Sundry Photography

STMicroelectronics N.V. (NYSE:STM) is a semiconductor company. The company has been facing supply chain issues where the company mentioned that “manufacturing capacity is fully saturated”. Therefore, we analyzed the issue faced by the company and determine the impact of its collaboration with GlobalFoundries (GFS) and Volkswagen (OTCPK:VWAGY) respectively on the supply issue.

Supply Constraints not Affecting Inventory Management

The semiconductor industry has been facing supply constraints since late 2020. As mentioned by Reuters, this is due to the high demand for electronics fueled by work-from-home practices. The sales of gadgets then led to:

supply crunches for other industries such as autos and telecom suppliers.

STM is also facing this issue where their “book-to-bill is well above parity” and where the “manufacturing capacity is fully saturated”. The company mentioned in its latest earnings briefing that:

backlog visibility is now above 18 months and well above our current and planned manufacturing capacity through 2023

and the lead time constraints of the whole supply chain as almost all of STM’s process tools have an 18 months lead time. STM also mentioned that their largest revenue segment, automotive, continue to have strong demand supported by the “electrification and digitalization transformation of the industry”.

|

Efficiency Analysis |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

5-Year Average |

2-Year Average |

|

Inventory Turnover |

3.04x |

3.15x |

3.53x |

3.45x |

3.07x |

3.12x |

3.35x |

3.25x |

3.24x |

|

Days Sales Outstanding (days) |

46 |

46 |

46 |

46 |

51 |

51 |

46 |

47 |

48 |

|

Days Payables Outstanding (days) |

53 |

57 |

64 |

68 |

70 |

70 |

78 |

63 |

74 |

|

Days Inventory Outstanding (days) |

120 |

116 |

103 |

106 |

119 |

117 |

109 |

113 |

113 |

|

Cash conversion Cycle (days) |

112 |

105 |

85 |

83 |

99 |

98 |

76 |

97 |

87 |

Source: STMicro, Khaveen Investments

We compared STM’s latest 2-year average efficiency ratios and the pre-covid 5-year average to determine the impact of supply constraints on STM. The average inventory turnover and average days sales outstanding are quite close while the average day’s inventory outstanding for both periods is similar. However, the average days’ payables outstanding since covid (74 days) is higher than pre-covid (63 days) which indicates that STM is taking longer to pay its suppliers. The increase in days payables outstanding then caused the decrease in the cash conversion cycle. Therefore, we believe that the supply constraints are not that significant as STM is still able to maintain its efficiency, especially with inventory management.

Huge Expansion of Capacity

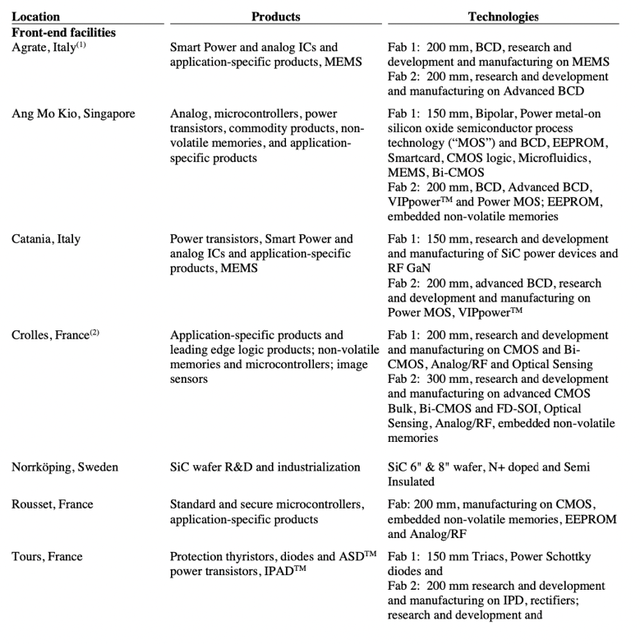

Currently, STM has 14 manufacturing sites. Based on the company’s annual report, below are the products and technologies produced at each manufacturing site.

As shown, the fab in Crolles is STM’s only fab that produces 300mm wafer products.

|

STMicro ($ mln) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

|

Revenue |

8,308 |

9,612 |

9,529 |

10,181 |

12,729 |

13,725 |

|

Growth % |

19.64% |

15.70% |

-0.86% |

6.84% |

25.03% |

7.82% |

|

Adjusted CapEx/Revenue |

15.59% |

13.07% |

12.36% |

12.56% |

14.34% |

13.58% |

|

Adjusted CapEx |

1,294.92 |

1,256.20 |

1,177.66 |

1,278.23 |

1,825.41 |

1,864.08 |

Source: STMicro, Khaveen Investments

We obtained the company’s 5-year average adjusted CapEx/Revenue by dividing the (investing cash flow excluding the acquisition and investment in marketable securities) over revenue. This figure came in at 13.58%. Assuming the company’s revenue reaches its target of $20 bln in 2027 (representing a 7.82% CAGR), we estimate it to require Capex of $1.864 bln in 2022.

However, STM mentioned that they would double their investments up to $3.6 bln, due to the chip shortage. STM also stated that it will continue to invest in a new 300mm wafer fab in Agrate, near Milan, Italy, with full capacity projected by the end of 2025 which would increase the company’s 300mm capacity.

Additionally, STM signed the MOU with GlobalFoundries in building a 300mm semiconductor foundry in Crolles, France in July which would increase STM’s 300mm production capacity. As stated in the press release, the new manufacturing facility would satisfy the company’s end-market needs such as:

automotive, industrial, IoT and communications infrastructure application.

The foundry is expected to reach full saturation by 2026, with up to 620,000 of 300mm wafers per year, where 42% of the full wafer production would go to STM where the remaining 58% going to GlobalFoundries. This would further produce an estimated increase in manufacturing capacity at Crolles from 10,000 wafers per week to 22,000.

This collaborative investment which the whole project would estimate to cost $5.7 bln is supported by France in line with the European Chips Act for the expansion of Europe’s chip-making capabilities; with the “goal of Europe reaching 20 percent of worldwide semiconductor production by 2030” and having more than €43 billion to support the act. This believe provides another capacity boost in addition to STM’s own increase in Capex spending.

Assuming STM’s share of the joint fab is 42%, this translates to $2.394 bln. To estimate the subsidized amount through the European Chips Act, we assumed the additional Capex required above the 5-year average Capex needed by the company that cannot be fulfilled by the company’s additional capex spend would be subsidized, which equals to $0.758 bln [$2.394 – ($3.500 – $1.864)].

|

ST Microelectronics Capex |

$ bln |

|

5-yr average CapEx estimate |

1.864 |

|

2022 Company Additional Capex |

1.636 |

|

European Chips Act subsidy estimate |

0.758 |

|

Total Capex 2022 |

4.258 |

Source: STMicro, Khaveen Investments

Hence, our estimate of the company’s total actual Capex of $4.258 bln is 128% higher than its 5-yr average Capex estimate which gives us confidence that the company will be able to solve the shortfall in chip supply.

Leveraging On Volkswagen & TSMC Market Leadership through Collaboration

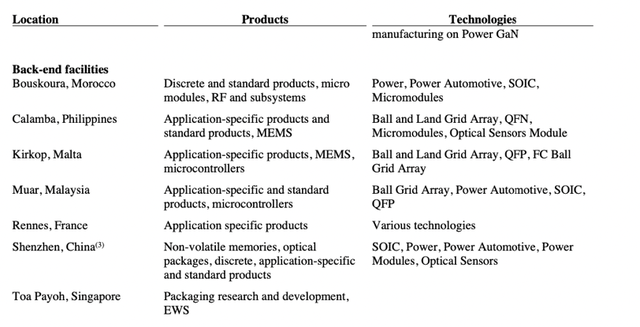

At the company’s Capital Markets Day, STMicroelectronics mentioned the $20 bln+ revenue target by 2027 which represents a 7.82% CAGR growth as compared to the 2021 revenue ($12.8 bln). The company further mentioned the revenue will be driven by:

1) the Company’s core business, leveraging ST’s technology and market leadership, is expected to grow in line with its established market

2) high growth areas, within or adjacent to ST’s core business, where the Company has or targets market leadership and is investing in technology, talent, product development, and manufacturing.

However, based on our past analysis, we believe that STM supplies to many end markets which results in it not having dominant market leadership in any of them. This is shown where in 2019, STM was the 5th largest in the MCU suppliers market (12% share), 3rd largest in the power discretes and modules market (5.8% share), 9th largest in the semiconductor suppliers market (2.2% share), 5th largest in the CIS semiconductor market (6% share) and 2021, STM was the 6th largest in the semiconductors market (7.6% share).

Hence, given the lack of market leadership, we believe the company will aim to carve out market leadership, especially in the high-growth areas including automotive. According to Allied Market Research, the automotive semiconductor market has a projected CAGR of 11.8% to 2030 (higher than our projected revenue CAGR of 7.82%). We believe this would enable the company to achieve the revenue target which we believe is the automotive segment.

As shown in the company’s presentation, the automotive segment would be the largest of its high-growth areas which is further supported by the company mentioning that they would focus on Industrial and Automotive.

Besides, the company mentioned in the latest earnings that:

the accelerated transformation of the automotive industry with electrification and digitalization and semiconductor pervasion continues to fuel demand for STM chips.

As a result, STM raised the number of current silicon carbide initiatives for automotive electrification, and the business declared a:

revenue objective of $1 billion silicon carbide revenues in 2023.

Additionally, we believe STM’s collaboration with Volkswagen, CARIAD – Volkswagen’s software unit to co-develop a new semiconductor, the “system-on-chip Stellar microprocessor” would increase STM’s market leadership in the automotive segment. Based on STM, the company will be participating in the co-development with Volkswagen and architecture by providing the technology which would then be manufactured by TSMC where STM would have the ownership of the SoC developed.

Company Data, Khaveen Investments

The partnership is also exclusive as stated

in the future, CARIAD plans to direct Tier 1 suppliers of the Group to use only the SoC co-developed with ST and ST’s standard Stellar microcontroller for CARIAD’s zone architecture.

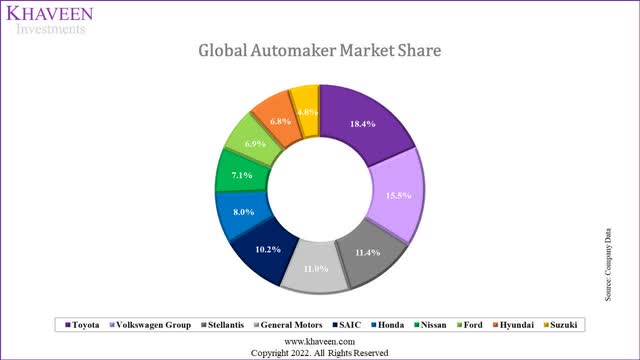

Thus, we believe that this partnership would be beneficial to STM as the company could leverage Volkswagen’s market leadership. Based on our previous analysis, Volkswagen has the second largest share (15.5%) in the global automaker market which we believe would contribute to higher revenues for STM.

Additionally, as mentioned in the previous point, STM is at full capacity. Hence, we believe that by partnering with TSMC (TSM), STM can leverage TSMC’s capacity to produce the SoC. We believe that TSMC, being the largest foundry in the world with a 54.9% foundry market share in Q1 2022 based on our previous analysis, would have the capacity to support the manufacturing of SoC. Therefore, we believe that the supply constraints that STM faces would not impact the manufacturing of the SoC which would then generate more revenue for STM.

Risk: Dependence on TSMC

As mentioned, TSMC will manufacture the chips instead in collaboration with Volkswagen. However, this poses a risk where if TSMC decided to stop manufacturing, STM would not have the capacity to support the collaboration as the company manufacturing capacity is completely saturated.

Verdict

To conclude, we believe that the supply constraints issue faced by the company would not produce much impact on the company due to the huge expansion in capacity. Plus, the collaboration with Volkswagen whose manufacturing is supported by TSMC would drive the company’s growth. The analyst consensus price target of $51.64 represents an upside of 35.11% of the current price ($38.22) and is higher than the price target of $48.51 from our previous analysis.

Be the first to comment