Gold Price Outlook:

Gold Price Drops as Treasury Yields Rise, Will XAU/USD Fall Further?

After encountering resistance last week, gold has since reversed lower and may continue to fall as Treasury yields rise. With the US10y Treasury yield breaching 1.3% for the first time since late February 2020 earlier this week, investors are faced with rising risk-free rates. As gold has no inherent yield, gaining exposure to US government bonds becomes an attractive prospect for many investors as Treasury yields rise amid reflation hopes.

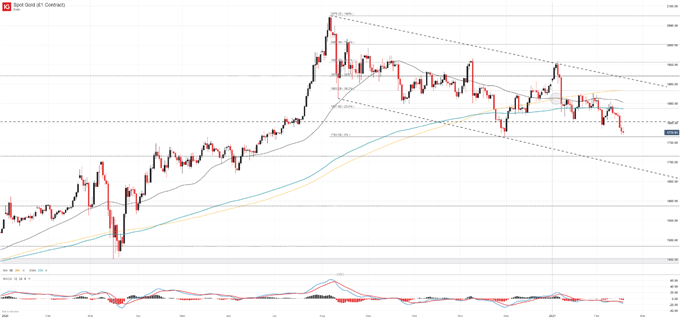

Gold (XAU/USD) Price Chart: Daily Time Frame (March 2020 – February 2021)

The negative correlation between the two assets is easily visible and it suggests as long as Treasury yields continue to rise, gold may suffer. With that in mind, the technical landscape of XAU/USD may see losses accelerate as the yellow metal nears a key level.

Gold (XAU/USD) Price Chart: Daily Time Frame (January 2020 – February 2021)

How to Trade Gold: Top Gold Trading Strategies and Tips

Quickly approaching its November 2020 low near $1,765, gold is treading water above a technical level that, if broken, would see the series of lower-lows and lower-highs extended. A continuation lower might see gold seek secondary support from the Fibonacci level near $1,714, or the lower bound of the descending channel originating in August.

Recommended by Peter Hanks

Get Your Free Gold Forecast

With yields rising and technical levels under fire, there is little to suggest the downtrend will suddenly give way to a bullish breakout. Suffice it to say, the medium-term outlook remains lower for the time being – further evidenced by the “death cross” formationin January.

Starts in:

Live now:

Feb 24

( 16:02 GMT )

Recommended by Peter Hanks

Weekly Stock Market Outlook

In the shorter-term, however, gold may require consolidation before continuing lower in earnest. In the event of a recovery effort, initial resistance will reside at the $1,800 mark followed by $1,838. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Be the first to comment