CreativaImages

Introduction

I like writing about undercovered stocks on SA, and today I’m taking a look at Stemtech Corporation (OTCQB:STEK). It’s a small nutraceutical company that relies on a direct sales distribution model whose market valuation has soared to $406.3 million as of the time of writing.

In my view, Stemtech looks overvalued as its quarterly revenues are barely above $1 million and the business is unprofitable. In addition, the shareholders’ equity was negative as of March. I can’t find the reason behind the recent increase in the company’s market valuation, but I think this level is unsustainable and that the share price is likely to return to below $2.00 eventually. Let’s review.

Overview of the business and financials

Stemtech is involved in the sale of adult stem cell nutrition and personal care products and currently has subsidiaries in the USA, Canada, Mexico, Malaysia, and Ecuador. The company specializes in dietary supplements that help nourish stem cells, boost the immune system, and help the body heal itself. The products of Stemtech don’t contain stem cells – they include natural botanicals and other ingredients that help stem cells perform better.

The company’s most advanced stem cell nutrition product is called stemrelease3, the one on the left here. Its other brands include StemFlo, Migrastem, DermaStem, DermaStem Lift, OraStem, and D-Fuze and Stemtech.

Stemtech

Stemrelease3 contains a blend of clinically tested ingredients that help release millions of the body’s own stem cells from the bone marrow into the bloodstream. Judging from the generally positive ratings on Amazon (NASDAQ: AMZN), this product seems to be well-received by customers. Unfortunately, Stemtech doesn’t provide a breakdown of its sales by product or country. Even if it did, it doesn’t matter much now since the company is a shadow of its former self as its history is full of setbacks.

Stemtech was launched in 2005 and focused on direct selling before switching to multi-level marketing (MLM) in 2009. The company’s problems began in 2012 when it was unable to fulfill its clients’ orders as one of its suppliers failed to deliver enough quantity. In 2013, a stem cell photographer won a lawsuit against Stemtech for copyright infringement and the company had to pay him $1.6 million. In 2016, Chief Science Officer Christian Drapeau created a firm named Biomics on the day before he resigned from the board of directors and Stemtech alleged it was formed to compete with it. In 2017, Stemtech was forced to file for Chapter 11 bankruptcy after one of its suppliers sued it over a contract termination and the refusal to pay amounts due. This was converted to Chapter 7 bankruptcy in 2018 and there has been no active marketing activity since 2017.

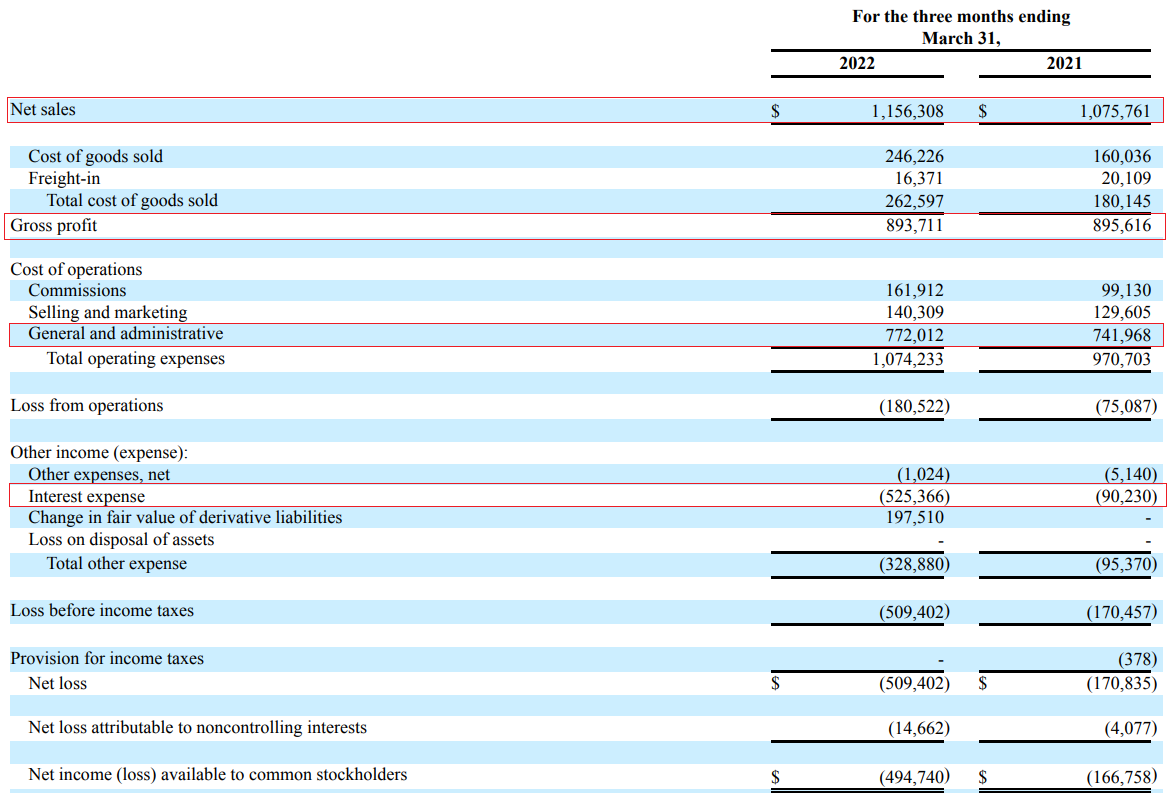

At the moment, Stemtech has small sales currently coming from returning consumers and they stood at just $1.16 million in Q1 2022. You can see from the table below that the gross profit margin was over 77% but Stemtech is nowhere near profitability due to high G&A and interest expenses.

Stemtech

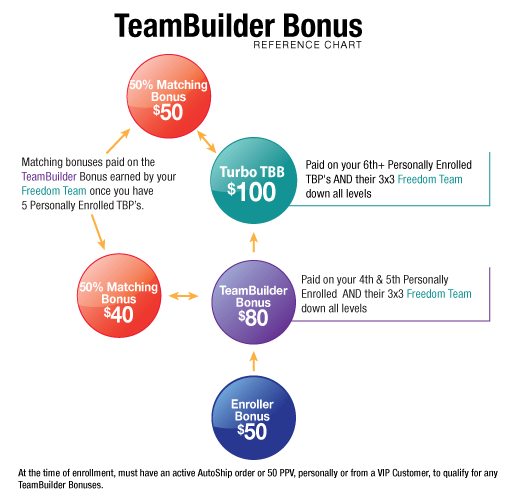

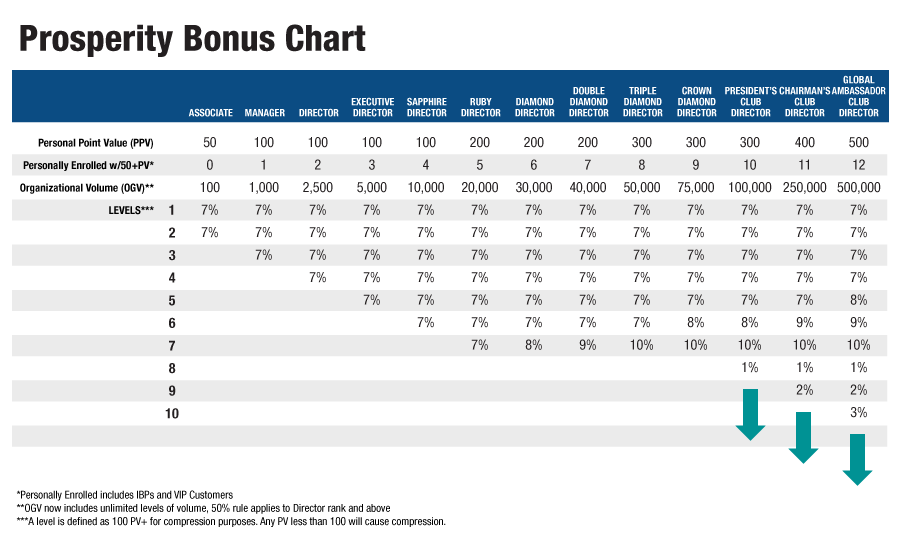

It seems that Stemtech still operates as an MLM company as its website is still currently promoting the enrolment of people and there is a bonus chart with 10 levels on it.

Stemtech Stemtech

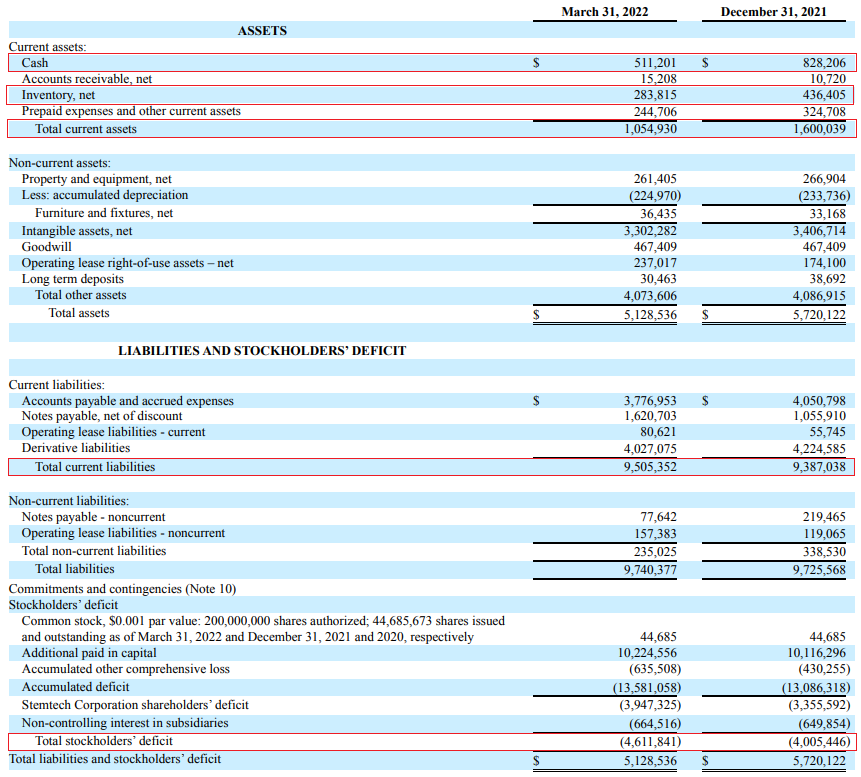

Stemtech became a public company in late 2021 when it completed a reverse takeover of a small OTC-listed firm named Globe Net Wireless Corp. However, the balance sheet looked bad as of March as cash and inventories stood at just $0.8 million and working capital and shareholders’ equity were in the red.

Stemtech

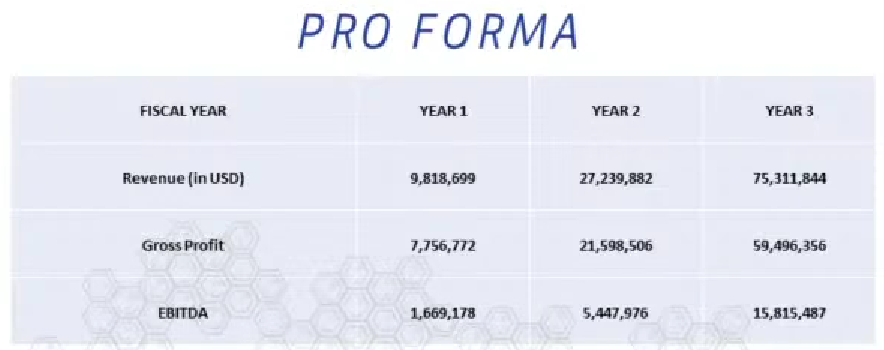

Looking at the future, Stemtech has ambitious growth plans which include increasing revenues to over $75 million and achieving annual EBITDA of over $15 million in just three years.

Stemtech

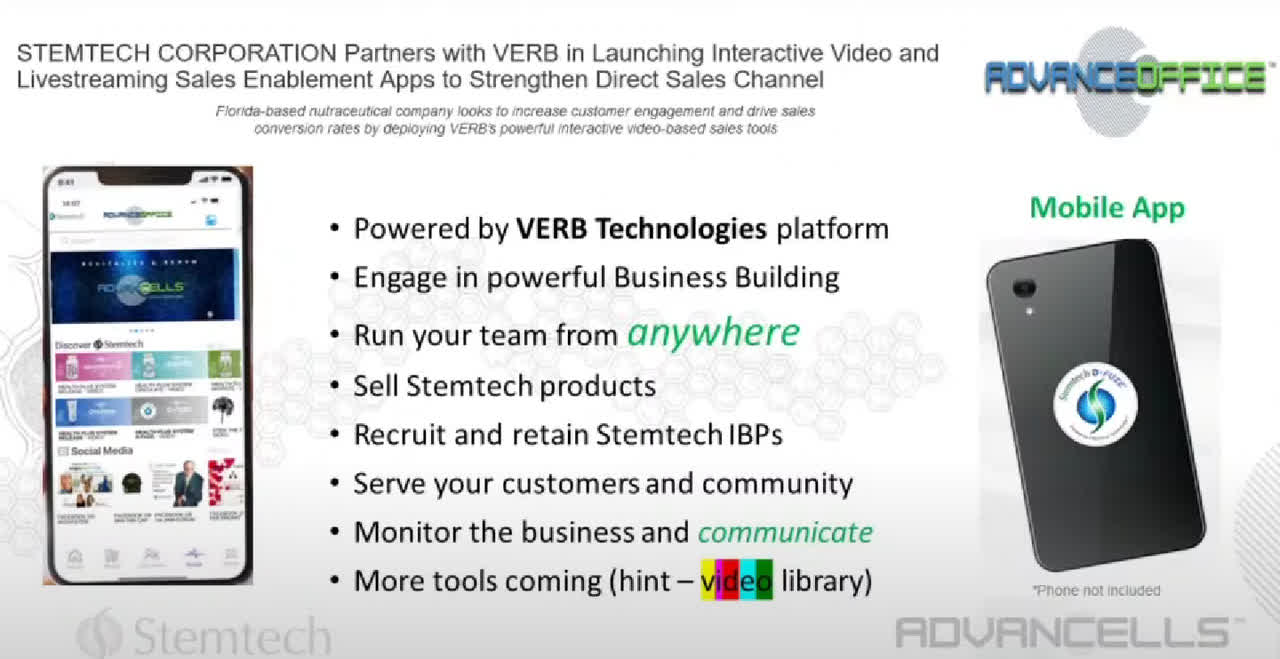

The company plans to achieve this by launching new products and adding 30,000 new independent business partner reps over the next 12 to 24 months. Stemtech is gearing up for the launch of interactive video and live streaming apps and it also wants to contact and re-engage over 200,000 former distributors.

Stemtech

I don’t think these growth plans are achievable. Re-engaging former distributors is a tough task as most of these people have probably moved on with their lives since 2017 and bringing on board 30,000 new independent business partner reps would require significant financial resources, which the company just doesn’t have at the moment. In addition, this growth plan hinges on launching 2 new products per year and hiring IT and marketing staff which would require millions of dollars in expenses. There is no information about what these new products might be or why they have the potential to drive up sales instead of the current offering. Looking at the app, it’s being developed by a small and little-known firm named Verb Technology (NASDAQ:VERB) which has quarterly revenues of below $3 million and has lost over 95% of its market valuation since its 2019 IPO. Overall, I think that this growth plan doesn’t inspire confidence at all.

That being said, the market valuation of Stemtech has been soaring over the past two months and stands at over $400 million as of the time of writing. Yet, I doubt that the company’s lofty goals or app launch plans are behind this as those first appeared in a corporate presentation on August 4. You can see it here.

Seeking Alpha

One theory about the share price rise circulating online is that this is a stock promotion. After all, Stemtech itself revealed in the middle of July that it was notified about foreign stock promotion on a British website World Finance. However, I couldn’t find any mention of the company on this website. And Stemtech doesn’t seem to be a meme stock as there is barely any chatter about it on websites such as twitter, and Reddit. There is a post about it on the infamous r/WallStreetBets subreddit, but it’s from August 10 and it doesn’t have any traction.

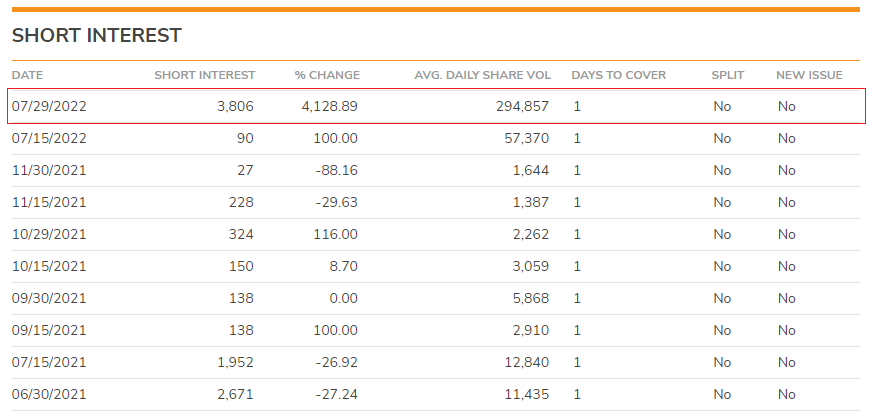

This doesn’t appear to be a short squeeze either as the short interest is less than 4,000 shares which means that it takes just a few minutes to cover.

OTC Markets Group

Whatever the reason behind the recent increase in the market valuation of Stemtech, I think the business of the company is close to worthless at the moment. The company is unprofitable and shareholders’ equity is negative, which is a recipe for disaster for investors. In my view, the most likely scenario is that the share price returns to around $2.00 in the near future, which is the level it held in early 2022 before this rapid increase in the market valuation began. I’m bearish and I think investors can take advantage of this unusual situation by short selling the stock. According to data from Fintel, the short borrow fee rate stands at 20.93% as of the time of writing. This rate is somewhat high and considering there are no call options available to hedge the risk, I think it could be best for risk-averse investors to avoid Stemtech.

Turning our attention to the risks for the bear case, I think that there are two major ones. First, I could be underestimating Stemtech’s ability to execute its ambitious growth plans. However, the company still looks overvalued at the moment even if its annual sales and EBITDA reached $75 million and $15 million, respectively. Second, sometimes the share prices of microcap companies can increase for spurious and unknown reasons, and it seems this is happening here. It’s impossible to predict how long it can go on or whether it could happen again in the future.

Investor takeaway

I think that Stemtech’s financials look underwhelming, and that its growth plans are highly unlikely to be achieved. The gross margins of the business are pretty high, but I think this one is close to worthless at the moment due to the high G&A and interest expenses. In addition, the balance sheet situation looked bleak as of March.

Yet, the market valuation of Stemtech has soared over the past few months and I can’t find a good explanation this is happening. In my view, this situation is unsustainable, and the share price is likely to get back to its May levels in the near future.

I’m bearish and I think it could be a viable idea to open a small short position. Risk-averse investors could be better off staying away from Stemtech as the stock borrow fee rate is above 20% and there are no call options.

Be the first to comment