We Are

One of the biggest problems facing most Americans today is the high inflation that has greatly increased the costs of food, energy, and many other things. This inflation has had such a negative effect on many people that they have been forced to take on second jobs or find other sources of income in order to get the money that they need to simply maintain their lifestyles. Fortunately, as investors, we have other methods that we can use to generate income. One of these methods is to invest in a closed-end fund that is focused on the generation of income. These funds provide easy access to a professionally-managed portfolio of assets that can in many cases deliver a higher yield than any of the individual holdings possess. In this article, we will discuss the BlackRock Enhanced Global Dividend Trust (NYSE:BOE), which is one of these funds. As of the time of writing, the fund yields 8.03%, which is certainly a level that most investors will find quite attractive but there are other reasons to like the fund. In particular, the fund is trading at a fairly significant discount to net asset value, which is something that we rarely see in today’s market. Therefore, let us have a look at this fund to see if it could be right for your portfolio.

About The Fund

According to the fund’s webpage, the BlackRock Enhanced Global Dividend Trust has the stated objective of providing its investors with current income and current gains. This is not something that we usually see as an objective for an equity fund. After all, common stocks are generally considered to be total return instruments since investors buy them in order to get both dividends and capital gains. However, it is the sort of thing that we can appreciate seeing in a fund that we are looking to use as a source of income. This is because the fund’s statement that it is specifically focusing on generating income might be a sign that it will not sacrifice a high yield in order to get a long-term capital gain. There are other funds that we can purchase for gains, this one is designed for people seeking income. The fund’s strategy is exactly what might be expected from the name. In short, the fund will invest in dividend-paying companies from around the world. It then attempts to synthetically boost the yields of these stocks by selling call options against its position. This is therefore a covered call options strategy.

The fund’s options strategy is something that admittedly may concern some investors that have heard about the dangers of options strategies in the past. However, the covered call strategy is generally a pretty safe way to handle options. This is because the potential loss is limited. The fund will actually have the stock that it would have to deliver to the option buyer should the option be exercised. The fund will not have to go out onto the market and purchase the stock, potentially having to pay any price to obtain it. The strategy does have a trade-off though and that is that it caps the potential gain. This is because the gain cannot be more than the difference between the price that the fund paid for the stock and the strike price of the call option. However, the strategy works very well in range-bound markets because it is highly likely that the option will expire worthlessly. This allows the fund to keep both the option premium and the underlying stock. It can then write another call option and collect the premium. We have a range-bound market today so this strategy should work pretty well until conditions change.

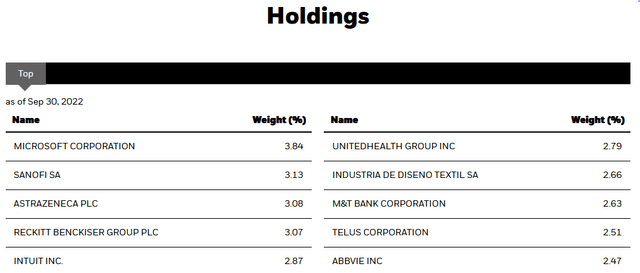

The fund’s largest holdings do consist mostly of dividend-paying stocks, although not all of these are companies that we would ordinarily expect to see in an income fund:

The two companies that are rather surprising here are Microsoft (MSFT) and Intuit (INTU) as the yields of both of these companies are negligible. We do see considerably more diversity here than in the Eaton Vance Enhanced Equity Income Fund (EOI), which I discussed recently. The surprising thing here is that we do not see much in the way of utilities or energy, which are traditionally among the highest-yielding sectors. However, the fund does generate much of its income through the covered call premiums as opposed to the dividends that it receives from its actual portfolio positions. Thus, the dividend yields are perhaps not the most important thing as more volatile stocks can frequently deliver higher option premiums.

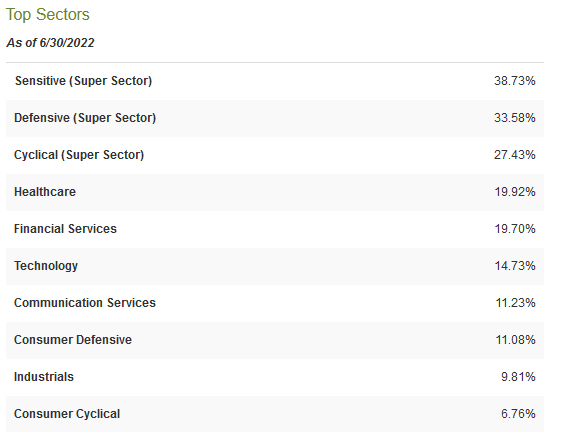

A broader look at the portfolio also reveals that the BlackRock Enhanced Global Dividend Income Trust has no exposure to either utilities or energy:

CEF Connect

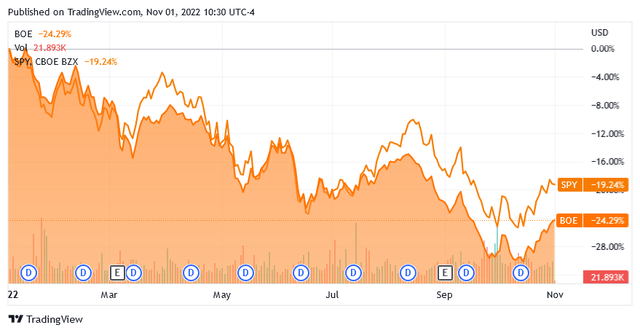

The absence of energy is very disappointing since that has been one of the only sectors to actually deliver a positive performance year-to-date. Then again, it might not be particularly surprising considering that this is a BlackRock fund. Lately, BlackRock has gone all-in on the environmental, social, and governance investing trend, and that generally eschews investing in fossil fuel companies regardless of their performance in the overall market. Unfortunately, the absence of these companies may result in a performance hit because, as just mentioned, this is one of the only sectors in the S&P 500 index (SPY) that has actually delivered a positive performance year-to-date. We can actually see this in the fund’s performance as it has considerably underperformed the S&P 500 index since December 31, 2021:

It is difficult to complain about the fund’s heavy allocation to healthcare, communication services, and consumer defensive, however. These are among the things that should be held during a weak economy because they tend to be quite recession-resistant. Although the United States is expected to post positive gross domestic product growth for the third quarter of 2022, the fact that many consumers are being crushed by rising food and energy prices does mean that they are cutting back on discretionary spending. However, most consumers will continue to pay for healthcare, cellular telephone service, soap, and similar things. Thus, the companies that the fund is invested in should hold up better financially, if not in terms of market price, than those companies that are dependent on consumers having access to considerable amounts of discretionary income.

It is also nice to see that the fund does not have outsized exposure to any individual asset. As my regular readers likely know, I do not generally like to see any individual asset in a fund account for more than 5% of the fund’s total portfolio. This is because that is approximately the level at which an asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio, then it will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market as a whole does not and if that asset accounts for too much of the portfolio, then it may drag down the entire fund with it. As we can see above though, there is no individual asset that accounts for such an outsized proportion of the portfolio so this does not appear to be something that we need to worry about here. This is another advantage that it has over the Eaton Vance Enhanced Equity Income Fund as that similar fund does have considerable exposure to a few large technology companies.

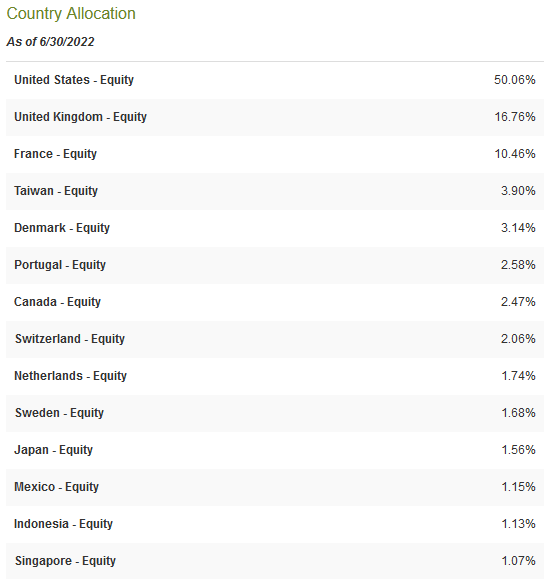

As the name of the fund implies, the BlackRock Enhanced Global Dividend Income Trust is a global fund that invests in companies from around the world. It is actually reasonably good at doing that, although the largest individual nation that the fund is invested in is the United States:

CEF Connect

As we can see above, American companies account for just over half of the fund’s total assets. This is much better than most global funds as many of them allocate a 60% to 70% weight to the United States. However, the United States only accounts for just under 25% of the global gross domestic product so the fund still has greater exposure to that country than its actual representation in the global economy. Still, though, it is nice to see that about half of the fund’s assets are invested outside of the United States. This is because of the protection that it provides us against regime risk. Regime risk is the risk that a government or other authority will take some action that has an adverse impact on a company that we are invested in. We saw a great example of regime risk last year when the incoming Biden Administration unilaterally revoked the permits for the construction of the Keystone XL pipeline and caused all the money that was spent by TC Energy (TRP) pursuing its construction to be wasted. The only realistic way to protect ourselves against this risk is to ensure that only a relatively small proportion of our assets is exposed to any individual nation. This fund seems to be doing that to a degree so we can use it as a way to improve the international exposure of a broader portfolio that is heavily invested in the United States. It is certainly not perfect in this regard though due to still having half of its assets invested domestically.

Distribution Analysis

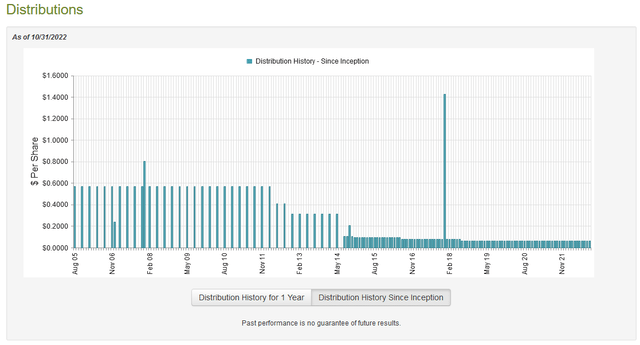

As stated earlier, the BlackRock Enhanced Global Dividend Income Trust has the stated objective of providing its investors with a high level of current income and gains. As such, we might assume that it boasts a fairly high distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.063 per share ($0.756 per share annually), which gives it an 8.03% yield at the current price. The fund has unfortunately not been especially consistent about this distribution over the years and has cut it multiple times over its history:

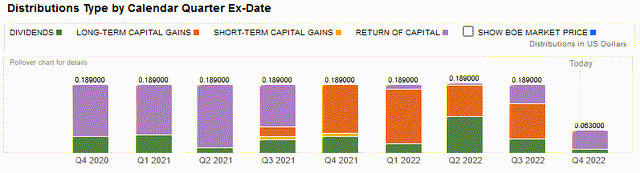

The fact that the fund has reduced its distribution several times is likely to be a bit of a turnoff for anyone that is seeking a safe and secure source of income with which to pay their bills. Another thing that may be concerning is that a not insignificant proportion of the fund’s distributions are classified as return of capital:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any kind of extended period. However, there are other things that can cause a distribution to be classified as a return of capital. This includes the distribution of money received from certain options strategies or the distribution of unrealized capital gains. As such, we should investigate in order to determine exactly how the fund is financing its distributions and how sustainable they are likely to be.

Fortunately, we do have some fairly recent financial information that we can consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it should give us a good idea of how well the fund performed during the generally volatile market that dominated during the first half of the year. During the six-month period, the BlackRock Enhanced Global Dividend Income Trust brought in a total of $12,992,397 in dividends from the assets in its portfolio. This gives the fund a total income of $12,319,331 after we net out foreign withholding taxes. The fund paid its expenses out of this amount, leaving it with $8,906,473 available for investors. This was nowhere close to enough to cover the $24,171,158 that the fund actually paid out in distributions during that period. This may be concerning on the surface.

However, there are other ways for the fund to obtain the money that it needs to cover its expenses. The most notable of these are capital gains and option premium income. It generally failed at that during the period, which was largely due to the volatile market. During the six-month period, the fund had net realized gains of $27,389,490 but this was more than offset by $154,925,472 net unrealized losses. Overall, the fund saw its assets decline by $147,881,585 during the period after accounting for all inflows and outflows. This is certainly not encouraging but we should keep in mind that the fund’s net investment income combined with the net realized capital gains were sufficient to fund the distribution. However, the unrealized losses do make it more difficult for the fund to continue to perform so we need to keep an eye on it and ensure that it does not continue to suffer losses or it may very well have to make another distribution cut. For now, though, the distribution is likely safe.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Enhanced Global Dividend Income Trust, the usual way to value it is by looking at the net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them at a price that is less than the net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is fortunately the case with this fund. As of October 31, 2022 (the most recent date for which data is currently available), the BlackRock Enhanced Global Dividend Income Trust had a net asset value of $10.52 per share but the fund only trades for $9.35 per share. This gives it an 11.12% discount on net asset value. This is a fairly attractive price that is relatively in line with the 11.19% discount that the fund has traded on average over the past month. Overall, the price certainly looks right here.

Conclusion

In conclusion, the BlackRock Enhanced Global Dividend Income Trust appears to offer investors a reasonably good proposition to generate income from their portfolios. The fund’s biggest problem is that it lacks exposure to the energy sector, which has outperformed the S&P 500 index year-to-date. It is much more diversified than some similar funds though, which is very nice to see. The 8.03% yield also appears to be reasonably safe, for now anyway. The fund also currently trades for an incredibly attractive price. Overall, this fund might be worth considering for a portfolio.

Be the first to comment