Michael Vi

Thesis

Palantir Technologies Inc.’s (NYSE:PLTR) Q2 earnings release highlighted that the slowdown in its government business was so significant that it indicated the company is facing challenges in clinching new deals. Is it surprising? We don’t think so.

We have noted that Palantir’s government segment has slowed since its growth rates peaked in late 2020. PLTR stock has also reflected the reality in its underlying metrics, given its battering as the company lapped challenging pandemic-driven comps. Coupled with increased uncertainties spurred by the current macroeconomic dynamics, it has led to an elongated sales cycle.

However, management reiterated its confidence that its long-term growth trajectory remains intact, as it proffered specific revenue guidance as a yardstick. Compared to its previously-communicated 30% revenue growth guidepost, we favor its updated framework, as it helps us to validate our valuation models better.

Furthermore, PLTR closed the week resiliently despite an underwhelming earnings release. Hence, we are confident that PLTR has formed its long-term bottom in May as the market looks to re-rate SaaS stocks broadly.

Accordingly, we reiterate our Buy rating on PLTR.

Palantir’s Growth Could Slow Through H2’22, But Look Ahead

We believe it’s pretty clear from management’s commentary that the company is facing a challenging sales cycle from its government customers, worsened by the macroeconomic headwinds. Therefore, we think it’s only reasonable to posit that the impact could be felt through H2’22.

Notwithstanding, management accentuated that it remains confident in its medium-term growth trajectory as CEO Alex Karp highlighted FY25 revenue guidance of $4.5B and expects to turn profitable.

However, Street analysts and some investors pointed out that Palantir stopped issuing its previous 30% revenue growth through 2025. Some analysts felt that withdrawing such guidance suggests that the company could be experiencing a structural slowdown in the medium-term. Morgan Stanley highlighted:

While the pause in government bookings appears temporary, it is notable that management decided not to reiterate its 30% long-term growth target. This suggests that management believes the sales environment could prove challenging not just for the next few quarters but potentially beyond. – Barron’s

We find that perspective interesting because Karp provided clear revenue guidance of $4.5 through FY25, which is immensely helpful in validating our reverse cash flow valuation model. Also, Palantir reported a TTM revenue of $1.744B in FQ2. Therefore, Karp’s guidance implies a revenue CAGR of 31% through FY25. So is withdrawing the initial 30% guidance really something that investors need to worry about? We certainly don’t see anything amiss here.

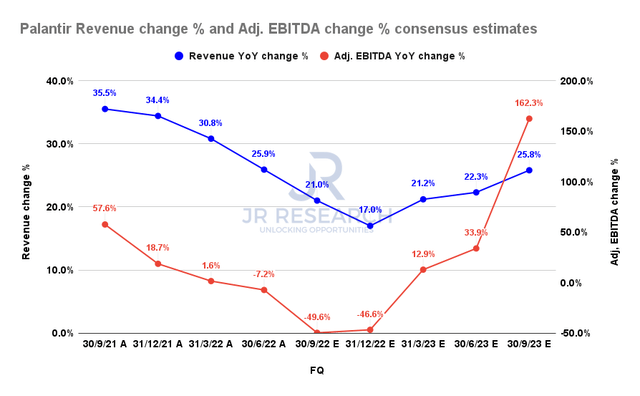

Palantir revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (neutral) suggest that Palantir’s revenue and adjusted EBITDA growth are expected to reach a nadir by FQ4 before recovering remarkably through 2023.

We believe the estimates seem credible, as Palantir has been reticent to provide more clarity on the timing of the deals with which it has come under pressure. Moreover, the current macro headwinds clouded the company’s visibility further. But Karp emphasized that he doesn’t expect the medium-term growth cadence to deviate, as he articulated:

And that’s why I am positing, internally and externally, the growth in US government over a multiyear period will be at least as good in the future as it was in the past. However, that 35% CAGR included a number of years where it was flat or even negative, and that’s just the frustrating part about contracting at our level. The contracts are so big and meaty that you got to kind of wait. (Palantir FQ2’22 earnings call)

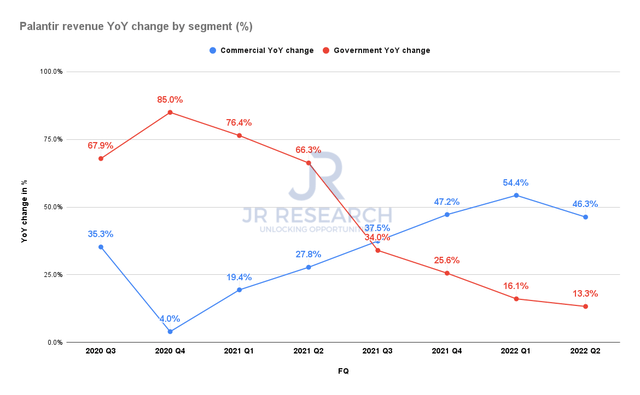

Palantir revenue change by segment % (Company filings)

As seen above, Palantir’s government revenue growth decelerated further to 13.3% in FQ2. However, even if we factor in a challenging H2 given tough macros, Karp’s guidance suggests that its growth should normalize markedly subsequently. Therefore, investors could potentially be adding positions at levels that could align with the bottoming of Palantir’s government revenue growth over the next six months or so.

PLTR’s Price Action Remains Constructive

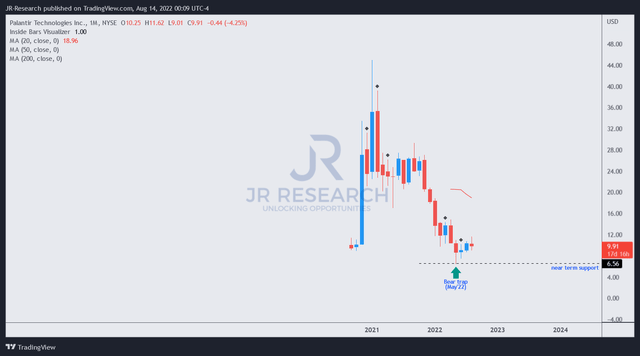

PLTR price chart (monthly) (TradingView)

Furthermore, PLTR’s post-Q2 sell down did not break the lows from July, as buying support returned remarkably, helping PLTR close robustly for the week.

Moreover, PLTR’s bear trap (indicating the market denied further selling downside) in May on its long-term chart corroborates its long-term bottom, as PLTR has been gathering buying momentum.

Therefore, we are confident that investors should capitalize on any near-term downside volatility in PLTR to add more positions, as we believe it has already bottomed out. Hence, the upside risk/reward profile seems favorable.

Is PLTR Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on PLTR.

While we are cognizant of a marked deceleration in its revenue growth, we believe it’s close to reaching a nadir (over the next six months) before reversing.

Our price action analysis also suggests that buying momentum has been returning to undergird its recovery since its May bottom as the market looks forward.

Be the first to comment