Marco Bello

While at first, it might seem that Palantir (NYSE:PLTR) revealed a relatively weak earnings report earlier this week, the reality is a little bit different. Yes, the management disappointed the street by forecasting lower revenue estimates for Q3 in its base case scenario, but it was something that investors could’ve expected. In my latest article on Palantir, which has been published a day before the reveal of a Q2 earnings report, I noted how the company’s management had done the same thing a few months ago when it revealed its Q1 earnings report and guided for weaker returns in the future. This gave Palantir the room to easily exceed its revenue forecast, and it’s exactly what happened on Monday when the Q2 earnings report came out and the company announced better than expected top-line performance.

On top of that, from the report, we also learned that Palantir’s business is stronger than ever. The company continues to have a solid balance sheet with over $2 billion in liquidity and no debt, its stock-based compensations decrease on a quarterly basis, and at the same time, Palantir grows at an aggressive double-digit rate even in the current turbulent environment. Therefore, a relatively poor Q3 guidance is something that is already priced into Palantir’s stock, and it also gives the management the room to once again beat its estimates in the future. In addition, the latest developments show that Palantir has the ability to create additional shareholder value for years to come, and this should be the main story for long-term investors, and not a revised quarterly outlook that could easily be beaten, as it was the case in Q2.

Firing On All Cylinders

After issuing a base case scenario under which Palantir will generate $470 million in Q2 a few months ago, the management gave itself additional room to maneuver since that guidance hasn’t accounted for the upside that’s associated with the geopolitical uncertainty. This is something that I’ve noted in my latest article on Palantir. Once the Q2 earnings report came out on Monday, we saw that Palantir easily beat its guidance, as its revenues during the quarter were up 25.9% Y/Y to $473.01 million. Considering this, it’s wrong to say that Palantir’s results were disappointing, especially since the company continues to grow at an aggressive rate in the current turbulent environment after being in the business for almost two decades.

What’s also important to mention is that while the government revenues were relatively weak in comparison to previous quarters, as Palantir generated only $263 million in government revenues in Q2, up 13% Y/Y, there are reasons to be optimistic about the company’s future in this field. In his letter to the shareholders, the company’s CEO Alex Karp explains how Palantir aims to increase the penetration of its software solutions amongst the large institutions in the U.S. and abroad, and at the same time ensure that those institutions run some or all of their operations on one of Palantir’s platforms. Considering the latest developments, there are reasons to believe that Palantir will be able to achieve this goal.

First of all, in late June and late July, Palantir won contract extensions with the U.S. Army to develop the TITAN program and enhance the army’s AI and ML capabilities. Both of those contract extensions will already give a boost to the company’s governmental revenues in Q3 and make the army more dependent on Palantir in the future. At the same time, Palantir also has an impact level 6 DoD SRG authorization, which makes it possible for the DoD customers to use Palantir’s software to store and transfer even secret-level data. This alone should help its business to win more awards in the future, as not a lot of companies in the world have such authorization.

In addition to all of this, Palantir’s commercial revenues in Q2 exceeded all the expectations and minimized the downside from the relatively weaker performance of the governmental business. During the quarter, the commercial revenues were up 46% Y/Y to $210 million, while the average revenue per customer increased by 17% Y/Y to $46 million. At the same time, even in the current environment with raging inflation and higher interest rates, there continues to be a high demand for Palantir’s software from new clients, as its commercial customer count has increased to 203 customers, up from 184 customers at the end of March.

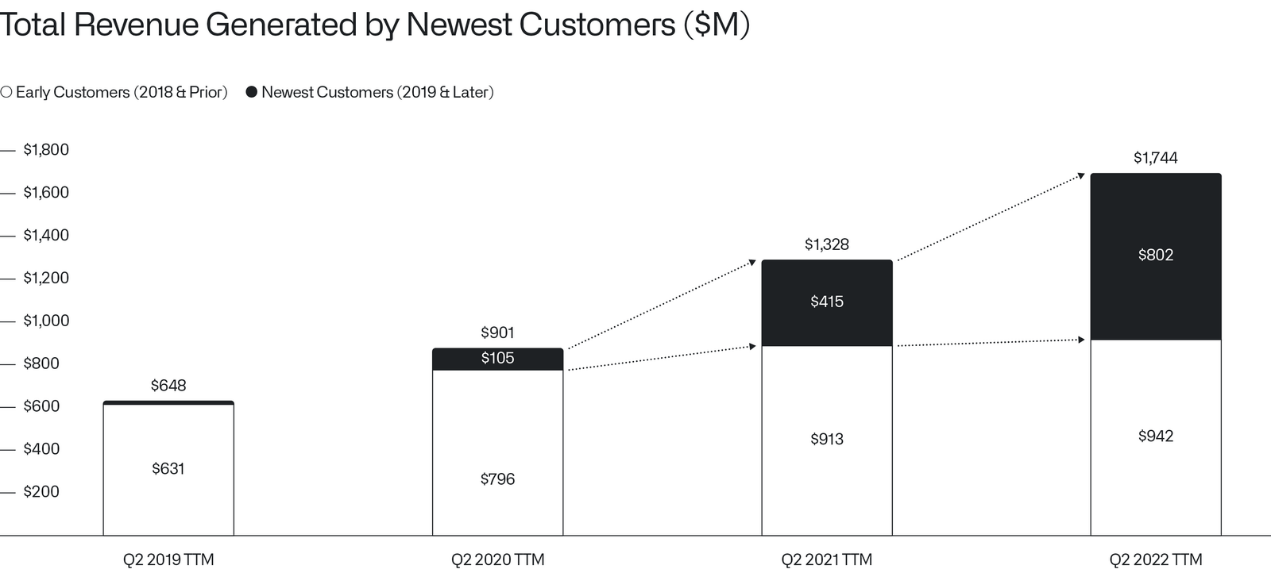

What’s more important is that the revenue that’s generated by customers that were added in 2019 will soon exceed the revenue that’s generated by clients from all the previous years. This proves that Palantir’s latest commercial endeavors are becoming more scalable and as more new clients begin to use its solutions, the easier it will become for the business to continue to generate aggressive returns.

Palantir’s Total Revenue Generated By Newest Customers (Palantir)

Insider Selling and Stock-Based Compensation Expenses Are Not That Relevant Anymore

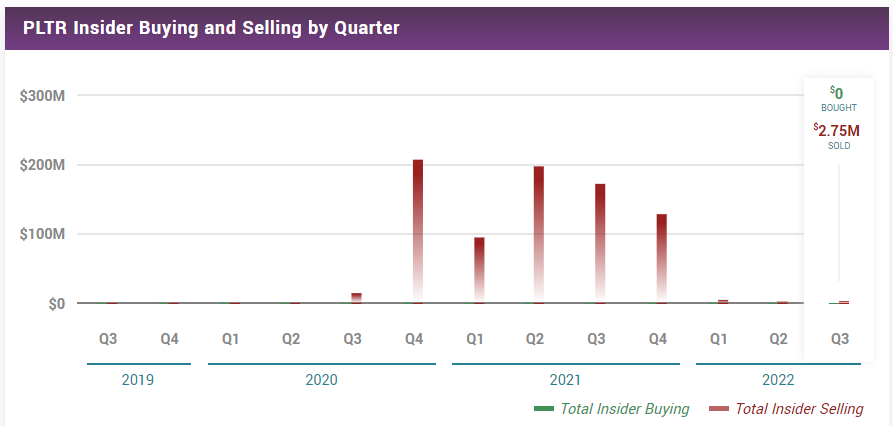

In my latest article on Palantir, I also stated that issues such as the constant insider selling along with the excessive stock-based compensation policy have been used as the main talking points of bears to justify their short positions in the company. While those issues were relevant in the past, I was correct when I said that they no longer pose a major threat to Palantir’s stock.

If we go through the latest data, we’ll see that in 2022, Palantir’s insiders and in particular the company’s CEO Alex Karp dramatically reduced the selling of the stock, which was creating selling pressure in the past. I don’t expect the selling to return to the previous levels, as the options that were behind most of that selling expired in December. In addition, as insiders continue to hold a relatively sizable stake in the business that accounts for almost 11% of all outstanding shares, it’s in their best interest to have the stock trading at a higher level before engaging in additional selling.

Palantir’s Insider Buying and Selling by Quarter (Market Beat)

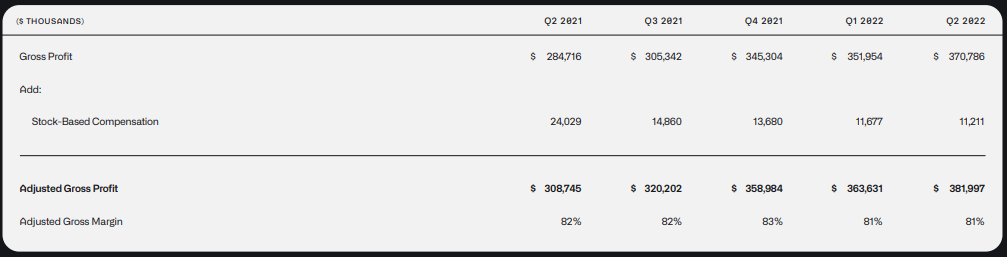

At the same time, in the Q2 earnings report, we could see that the stock-based compensation expenses have declined for the fifth quarter in a row, while revenues have only accelerated. This also proves my point that stock-based compensations are not that big of a threat to the stock anymore.

Palantir’s Financials (Palantir Q2 Earnings Report)

Going forward, there are several reasons to be bullish about Palantir. First of all, the company won’t be severely impacted by the higher interest rates, as it had $2.46 billion in liquidity and no debt at the end of June. At the same time, even though the stock-based compensation expenses decline, the company is able not only to retain its talent but is also on a hiring spree, which is a sign that its business is stronger than ever. What’s also important to mention is that at the end of Q2, Palantir had $3.5 billion in total remaining deal value, which ensures that the business will continue to grow at an aggressive rate in the following quarters.

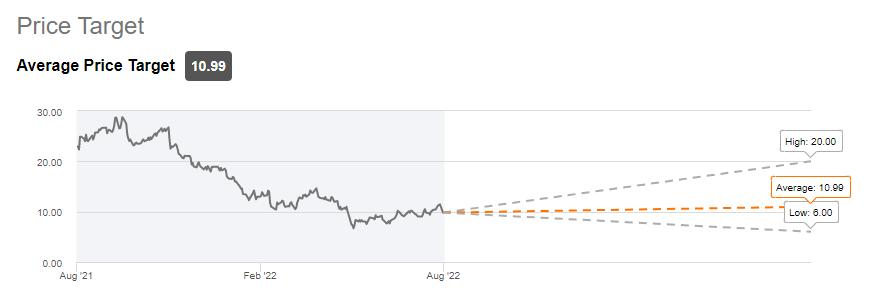

When it comes to Palantir’s valuation, after the market overreaction that occurred once the Q2 report came out, the company is once again trading at a discount to its fair value. Back in July, my DCF model showed that Palantir’s fair value is $11.17 per share, while the current consensus price target is $10.99 per share. This shows that there’s more upside to the stock from the current levels. On top of that, as the revenue generated from new clients continues to accelerate, the business’s fair value will likely be much higher as well in the foreseeable future.

Street Consensus Price Target (Seeking Alpha)

What Is The Main Downside?

Palantir’s major problem right now is the fact that its stock could continue to trade at the current levels without moving significantly higher, as it’s likely that the company won’t be able to achieve a 30% Y/Y growth in revenues this year. For FY22, the management expects revenue to be in the range between $1.9 billion and $1.902 billion, which represents an annual growth rate of only ~23.35% Y/Y.

Even if the company beats these estimates and achieves a 25% growth rate, it’ll likely not be enough to push the shares significantly higher. Add to this the possible further decline of the market fueled by higher interest rates, and Palantir’s stock could lose even more value in the near term. That’s why even when the business is strong as ever and continues to grow at a double-digit rate after operating for nearly two decades, while other major risks have been mostly eliminated and the valuation signals an upside, the stock could continue to trade at the current levels for a while. This is something that investors need to be aware of and have a longer time horizon in order to receive any meaningful returns.

The Bottom Line

Since the Q2 report came out, there has been too much emphasis on the disappointing quarterly outlook and not a lot of analysis about Palantir’s actual performance and its long-term perspectives. The overview of the Q2 earnings report presented above shows that the business is stronger than ever and as Palantir scales its solutions and generates more meaningful returns from its new clients, there are more than enough reasons to be optimistic about its future.

Overall, I believe that the company is moving in the right direction and despite some roadblocks, it still has the opportunity to create additional shareholder value in years to come. That’s why I continue to hold my long position in the company despite all the downside and have no plans to sell my shares anytime soon.

Be the first to comment