nothing unusual about Wall Street trimming estimates for the quarter just ended to lower the bar for the companies they follow. I still believe the Q1 number is too low. More importantly, analysts have increased the estimate for 2022 by 2% from $223.43 to $227.80. Additionally, GDP estimates for the first quarter have been increasing over the past month, finishing close to 2%, which is near the highest level since we started the year. That also bodes well for corporate profits. The positive rates of change in estimates for earnings and GDP growth should help buffer the pressure on valuations from rising interest rates, and it certainly runs counter to those arguing a recession is on the horizon.

Edward Jones

This year’s rapid rise in long-term rates will undoubtedly weigh on home and auto sales, but the growth in demand for services should help offset any weakness. It is also important to remember that the rise in long-term rates is the best cure for the rise in long-term rates. Fed rhetoric has done more to tighten monetary conditions than anything else up to this point, as we have only had one 25-basis-point rate increase to date. I think market expectations are overshooting what the Fed will actually do by the end of this year.

There is far too much negativity in markets today, which is understandable considering the macroeconomic and geopolitical backdrop. The fundamentals supporting the economy, as well as consumer and corporate balance sheets, remains extremely strong.

Technical Picture

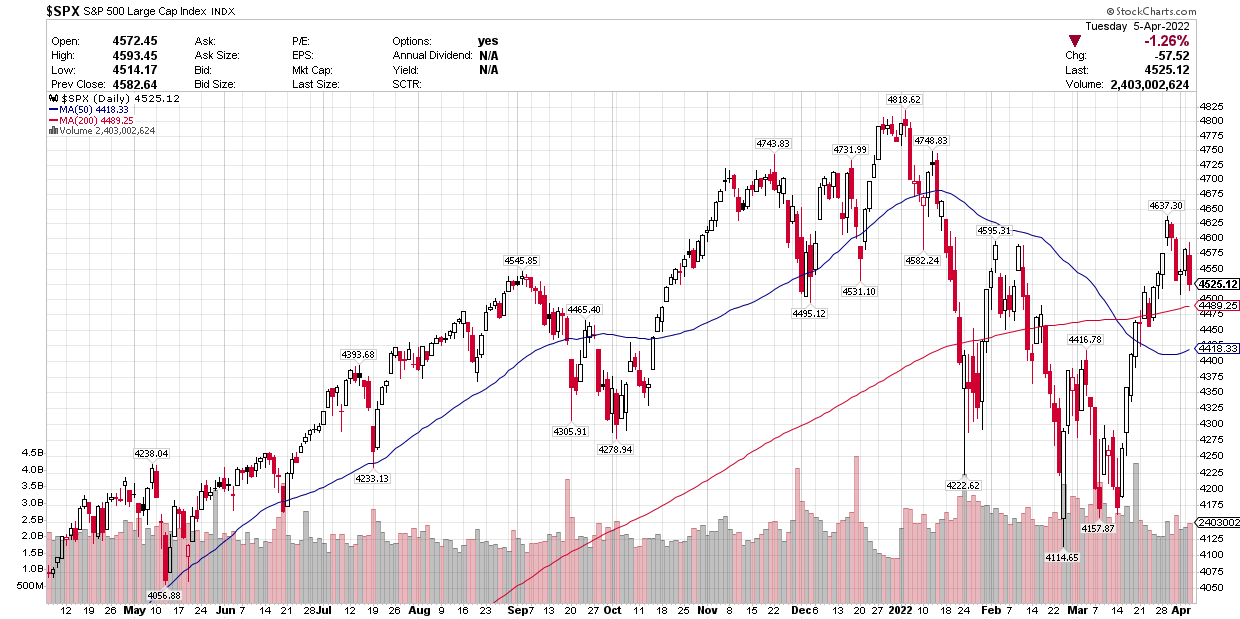

After a tremendous rebound off the correction lows in the S&P 500, the index looks to be consolidating the gains with a pullback to test its 200-day moving average at 4,490.

StockCharts

Be the first to comment