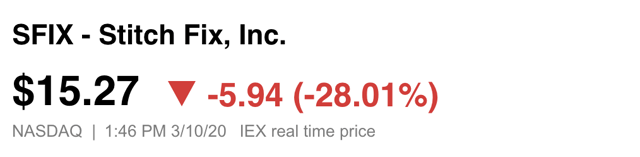

After a brutal day in the stock market, Stitch Fix (SFIX) cratered following a slight revenue miss and weak guidance for the 2H’20. The stock was already down to $21 following a difficult couple of tough weeks in the market while the mid-day action has Stitch Fix down nearly 50% from February highs. My investment thesis maintains an aggressive buy on the stock at $15 due to the hysteria over the guidance cut.

Tough Guidance

Heading into the quarterly report, investors had every reason to believe the personalized stylist firm could thrive during the coronavirus panic and still achieve annual revenue growth in the 22% range. Even the FQ2 revenue miss wasn’t a big deal, considering Stitch Fix exceeded the midpoint of previous guidance of $451.0 million.

The problem occurred with revenue guidance for the year being cut from 21.5% to only 16.0% now. The company now expects FY20 revenues of $1.825 billion, down from $1.915 billion. The revenue hit is ~$90 million over the next two quarters.

Source: Stitch Fix FQ2’20 shareholder letter

The problem is the hopes that new initiatives in the direct buying program, Shop Your Styles and Shop Your Colors, would help maintain and possibly drive faster growth. The company gave a lot of reasons for cutting revenue guidance for the whole year:

- Heightened promotional activity across retail caused active clients to spend less per Fix.

- Due to higher customer acquisition costs, the company has reduced marketing plans.

- Brexit has reduced U.K. revenue.

- Coronavirus makes the company more conservative on guidance.

The big question is which of the issues really contributed to the reduced guidance. Brexit and coronavirus are macro themes that don’t impact the long-term picture, while some of the promotional activity in the sector will likely resolve over time.

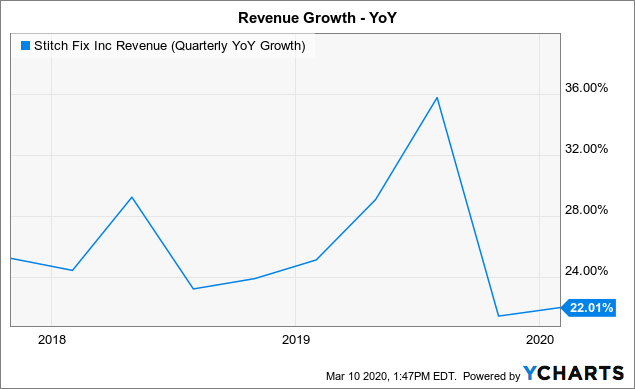

Stitch Fix has run into other issues where marketing expenses were reduced in order to better align costs with sales and test out marketing campaigns. The stock collapsed back at the end of 2018 when the company missed FQ4’18 estimates and guided FY19 revenues to as low as only 20% revenue growth.

The stock rebounded as Stitch Fix eventually hit nearly 36% growth by FQ4’19. The point here is that the company has volatile results based on adjusting marketing plans.

Data by YCharts

Data by YCharts

Ultimate Hysteria

The stock ended after-hours down nearly 40% to $13. The market capitalization is now down to only $1.5 billion here at nearly $15, or a fraction of the $1.8 billion revenue target for FY20.

Source: Seeking Alpha

The company didn’t choose the best day to release earnings and cut guidance with U.S. index averages down nearly 8% on the day. The market hysteria has reached peak levels here.

Investors are clearly reacting to fears that Amazon (AMZN) Personal Shopper by Prime Wardrobe is taking market share. At the least, a tough retail space is slowing down the growth potential. Even a couple of percentage points due to the macro events would push the growth rate back up to 18%.

On the earnings call, interim CFO Mike Smith was clear in response to a question from analyst Ike Boruchow from Wells Fargo Securities that the company remains on plans for revenue growth rates in excess of 20%:

No, I don’t think you should assume the plan is changed on a 20% to 25% algo. It’s – we’re trying to reflect kind of current trends that we’re seeing to earlier question, more macro than sort of company-specific challenges. And we feel very confident in things like direct buy and how, in the future, how big an opportunity that is for us. So no change in the algo.

In fact, Mr. Smith was much more clear that the revenue cut was due to the macro issues: Brexit and coronavirus. The market wouldn’t have freaked out, if more of the revenue issue was assigned directly to these problems.

The original guidance gave more of an impression that Amazon was pressuring pricing in the personalized styling space, which doesn’t appear to be the actual case based on more details provided in the earnings call.

With about $300 million in cash, Stitch Fix has an enterprise value of only $1.2 billion here. The personalized shopping service even forecasts generating positive adjusted EBITDA of $80 million this year.

Takeaway

The key investor takeaway is that market hysteria has people fleeing this stock on false fears. At an EV/S multiple 0.66x, the stock is far too cheap for sustainable growth rates above 20% and no indication this isn’t an accurate expectation.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SFIX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Be the first to comment