JazzIRT

Thesis: Defensive ~6% Yield

Universal Health Realty Income Trust (NYSE:UHT) is a defensive healthcare REIT with a 35+ year dividend growth streak. Its portfolio of mostly triple-net leased medical office buildings, hospitals, and other healthcare facilities have survived four recessions and multiple interest rate hiking cycles.

After reporting decent third quarter earnings, UHT has enjoyed a nice rebound. As we’ll discuss below, this rebound isn’t so much because of the strength of earnings but rather because of the overdone negativity priced in to the stock before earnings.

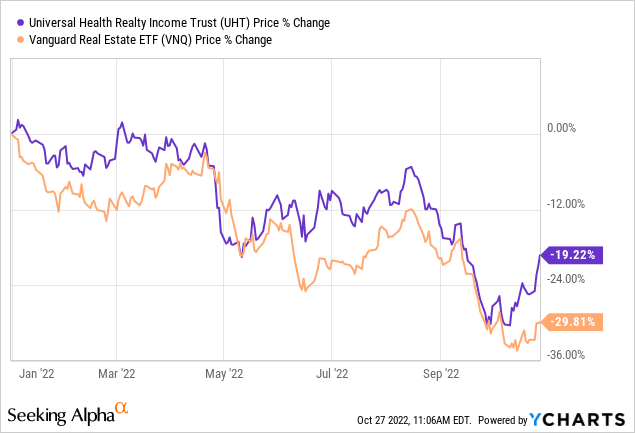

Even so, UHT was slightly outperforming the broader real estate index (VNQ) this year even before Q3 earnings were released.

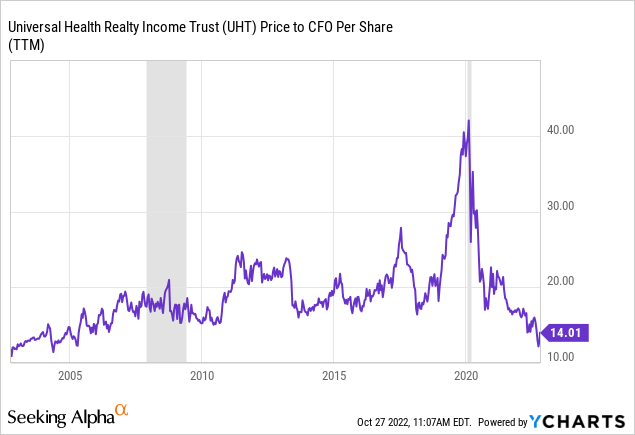

Now, even after a rebound following UHT’s year-to-date selloff, the REIT remains near its cheapest level by price to cash flow since the mid-2000s.

Using my estimate of full-year 2022 FFO per share of $3.50, UHT is now trading at around a 13.7x FFO multiple. But I believe UHT’s fair value is at least 15x FFO, giving the REIT about 10% upside on top of a nearly 6% yield and low single-digit growth.

UHT still makes a good buy after its rebound. The dividend looks safe even with the challenges of vacancies and interest rate headwinds.

Overview Of Universal Health Realty

UHT started as a spinoff of the real estate assets of Universal Health Services (UHS) in the mid-1980s. To this day, UHS continues to externally manage UHT for a reasonable management fee of 0.7% of average real estate asset value. Plus, UHS maintains 5.7% ownership of UHT, and UHS founder Alan B. Miller also owns slightly over 1% of UHT stock.

Indeed, as recently as September 2022, Miller purchased 4,000 more UHT shares at an average price of $48.61 apiece.

I stress this upfront because many investors will immediately stop considering UHT as an investment when they hear about its external management structure. As far as externally managed companies go, this one has a relatively high degree of alignment of interests.

The biggest complaint I have about UHT’s external management is the manager’s apparent disinterest in performing much marketing of the stock, despite its strengths. UHT does not release investor presentations or supplemental financial documents at its quarterly releases, which leads me to believe that management’s time and focus is a lot more on the core healthcare operations side than the real estate side.

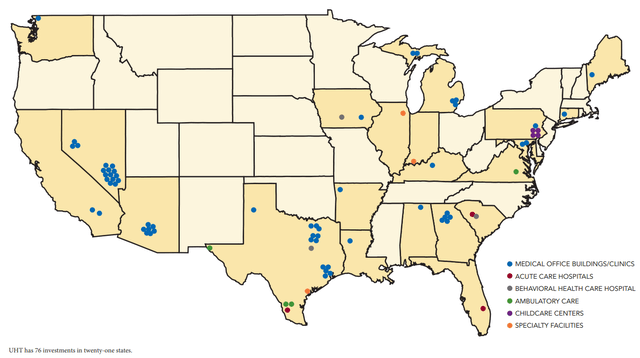

The REIT owns about 80 properties across the country, with a disproportionately high weighting to Sunbelt states like Texas, Nevada, Arizona, and Georgia.

UHT Website

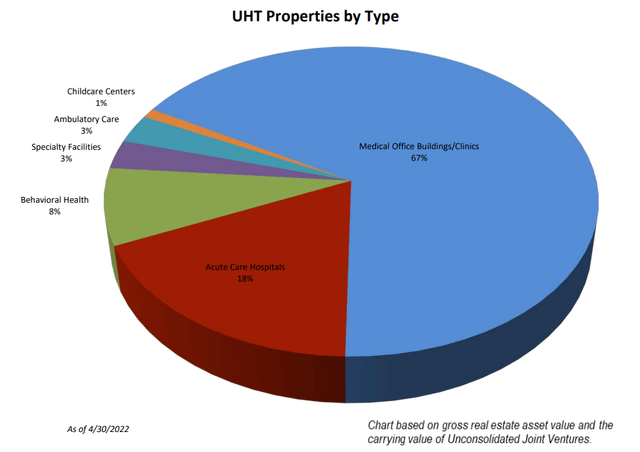

About two-thirds of the portfolio is made up of medical office buildings (“MOBs”) or outpatient clinics. Another 18% is in hospitals, with the remainder spread across other types of healthcare facilities.

UHT Website

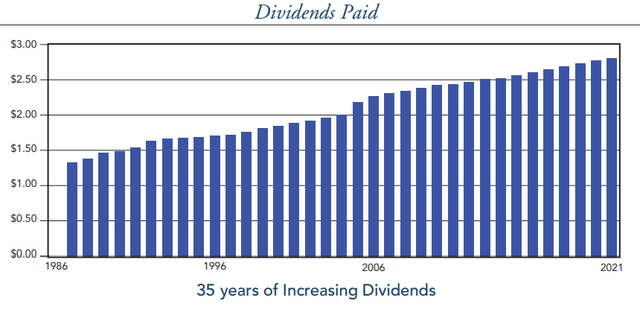

Though UHT is a very slow-growing REIT, it is also consistent. The dividend, which grows at a rate of about 1.5% annually, has been raised for 36 consecutive years. Not many REITs can boast such a long streak!

UHT 2021 Annual Report

This fact alone should severely blunt the criticisms of UHT’s external management structure. Those external managers have achieved a dividend growth streak that only a few other REITs have accomplished.

Probably the biggest issue the market has with UHT is its balance sheet. Around 85% of UHT’s ~$340.5 million in debt is borrowings on its floating rate credit facility. That floating rate is equal to LIBOR plus a margin of 1.2%. Given where LIBOR rates are right now, I estimate that currently (as of October 26th) puts UHT’s effective credit facility interest rate at about 5.6%.

Obviously, that is high. But it isn’t catastrophically high.

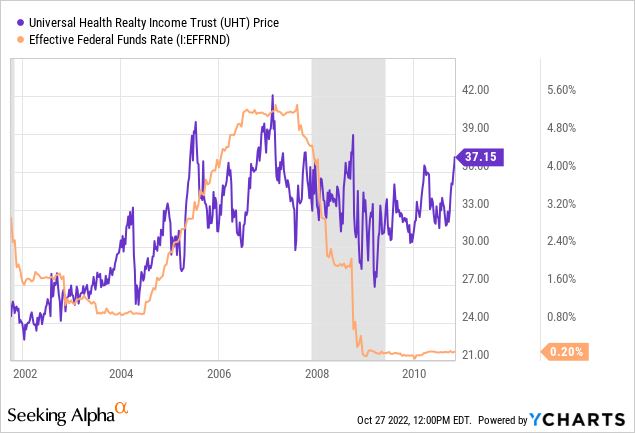

As I explained in “UHT: The Market Overreacted To Floating Rate Debt,” UHT has gone through interest rate hiking cycles with similar percentages of its debt in its floating rate credit facility and survived with relatively little pain. For example, see UHT’s performance during the mid-2000s rate hiking cycle:

Of course, stock price does not equal fundamental performance. But even looking at fundamentals, UHT wasn’t that impacted by the interest rate headwind during those years. We see interest expense spiking from 2003 to 2005 before management began making moves to lower interest expense through hedging techniques (shifting ongoing interest expenses to one-time, upfront fees).

| Year | FFO Per Share | Dividend | Interest Expense |

| 2003 | $2.56 | $1.96 | $2.49m |

| 2004 | $2.64 | $2.00 | $3.36m |

| 2005 | $2.47 | $2.18 | $3.5m |

| 2006 | $2.44 | $2.26 | $2.48m |

| 2007 | $2.45 | $2.30 | $1.75m |

Note that FFO per share did fall during these years, enough so that the payout ratio reached 94% in 2007. But UHT is nowhere near that high of a payout ratio today. In the first nine months of 2022, UHT’s payout ratio has been 80.5%.

Third Quarter Earnings Update

In Q3 2022, UHT’s FFO per share dropped about 6.5% year-over-year from $0.92 in last year’s Q3 to $0.86 in this year’s Q3.

Most of that drop in FFO per share pertains to a newly vacant specialty hospital in Chicago, wherein the tenant vacated at the end of 2021. But increased interest expenses also played a smaller yet still significant role in the drop. Here’s how the various factors at play impacted results:

- $0.05 per share drop due to vacant Chicago hospital

- $0.04 per share drop due to interest rate expense increase

- $0.02 per share increase due to purchase of a property from UHS

- $0.01 per share increase due to fair market value rent increase for Wellington Regional Medical Center in South Florida

- $0.02 per share increase from NOI increases at various other properties

The average effective interest rate on UHT’s total debt based on annualized Q3 interest expenses is about 3.31%. Compare that to an average effective interest rate of 2.74% in Q3 2021.

The good news is that UHT is engaging in very little equity issuance this year. In Q3 2022, UHT’s weighted average number of shares outstanding stood at 13.8 million, only 1/10th of a percent higher than Q3 2021’s 13.78 million share count.

In Q3, the dividend payout ratio ticked a bit higher to 82.6%, but the high-yielding dividend is still well-protected.

The biggest problem UHT faces is its three vacant properties (the Chicago hospital vacant since the end of 2021 and two other properties that have been vacant since 2019) that are a cash drain right now.

Could the persistence of these vacancies indicate a weakness in UHT’s property underwriting? Perhaps. But fortunately, UHT only has three of these hot potatoes right now. Hopefully management will be able to re-lease or dispose of them in order to get rid of the cash drain.

Bottom Line

UHT is not hurting as bad as the market had been pricing in prior to Q3 results. Its largest tenant, UHS, is performing better than many health systems amid a very challenging environment for healthcare operators. And though interest rate headwinds will continue to further weigh on FFO in the quarters ahead, the REIT’s dividend remains well-covered and liable to keep growing at its crawling pace going forward.

UHT will get through this difficult period. In the meantime, its 5.9% dividend yield looks attractive for conservative income investors.

Be the first to comment