Ellenkaspring/iStock via Getty Images

Thesis

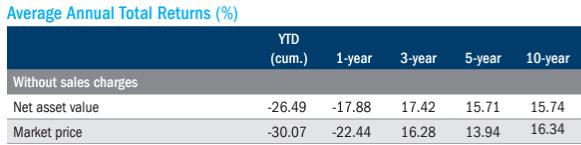

Columbia Seligman Premium Technology Growth Fund (NYSE:STK) is an equity “buy-write” closed end fund. The vehicle has performed admirably in the past decade, being up more than 461% on a total return basis, and exhibiting long periods of time when it outperformed its benchmark index, the Technology Select Sector SPDR Fund (XLK). The CEF has a 10-year Sharpe ratio of 0.85 with a standard deviation of 21.47% and has managed average annual total returns over 16% on a 10-year look-back:

Average Annual Returns (Fund Fact Sheet)

The fund exhibits extremely attractive risk/reward analytics and enhances its returns via writing covered calls on the portfolio. As per the fund’s literature:

Under normal market conditions, the fund’s investment program will consist primarily of investing in a portfolio of equity securities of technology and technology-related companies as well as writing call options on the NASDAQ 100 Index or its exchange-traded (ETF) fund equivalent on a month-to-month basis. The aggregate notional amount of the call options will typically range from 25% to 90% of the underlying value of the fund’s holdings of common stock. The fund expects to generate current income from premiums received from writing call options on the NASDAQ 100 or its ETF equivalent.

While the covered portion of the portfolio can vary from 25% to 90%, the fund currently has 89.9% of the portfolio overwritten, at the top end of the range:

Percent Overwrite (Fund Fact Sheet)

Also, to note that the fund has a slight basis between the holdings (only 62 names in the portfolio currently) and the written calls which are done on the index. We like the fact that the fund is concentrated on a smaller number of names when compared to the index because it allows the portfolio managers to generate alpha for the fund, active management which has proven its worth throughout time via its stellar performance.

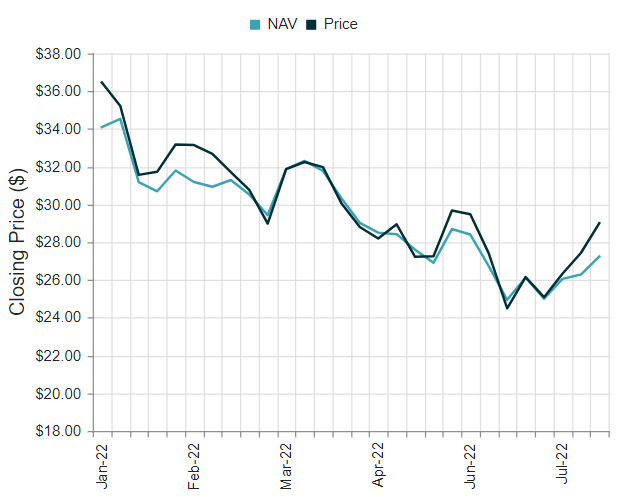

The fund has experienced its largest decade long drawdown this year, being down more than -30% earlier in June. Its performance has rebounded, now down “only” -15.6%, outperforming the index. Unfortunately, a large portion of the fund’s outperformance since June is represented by the widening of the premium to par rather than a “clean” recovery in the underlying asset prices:

Price vs NAV (CEFConnect)

We can see from the above graph, courtesy of CEF Connect, that during the June sell-off the price dipped below NAV, but has now shot up, trading at a premium of 9.18% to net asset value. This premium is close to a decade long high of 10.63% seen for this fund, and in our opinion it is unwarranted. The vehicle usually trades at premiums of only 1% to 2% versus net asset value.

We believe we are currently in the midst of a bear market rally, triggered by significantly oversold conditions and earnings which came in better than expected from a low threshold to begin with. Inflation is not yet coming down, it is actually surprising to the upside. The Fed is not done hiking and rates will stay higher for longer. This is a relief rally which will turn as market participants realize a Fed dovish shift is much farther away than expected and that the discount rate to be used for Tech stocks will be higher. We expect another leg down in this market which will result not only in a NAV move lower for STK but also a compression of the premium to par values, as we dully saw in June. We are targeting a -10% to -15% move in STK in the next months. Let us not mince our words – STK is a premier technology CEF and a golden standard in the space via its performance, but it is currently very overpriced via its premium and it will not be able to escape the gravity of the next leg down in this bear market.

Holdings

The CEF falls in the Large Cap / Growth category as illustrated by Morningstar:

Morningstar Box (Morningstar)

For those readers that are not that familiar with the Morningstar categorization nomenclature, please find below from the fund’s fact sheet:

The Morningstar Style Box is based on the fund’s portfolio holdings as of period end. For equity funds, the vertical axis shows the market capitalization of the stocks owned, and the horizontal axis shows investment style (value, blend, or growth). Information shown is based on the most recent data provided by Morningstar.

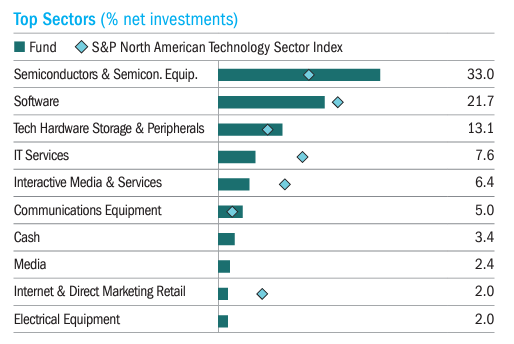

The CEF is heavily Technology focused, being overweight Semiconductor stocks:

Top Sectors (Fund Fact Sheet)

We can see from the above table that, versus the index, the fund is overweight Semiconductor stocks and Tech Hardware Storage, while underweight Software, IT Services, and Interactive Media.

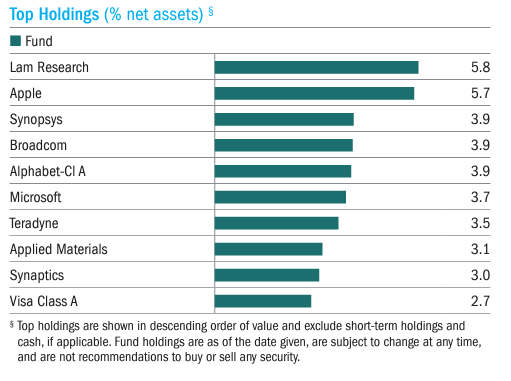

The top holdings in the fund include Lam Research and Apple:

Holdings (Fund Fact Sheet)

The fund runs a fairly conservative portfolio from a valuation standpoint, with fairly low P/E ratios when compared to the overall sector:

Portfolio Characteristics (Fund Fact Sheet)

Performance

The fund is down -15.6% year to date:

YTD Performance (Seeking Alpha)

We can see that STK closely mirrored the XLK performance and is currently outperforming the index.

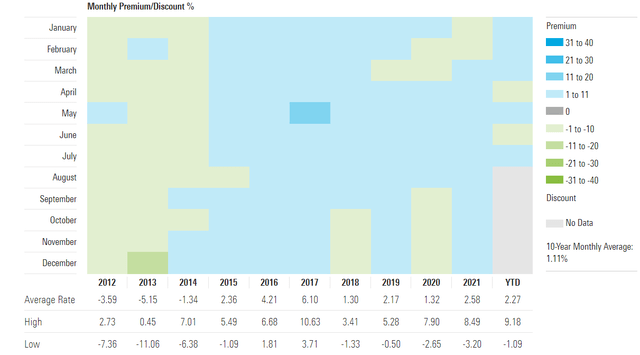

On a five-year basis, STK shows a slight underperformance versus the index, but still a very robust overall performance:

We can see that STK is up 121% versus 166% for the index. A decade long chart shows us why STK represents a golden standard in the technology CEF space, with the fund matching the index on a 10-year lookback:

10-Year Total Return (Seeking Alpha)

What is interesting to note is that the fund had significant periods of outperformance versus the index during the 2016-2018 time frame.

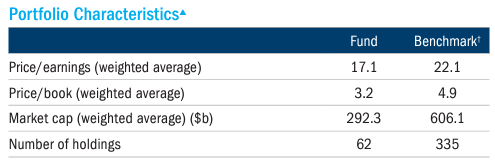

Premium / Discount to NAV

The fund usually trades at a premium to net asset value:

Premium / Discount to NAV (Morningstar)

We can see that on a ten-year look-back, the fund exhibited a maximum premium of 10.63% in 2017, while on average the fund premium is closer to 1%-2% only.

Conclusion

STK is a technology focused equities “buy-write” fund. The vehicle has stellar long-term results, with average annual total returns exceeding 16% on a ten-year lookback period. The vehicle has only 62 holdings versus the index and is currently writing covered calls on almost 90% of its portfolio. The fund has turned from a -30% drawdown earlier in the year, but its move higher has been mainly driven by a widening of the premium to net asset values rather than a “clean” gain in value for the underlying fund assets. STK is currently trading at a premium close to its historical highs, while it exhibited a discount to NAV during the June market sell-off. We believe we are currently in the midst of a bear market rally, triggered by significantly oversold conditions and earnings which came in better than expected from a low threshold to begin with. We expect another leg down in this market which will result not only in a NAV move lower for STK but also a compression of the premium to net asset values, similar to what we saw in June.

Be the first to comment